27 million Americans now own crypto. 3% of them own dogecoin, as many as do eth, and 45% own bitcoin. However, the most interesting finding of one of the biggest crypto survey, involving 54,534 people, may well be just how much global adoption is growing, and yet still just how few do crypto in population percentage terms.

In a birds eye view of crypto adoption across 27 countries, Finder reveals the dominant USA still has “the sixth-lowest rate of cryptocurrency ownership among all countries in our survey, with just 10.5% of Americans owning crypto.”

The crown instead goes to Vietnam, with 28.6% owning crypto. Somewhat surprisingly, India is in second place with 23.4%, followed by Australia at 22.9%.

If we extrapolate India’s numbers, this would give us more than 200 million crypto owners.

Previous surveys have suggested 100 million Indian crypto users, which we thought might be an optimistic estimate, but in recent months the growth in Indian crypto adoption has become more noticeable. And so it may well be they do actually have 100-200 million cryptonians.

Globally “the number of Internet users who say they own crypto jumped from 11.2% in October to 15.5% in December.”

That makes the current phase of adoption that of institutional investors, just coming out of early adopters to the early majority.

It is still early adopters until 15%, which is just about where we are currently, but things start changing at that point as we move towards more mainstream, with no IQ measure in this survey, but we’d expect it to start gradually falling.

An interesting measure they do bring up however is a potential correlation between attitudes towards crypto and the corruption perception index.

The more corrupt is a country, the more the people of that country look towards cryptos very favourably.

Nigerian adults are the most likely to say cryptocurrency is a good investment (87%), followed by Venezuelans (81%), Ghanians (78%), Kenyans (77%), and Filipinos (73%).

Meanwhile Germans are the least enthusiastic (17%) followed by Swedes (18%), Norwegians (20%), Canadians and Japanese (24% each).

Can we deduce from this that the less developed your civil service, the more likely you are to think of bitcoin as a solution?

Probably, it makes logical sense as bitcoin fundamentally is free market money which competes with national fiat money. If the latter is not managed well, or worse, collapses completely as in Venezuela, then alternatives like bitcoin have a greater role to play.

“Those living in regions where trust in the financial and regulatory systems is low are more likely to consider cryptocurrency a good investment,” says Finder’s head of consumer research, Graham Cooke, before adding:

“With low trust in the government, it’s likely people are looking for ways to build their own wealth while circumventing their government’s financial mandates on finance.

It’s here where crypto becomes an attractive investment because governments don’t regulate crypto – it’s decentralized digital money.”

But is Russia the exception that proves the rule, or does it reveal something else that might explain this correlation.

Globally, the percentage of people that view cryptos positively has increased, but in Russia it saw a drop of 13%.

That’s amid huge financial sanctions which have led to significant growth in Russia from 6.7% saying they own crypto in October, to 19.6% in December.

It is in November and December when Russia began amassing troops near Ukraine with US and Europe raising the alarm at that time while also threatening sanctions.

So we have two very contradictory data points, if we take the data at face value. Perception has turned negative while the buying has increased hugely.

One potential explanation can be that insiders, and here that would include the army boys as well as their families, bought because they knew of changed probabilities of what was coming.

At the same time the propaganda was increased against crypto, including the rehashed suggestion in January that the Russian central bank might ban it, something that to us was clear ‘granny propaganda’ as one might call it because there was no chance Putin would allow it, and they did back down.

There is no propaganda index however as far as we are aware, not least because presumably it would be quite difficult to measure it. So we can’t easily see if there’s a better explanation regarding this correlation.

The intense negative propaganda against cryptos in USA and in some of Europe by the media, and sometime by government agencies, is undeniable however.

It is obviously effective as well to some extent as the Russian case shows, so rather than corruption it may be lower trust in the government means lower chances of being fooled by propaganda where they’re buying while telling the public to keep away.

Because if you limit it to the corruption index, you’d miss a lot of the wider picture. Including that fiat is targeted towards inflation, which itself is a corruption of sorts because who does the fiat genesis block go to, or any fiat blocks?

$10 trillion was borrowed from the FED by the US government, a Fed which ‘lent’ printed out of nothing ‘fiat blocks’ and now wants them repaid with interest perhaps at 2% or more by the end of the year, when they lent them at 0%.

Who does this 2% go to? That’s a question asked since 2018 now when the Swiss had their referendum on Sovereign Money, and still remains unexplained officially.

As long as that continues, crypto adoption may well continue to grow because it has passed the tipping point in almost all of the countries surveyed.

“It’s clear that crypto is gaining global popularity and with continued enthusiasm for blockchain technology, there’s no denying that crypto is part of the future of finance,” Cooke says.

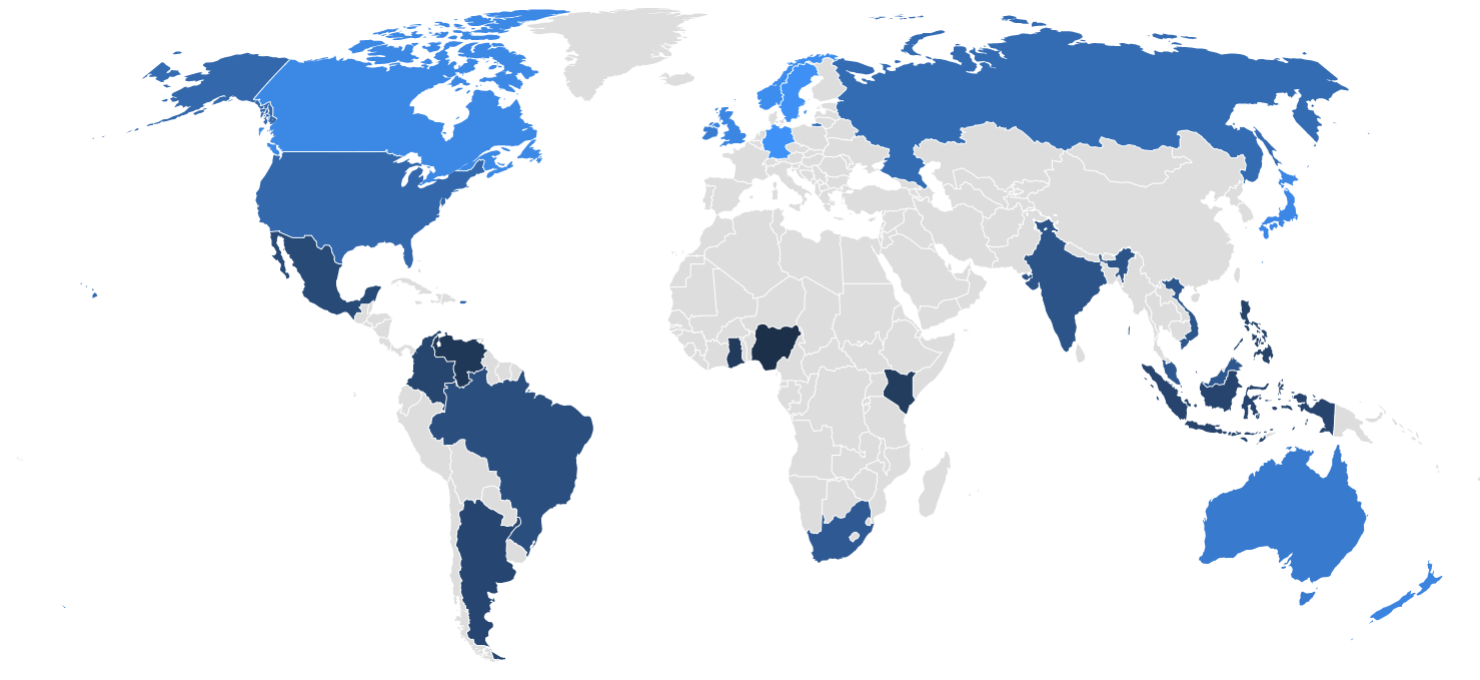

As the featured image above shows, where the darker the blue, the more positive the view towards cryptos, attitudes are improving with global positivity towards cryptocurrency as of February 2022 up 8% from the previous survey.

At a global scale, that’s a fairly big deal, with this snapshot indicating that crypto is moving in the right direction, but is still very small and only now stands on the verge of moving towards the early majority of adopters.

This news is republished from another source. You can check the original article here