Access to finance remains a key growth constraint for small businesses, with data showing a $330 billion financing deficit for the small enterprises that make up 90% of Africa’s businesses.

This is the gap that Kenya’s embedded finance fintech Pezesha seeks to bridge as it expands into Nigeria, Rwanda and Francophone Africa following a $11 million pre-Series A equity-debt round led by Women’s World Banking Capital Partners II with participation from Verdant Frontiers Fintech Fund, cFund and Cardano blockchain builder Input Output Global (IOG). The round also included a $5 million debt from Talanton and Verdant Capital Specialist Funds.

The fintech’s new growth strategy follows its plan to power its embedded finance offering beyond its current markets including Uganda and Ghana, to bridge the financing gap affecting millions of micro, small medium-sized enterprises (MSMEs) across these markets.

Founded in 2017 by Hilda Moraa, Pezesha has built a scalable digital lending infrastructure that allows both traditional and non-traditional finance institutions to offer working capital to MSMEs.

“The opportunity and impact in solving working capital problems for SMEs is huge. [We are] solving the root cause, which is information asymmetry issues, to ensure quality and responsible borrowing. Pezesha solves this through our robust API driven credit scoring technology,” Moraa, also the CEO, told TechCrunch.

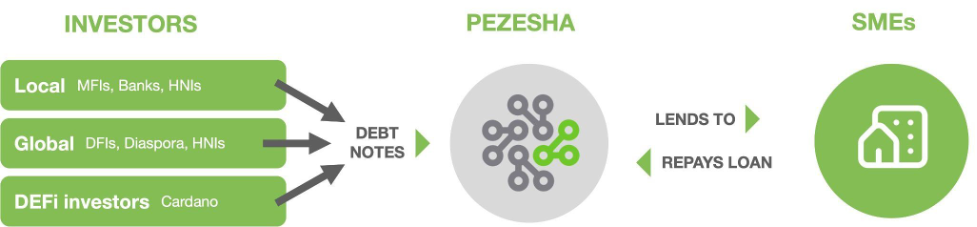

Pezesha is tapping local and international banking institutions, HNWIs and DeFi for additional liquidity for onward lending. Image Credits: Pezesha

The fintech works with partner companies such as Twiga and MarketForce, which integrate its credit scoring APIs in their platforms to enable their customers get real time loan offers.

Pezesha said it is currently working with over 20 partner companies that have enabled it to extend loans to over 100,000 businesses to date. It expects this number to grow before the end of the year as an additional 10 companies integrate with its infrastructure. The fintech is able to extend loans of up to $10,000 at single digit interest rates, and a repayment period of one year.

Pezesha plans to create a $100 million financing opportunity each year for businesses by tapping local and international banking institutions, high net-worth individuals and decentralized finance.

“We are building for the future and this means tapping new innovations for additional liquidity that allows us to offer affordable loans to SMEs,” said Moraa, a two-time founder, who started Pezesha after successfully exiting Weza Tele in 2015.

Charles Hoskinson, the co-founder of IOG and Cardano, while commenting on their investment in Pezesha said in a statement that, “Facilitating the movement of capital into emerging markets to support economic growth and job creation is a core promise of blockchain and cryptocurrencies. Our vision is centered on using technology to make it easier for people across the globe to borrow and lend to each other in a regulated way. This investment in Pezesha is an important milestone, and we’re excited to be a part of their growth story.”

The IOG’s investment into Pezesha follows an earlier announcement that the two companies had partnered to build a peer-to-peer financial operating system for Africa.

Image Credits: Pezesha

Moraa said that working with strategic partners like Cardano will open up the debt liquidity market and offer the affordable capital critical for the growth of all sectors of the economy.

The fintech plans to open up more lending opportunities for women entrepreneurs who continue to be locked out by the formal banking sector.

“Pezesha is dedicated to solving Africa’s working capital problem through its robust lending infrastructure, and this investment will allow them to deepen the range of financial products offering especially to women owned MSMEs,” said Christina “CJ” Juhasz, the chief investment officer of Women’s World Banking Asset Management.

Pezesha did not reveal how much it has raised in the past, but Moraa noted that 20% of its initial pre-seed investment in 2017 was from local angels. The fintech, which raised seven figures last year, counts Seedstarts, GreenHouse Capital and Consonance Investment Managers, among its several investors.

“We have the right business model, are profitable, and continue to pursue the kind of investors that are aligned with our goals and values,” Moraa said.

This news is republished from another source. You can check the original article here