If you’re looking to invest in cryptocurrency for the first time – you will be entering a new and existing trading space that has since surpassed a market value of $1 trillion.

In this beginner’s guide, we’ll teach you everything you need to know about investing in cryptocurrency. Key topics include how to choose a safe and low-cost cryptocurrency exchange, selecting the best digital currencies for your portfolio, and the steps required to invest in less than five minutes.

How to Invest in Cryptocurrency for Beginners – 4 Easy Steps

In just four simple steps – you can invest in cryptocurrency via a regulated online broker in under five minutes.

Best of all, when using eToro for this purpose – you can instantly pay for your cryptocurrency investment in US dollars without paying any transaction fees.

Here’s a quick-fire overview of how to invest in cryptocurrency at eToro:

- ✅Step 1 – Open an Account With eToro: Opening an account with eToro is super easy as it’s just a case of providing the broker with some personal information. You’ll also need to upload a copy of your ID for anti-money laundering purposes.

- 💳Step 2 – Deposit: You only need to deposit $10 into eToro when you first open an account and no transaction fees are charged(US clients only). Choose from ACH, a debit/credit card, an e-wallet, and more.

- 🔎Step 3 – Search for Cryptocurrency: Now that you have a funded account, use the search bar to find the cryptocurrency that you want to invest in. If you’re unsure which digital asset takes your fancy, click on the ‘Discover’ button to browse the 60 digital currencies supported by eToro.

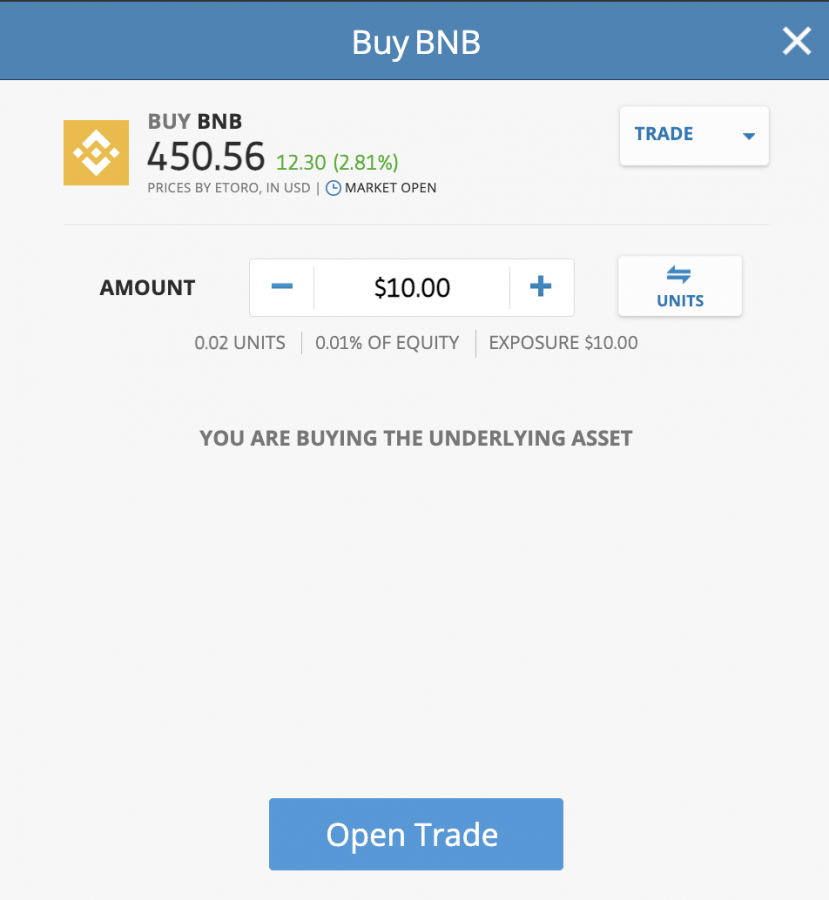

- 🛒Step 4 – Invest in Cryptocurrency: After clicking ‘Trade’ you will see an order box appear on your screen. Enter your investment stake in the ‘Amount’ box and click ‘Open Trade’ to invest in your chosen cryptocurrency.

Cryptoassets are a highly volatile unregulated investment product.

First-time traders might appreciate our more detailed guide on how to invest in cryptocurrency – which you will find by scrolling down.

Where to Invest in Cryptocurrency

There are over 100+ exchanges and brokers in the online space that allow you to invest in cryptocurrency. When thinking about where to invest in cryptocurrency, we would suggest choosing a provider that is regulated to ensure that you can invest in safety.

It’s also a good idea to choose a platform that offers low fees and of course – support for your preferred cryptocurrencies.

In the sections below, you will find reviews of where to invest in cryptocurrency assets safely and in a low-cost way.

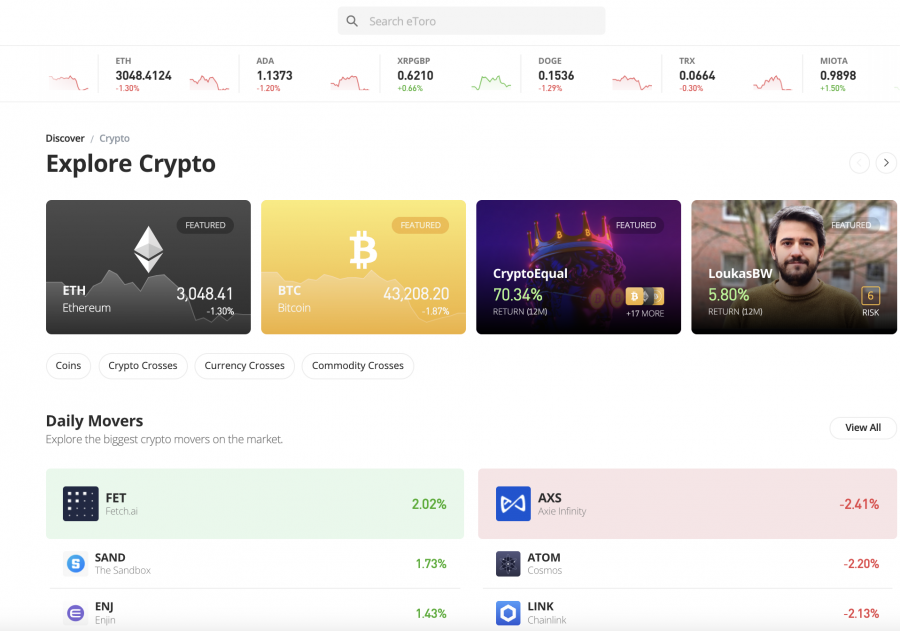

1. eToro – Overall Best Place to Invest in Cryptocurrency

eToro was launched in 2007 and the platform is home to a wide range of asset classes. In addition to cryptocurrencies, this covers everything from ETFs and index funds to forex and commodities. You will have access to 60 cryptocurrencies here – all of which can be purchased from a minimum investment of $10.

This is ideal if you’re looking to explore crypto assets for the first time and you don’t want to risk too much money. Moreover, at a minimum trade size of $10, you can invest in expensive cryptocurrencies like Bitcoin and Ethereum – both of which are now worth thousands of dollars per token.

When it comes to fees, eToro allows US clients to deposit USD on a fee-free basis. This is the case irrespective of which deposit type you choose. Options here include ACH, e-wallets like Paypal and Neteller, online banking, and debit/credit cards. Trading commissions when you buy cryptocurrency cost just 1% – which is built into the price that you see when you place an order.

If you are interested in gaining exposure to cryptocurrency but you don’t know which tokens to add to your portfolio – eToro offers a duo of passive trading tools. First, there are professionally managed smart portfolios, which allow you to diversify across more than a dozen digital currencies through a single investment.

You might also consider the copy trading tool. This allows you to mirror the cryptocurrency investments of a proven trader like-for-like. The minimum investment stake with copy trading is just $200. We also found that eToro offers one of the best crypto wallets for beginners. This is because when you buy cryptocurrency here, the tokens are kept safe in your eToro web wallet.

Alternatively, for more control and flexibility over your cryptocurrencies, the eToro wallet app can be downloaded to your iOS or Android smartphone. Finally, we should note that eToro is perhaps the best crypto exchange in the market for complete beginners – as both its website and mobile app are super easy to use.

| Number of Cryptos | 60 |

| Trading Commission | 1% plus market spread |

| Debit Card Fee | FREE |

| Minimum Deposit | $10 |

What We Like

- Heavily regulated

- Super low trading fees

- No deposit fees

- Supports dozens of coins

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Copy trading tools

Cryptoassets are a highly volatile unregulated investment product.

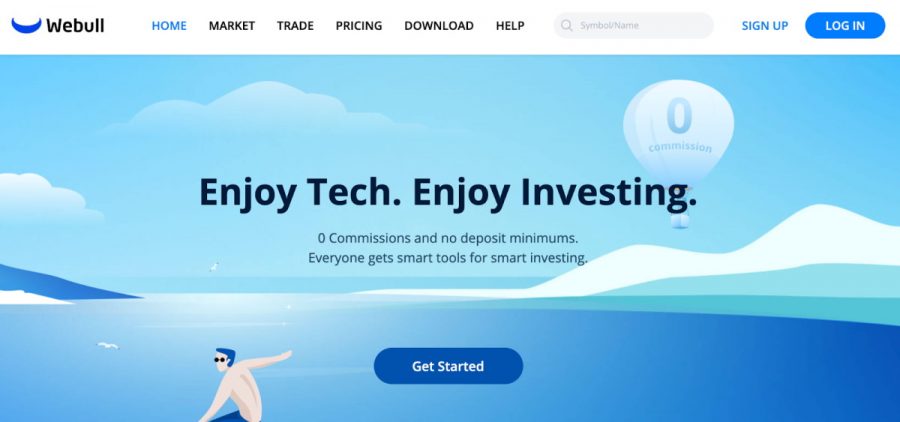

2. Webull – Invest in Crypto With Just $1

There is no longer a requirement to risk large sums of money when you invest in crypto – especially when you have an account with a broker like Webull. Put simply, this top-rated brokerage site allows you to buy and sell cryptocurrency from just $1 per trade.

There is no longer a requirement to risk large sums of money when you invest in crypto – especially when you have an account with a broker like Webull. Put simply, this top-rated brokerage site allows you to buy and sell cryptocurrency from just $1 per trade.

And, best of all, you won’t be required to meet a minimum deposit when you open an account. As such, this means that you can deposit $1 to get a feel for how the cryptocurrency platform at Webull works. With that said, it’s best to use ACH when depositing funds here – as no transaction fees are charged.

Domestic bank wires, however, are charged at $8 per transaction. Nonetheless, another major benefit of choosing Webull to invest in crypto is that you will not pay any commissions. Bid-ask market spreads start at 1% here, so do bear that in mind when calculating your investment costs.

If you are looking for a cryptocurrency broker that also enables you to invest in traditional assets – Webull also offers stocks, ETFs, and options. These financial instruments can also be bought and sold on a commission-free basis – plus the market spread. Finally, Webull offers retirement accounts across various IRAs, but no copy trading tools are available.

| Number of Cryptos | 20+ |

| Trading Commission | 0% commission plus market spread |

| Debit Card Fee | ACH and bank wires only |

| Minimum Deposit | No minimum deposit |

What We Like:

- 0% commission broker

- Minimum position size only $1

- Real-time market data and charting features

- Two-factor authentication offered

- $5 reward when completing first crypto trade

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

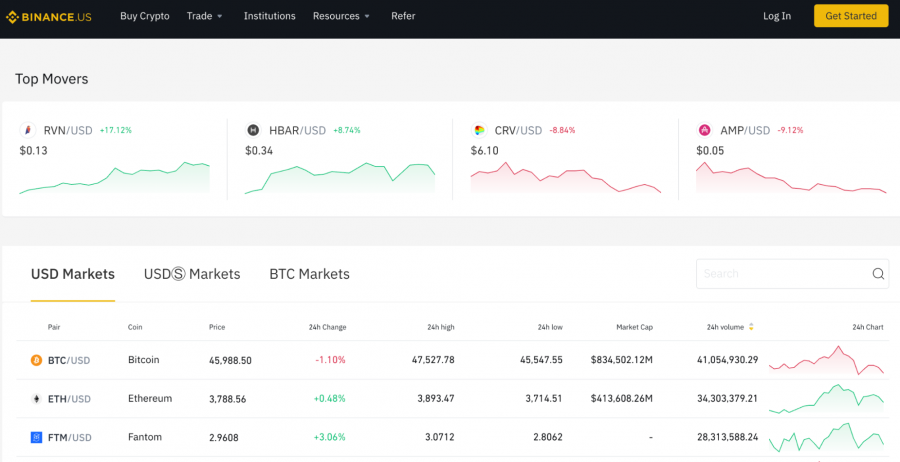

3. Binance – Low Fee Exchange to Invest in Heaps of Cryptocurrencies

Binance is the largest cryptocurrency exchange globally. With that said, the exchange offers a domestic version of its website that is only accessible to US clients. And, compared to the 600+ cryptocurrencies hosted on the main Binance website, the US version of this exchange supports 80+ markets.

Binance is the largest cryptocurrency exchange globally. With that said, the exchange offers a domestic version of its website that is only accessible to US clients. And, compared to the 600+ cryptocurrencies hosted on the main Binance website, the US version of this exchange supports 80+ markets.

Nevertheless, once you have opened a verified account here and made a deposit, you can trade cryptocurrencies at a commission of just 0.10% per slide. Moreover, when funding your Binance account via ACH or a domestic bank wire, you won’t be charged any transaction fees.

On the other hand, depositing with a debit or credit card is expensive here, with Binance charging 4.5%. Moreover, this is in addition to an instant buy fee of 0.5%. When it comes to trading tools, this is where Binance stands out. This is because you can analyze the cryptocurrency markets through high-level technical indicators and charting features.

However, these tools won’t be suitable for beginners, so do bear this in mind before you open an account with Binance. Another popular feature offered by Binance is its Trust Wallet app – which enables you to store thousands of different tokens across multiple blockchains. For a simpler way to store your crypto investments – you can use the main Binance web wallet.

| Number of Cryptos | 80+ |

| Trading Commission | Up to 0.10% |

| Debit Card Fee | 4.5% plus an instant buy fee of 0.5% |

| Minimum Deposit | Depends on the payment method |

What We Like:

- 80+cryptocurrencies to trade

- Low trading commissions

- Dedicated staking service gives users access to the best staking coins

- Suitable for technical traders

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

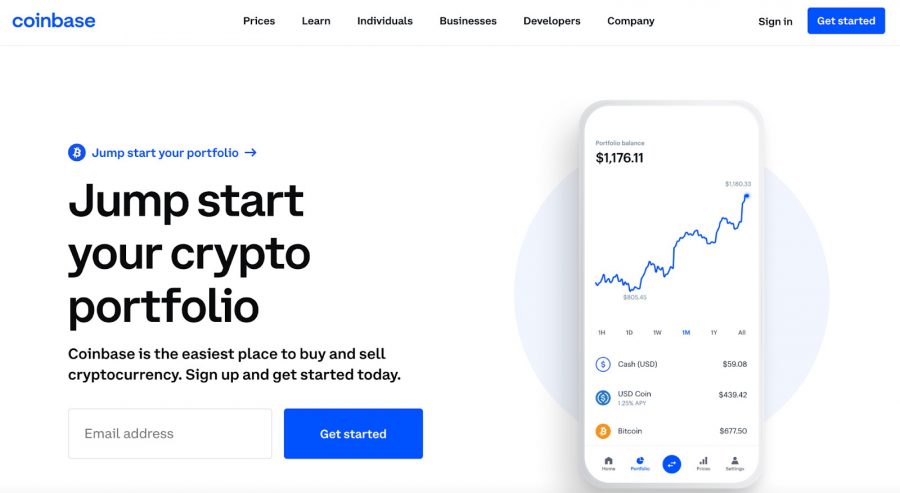

4. Coinbase – Top Exchange for First-Time Cryptocurrency Investors

The Coinbase website itself offers a somewhat bare-bones service – which will likely appeal to first-time investors. There is no complicated jargon found at Coinbase and when you invest in cryptocurrency – you will be guided through the required process step-by-step.

The Coinbase website itself offers a somewhat bare-bones service – which will likely appeal to first-time investors. There is no complicated jargon found at Coinbase and when you invest in cryptocurrency – you will be guided through the required process step-by-step.

Coinbase is a heavily regulated exchange that is now listed on the NASDAQ as a tradable stock. We like that the platform keeps 98% of client funds in cold storage and all accounts must have two-factor authentication installed. All in all, Coinbase is one of the safest cryptocurrency platforms in this industry.

However, Coinbase also charges some of the highest fees that we have come across. For example, when you invest in cryptocurrency here, you will pay a standard commission of 1.49%. This 1.49% commission will again be charged when you close a position. Although ACH payments can be made fee-free, debit/credit card transactions are charged at 3.99%.

This does, however, include your trading commission. Nonetheless, cheaper fees are most certainly available elsewhere. If you do decide to use Coinbase to invest in cryptocurrency – then you have several options when it comes to storage. This includes a dedicated wallet app that allows you to manage your private keys.

| Number of Cryptos | 50+ |

| Trading Commission | 1.49% |

| Debit Card Fee | 3.99% |

| Minimum Deposit | Depends on the payment method |

What We Like:

- User-friendly mobile app interface

- Can purchase crypto using credit/debit card and PayPal

- Great educational content

- Two-factor authentication

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Gemini – Safe and Regulated Exchange to Invest in Cryptocurrency

In many ways, Gemini offers a very similar service to that of the previously discussed Coinbase. This is because, just like Coinbase, Gemini offers a simple user interface that makes the process of investing in cryptocurrency easy – even for beginners. Furthermore, Gemini is a heavily regulated exchange.

This includes a license with the New York State Department of Financial Services (NYSDFS) – so you should have no issues regarding safety. However, much like Coinbase, Gemini is one of the most expensive cryptocurrency exchanges in the market. For example, you will pay a standard commission of 1.49% per slide for any cryptocurrency investments above $200.

If you trade less than $200, you will pay a flat fee depending on the size of the investment. Either way, this will work out at more than 1,49% in percentage terms. Another thing to note about the pricing structure at Gemini is that although debit and credit card payments are supported, this will set you back 3.49% of the purchase amount.

This is why it’s best to deposit funds via a wire transfer at Gemini, which is free of charge. In terms of supported markets, Gemini is home to 75+ leading cryptocurrencies. This includes everything from Bitcoin, Ethereum, and Litecoin, to Chainlink, Zcash, and Bitcoin Cash. Finally, Gemini also offers an earning tool that allows you to generate interest in your crypto investments.

| Number of Cryptos | 75+ |

| Trading Commission | 1.49% |

| Debit Card Fee | 3.49% |

| Minimum Deposit | Depends on the payment method |

What We Like:

- Strong regulatory framework

- Institutional-grade security

- 75+ cryptocurrencies supported

- Earning tool that allows you to generate interest

Cryptocurrency Investment Explained

Granted – the underlying blockchain technology that supports cryptocurrencies like Bitcoin and Ethereum can appear somewhat complex at first glance. However, in terms of investing in cryptocurrency – the process is no different from buying stocks.

That is to say, the overarching concept when you invest in cryptocurrency is that you will make money if the value of the token increases. And, just like stocks, this is based on demand and supply.

This means that as more and more people invest in a specific cryptocurrency – its value will increase.

To highlight just how simple the cryptocurrency investment process is, we’ll use buying Binance Coin as a prime example:

- Let’s suppose that you decide to invest $3,000 into BNB

- When you place your order at your chosen cryptocurrency exchange – BNB is priced at $390 per token

- You decide to hold on to your BNB tokens for two years

- Two years have passed and BNB is now trading at $1,050 per token

- This means that since you invested, the value of BNB has increased by 169%

As per the above example, if you were to cash out your BNB invested when the token was priced at $1,050 – your 169% gains would amount to a total return of $8,070. As such, on your original investment of $3,000 – you made a profit of $5,070.

Interestingly, although returns of this magnitude might seem high – consider that since BNB was launched in 2017, it has increased in value by more than 10,000%.

Is Cryptocurrency a Good Investment?

Like all asset classes, there is no guarantee that you will make money from a cryptocurrency investment. Moreover, it is important to remember that cryptocurrencies are volatile and speculative.

Therefore, before you decide to invest in cryptocurrency – it’s important to consider both the benefits and risks.

Should I Invest in Cryptocurrency? Benefits of Crypto Investing

In this section, we will talk about some of the reasons why so many investors in the US are now turning to cryptocurrencies to make long-term financial gains.

Thousands of Cryptocurrency Tokens to Choose From

First and foremost, we like the fact that there are now thousands of cryptocurrency projects in the market.

And as such, in a similar nature to the thousands of stocks listed on the NYSE and NASDAQ, you are sure to find a cryptocurrency that aligns with your financial goals.

For example, if you’re simply looking to dip your toes into cryptocurrency for the first time, then you might decide to stick with established and large-cap projects like Bitcoin and Ethereum.

In comparison to lower-cap tokens, these cryptocurrency projects are less volatile, albeit, the upside potential might be more limited.

On the other hand, you might also consider investing in less established cryptocurrencies with a smaller market capitalization. These tokens will appeal to investors that have a higher risk tolerance and wish to target greater profit margins.

Cryptocurrencies Smash Through Stock Market Gains

While cryptocurrencies are inherently risker than traditional stocks, the former continues to generate significantly higher gains.

For instance, over the prior five years, the S&P 500 has increased by 94%. Moreover, the NASDAQ Composite has returned 144% over the same period.

- In comparison, consider that over the past five years, Bitcoin has increased by more than 3,600%.

- Bitcoin isn’t the best-performing cryptocurrency though, as many other tokens in this marketplace have generated even higher growth levels.

- For example, Ethereum has increased in value by over 7,000% during the same period, while as noted earlier, BNB is up 10,000%.

When you look at some of the best Metaverse coins in the market – gains are even more impressive. For example, Decentraland and its MANA token have grown by over 25,000% since launch.

Major Companies are Engaging With Cryptocurrency

Some of the biggest and most dominant companies globally are now engaging with cryptocurrency – which once again, proves beyond doubt that this industry is here to stay in the long run.

For example, Tesla – which is one of the largest companies globally with a market capitalization of over$1 trillion, invested $1.5 billion from its balance sheet in late 2020 into Bitcoin.

Then you have companies like Overstock, Paypal, Microsoft, and Starbucks – all of which allow you to spend Bitcoin on their respective products and services.

Cryptocurrency can Yield Capital Gains and Regular Income

Another major reason that is leading to more and more people investing in cryptocurrency is that digital assets now allow you to make money on two fronts.

First, as noted earlier, you will make a profit from your cryptocurrency investment if the value of the token increases in the open marketplace.

However, what you can also do is deposit your digital tokens into crypto savings accounts to earn passive income. For example, if you were to deposit your Bitcoin into Aqru – you would earn 7% interest annually.

This can be achieved without you needing to sell your cryptocurrencies. Meaning – that while your tokens are stored in a crypto interest account, you will still make money if the token rises in value.

Cryptocurrency is Still a New Concept

On the one hand, cryptocurrency has achieved legitimacy in many ways – especially when you consider the vast number of established companies and brands that are now engaged in this space.

However, it is also important to remember that the world’s first cryptocurrency – Bitcoin, was only launched in 2009. Moreover, some of the largest cryptocurrency projects in this space are even younger.

- For example, Cardano and Solana were only launched in 2017.

- Avalanche and Shiba Inu – both of which carry a multi-billion dollar market capitalization, were launched as recently as 2020.

- You then have Lucky Block – which is one of the most successful cryptocurrencies this year – was launched in early 2022.

And all in all, it is far from too late to invest in cryptocurrency – as the broader marketplace is still in its infancy.

What are the Risks of Investing in Cryptocurrency?

It is all good and well to focus on the many benefits that you can take advantage of when you invest in cryptocurrency.

However, seasoned traders will always consider the risks of an asset class before proceeding with an investment.

And as such, in the bullet points outlined below, we take a closer look at some of the main risks to consider when you invest in cryptocurrency.

- Speculative: Many investments in the cryptocurrency markets are highly speculative. This means that the overarching focus is on short-term price increases as opposed to long-term value.

- Volatile: A direct result of the speculative nature of cryptocurrencies is that this marketplace can be extremely volatile. Moreover, the smaller the market capitalization that a cryptocurrency has, the more volatile it becomes.

- Rug Pulls: The term ‘rug pull’ refers to a cryptocurrency project that was created with the sole intention of scamming investors. A recent example of this was Squid Coin, which resulted in investors losing millions of dollars.

- Hacks: Another risk to consider before you invest in cryptocurrency is that hackers will often favor this asset class. The biggest threat in this respect is if your wallet is remotely hacked – your entire balance can be stolen in a matter of seconds.

There are many things that you can do to reduce the risks of losing money from a cryptocurrency investment. This includes diversifying well, across lots of different projects, and doing in-depth research before parting with any money.

Moreover, to ensure your cryptocurrency tokens remain secure – consider using a heavily regulated broker like eToro.

The Best Cryptocurrency to Invest in

Although it’s great that you have thousands of digital tokens to choose from, knowing which cryptocurrency to invest in can be a cumbersome and challenging process.

With that said, if this is your first time investing in cryptocurrency – you might want to consider some of the solid projects discussed below.

Bitcoin

It will likely come as no surprise to learn that Bitcoin is the best cryptocurrency to invest in 2022 if this is your first time entering the market. Bitcoin is the world’s first and still de-facto cryptocurrency – and thus – it has the longest track record in this space.

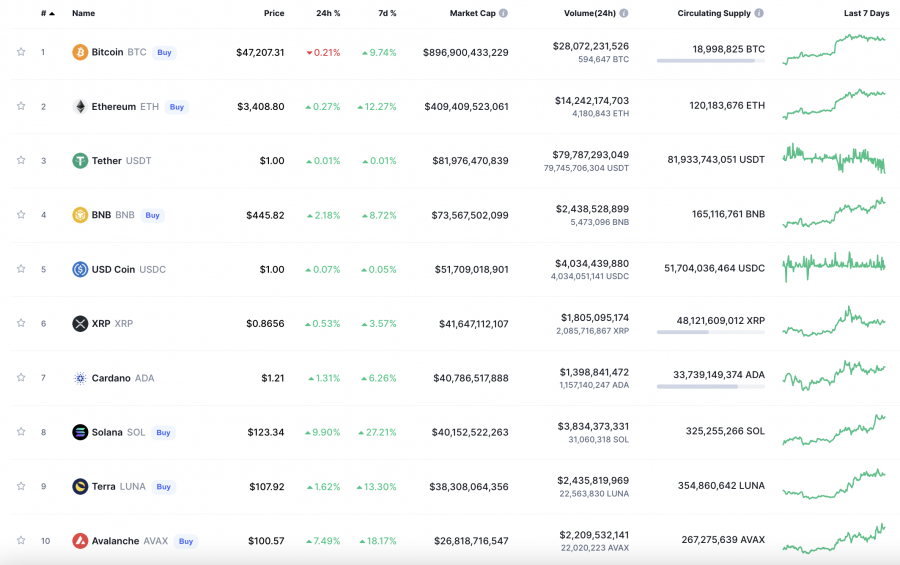

Excluding stablecoins like Tether, Bitcoin also attracts the largest trading volumes. Moreover, Bitcoin carries the largest market capitalization of any cryptocurrency – so in theory, it is one of the least volatile to own.

Cryptoassets are a highly volatile unregulated investment product.

XRP

Another cryptocurrency that has an established track record in this space is XRP. Launched in 2012, XRP is the native cryptocurrency of the Ripple blockchain.

This project provides banks and large financial institutions with technology that can execute cross-border transactions. Unlike traditional systems, Ripple and XRP permit cheap and near-instant transfers – regardless of the currencies involved.

Cryptoassets are a highly volatile unregulated investment product.

BNB

Founded in 2017, although BNB is younger than its Bitcoin and XRP counterparts, it’s still one of the best cryptocurrencies to invest in today. This digital currency is backed by Binance, the world’s largest exchange.

BNB is a top-five cryptocurrency for market capitalization and it is the primary token used on the Binance Smart Chain, which is home to thousands of projects. BNB is also used by traders to reduce Binance exchange commissions by 25%.

Cryptoassets are a highly volatile unregulated investment product.

Ethereum

Ethereum was launched in 2015 and since then – its native ETH token has increased in value by over 28,000%. The Ethereum blockchain allows developers to deploy smart contracts and decentralized applications (DApps).

Crucially, not only is Ethereum the second-largest cryptocurrency for market capitalization, but it is the preferred blockchain protocol for lots of other successful projects. This includes Basic Attention Token, Uniswap, Axie Infinity, Maker, and more.

Cryptoassets are a highly volatile unregulated investment product.

Lucky Block

Lucky Block was launched as recently as January 2022 and thus – it’s one of the best new cryptocurrency to invest in. The project is building a decentralized ecosystem that will allow players from all over the world to access lottery games. LBLOCK has also been dubbed as one of the most undervalued cryptos in 2022.

All games are executed by smart contracts – meaning that there is no involvement from conventional state-backed franchises. Moreover, all lottery games are guaranteed fairness and transparency by the blockchain protocol.

Cryptoassets are a highly volatile unregulated investment product.

Note: The above cryptocurrencies have been selected by the author of this guide. And as such, you should do your own due diligence and in-depth research before risking any money.

Best Penny Cryptocurrency to Invest in

If you come across the term ‘penny cryptocurrency’, this simply refers to digital tokens that trade for less than $1. As such you can explore the cheapest options via our best cryptos under $1 guide.

Crucially, it is important to remember that just because a cryptocurrency is cheap – this doesn’t mean that you are taking on enhanced risk. After all, the value of a cryptocurrency is determined by the number of tokens in circulation and its current market price.

- For example, as of writing, XRP is trading at just $0.86 per token, albeit, it carries a market capitalization of over $40 billion.

- On the other hand, Yearn.finance has a market capitalization of less than $1 billion even though as of writing – a single token would cost you more than $23,000.

Nevertheless, if you’re specifically looking for the best penny cryptocurrency to invest in 2022 because you wish to own a large number of tokens – consider the projects outlined below:

- The Graph: Provides blockchain projects with indexing capabilities. This means that blockchains can separate and prioritize data. In turn, blockchains can avoid becoming overloaded with information.

- Dogecoin: As one of the best meme coins on the market, this speculative cryptocurrency is favored by Tesla’s CEO Elon Musk. Over the prior five years, Dogecoin has returned investors with gains of over 800%.

- Stellar: Although Stellar was launched in 2014, this penny cryptocurrency has never surpassed a value of $1. Its underlying blockchain offers speedy transactions at a fee of near-zero. Notable partnerships include IBM and MoneyGram.

Once again, conduct your own due diligence before investing in penny cryptocurrencies.

Investing in Cryptocurrency vs Trading Cryptocurrency

The terms ‘investing’ and ‘trading’ are typically used interchangeably in the cryptocurrency industry. However, just like in the stocks and shares scene, these two terms refer to different strategies.

For example, in the case of cryptocurrency investing:

- When you invest in a cryptocurrency, you typically do so with a long-term vision in mind. Hence why so many investors look for the best long term crypto investments on the market.

- This means that at a minimum, you will likely hold onto your tokens for at least one year.

- Cryptocurrency investing requires little input from you after having bought your chosen tokens.

And, when you trade cryptocurrency:

- Cryptocurrency trading is typically viewed as a shorter-term strategy.

- This means that you might buy a cryptocurrency and cash out within the next few weeks or months. This is also referred to as crypto day trading.

- In some cases, traders will open and close a position within one day.

- Crucially, cryptocurrency trading requires active participation in terms of research and technical analysis.

As a newbie in this industry, it’s best to stick with a long-term approach to cryptocurrency. This means that you will look to choose solid projects that offer a viable long-term outlook and thus – you will have little interest in shorter-term volatility.

Is it Safe to Invest in Cryptocurrency?

In a nutshell – it is very safe to invest in cryptocurrency in the US. However, as we covered earlier, there are still several risks that you need to take into account to ensure that your investments remain safe and secure at all times.

At the forefront of this is ensuring that you only invest in cryptocurrency with an online broker that is regulated to offer US clients digital asset services.

For example, when you use eToro, you can be sure that your capital and digital tokens are in safe hands – as this brokerage firm is regulated by multiple tier-one bodies. Webull, Coinbase, and Gemini also have a strong regulatory standing in the US.

Moreover, when it comes to wallet security, this is another area where eToro excels.

This is because when you invest in cryptocurrency through this broker, your digital tokens are kept safe by the platform’s in-house wallet – which is bound by institutional-grade security controls.

And if you’re a beginner, keeping your cryptocurrency investments in your eToro web wallet will most definitely appeal, as you don’t need to have any knowledge of private keys or remote hacking defenses.

How to Invest in Cryptocurrency – Tutorial

This beginner’s guide on how to invest in cryptocurrency in the US will now conclude with a detailed walkthrough of how to purchase your first-ever digital asset.

The steps below will show you how to open an account with eToro, deposit US dollars fee-free, and subsequently invest in your chosen cryptocurrency from a stake of just $10.

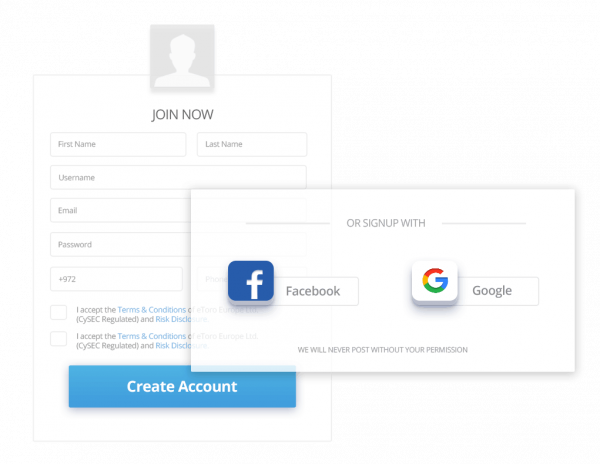

Step 1: Register an Account

First, open an eToro account – which you can do by clicking ‘Join Now’ on the official website. Enter your personal information and contact details when prompted, alongside a username. You also need to verify your email address.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

To get yourself verified near-instantly, you will need to upload some ID. If you’re based in the US, this can be a valid passport, driver’s license, or state ID card.

Step 2: Deposit Funds

Deposits at eToro can be executed instantly when you choose from a debit or credit card, or an e-wallet. The latter is inclusive of Neteller and Paypal.

No fees are charged on US dollar deposits and the minimum for first-time customers from the US is just $10.

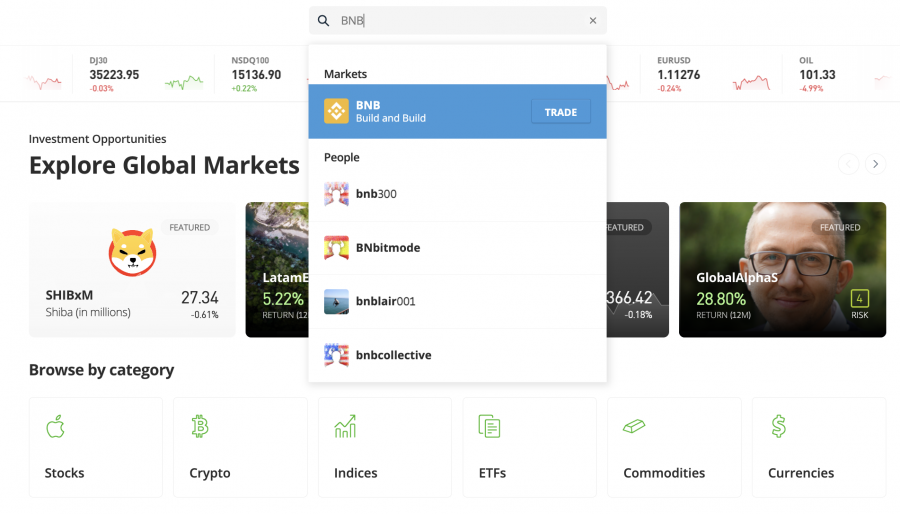

Step 3: Choose Which Cryptocurrency to Invest in

If your eToro account is funded, you can now decide which cryptocurrency to invest in. eToro lists 60 digital currencies – so click on ‘Discover’ to see what markets are supported.

Alternatively, you can use the search bar at the top of the page if you already know which cryptocurrency to invest in. In our example above, we are searching for BNB.

Step 4: Invest in Cryptocurrency

You need to click on the ‘Trade’ button next to your preferred cryptocurrency – which will load an order form.

Here, you need to type in the amount of money you wish to invest. You can stake any amount from just $10 at eToro.

To invest in cryptocurrency right now – click on the ‘Open Trade’ button.

Conclusion

To invest in cryptocurrency right now – the process takes just five minutes from start to finish.

You should, however, ensure that you do plenty of research so that you can decide on which cryptocurrency to invest in. You should also remember that digital currencies are volatile, so consider the risks involved before proceeding.

Ultimately, eToro offers the overall best place to invest in cryptocurrency in the US for its industry-leading fee structure, support for 60 digital assets, and the ability to deposit US dollars without being charged.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Frequently Asked Questions on Investing in Cryptocurrency

Is cryptocurrency a good investment?

How do I invest in cryptocurrency?

What is the best way to invest in cryptocurrency?

What is the best site to invest in cryptocurrency?

What cryptocurrency should I invest in?

This news is republished from another source. You can check the original article here