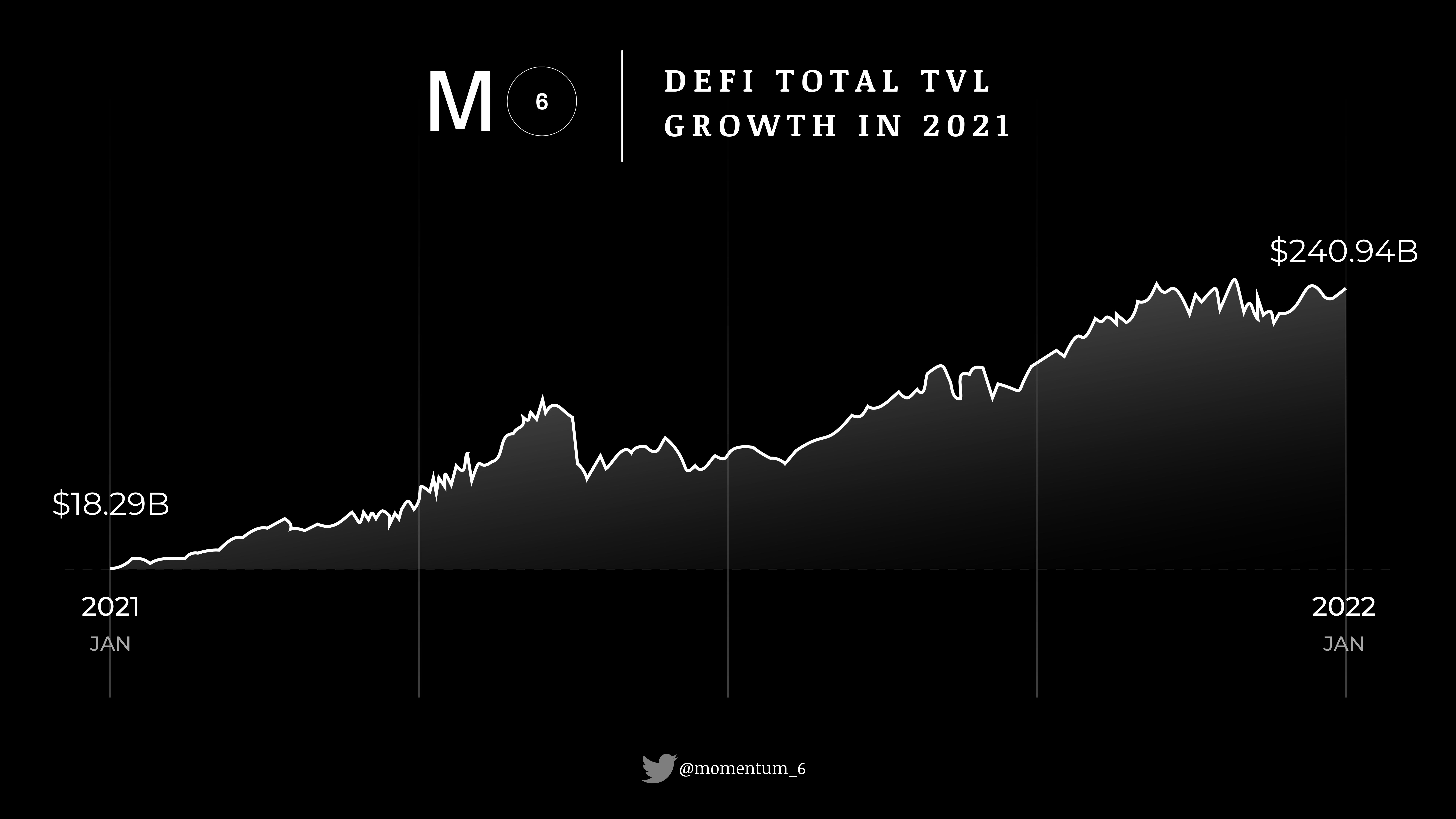

Decentralized finance (DeFi) is an umbrella term for various blockchain-powered financial applications geared towards democratizing access to financial products and disrupting financial intermediaries. In 2021, lending protocols grew from a TVL of $7.1 billion to $46.8 billion, representing a 559.2% increase. The lending landscape is becoming diverse with the introduction of new protocols that come with various tweaks and target specific niches. May 2021 was the best month for decentralized exchanges (DEX), Curve remained the most prominent decentralized exchange.

kadeemclarke.eth

Head of Labs @ Momentum 6 | Tech Entrepreneur | Blockchain Investor | Car Enthusiast | Ask me about crypto and NFTs

Inspired by the “2022 Digital Asset Outlook” report by The Block

Decentralized finance (DeFi) is an umbrella term for various blockchain-powered financial applications geared towards democratizing access to financial products and disrupting financial intermediaries. Decentralized finance expands the use of blockchain and cryptocurrencies from mere value transfer to more complex financial use cases.

DeFi is an alternative to the traditional financial systems characterized by old infrastructure and processes. Users enjoy borderless and permissionless access to financial instruments without giving intermediaries, such as banks and brokerages, control over these assets. The following are some of the categories that defined DeFi in 2021:

Lending

Lending is one of the main pillars of DeFi. In 2021, lending protocols grew from a TVL of $7.1 billion to $46.8 billion, representing a 559.2% increase. Maker, Compound, and Aave were the top three lending protocols based on value locked with a TVL of $18.3 billion, $12.8 billion, and $10.8 billion, respectively. These protocols also had total outstanding debts valued at $9.1 billion, $7.7 billion, and $6.5 billion, respectively.

$DAI, the largest decentralized stablecoin, is powered by Maker. On the other hand, Aave and Compound are money markets that have algorithmically adjusted interest rates based on the utilization rates of lending pools.

These lending protocols offer loans that are over-collateralized. The lending landscape is now becoming diverse with the introduction of new protocols that come with various tweaks and target specific niches. Cream is one of the protocols that tried to onboard various long-tail assets onto its money market. Rari’s Fuse and SushiSwap’s Kashi are other examples that introduced isolated lending pairs but were characterized by capital inefficiency.

Abracadabra and Alchemix experimented with yield-generating positions as collateral. Even though this approach mitigates risks to a certain extent, it also comes with composability risks.

Fixed-term, fixed-rate lending didn’t appeal to DeFi power users, despite repeated efforts, and this can be attributed to fragmented liquidity. Liquidity Mining may bootstrap liquidity temporarily. However, it distorts bond prices when organic demand is lacking.

Decentralized Exchanges (DEX)

May 2021 was the best month for decentralized exchanges as trading volume reached $162.8 billion. Curve remained the most prominent decentralized exchange constituting 6.8% of decentralized exchange volume with a locked value of $16.8 billion.

Users may opt to trade through DEX aggregators when liquidity gets fragmented. However, only about 13.9% of the volume of the decentralized exchange originated from these aggregators in 2021.

Derivatives

Perpetual futures contracts contribute to the biggest crypto market by volume. Perpetual Protocol was the most used in the derivatives in the first half of 2021. Perpetual futures do operate in isolation from other decentralized finance protocols. They usually sacrifice composability in favor of capital efficiency that is achieved through leveraging.

Structured Products

The DeFi space has shown portfolio management sophistication in the last few years, and we can now see different pre-packaged structured products. Yield optimizers, tasked with sourcing and optimizing yields for fund depositors, were the earliest form of structured products. Convex, launched in May 2021, was the largest yield optimizer with a TVL of $16.9 billion. We can now see other types of structured products coming up. For instance, BarnBridge is a yield-tranching protocol.

Liquid Staking

Beacon Chain was rolled out in December 2020 and initiated Ethereum’s gradual transition to the PoS consensus algorithm. Ethereum 2.0 allows users to stake Ether and earn more Ether after maturity. With a TVL of 1.5 million Ether and a market share of 86.6%, Lido was the top Ethereum 2.0 staking platform within one year. Lido is also available on other platforms that apply proof of stake consensus algorithms, such as Solana with a TVL of 1 million SOL and Terra with a TVL of 68.1 million LUNA.

Decentralized Stablecoins

$DAI, from Maker, is the largest decentralized stablecoin. So far, there are four collateralized stablecoins with a market cap of over $300 billion. 2021 was also when uncollateralized stablecoins, like Empty Set Dollar, collapsed. On the other hand, collateralized algorithmic stablecoins started to flourish. UST, a Terra-based stablecoin backed by LUNA, is the largest collateralized algorithmic stablecoin with a market cap of $7.6 billion.

Low volatility tokens/non-pegged stablecoins

These are algorithmic low-volatility tokens. OHM from Olympus DAO is the biggest currency in this category, with a market cap of $4.1 billion. Even though they trade at a premium, these tokens are backed by collateral. Artificial demand is usually generated, attracting people to stake OHM tokens and earn more OHM tokens.

Bitcoin in DeFi

The Bitcoin network is not the best when it comes to DeFi. However, Bitcoin is heavily utilized in other blockchains despite it having a 39.1% market dominance. The amount of BTC wrapped on Ethereum has been on the rise as it was 140,000 at the start of 2021 and closed at 316,600.

Maximal Extractable Value (MEV)

Maximal (formerly “miner”) extractable value (MEV) refers to the maximum value that can be extracted from block production in excess of the standard block reward and gas fees by including, excluding, and changing the order of transactions in a block. Over the last two years, a rough estimate of the MEV is $762.8 billion, where 78.4% was extracted in 2021.

Smart Wallets

Ethereum has two main types of accounts. That is, contracts dictated by code and externally owned accounts controlled by private keys. The contracts allow the creation of ‘smart contracts’ that come with greater flexibility. Smart wallets also come with user-friendly features for wallet management. Dharma and Argent are perfect examples of wallets that allow user-selected ‘guardians’ to restrict or restore access to their smart wallets. In 2021, the number of Dharma and Argent wallets increased from 10,400 and 38,400 to 16,400 and 59,400, respectively.

Privacy

In 2021, the go-to privacy mixer on Ethereum remained to be Tornado Cash. Handling $86.4 million withdrawals and $87.4 million in weekly deposits, its TVL rose from $55.1 million to $695.9 million.

Insurance coverage

Even though most DeFi sectors grew in 2021, DeFi insurance dwindled. Nexus Mutual was the biggest DeFi insurance coverage solution. 2021 was its biggest year, where active coverage reached $2.3 billion in February. However, it later recorded a 70% decrease.

Token Offerings

IDOs (initial DEX offerings) were one of the most popular forms of token offering in 2021. Solana projects prefer the initial bonding curve offering (IBCO) that mostly runs on the Hegic Protocol. With this, investors can deposit and withdraw tokens during the sale.

Prediction Markets

The prediction markets are where speculators bet on the occurrence of real-world events. Prediction markets, such as Augur, were among the first DeFi applications on blockchains. These markets failed to attract meaningful volume compared to other decentralized finance products.

Polymarket, running on Polygon blockchain, was the leader in prediction markets in 2021. Some of the popular events include US presidential elections, Covid-19, and various crypto trends such as Ethereum upgrades and BTC prices.

Sporting events were not that attractive as gamblers favor traditional bookmakers due to their liquidity. DeFi is becoming more user-friendly, and we are likely to see decentralized prediction markets reaching more gamblers globally and coming with deeper liquidity and competitive rates. Typical retail bettors will go for improved user experience and not decentralization. As a result, protocols that offer frictionless fiat on- and off-ramps are likely to capture a big market share.

Centralized event oracles are what Polymarket relies on for settlement purposes. However, we expect that prediction markets will utilize decentralized event oracles that are corruption-resistant and economically sound as the market grows.

Governance Revamp

There is so much misalignment between the interest of protocol users and token holders. A recent study shows that only 7% of users belong to both categories. Protocol users are looking for neutrality and longevity of the protocol. Token users seek to extract the protocol’s short-term value, even if it means compromising long-term sustainability.

Maker is a perfect example of what a governance dilemma is all about. $MKR token holders benefit when the interest rates of $DAI rise. On the other hand, borrowers want the interest rates to remain low.

Curve solves this dilemma through its token locking mechanism. Essentially, holders of $CRV cannot vote, but they can lock and get veCRV, which comes with voting rights. The longevity of locking CRV determines the veCRV received. Such an approach ensures that voters have a vested interest and want the decentralized exchange to flourish. We are likely to see more variations of vote locking to realign governance.

Non-Dollar Stablecoins

Stablecoins are mostly used for trading cryptocurrencies on various USD pairs, which explains why most are dollar-pegged. It is worth noting that there are many stablecoins pegged to various fiat currencies. However, demand and liquidity for most of them are non-existent.

Euro stablecoins look promising and form the second-largest group so far. The DeFi space already has two liquid Euro-pegged stablecoins; STATIS EURO (EURS) from STATIS and sEUR from Sythentix. Their market caps are $102.2 million and $118.7 million, respectively. The sEUR-EURS pool, whose TVL is $109.8 million and incentivized by Curve, is the primary source of demand for these stablecoins.

The European Union has become proactive in addressing the legal issues surrounding crypto assets and stablecoins, likely to grow demand for Euro-pegged stablecoins. The union already has a proposed regulation dubbed Markets in Crypto-Assets that seeks to establish a union-level framework that provides regulatory clarity in the crypto space.

Real-World Asset Tokenization

Crypto as an asset class is now a two trillion-dollar market. However, this asset class is somehow disconnected from other economies. The token-based economy is growing, and we are likely to see everything that carries value, irrespective of whether it is cultural or financial, tokenized. If we bridge the gap between DeFi and real-world assets (RWA), we expect the new digital economy to receive a lot of ‘old wealth.’

Tokenized real-world assets will benefit a lot from the existing DeFi and blockchain infrastructure. RWA can be tokenized as NFTs on the Centrifuge blockchain. These tokenized assets can be financed through DeFi. Tinlake, the investment portal for real-world assets on Centrifuge, has over ten RWA pools with a TVL of over $44.4 million.

Innovation in Derivatives

There have been loads of experiments on the DeFi space over the years. DeFi is on its way to revolutionizing the derivatives landscape’s novel and creative designs. The Crypto options market is known for fragmented liquidity and high rollover cost across expiries. This market can use the same framework as perpetual futures as they never expire or require delivery. Such an approach provides greater capital efficiency to liquidity providers as it consolidates liquidity from many expiring dates into one market.

Bootstrapping Liquidity

We have seen a lot of DeFi projects fail to live to their full potential as they were unable to attract short-term and retain long-term liquidity. The availability of liquidity miners may offer short-term solutions, but their sustainability and efficiency are questionable.

Typical liquidity miners (LMs) incentivize liquidity across the full price range from zero to infinity. This is a misplacement of resources and inefficient as most liquidity is never utilized. We will likely see a variant of LMs that reward loyal liquidity providers who supply meaningful liquidity. A basket of liquidity-related parameters such as proximity to the market price, concentration, and loyalty will be used to weigh out rewards.

Liquidity mining is known for diminishing marginal utilities, which is unsustainable. When mercenary liquidity providers offload all their rewards and create immense selling pressure, the reward token devalues. As a result, yields diminish over time, and liquidity providers end up removing their liquidity. LM becomes a recurring expense for various protocols.

We can now see protocol-owned liquidity (POL), which Olympus DAO introduced. Typical decentralized protocols will never implement changes such as removing liquidity without a thorough approval process, meaning that protocol-owned liquidity is permanent. We shall wait and see how POL will change the liquidity bootstrapping question and expect other innovative procedures to be introduced.

Wrapping up

DeFi had a good year in 2021 as we saw various products grow to larger heights. Developers and policymakers were also forced to rethink some processes to improve DeFi. We predict that 2022 will also be a great year for DeFi, and we can only wait and see what it has in store for us.

Also Published Here

Tags

This news is republished from another source. You can check the original article here