- Chainlink reiterated that it was open to adopting dynamic NFTs.

- Its NFT volume has been relatively good, but LINK circulation was down.

Chainlink [LINK], which prides itself as the industry standard for web3 services, could dive into Dynamic NFTs [dNFTs] in the future. On 30 January, the decentralized oracle network shared a tweet differentiating between static web pages, static NFTs, and dNFTs, which it proclaimed would be a “game changer” for digital collectibles.

1997: “Most web pages are static. In the future, most web pages will be dynamic.”

2023: “Most NFTs are static. In the future, most NFTs will be dynamic.”

Understand why dynamic NFTs are a game-changer for non-fungible assets👇https://t.co/Xyqz72Ai9a pic.twitter.com/gEGGshKt2d

— Chainlink (@chainlink) January 30, 2023

Realistic or not, here’s LINK’s market cap in BTC’s terms

Posed to be the commander?

In the same post, Chainlink attached a 23 January blogpost, where it explained how it intends to lead the charge for the NFTs. According to the post, dFTs were not identical with the regular NFTs currently circulating.

Chainlink noted that the NFTs with encoded smart contract logic could provide permanent tokenID for verifying ownership.

While it also noted that these dNFTS have limitless potential, Chainlink pointed out that it aims to help overcome the few limitations by bridging decentralization and automating dNFTs processes. The blog post read,

“As the dNFT ecosystem expands and NFTs become more heavily integrated with the real world, Chainlink acts as a bridge between the two disconnected worlds.”

However, data from Santiment showed that LINK NFT sales volume had only hit $1 million fewer times since 2023 began. Nonetheless, the month-long performance has been one of the best in recent times.

As of this writing, the sales volume was $210,000. Moreso, quite several unique addresses have been involved in transacting the collectibles.

Source: Santiment

This was because there were several hikes in that aspect in the last 30 days. This means that Chainlink NFT got massive attention. Hence, it could help drive the dNFTs mission if sustained. Also, there were signs of increased involvement in the NFT market.

LINK: Pursuing even distribution

Further, on-chain data from Glassnode revealed that the LINK Herfindahl Index was at a low score. The metric measures smart contracts address supply and balances in the Chainlink network. At press time, the Index was 0.0044. This indicated that funds across LINK addresses were evenly distributed.

Source: Glassnode

Is your portfolio green? Check out the Chainlink Profit Calculator

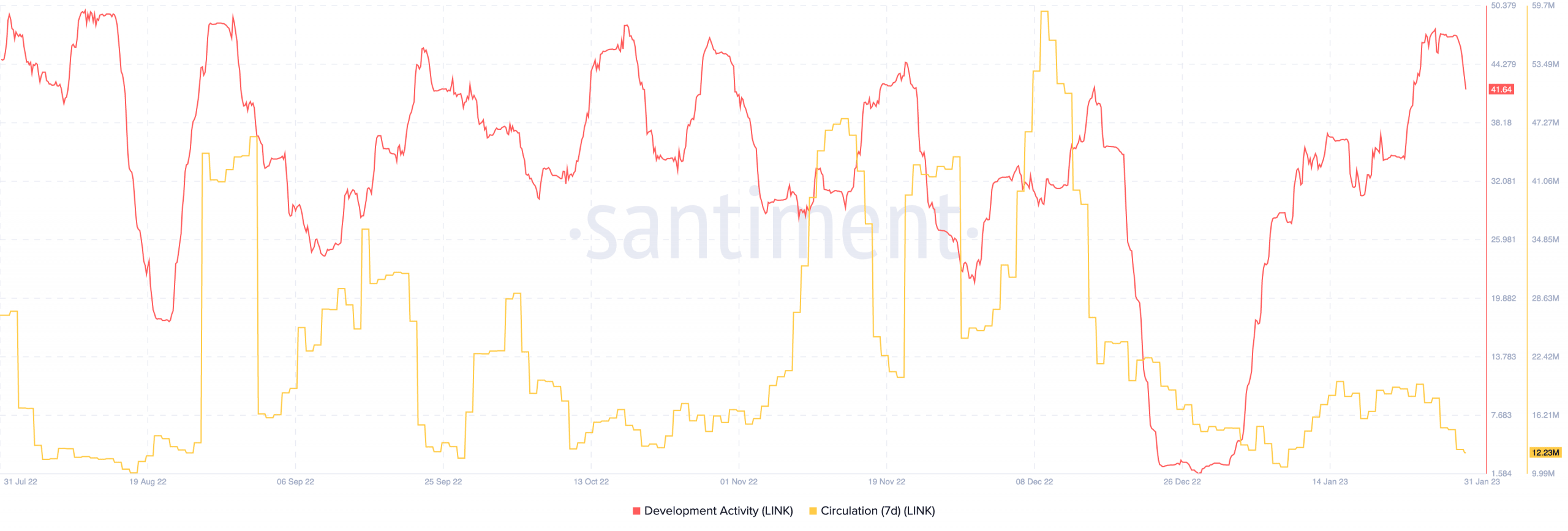

Additionally, the Chainlink development activity was close to its four-month crest. This depicted unwavering commitment to the project. Hence, there could be a cause for its dedication to see the dNFTs come to life.

Per its seven-day circulation, LINK was not at its best performance — down to 12.23 million. An explanation of this state points to a decrease in token usage within the period. Yet, Chainlink remains a candidate to usher in the widespread adoption of dNFTs.

Source: Santiment

This news is republished from another source. You can check the original article here