Three years ago, Bitcoin evangelist Jimmy Song publicly bet Ethereum investor Joseph Lubin that decentralized applications (dapps) running on the Ethereum blockchain would not get much traction.

Why it matters: There’s a big question in blockchain culture: Whether Bitcoin is the only crypto creation that ever mattered or whether the decentralized future will feature lots of blockchains that are useful in different ways. New data points toward the latter.

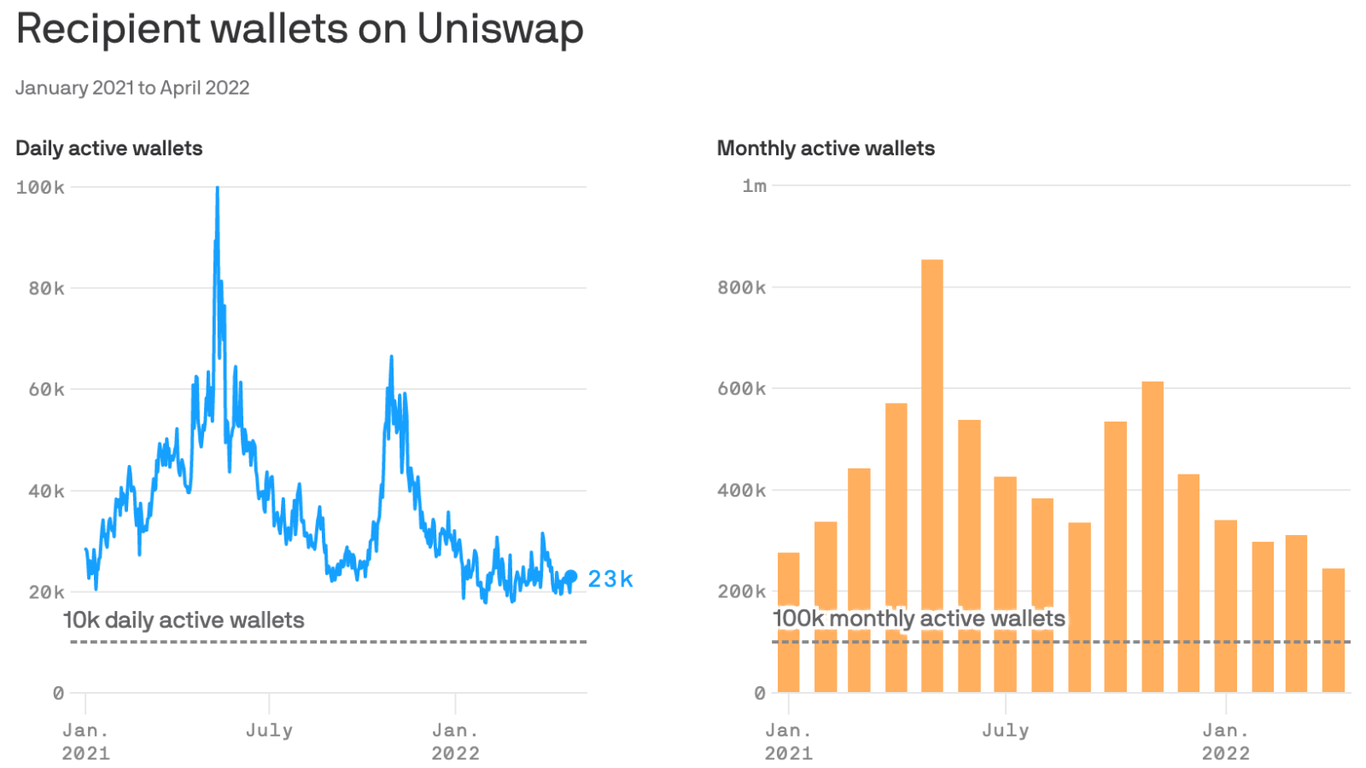

- What’s happening: These charts, based on research from blockchain data firm CoinMetrics, look at usage of the decentralized exchange Uniswap. It doesn’t resolve their bet, but it looks pretty bad for Song.

Details: In 2018, Lubin sketched out the outlines of a bet on stage at CoinDesk’s Consensus conference, contending that Ethereum would find its product-market fit soon. Song disagreed, saying at the time, “I don’t really see much of this stuff gaining much traction.”

In 2019, the disputants got together again to nail down the bet’s details:

- Lubin bet that at least five unique dapps on Ethereum would have 10,000 daily active users and 100,000 monthly active users for any six months within a year.

- Ethereum had to hit those numbers by May 23, 2023.

By the numbers: At the time, it was a $500,000 bet, but they spelled it out in cryptocurrency terms. If Ethereum hits its numbers, Song will pay Lubin 810.8 ethers (that’s about $2.3 million today). If it doesn’t, Lubin will pay Song 69.74 bitcoins (about $2.7 million today).

- One researcher estimates that 4 million people have used at least one decentralized finance app, one time, so far.

State of play: “Uniswap has beaten out the 10K DAU and 100K MAU criteria at least since the beginning of 2021,” CoinMetrics’ Kyle Waters tells Axios.

There are caveats galore. The data above doesn’t resolve the bet. It’s just data for one application, and it’s open to critique.

- CoinMetrics counted “recipient wallets.” That is, how many wallets received a token at the end of a Uniswap trade.

- Wallets are not the same as users. Many people use multiple wallets. Many wallets are also run by bots (though all bots benefit somebody).

The intrigue: Lubin at the time was concerned about the bet terms requiring that users pay a transaction fee to be counted.

- Not only would all of the people in the data above have paid for their transactions, they paid vastly more than anyone in 2019 would have guessed they’d be willing to.

Meanwhile, the data above only tracks wallets that received tokens in Uniswap trades (on all three versions). It doesn’t count liquidity providers, the people who deposit funds to earn trading fees (but that would only strengthen Lubin’s case).

It’s hard to say what the right heuristic for translating wallets to users is, but the wallet count is well above twice the bet threshold each day and month.

Our thought bubble: This reporter was actually on camera with the two, mediating the dealmaking, and — looking back on it — none of us quite knew at the time how to conceptualize the details of the decentralized future. So the terms of the bet are a bit of a mess.

- “It’s actually fairly non-trivial to gauge ‘active users’ for any given dapp,” Waters says. Translation: Finally resolving this bet is going to be a real pain for somebody.

- The terms may have been lousy in retrospect, but the spirit was straightforward: Will a respectable number of people actually use Ethereum dapps? The answer, increasingly, seems to be: Yes.

This news is republished from another source. You can check the original article here