- Uniswap’s NFT aggregator registered a sharp uptick in sales volume and active users.

- Native token UNI jumped by 3.61% at press time.

As per a tweet by crypto analyst firm Messari on 27 January, about $3.3 million worth of NFTs in volume was routed through Uniswap [UNI] in the first month of its launch.

~@Uniswap Q4 from @PortKey256

+Uniswap’s NFT aggregator routed $3.3M of NFT volume

+Uniswap briefly surpassed @Coinbase in terms of trading volume

+$USDC/$ETH pools accounted for 50% of total volume and 29% of trading revenue.🔗 https://t.co/xTH5LXS6pD pic.twitter.com/tMFI2logSc

— Messari (@MessariCrypto) January 27, 2023

Realistic or not, here’s UNI’s market cap in BTC’s terms

In fact, Uniswap stood in the third position behind Blur and Gem in the NFT aggregators’ market share, data from Dune Analytics showed, thus highlighting its growing dominance.

At the time of writing, Uniswap’s native token exchanged hands at $6.85, which amounted to gains of about 35% in the last 30 days.

Gas rebates driving up adoption?

As per data from DappRadar, key performance indicators for Uniswap NFT aggregator registered a drastic increase in the last 10 days. The total number of transactions shot up to more than 40k from just 92 on 17 January.

Moreover, the number of unique active users rocketed from 75 on 17 January to 22.38k by 27 January. But what explains this phenomenal surge?

Source: DappRadar

As part of the launch, Uniswap offered a rebate on gas fees to its first 22k users who purchased NFT from 30 November to 14 December. Through a Twitter post on 16 January, Uniswap announced that users were eligible to claim these rebates. This could explain the increased popularity of the NFT aggregator in the last few days.

As promised, the gas on your first NFT purchase was on us 🎁

We wanted to make it as easy as possible for you get your 💰 back, so we airdropped .01E to everyone that purchased an NFT on Uniswap from Nov 30-Dec 14.

Go check your wallets 😉 Thanks for being early!

— Uniswap Labs 🦄 (@Uniswap) January 16, 2023

UNI’s bullish momentum has paused

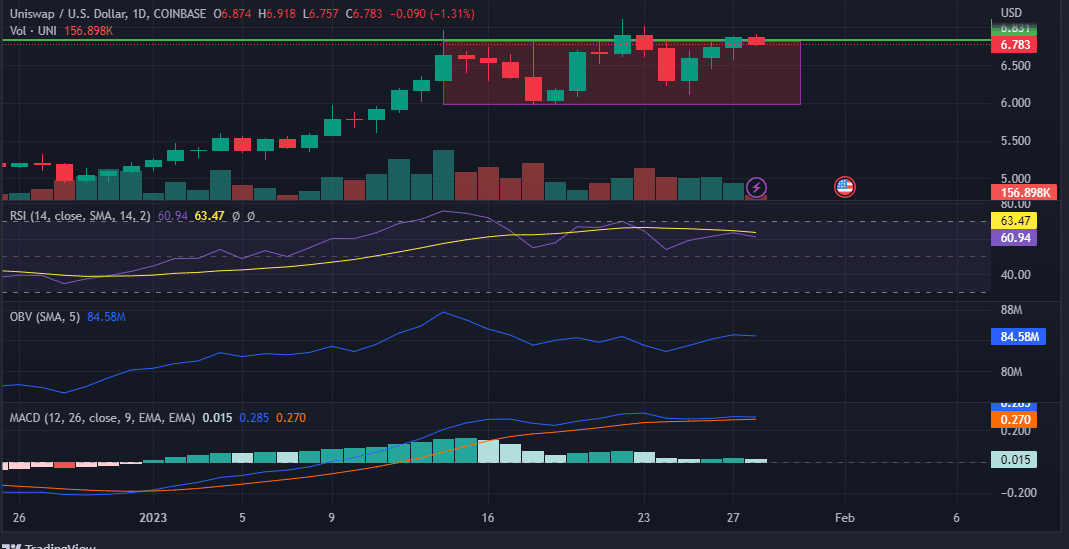

UNI faced resistance at $6.831 at the time of writing and this level has impeded its bullish momentum, during which it gained 35%. A breakout from this level would mean a reversal of FTX-induced losses.

The Relative Strength Index (RSI) moved above the neutral 50 mark. However, the dip signaled another pullback from the current resistance. The Moving Average Convergence Divergence (MACD) line could fall below the signal line, which strengthened the idea of a pullback.

Source: Trading View UNI/USD

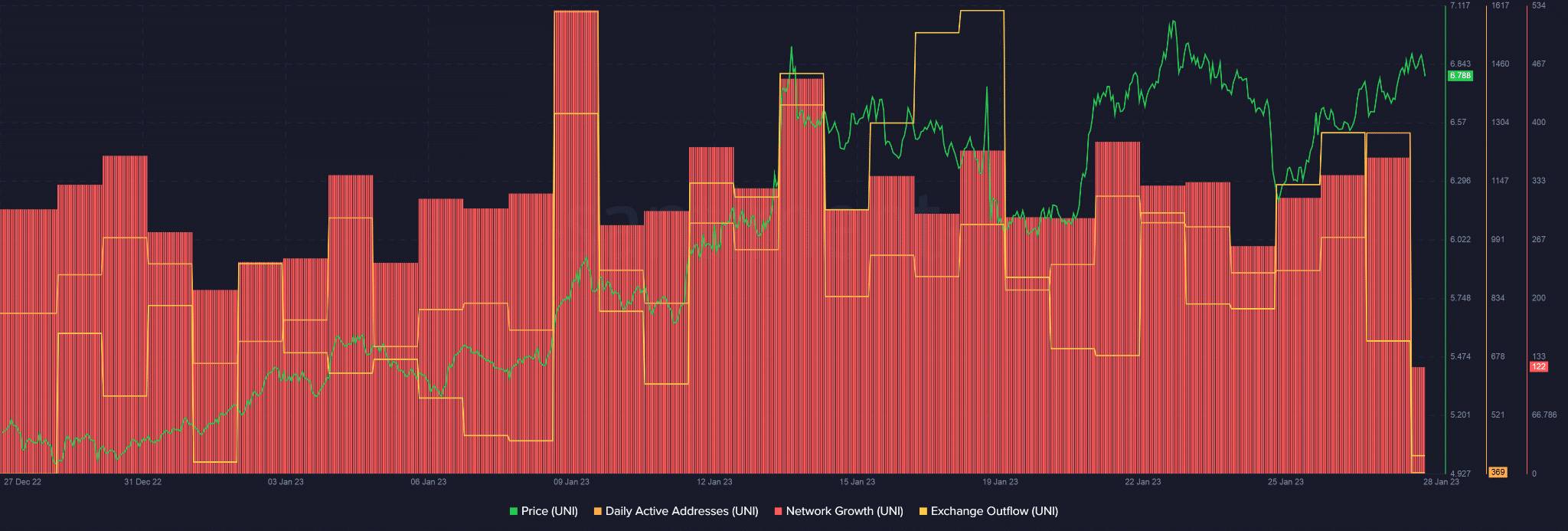

The Network growth steadily rose over the last four days, suggesting that new wallets showed interest. The same was evidenced by the growth in daily active addresses, which jumped to its 12-day high of 1277 as of 27 January.

The Exchange Outflow was also on the rise, which indicated that traders will hold on to their UNI holdings, anticipating returns in the future.

Source: Santiment

Is your portfolio green? Check out the Uniswap Profit Calculator

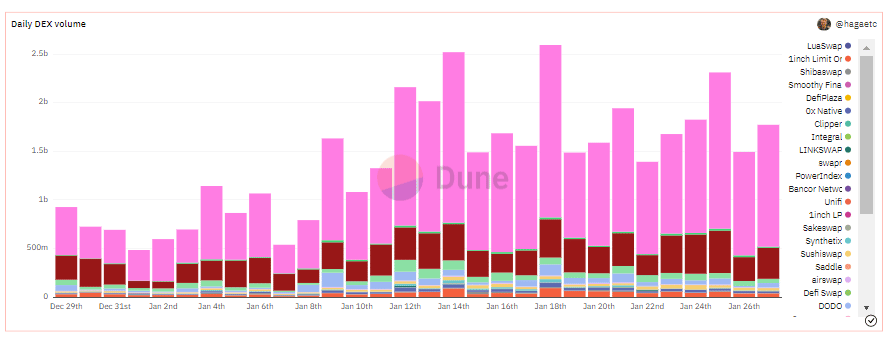

All this augured well for further expansion of the decentralized exchanges (DEXes). The daily volume generated by DEXes almost doubled over the last one month, data from Dune Analytics showed.

Uniswap continued to be the undisputed leader with a daily volume of about $0.12 billion out of the total $1.75 billion as of 27 January.

Source: Dune Analytics

This news is republished from another source. You can check the original article here