Bitcoin turned 14 yesterday. Just a passing fad? Don’t know any fads that last 14 years, do you? Meanwhile, Chain’s XCN has been surging, and DOGE is still frenetically humping Elon Musk’s leg.

Let’s look at the birthday blockchain first. As usual, the main Crypto Twitter focus (and that of this column) is on price action, and speculation about which direction the leading digital asset is going to pull the market next.

But before we jump into that, just a quick reminder first about how it all began – with a whitepaper released to the world 14 years ago on Halloween as a response to the 2008 GFC, from someone or somebodies named Satoshi Nakamoto.

The email that started the revolution. Happy 14th birthday #Bitcoin! pic.twitter.com/XElMSoQRJk

— Bitcoin Magazine (@BitcoinMagazine) October 31, 2022

All these years later, and we reckon, yep, it’s fair to say that Bitcoin is indeed a revolution – one that’s helped spawn the wider crypto universe, good and bad.

Countries and nation states are adopting Bitcoin and other cryptocurrencies, massive institutions are buying in, and blockchain-based utility is slowly starting to creep its way into many aspects of society – payments, contracts, art, gaming, ticketing, and so on.

Anyhoo, where were we? Price action…

“#Bitcoin is currently trading at $1.25 million US dollars” in Zac Efron’s new movie: Goldpic.twitter.com/chdNemdyLx

— Bitcoin Magazine (@BitcoinMagazine) October 31, 2022

Top 10 overview

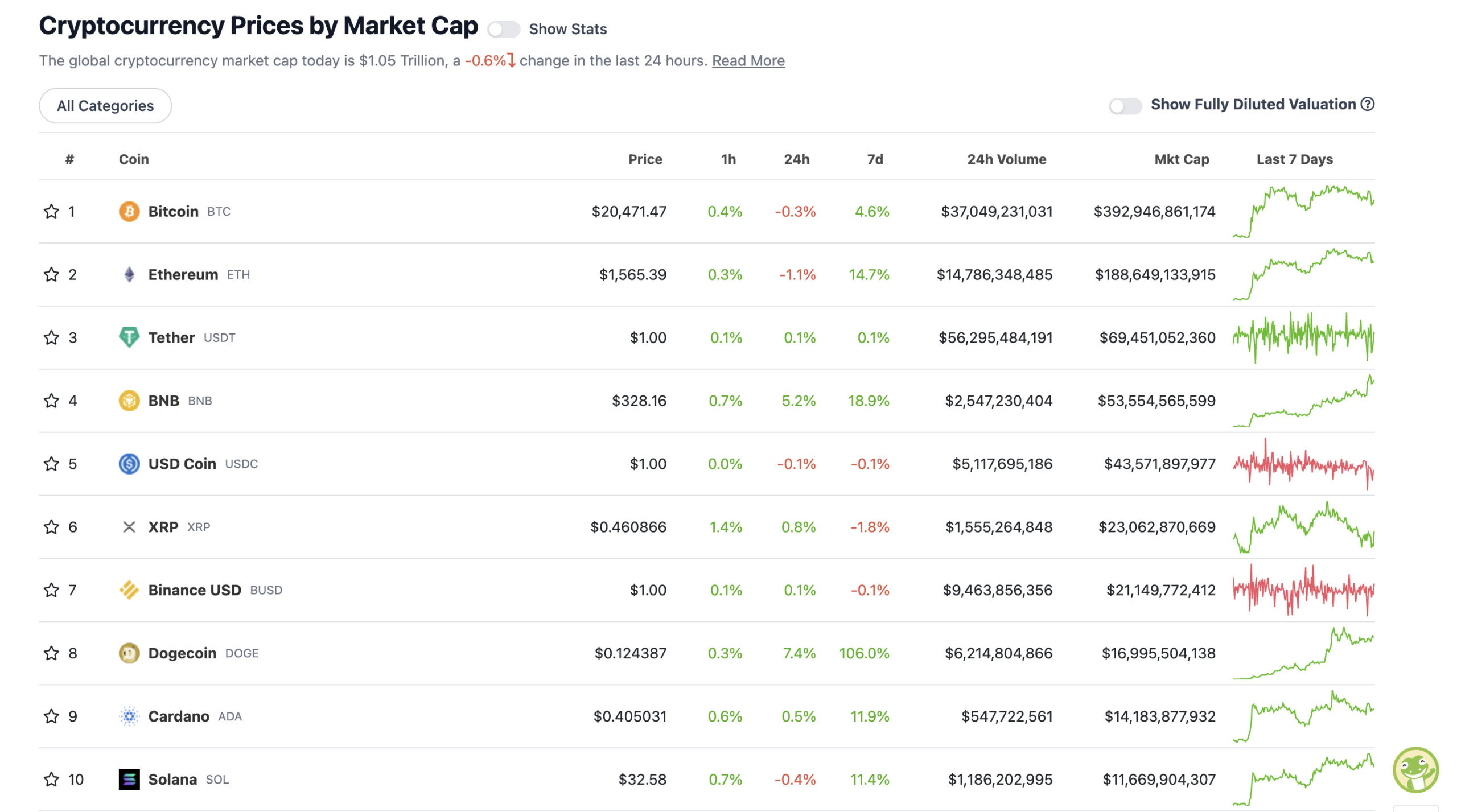

With the overall crypto market cap at US$1.05 trillion, down about 0.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Yeah, we see you DOGE. Your Elon Musk-related narrative hasn’t changed since yesterday, in fact it only seems to have picked up more steam. Here’s hoping the billionaire’s Twitter buy proves to be a net positive for the crypto market as a whole.

Looking down the top list, BNB is also faring particularly well, with a 5% daily surge and almost 19% over the past week. It’s now trading above US$320 for the first time since the middle of August.

Perhaps, Binance’s support for the Elon Musk Twitter vision has something to do with the positive movement.

“We’re excited to be able to help Elon realize a new vision for Twitter,” Binance Founder and CEO Changpeng Zhao said in a statement on the weekend. “We aim to play a role in bringing social media and Web3 together in order to broaden the use and adoption of crypto and blockchain technology.”

Meanwhile, as for Bitcoin (BTC) – it’s pulled back a tad from where it was this time yesterday, but it’s managed to make a monthly close above US$20k for the first time in a couple of months. This is obvs a positive sign.

#BTC performs a new Weekly Close above ~$20000 for the first time in almost two months$BTC #Crypto #Bitcoin pic.twitter.com/WlA3BChXfX

— Rekt Capital (@rektcapital) October 31, 2022

And some of the more bullish crypto analysts out there – Stockmoney Lizards for instance – are seeing something else that always makes them as excitable as a shiba inu on heat. A double bottom.

#Bitcoin repeats itself🍿 pic.twitter.com/n8KTkiO39Q

— Stockmoney Lizards ⚡️ (@StockmoneyL) October 31, 2022

Interrupting sweet thoughts about double bottoms, though, are the more pessimistic short-term voices we’re hearing out there, including Roman Trading. He’s actually been noting the antithesis – a double top, which is a negative charting pattern. “Il Capo of Crypto”, is also in a bearish frame:

Good morning. pic.twitter.com/NPVGwf8HnN

— il Capo Of Crypto (@CryptoCapo_) October 31, 2022

Crypto charting – conflicting as ever, then, especially in terms of which timeframes matter most. Perhaps, as trader/analyst Justin Bennett notes below, though, just keep an open mind in a week he describes as “pivotal”.

Here’s hoping the Fed, which meets on Wednesday to discuss and then reveal its next interest-rate hiking plans, regards it as pivotal, too.

The best advice I can give anyone during a pivotal week like this is to keep an open mind.

There are a lot of biases out there, but none of us know what will happen.

Make a plan accounting for bullish and bearish outcomes with clean invalidations so you’re prepared regardless.

— Justin Bennett (@JustinBennettFX) October 31, 2022

This is most likely the box the S&P trades in until #FOMC.

I’m not anticipating any decisive breaks until market participants hear what Powell has to say on Wednesday. $SPX $SPY https://t.co/e1VfPGSxEJ pic.twitter.com/XeXX60O4Pk

— Justin Bennett (@JustinBennettFX) October 31, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.98 billion to about US$429 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Chain (XCN), (market cap: US$1.43 billion) +34%

• Avalanche (AVAX), (mc: US$5.7 billion) +6%

• OKB (OKB), (mc: US$4.3 billion) +5%

• Shiba Inu (SHIB), (mc: US$7.3 billion) +4%

• Synthetix Network (SNX), (mc: US$604 million) +3%

Blockchain infrastructure company Chain (XCN), now ranked 41 on CoinGecko, has entered into an undisclosed-sum advertising and promotional deal with NBA team Miami Heat, which also happens to be sponsored by crypto exchange FTX.

The blockchain firm will become the Heat’s “official Web3 and blockchain infrastructure partner,” according to an announcement.

Things are HEATing up this fall. Chain is proud to announce a partnership with the @MiamiHEAT as their official Web3/Blockchain infrastructure partner. Read more: https://t.co/7mgQVHPmAR pic.twitter.com/FhBeabooAp

— Chain (@Chain) October 31, 2022

DAILY SLUMPERS

• Tokenize Xchange (TKX), (market cap: US$1.5 billion) -14%

• WhiteBIT Token (WBT), (mc: US$1.38 billion) -14%

• Klaytn (KLAY), (mc: US$787 million) -5%

• EthereumPoW (ETHW), (mc: US$707 billion) -3%

• Curve DAO (CRV), (mc: US$498 million) -3%

Lower-cap wrap

Time to put on the sewage suit for a tentative exploration deeper into “sh*tcoin” territory. Where high risk meets occasional reward and the odd gem. Here’s what’s catching our eye.

• Enecuum (ENQ), (market cap: US$10 million) +49%

• Groestlcoin (GRS), (mc: US$35 million) 37%

• Tamadoge (TAMA), (mc: US$34 million) +31%

• Propy (PRO), (mc: US$40 million) +115%

• Injective Protocol (INJ), (mc: US$189 million) +11%

DAILY SLUMPERS

• HUSD (HUSD), (market cap: US$60 million) -56%

• Dogechain (DC), (mc: US$66 million) -22%

• Rocket Pool (RPL), (mc: US$395 million) -15%

• Unizen (ZCX), (mc: US$36 million) -14%

• Cult DAO (CULT), (mc: US$27 million) -10%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

We are all Satoshi. Happy #Bitcoin White Paper Day. pic.twitter.com/Ul71l2mewr

— Michael Saylor⚡️ (@saylor) October 31, 2022

Very interesting week ahead. It will shape all markets until years end.

First it will be interesting to see if markets keep rallying until Wednesday Fed announcement, or show downward consolidation.

Reaction to Fed decision is everything this week though.

🕰️

— John Wick (@ZeroHedge_) October 31, 2022

All the bitcoin miners blowing up simultaneously seems not great https://t.co/vElyCmHBsr

— Cobie (@cobie) October 31, 2022

Thrilled to finally announce that @GameStopNFT Marketplace is officially LIVE on @immutable.

This is a huge step in making true ownership real for hundreds of millions of gamers.

PTTP

(1/n) pic.twitter.com/f4CJsdGxFe— Robbie Ferguson 🅧 – Hiring! (@0xferg) October 31, 2022

Oh no, all our diabolical plans have been revealed!!

— Elon Musk (@elonmusk) October 31, 2022

This news is republished from another source. You can check the original article here