The shares of LGBTQ social media platform Grindr pumped over 200% to roughly $40 on Nov. 18, 2022, after the company merged with Tiga Acquisition Group in a deal worth $2.1 billion.

Grindr’s share price ended the trading day on Nov. 17, 2022, at $11.63 and opened the trading day on Nov. 18, 2022, at $17.00, up 46.2% overnight.

DOGE and SHIB rallies come to mind

The surge in price was caused partly by the low float of 500,000 shares and by interest in the company. The stock has since fallen slightly to $36.50.

Other stocks racking up significant gains on Nov. 18, 2022, include PaxMedica, a pharmaceutical company, whose stocks have gained 36.8% in intraday trading to exchange hands at $2.135, and YTRA, a travel-based company, saw a rise of 33% in intraday trading to $2.82.

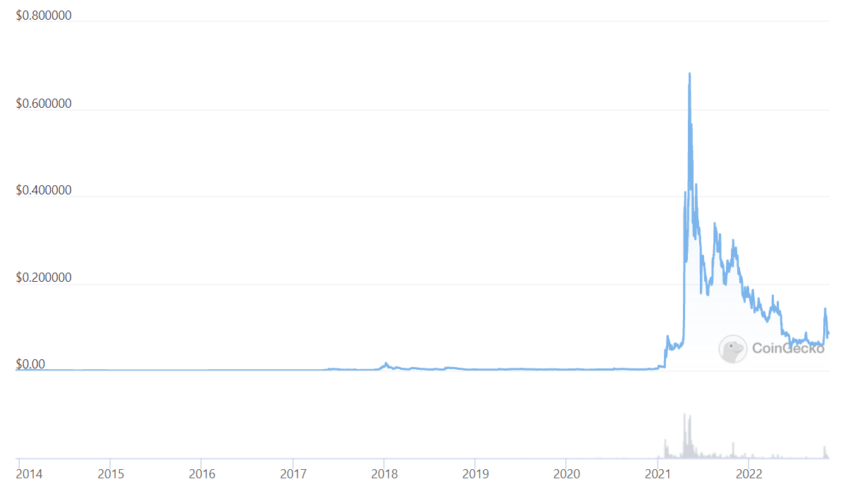

The surge in Grindr stock is reminiscent of the early rallies of meme coins like Dogecoin, for which price increases of 10,000% and higher were not uncommon in 2021.

Between Jan. 27, 2021, and May 8, 2021, the coin rose over 10,000% from $0.002 at the end of Jan. 2022 to $0.68 early May.

The surge in Doge happened as speculative investors piled into cryptos during and after the Covid-19 pandemic. Nationwide lockdowns resulted in record trading volumes driven by slick trading interfaces from the likes of Robinhood Markets. Bloomberg reported an increase of roughly 149% in the number of taxpayers invested in cryptocurrencies in 2020 compared to 2019.

Dogecoin preceded another memecoin, Shiba Inu, which also racked up gains of roughly 11,000% between the end of Sep. 2021 and the end of Oct. 2021.

Memecoins differ from other major cryptocurrencies because they have little value or utility beyond speculation.

DOGE tracks Musk’s tweets

The sentiment of celebrity influencers often drives memecoin price rallies.

A case in point is that Dogecoin’s price has more or less tracked bullish statements made by the Twitter owner and Tesla CEO Elon Musk, whose tweets have pushed up the cost of Doge by as much as 20% within a day.

On the flip side, negative celebrity sentiment can drive down the price, as was seen when Binance CEO Changpeng Zhao tweeted that Binance would sell its holdings of FTX’s FTT token, worth $540 million at the time. The token fell 76% on Nov. 8, 2022, roughly two days after the tweet, with Zhao’s message spooking investors and causing mass withdrawals of the token from defunct exchange FTX, wiping out the holdings of many FTX customers as the FTT price fell. The exchange soon filed for bankruptcy.

On rare occasions, coins whose values skyrocket within a few days, like last year’s infamous SQUID token, are often linked to scams. The SQUID token rose from $0.01 to $3,000 in six days and crashed as developers disappeared with about $3.3 million in liquidity.

Difficult year for crypto stocks

It’s been a tough year for crypto-related stocks. Shares of MicroStrategy, the largest corporate holder of Bitcoin with over 130,000 BTC on its balance sheet, are down almost 70% year-to-date at $170.12, while shares of Coinbase, the largest crypto exchange in the U.S., are down about 80% YTD to trade at $45.44.

The latter reported a loss of $540 million for Q3, 2022, which was its third straight quarter of losses as it battles falling trading revenues.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

This news is republished from another source. You can check the original article here