The Shiba Inu price has risen by 50% from its low point in December and its daily trading volume has seen an increase to $300 million.

SHIB’s growth in volume and price has been reflected in its market cap, which stands at $6.8 billion. The meme coin is now the 13th largest crypto after toppling Litecoin (LTC). Shiba Inu has 549 trillion tokens in circulation, but a total supply of 589 billion. Other SHIB tokens have been locked in smart contracts for staking purposes.

Is The Shiba Inu Price Uptrend Intact – Evaluating Support from Whales

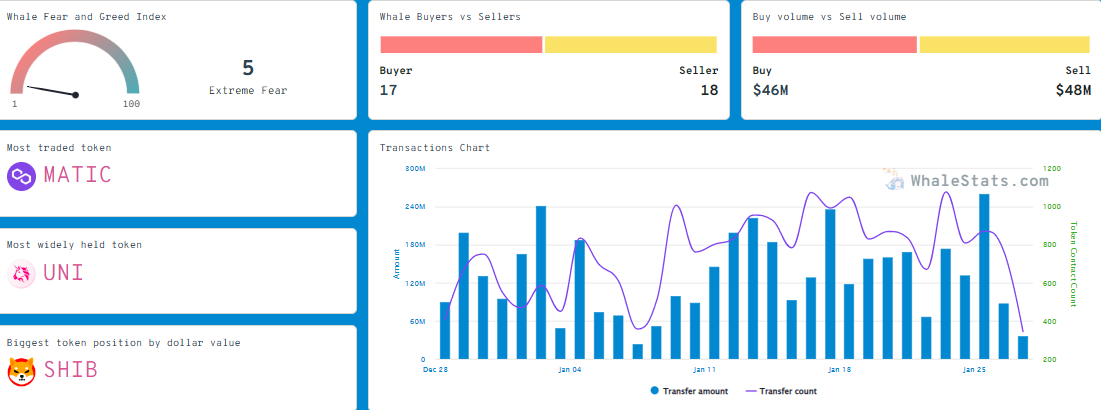

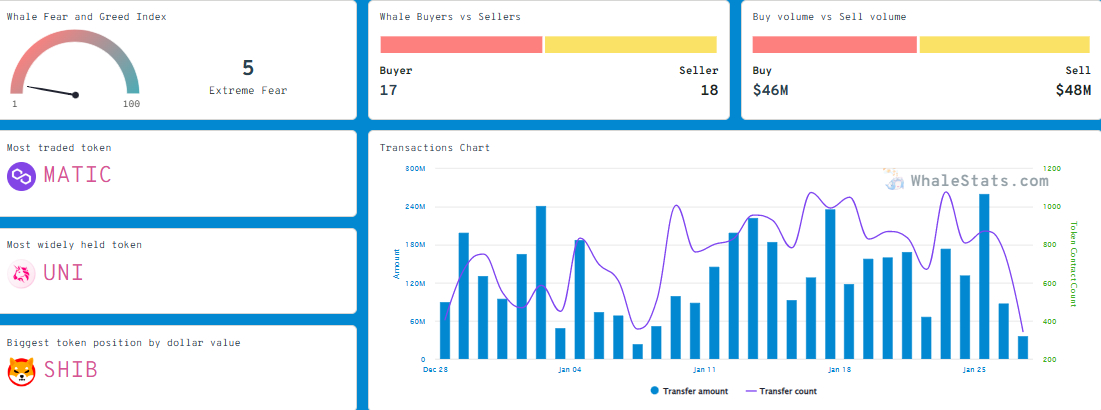

Shina Inu has always been a darling among large-volume crypto holders, especially Ethereum whales. According to WhaleStats, Shiba Inu is of the top ten most used smart contracts for the top 1,000 biggest Ethereum whales on Friday.

The story gets juicer, with Shiba Inu appearing among the most used smart contracts for the top 100 Ethereum whales in 24 hours. Alongside SHIB is Numeraire (NMR), Maker (MKR), Decentraland (MANA), and Biconomy (BICO).

In other news, an opulent whale has moved a colossal amount of SHIB tokens, possibly in preparation for the launch of the new protocol, Shibarium. Data released by Whale Alert, a platform monitoring whale transactions in the crypto market, the investor transferred slightly over 3 trillion SHIB, worth approximately $38 million at the time of writing. The transfer originated from an unknown wallet and still ended up in another unknown wallet.

Interestingly, the wallet received roughly the same number of tokens a fortnight ago from an unidentified wallet which at the moment has a zero balance, based on data from Etherscan.

Where Is Shiba Inu Price Headed to Ahead of Shibarium’s Launch

Shiba Inu price is trading within the boundaries of a falling trend channel, as shown on the daily time frame chart. Following the rejection SHIB suffered from January highs at $0.00001292, the token has retreated to trade at $0.00001149, with the 200-day Exponential Moving Average (EMA) (in purple) capping movement at $0.00001181.

The technical outlook from the Moving Average Convergence Divergence (MACD) indicator’s perspective is bearish, although this retracement could be temporary. Short positions in Shiba Inu price could ideally be triggered after the MACD line in blue crosses below the signal line in red, thus confirming a sell signal.

If declines continue unabated over the weekend, Shiba Inu may be forced to seek refuge at the trend channel’s lower boundary support, or if you’d like, the buyer congestion at $0.00001.

On the flip side, traders could comfortably hold onto their long positions on the whim of the 50-day EMA (in red) crossing above the 100-day EMA (in blue). While this pattern is not an ideal golden cross (which occurs when the 50-day EMA crosses above the 200-day EMA), it suggests Shiba Inu’s upside momentum is in place and has the potential to hold in position in the coming sessions, possibly for days.

Therefore, bulls only need to give Shiba Inu price a minor push to deal with two critical hurdles: The 200-day EMA and the upper boundary of the trend channel. Realize that a clear break and hold above this chart pattern would open the door to gains eyeing $0.00001520 (SHIB’s October high) and $0.000018 – Shiba Inu’s November peak.

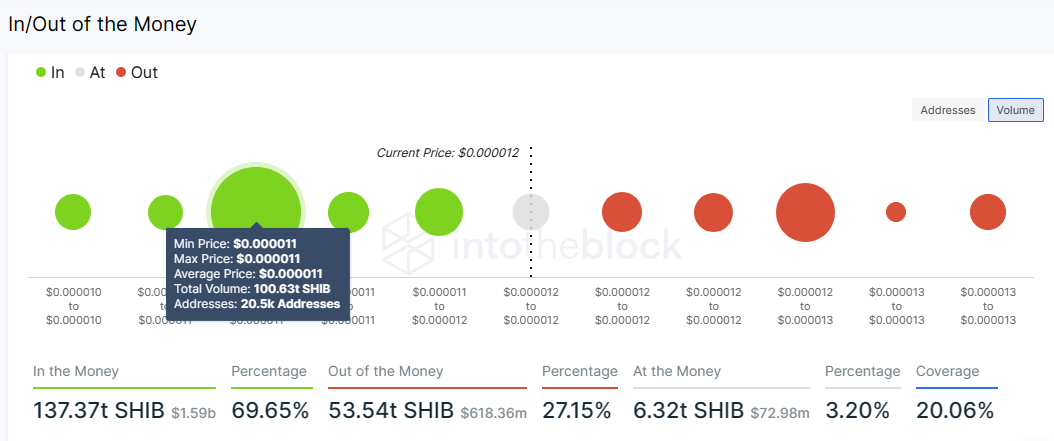

The IOMAP model by IntoTheBlock corroborates the above bullish narrative by highlighting a solid buyer congestion zone at $0.000011. Approximately 20.5k addresses that purchased 100.6 trillion SHIB around this area would be willing to back a positive outcome in Shiba Inu price.

At least 137.37 trillion SHIB tokens are in the money (unrealized profit), representing 69.65% of the protocol’s total supply. The tokens that are out of the money (unrealized loss) account for 27.15% of the supply, approximately 53.54 trillion SHIB. There are 6.32 trillion tokens at the breakeven point, representing 3.20% of the supply.

The data above shows that there are more SHIB tokens with unrealized profit than those experiencing unrealized losses and at the break-even point combined. This shows that investors would be willing to back a Shiba Inu price rally as opposed to selling the token, especially with the launch of the Shibarium protocol on the horizon.

Atomic Wallet to Support Shibarium Layer 2 Protocol

The ShibArmy, an online community of Shiba Inu’s supporters, is celebrating news of early support from Atomic Wallet. This gesture from Atomic Wallet would see the new protocol exposed to more than 3 million global users immediately after its debut.

Core developers of the Shiba Inu ecosystem assured investors on January 16 that the Shibarium beta “is about to be launched.” However, the team insisted that it is focusing on building the Layer 2 protocol “correctly and introducing it responsibly.” The community has been asked to stop asking when the launch will be, but then, the finish line is nigh.

What Is Shibarium

Shibarium is a powerful layer 2 blockchain designed to revolutionize the Shiba Ecosystem. Its main goal is to scale transactions on Shiba Inu without compromising on security and decentralization.

The layer 2 protocol maintains its anchor to the Ethereum blockchain used by all the tokens in the ecosystem like SHIB, LEASH, and BONE. Layer 2 blockchains like Shibarium and Polygon provide the benefits of scalability and faster transaction times while keeping the fees low.

The launch of Shibarium is expected to be a catalyst for Shiba Inu price, which hit an all-time high of $0.00008616. However, no one knows when it will go live, but investors expect to see it released in Q1 2023.

Buy Shiba Inu Now

Shiba Inu Alternatives to Buy Today

If you’re looking for other high-potential crypto projects alongside SHIB, we’ve reviewed the 15 top cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Related Articles:

This news is republished from another source. You can check the original article here