Key Takeaways

- Dopex is a decentralized options exchange that uses option pools to let anyone buy or sell options in a capital efficient and simplified manner.

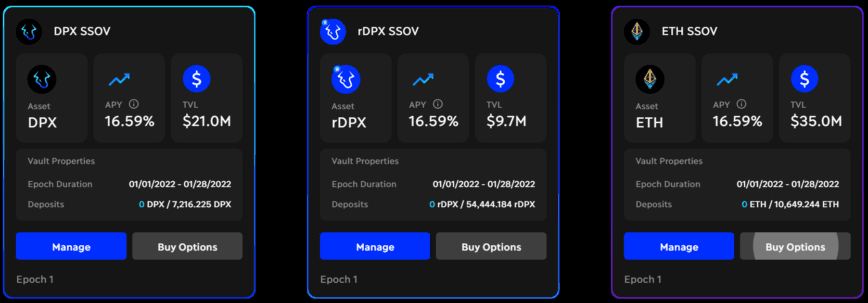

- Its flagship product is Single Staking Option Vaults, which provide deep liquidity for option buyers and automated, passive income for option sellers.

- Dopex’s options contracts are ERC-20 tokens, meaning they’re liquid, transferable, and composable.

Share this article

Dopex, which stands for “decentralized options exchange,” is a DeFi protocol that seeks to maximize liquidity and maximize returns for option buyers and sellers.

A Quick Primer on Options

Dopex is a decentralized options exchange that uses option pools to let anyone buy or sell options contracts and passively earn yield.

It offers advantages to both options buyers and sellers and the wider DeFi ecosystem by delivering a permissionless and composable options product that can be used in conjunction with other protocols. It ensures fair, optimized, and competitive option pricing and a simplified trading experience.

To understand the value proposition of Dopex, it’s worth explaining how options contracts work. Options are derivative financial instruments that let investors speculate or hedge against the volatility of an underlying asset like a stock, cryptocurrency, or another derivative or synthetic instrument representing, for instance, the volatility of interest rates.

There are two types of options contracts: call options and put options. Call options give buyers the right but not the obligation to buy the underlying asset at a specified price called a strike price, before or at a specific expiry date. Conversely, put options give contract holders the right but not the obligation to sell the underlying asset at the strike price before or at an expiry date.

With call options, the buyers are betting on the underlying asset’s price increasing, while the sellers are betting on the price decreasing. Put options, on the other hand, are the opposite: the buyers are betting on the asset’s price decreasing, while the sellers are betting on the price increasing.

Options also have a price or a premium that buyers pay upfront for the rights granted by the contract. For buyers, options contracts offer an opportunity to short assets, take on leverage, or hedge bets, while sellers can take the other side of those trades and simultaneously earn passive income by collecting premiums.

To make the concept more tangible, assume an investor would be happy to sell their Ethereum at $5,000, but the price is holding around $3,000. They believe that Ethereum will eventually reach the $5,000 mark but don’t know exactly when. They could use options to sell a covered call contract, giving someone else the right to purchase the Ethereum at $5,000. This would mean they forego any upside past the strike price in exchange for the premium they earn from selling the option. They could choose a contract that expires in March 2022 if they do not believe that Ethereum has the capacity to hit the $5,000 strike price before the expiry.

Now, if the options seller is right in their forecast and Ethereum hits $4,000 but does not break the $5,000 strike price before the March expiry, they would get to keep their coins plus a premium. On the other hand, if they’re wrong and Ethereum surpasses $6,000, for example, they would still have to sell at $5,000, meaning they would make some money on the premium but incur an opportunity cost of $1,000.

While options may sound rather straightforward in theory, they are complex financial instruments that few retail market participants understand or know how to trade profitably.

that unsophisticated investors can hardly understand, let alone trade profitably. This is where Dopex comes in. Dopex abstracts all the nuances and intricacies that come with option writing and purchasing by optimizing for simplicity and efficiency.

Crypto Briefing caught up with a Dopex core team member who operates under the pseudonym Halko, and they explained that the project is hoping to make options more accessible to all DeFi users. “The idea is not to build another protocol for experienced options traders,” they said. “For that, people can just go and trade on Deribit or FTX. We wanted to build a product anyone can use, and we’re building based on the needs and wants of the community.”

Dopex Under The Hood

Dopex is building a decentralized and permissionless options exchange that aims to offer maximum liquidity, fair option pricing, high capital efficiency for sellers, cheaper options for buyers, and incentives for all protocol participants.

It runs on Arbitrum, a Layer 2 scaling solution that leverages Optimistic Rollup technology to process transactions faster and at a lower cost than Ethereum mainnet. “We launched on Layer 2 simply because Ethereum trading fees are too expensive. It’s really important for options trading to keep the costs really low to ensure profitability,” Halko said. “Arbitrum was the fastest [Layer 2 solution] to open its testnet to developers; to build on Optimism, you must be whitelisted.”

According to Halko, there was a potential risk to launching on other Layer 1 chains such as Solana, Avalanche, and NEAR, because they don’t have “Lindy.” The “Lindy Effect” argues that the life expectancy of technology or ideas is proportional to their current age. In other words, as Ethereum has been around for longer than most other blockchains, it may be more likely to survive. “We don’t know where [other Layer 1 blockchains] will be two to three years from now, while with rollups, we’re is still on Ethereum, so it’s also a security element,” they said.

One of the advantages of using decentralized or on-chain options protocols over centralized ones is that they offer greater efficiency. Halko explained that Dopex can charge considerably less than centralized exchanges for options products. This is because the products require less maintenance and are easier to scale once they are deployed on-chain. Hence, options on Dopex are typically a few dollars cheaper than on centralized exchanges like Deribit or FTX. Halko says the difference in price is enough to make them more attractive to users without incentivizing arbitrage.

Dopex currently offers only one product called Single Staking Option Vaults, which represents a simplified way to buy and sell options. Discussing how the product works, Halko said:

“Single Staking Option Vaults allow us to bootstrap an options market very simply. We don’t want to overwhelm people, so we’re keeping it simple by offering only call options with a few strikes. Plus, building new vaults on new products is very easy, allowing us to expand the product line without introducing complexity. The vaults are also farming yield in the background. People love it; it helps us acquire more users and build a large community.”

Dopex’s next core product, Option Pools, will be more complex and suited for more experienced options traders. “When they go live, option pools will very much be like options on FTX or Deribit, but on-chain,” Halko said. The code and frontend for the Option Pools are already finalized, but Dopex wants acquire more users before it launches them. In the meantime, the team is also working on an OTC portal where users will be able to trade options peer-to-peer on the secondary market.

That’s another one of Dopex’s advantages—all of the options contracts are ERC-20 tokens, meaning they’re liquid, transferable, and composable. Anyone building in DeFi on Ethereum can use Dopex’s options and integrate them into their protocols in some shape or form. One such project is Jones DAO, which is building vaults that will let users generate yield with sophisticated, actively managed, hedged options strategies on top of Dopex.

Single Staking Option Vaults Explained

Single Staking Option Vaults are Dopex’s flagship product. Similar to single-sided staking vaults on other protocols, they let users lock up tokens for a specified period and earn a passive yield on their staked assets.

There are two sides to the product: stakers and option buyers. The stakers deposit and lock liquidity in base assets (ETH, gOHM, DPX, and rDPX) or quote assets (dollar-pegged stablecoins) into a vault at the beginning and for the duration of each monthly epoch. The vault contract then sells call options on the underlying assets to earn premiums and deposit the funds in single staking DeFi pools to generate additional yield. Dopex also incentivizes liquidity providers by paying rewards in DPX—one of its two native tokens. To stakers or option sellers, Single Staking Option Vaults provide boosted yields, capped upside, and partially mitigated downside risk—all on autopilot.

For buyers, Dopex offers a user experience for buying call options that rivals the likes of Robinhood. There are only three steps to take: select options size, select strike price, and purchase. The call options are European, meaning the buyer can exercise them only at the expiry date. If the options are “in the money” at expiry, the buyer profits at the cost of staker. By contrast, if the options are “out of the money” at expiry, the buyer lose what they paid, and the money or the premium stays with the staker or options seller. Single Staking Option Vaults represent a simple and relatively inexpensive way for buyers to permissionlessly purchase call options on a variety of crypto assets.

What’s Next for Dopex?

Dopex roadmap includes plans to expand its product line with Option Pools, add new types of Single Staking Option Vaults, offer options on networks like Binance Smart Chain, Avalanche, and Fantom, build the OTC marketplace, and revamp the tokenomics for its rDPX token.

Besides introducing put option vaults and new vaults for a variety of exotic tokens, perhaps the most interesting development is Dopex’s plan to launch options contracts for betting on the possibility of an Arbitrum token airdrop and interest rate options that would allow users to bet on the direction of the interest rate of a chosen Curve pool.

Halko says the Arbitrum option contract is just for fun, but offering a way to bet on Curve pools could affect Ethereum’s entire DeFi landscape by empowering participants in the “Curve Wars.” The Curve Wars can be described as a game between DeFi protocols that centers on the largest decentralized exchange for stablecoins, Curve Finance. Protocols are increasingly making efforts to exert influence over Curve to ensure that their preferred pools are offering the highest liquidity incentives. The likes of Convex Finance and Yearn.Finance offer generous staking rewards on CRV tokens as a way of attracting liquidity and increasing their voting power by locking up tokens to convert them into veCRV.

Using Dopex’s novel interest rate options, protocols like Redacted Cartel and Convex Finance could hedge their treasury portfolios or make directional bets on the interest rate volatility of different Curve pools, then leverage their outsized influence over the protocol to make their bets pay off. By introducing this novel primitive, Dopex will essentially be adding another weapon to the arsenal of participants in the Curve Wars. This could completely change the dynamics and outcome of the Curve Wars.

Dopex is also in the process of overhauling the tokenomics of the rDPX token. It was initially designed as a rebate token to cover any losses incurred by pool participants. The team has since moved away from this model and will soon publish the new tokenomics. Meanwhile, the use cases for Dopex’s second native token, DPX, will stay the same—it will continue to be a vanilla governance and protocol fee accrual token.

Ultimately, Dopex wants to become the largest options trading platform in crypto. “Deribit is our end game boss,” Halko told Crypto Briefing. Dopex has reached a total value locked of around $500 million within seven months of launching—an impressive feat for a protocol hosted on a nascent ecosystem like Arbitrum. Whether it will manage to surpass established centralized options exchanges like Deribit or FTX remains to be seen. What is certain, however, is that Dopex has a clear product-market fit and an experienced team that continues to deliver.

Disclosure: At the time of writing, the author of this feature owned ETH and several other cryptocurrencies.

Share this article

DeFi Project Spotlight: Abracadabra.Money, DeFi’s Magic Money Sp…

Abracadabra.Money is a lending protocol that allows users to deposit interest-bearing assets as collateral to borrow a stablecoin called Magic Internet Money that can be used across multiple blockchains. Abracadabra.Money…

DeFi Project Spotlight: Tokemak, the Liquidity Black Hole

Tokemak is DeFi’s first Liquidity-as-a-Service product. It is designed to mitigate impermanent loss for liquidity providers and secure deep and sustainable liquidity for DeFi protocols. Tokemak reactors can help projects…

What Is The Crypto Volatility Index?

The Crypto Volatility Index (CVI) is a decentralized solution used as a benchmark to track the volatility from cryptocurrency option prices and the overall crypto market.

DeFi Project Spotlight: Orion Money, the Cross-Chain Stablecoin Bank

Orion Money is aiming to become a cross-chain stablecoin bank based on an innovative suite of DeFi products providing seamless and frictionless access to stablecoin saving, lending, and spending. Its…

This news is republished from another source. You can check the original article here