Buying digital currencies like Bitcoin, Dogecoin, and Cardano is now a simple and burden-free process.

All you need to do is open an account with a trusted cryptocurrency broker that offers low fees – make a deposit, and decide how many tokens you wish to buy.

In this beginner’s guide, we explain how to buy cryptocurrency in great detail – covering the step-by-step investment process alongside an overview of the best exchanges to consider.

How to Buy Cryptocurrency – Quick Guide

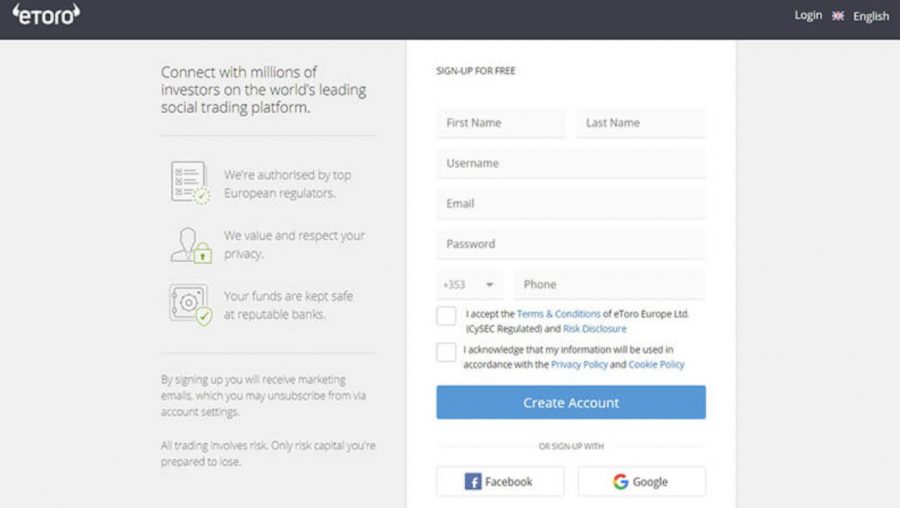

Step 1: Open an eToro account

eToro is the best place to buy cryptocurrency in terms of fees, SEC regulation, and low minimums. Open an account with eToro to get the process started.Step 2: Deposit Funds

When you deposit USD at eToro – no fees apply using debit/credit cards, e-wallets, or bank transfers. The minimum deposit is just $10.Step 3: Search for Cryptocurrency

eToro supports over 40+ cryptocurrency assets. You can use the search bar at the top of the page to find the cryptocurrency you want to buy.Step 4: Buy Cryptocurrency

Finally – in the ‘Amount’ box, you need to specify the size of your cryptocurrency investment, before clicking on ‘Open Trade’.

In the following sections of this guide, we explain the process of how to buy crypto in a more detailed way.

Where to Buy Cryptocurrency

It goes without saying that in order to buy cryptocurrency online, you need to have an account with a broker or exchange.

When deciding where to buy cryptocurrency – your chosen platform should offer low fees, your preferred payment method, small account minimums, and of course – a strong regulatory framework. So, whether you’re looking to buy the Graph, XRP, or Ethereum, you’ll need to choose an exchange or broker that matches your trading needs and financial goals.

Below, we review a selection of top-rated platforms that allow you to buy cryptocurrency safely and cost-effectively.

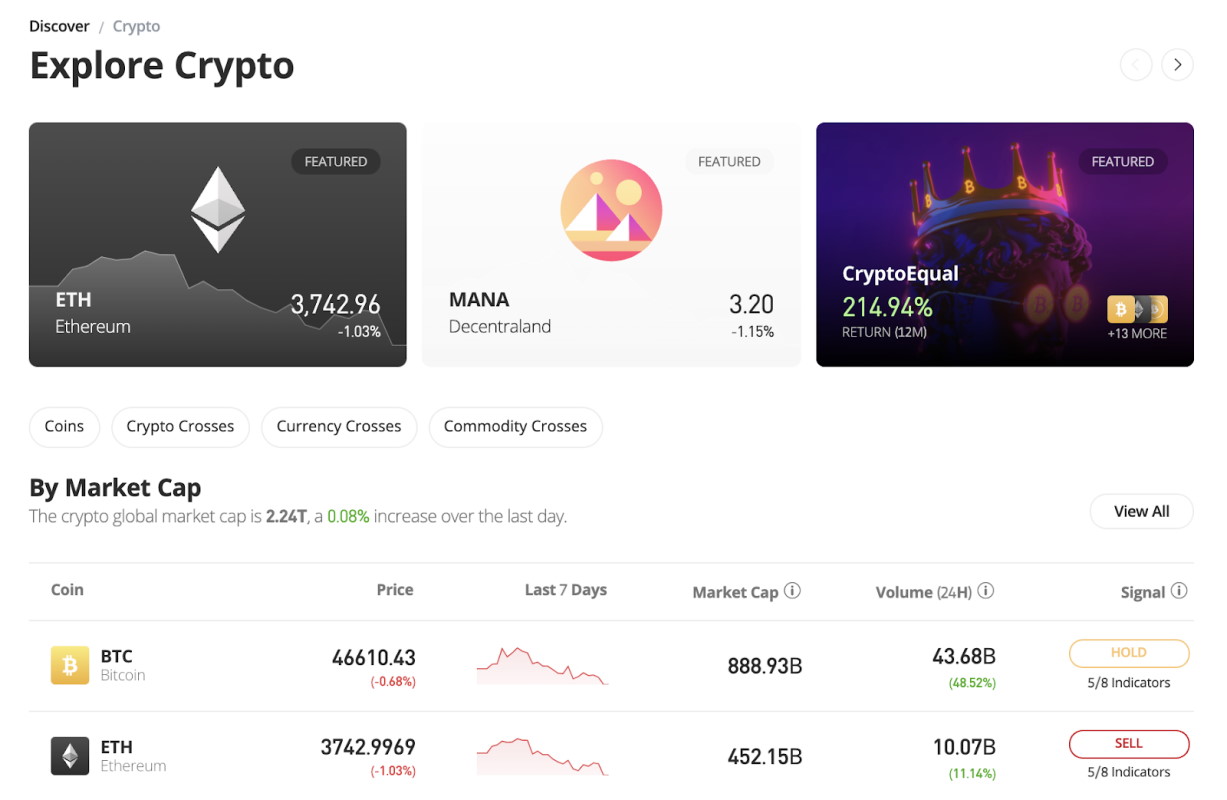

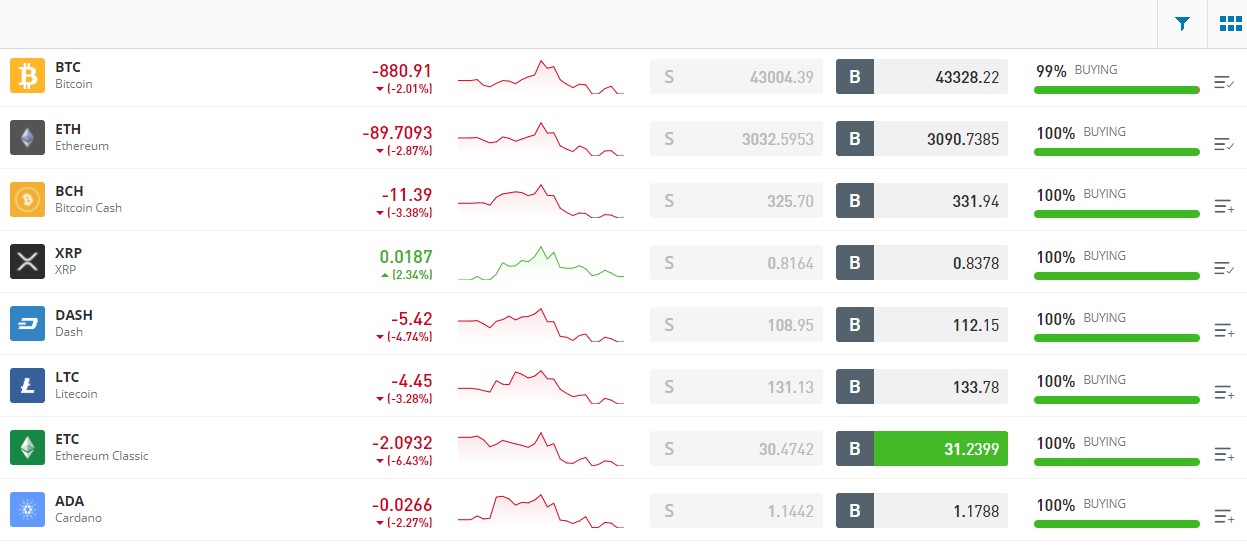

1. eToro – Overall Best Platform to Buy Cryptocurrency in 2022

You won’t find a better online broker to buy cryptocurrency than eToro – which offers a safe, low-cost, and budget-friendly way to invest. First, this innovative social trading platform is regulated by several tier-one licensing bodies – which include the SEC in addition to the FCA, ASIC, and CySEC. Moreover, eToro is a member of FINRA.

You only need to deposit $10 to open an account at this broker – which is ideal for those wishing to invest small amounts of money. Similarly, the minimum cryptocurrency purchase permitted at eToro is also $10. Supported cryptocurrencies are plentiful at eToro, with more than 50+ digital assets available to buy. Therefore you can buy Dogecoin on eToro as well as other popular altcoins with low fees.

This covers large-cap tokens as well as several DeFi coins. For instance, you could buy Solana or you could buy Axie Infinity with a tight transaction fee of just 1% on eToro.

eToro really stands out when it comes to fees. For instance, US clients can deposit funds without paying any fees at all – which covers debit/credit cards, e-wallets, and bank transfers. When you buy and sell cryptocurrency here, you only need to cover the spread – which starts at just 0.75%. Furthermore, USD withdrawals are also free.

If you’re interested in cryptocurrency but have little experience in this space – eToro offers a Smart Portfolio that manages your investments on your behalf. The portfolio in question will cover more than a dozen digital assets – which will be rebalanced regularly by the eToro team.

Alternatively, you can choose to copy top crypto traders on the eToro platform. The copy trading tool allows you to instantly copy the portfolios of any crypto trader on the platform, and you can access in-depth statistics on their performance all for no extra cost! Finally, eToro also offers a top-rated mobile app – which is available on both iOS and Android. This means you can gain exposure to the crypto market directly from your smartphone device and buy Celo and other exciting new altcoins with tight spreads and low fees.

eToro is also widely regarded as the best stock broker due to its copy trading tools and zero commission policy on buying and selling stocks.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Coinbase – Good Place to Buy Cryptocurrency for Beginners

Launched in 2012, Coinbase is a large cryptocurrency exchange and broker based in the US. With millions of customers using Coinbase to buy and sell cryptocurrency – the platform is often the preferred provider for beginners. This is because Coinbase is simple to use and it supports small investments.

On the other hand, Coinbase is expensive – especially when it comes to debit/credit card payments. That is, by using your Visa or MasterCard to buy cryptocurrency instantly, Coinbase will charge you almost 4%. Standard commissions at this platform are also pricey at 1.49% per slide.

On the flip side, you can deposit US dollars via ACH without paying any fees. Moreover, Coinbase offers a relatively broad selection of cryptocurrencies to choose from – you can diversify well here. We also like that Coinbase is regulated – and that it keeps 98% of client digital funds in cold storage.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

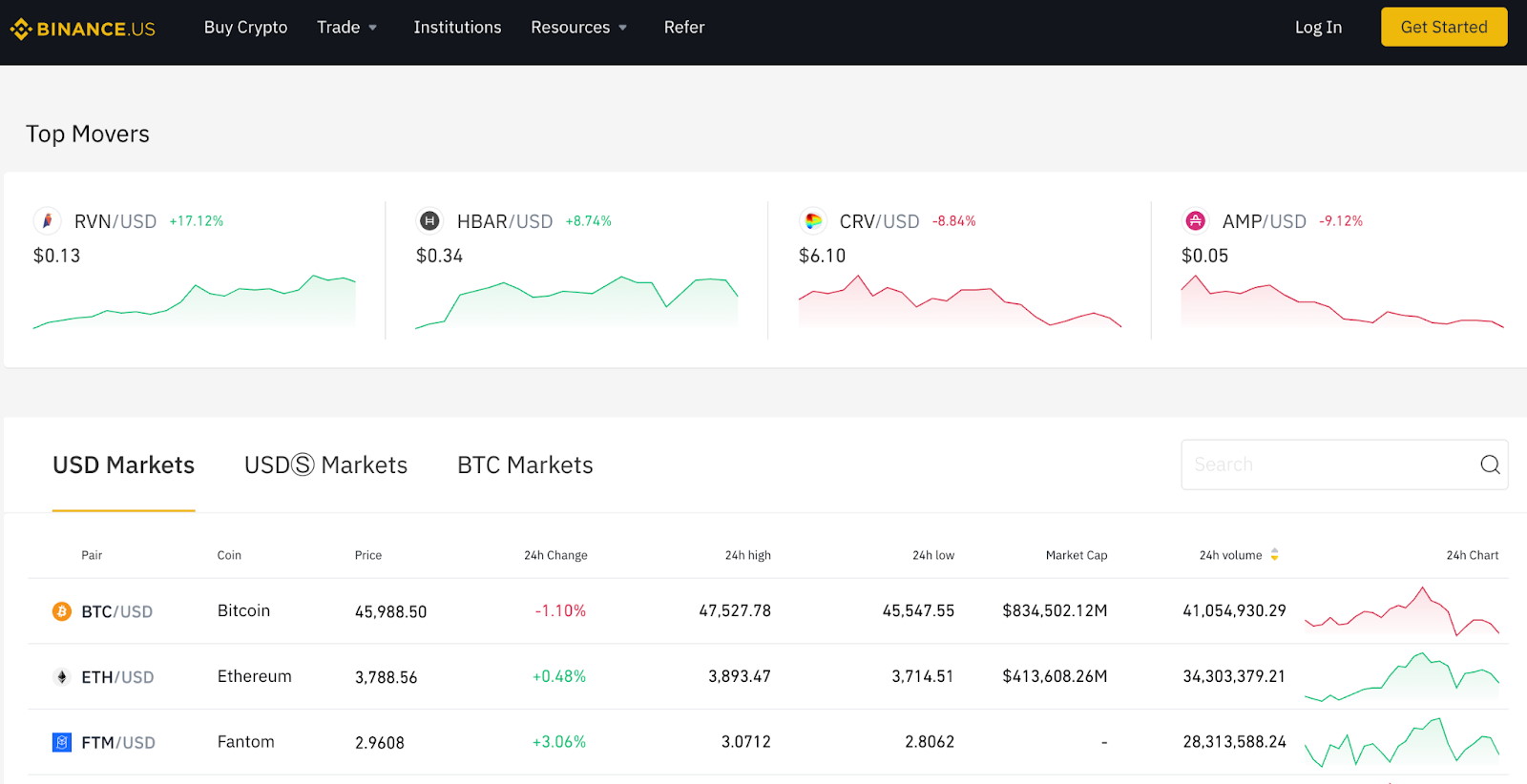

3. Binance – Popular Place to Buy Bitcoin for Asset Diversity

Binance is larger than Coinbase – with a global user base of over 100 million clients. The platform is also the biggest in terms of daily trading volume. As such, Binance is popular with those seeking high levels of liquidity and a wide selection of digital currency markets.

If you’re based in the US, you will have access to a dedicated US version of Binance. This gives you access to over 50+ currencies – all of which you can buy with a debit/credit card. Much like Coinbase, the fees here are expensive – with Binance charging 4.5% to use Visa or MasterCard, in addition to a buy commission of 0.5%. This means you could buy Polkadot with a small commission of 0.5%.

With that said, if you are able to deposit funds with ACH or a domestic wire transfer, you will not be charged any fees. When it comes to trading commissions, Binance is very competitive. In fact, you’ll pay a maximum commission of 0.10% per slide to trade crypto-crypto pairs. If you’re a seasoned investor, Binance offers advanced trading tools and OTC services.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Webull – Buy Cryptocurrency From Just $1

Webull is one of the most popular brokerage sites in the US, with the platform offering thousands of stocks, ETFs, and even options. However, Webull is also known for offering low-cost cryptocurrency services. In fact, you can buy cryptocurrency here at a minimum of just $1 – which is ideal for casual traders.

When it comes to fees, Webull does not charge any commissions when you buy or sell cryptocurrency. You do, however, need to be aware that cryptocurrency spreads here start from 1%. You can trade a variety of digital currencies here – including but not limited to Bitcoin, Chainlink, Uniswap, Zcash, Bitcoin Cash, Litecoin, Ethereum, and more.

Webull also offers a fully-fledged trading app that gives you access to your investment account on the move. You can deposit funds at this brokerage without needing to meet a minimum. Although you won’t be able to deposit via a debit/credit card, you can fund your account with ACH or bank wire. The latter comes with a deposit/withdrawal fee of $8/$25 respectively.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Gemini – Solid Cryptocurrency Exchange for Seasoned Investors

Gemini offers one of the most secure places to buy cryptocurrency – especially if you are a large-scale investor. The platform is authorized and regulated by the New York State Department of Financial Services and is structured as a trust company. Moreover, in addition to institutional-grade security – Gemini has also secured $200 million of cold storage insurance.

Although Gemini offers a rock-solid place to buy cryptocurrency safely, the platform does charge a rather pricey commission of 1.49% per slide. Nevertheless, when it comes to supported markets, you will have access to over 70+ cryptocurrencies at Gemini. This includes a wide selection of large caps, ERC-20s, and DeFi coins.

Another top-rated feature at Gemini is its crypto interest offering. In a nutshell, by depositing your idle digital tokens into the Gemini exchange, you will be paid a rate of interest – which will depend on the respective asset. For example, you can earn 8.05% APY on the Gemini Dollar and 4.03% on Bitcoin Cash.

Should I Buy Cryptocurrency?

When learning how to buy cryptocurrency for the first time – you will quickly figure out that this marketplace is extremely volatile.

- For example, across the 12 months prior to writing this guide, Bitcoin has experienced 52-week lows and highs of $29,000 and $69,000 respectively.

- In simple terms, this amounts to a volatility spread of over 80%.

Taking this into account, it’s important to do plenty of research before you buy Bitcoin.

On the flip side, and as we cover in more detail shortly, it is important to note that 10 years prior to writing, Bitcoin was available to buy at just $1 per token. This means that the cryptocurrency has since grown by over 7 million percent.

- And, don’t forget that Bitcoin isn’t the only cryptocurrency that you can buy.

- On the contrary, CoinMarketCap now lists over 17,000 different digital currencies – all of which freely trade online.

Crucially, some cryptocurrencies have performed significantly better than Bitcoin in recent years.

Examples include the likes of Dogecoin, Shiba Inu, Ethereum, Binance Coin, and Solana – all of which have outperformed Bitcoin since each respective project was launched.

Beginner crypto traders often find choosing which altcoin to buy and how much to invest in very challenging. Something that could potentially help is to use the best crypto signals. Crypto signals do exactly what they say on the tin. Simply put, they’re trading ideas from experienced cryptocurrency traders indicating whether you should buy or sell specific cryptos at a certain time and price.

You could also consider trading crypto CFDs with a Bitcoin robot such as Bitcoin Prime. Trading via a Bitcoin bot means you’ll be speculating on the price movements of crypto CFDs and will not gain ownership of the underlying assets.

Benefits of Buying Cryptocurrency

The most important thing to consider when learning how to buy cryptocurrency is whether or not this volatile and speculative asset class is right for your financial goals.

If you’re still undecided, below we discuss some of the main benefits of buying cryptocurrency in 2022.

Monumental Price Increases

Before we give some examples of just how successful some cryptocurrencies have been since they were launched – it is important to note that not all digital assets have performed well. On the contrary, many tokens have seen huge losses in terms of their token value.

Nevertheless, it goes without saying that the overwhelming majority of people will look to buy cryptocurrency because of the huge returns that have been generated in recent years.

For example:

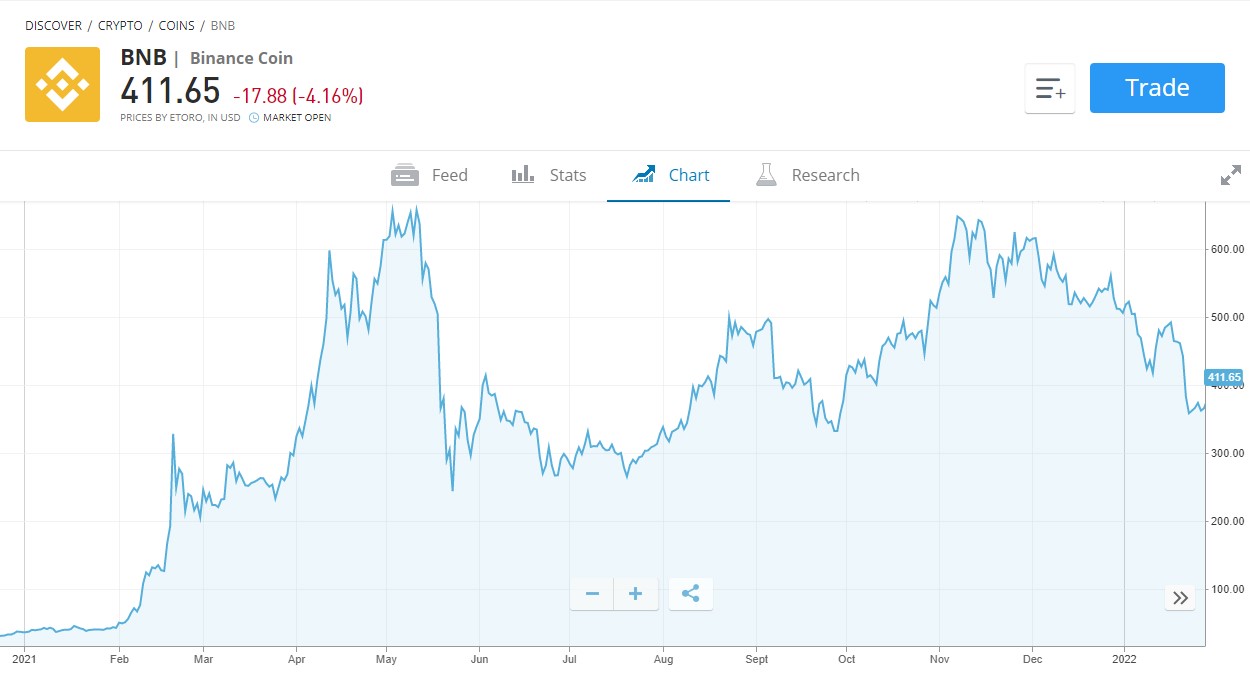

- When BNB was launched in 2017, it carried a token price of just $0.011

- Fast forward to 2022 and BNB has hit highs of $530

- This means that in just over five years, early BNB investors have made returns of over 480,000%

- In other words, had you invested just $1,000 into BNB when it was first launched, your portfolio would now be worth over $4.8 million

In another example:

- When Ethereum – which is the world’s second-largest cryptocurrency in terms of market capitalization, was first launched in 2015 – it was trading at approximately $0.75.

- Towards the end of 2021, Ethereum hit highs of just under $4,900.

- This means that in just over six years, the value of Ethereum grew by more than 653,000%

- As such, an initial investment of $1,000 in 2015 would have since grown to over $6.5 million

Although the above examples are just two of many – the key point here is that in buying cryptocurrency for your portfolio, you stand the chance of making sizable returns. Of course, you also stand the chance of losing money – so bear this in mind.

Diversification

Another benefit of buying cryptocurrency is that it is really easy to diversify. This is because of two key reasons.

First and as noted earlier, you can now choose from more than 17,000 tradable digital assets. As such, to reduce the risk of being overexposed to one or two cryptocurrencies, you could invest in a large basket of tokens.

Second, all cryptocurrencies can be fractionated into tiny units. For example, you don’t need to buy one full Ethereum token for several thousands of dollars. Instead, you can invest any amount of your choosing – even a couple of dollars.

This diversification strategy is particularly effective when you use a low-cost cryptocurrency broker that supports small investments. At eToro, for instance, you can diversify across more than 40 digital currencies at a minimum investment of just $10 per asset.

Limited Supply

Some, but not all, cryptocurrencies have a limited supply that is determined by immutable mathematical code.

For example, the total supply of Bitcoin will never surpass 21 million tokens – which is expected to happen by the year 2140.

- Crucially, this framework ensures that cryptocurrencies cannot be manipulated by central banks or governments – which is the case with all fiat currencies in circulation.

- For instance, the US Federal Reserve has printed trillions of dollars out of thin air since COVID-19 came to fruition.

Another benefit of investing in a cryptocurrency that has a limited supply is that finite assets typically perform well over the course of time.

Gold is a prime example here, its finite characteristics ensure that demand will always surpass supply.

Perfect for Cross-Currency Payments

If you have ever transferred money overseas – especially if the beneficiary was based in an emerging or third-world country, then you will know that the process can be both slow and expensive.

- Cryptocurrencies, however, offer a real solution to this problem, not least because the underlying blockchain is not restricted by jurisdictional borders.

- For example, if you were to buy XRP and transfer it – the transaction would take less than 5 seconds to process, regardless of where the sender and receiver are located.

- Furthermore, the transaction would cost you a small fraction of a cent in fees.

These benefits are not exclusive to XRP – but many other digital currencies that are currently in circulation.

Hedging Against Inflation and Stagnant Stock Markets

One of the biggest economic consequences that countries around the world are now facing as a result of COVID-related stimulus packages is that inflation levels are rising rapidly.

- In simple terms, this means that the value of your money becomes weaker – as prices for goods and services increase.

- To counter the very real threat of rising inflation, some investors are turning to stores of value like Bitcoin.

- After all, when you compare Bitcoin to broader inflation levels, the former has performed excellently as a hedging tool.

Additionally, cryptocurrency can also be a useful tool in hedging against the wider stock markets. For example, over the prior five years, the S&P 500 has grown by nearly 90%. Bitcoin, however, has increased in value by over 3,000% during the same period.

When to Buy Cryptocurrency

When you consider that cryptocurrency is a volatile asset class – you might be tempted to try and time the market in terms of when to buy and sell.

As noted earlier, in the 52 weeks prior to writing this guide, Bitcoin has carried a volatility spread of 80% – which is huge.

On the one hand, timing the cryptocurrency markets correctly is no easy feat – as the industry is both volatile and unpredictable.

With that said, there are a couple of proven strategies that you can take to ensure that you enter the cryptocurrency market at the most favorable time possible.

Buy the Dip

The first strategy that you might consider in your attempt to time the cryptocurrency markets is to ‘buy the dip’. This is a strategy widely used in the traditional stock trading industry and it simply means that you will buy cryptocurrency when it goes through a market dip.

- For example, moving into 2022, Bitcoin was priced at approximately $46,000.

- Just over three weeks later, Bitcoin was valued at $33,000

- This means that in buying this market dip, you can buy Bitcoin at a huge discount of 25% – compared to its price three weeks prior

The overarching concept here is that while inexperienced investors are fraught with fear and panic when cryptocurrency prices decline, seasoned traders will view this as an opportunity to increase their holdings by purchasing more tokens but at a discounted price.

Dollar-Cost Averaging

Various researchers argue that buying the dip is not a viable strategy in the long-term – at least in the traditional stock markets.

The reason for this is that by only buying the dip, you are missing out on prolonged upward pricing swings. With that in mind, you might instead consider a dollar-cost averaging strategy.

The main concept here is that you will engage in a long-term investment strategy that will see you buy cryptocurrency at fixed amounts, at specific intervals.

For example:

- Let’s suppose that you have $100 to invest in digital currencies every Friday

- This means that on Friday, you will buy cryptocurrency at a different price – baring in mind market fluctuations

- Over the course of time, your cost price will average out in line with the broader markets

- In other words, when prices are going down – you get to buy cryptocurrency at a lower cost

- And, when prices are going up, you will buy cryptocurrency during an upward trend

The key point here is that dollar-cost averaging removes the need to try and time the market. Instead, you will slowly but surely build your portfolio through systematic investments. In doing so, you should have little interest in shorter-term pricing swings.

Which is the Best Cryptocurrency to Buy 2022?

So now that we have covered investment strategies and market timing, we can now talk about which cryptocurrency to buy in 2022.

Once again, you’ve got thousands of options to choose from – so independent research is crucial.

We, however, will discuss five of the best cryptocurrencies to buy right now, as per our own subjective analysis.

Bitcoin – Best Crypto to Buy Now for Beginners

Out of more than 17,000 digital currencies listed on CoinMarketCap – more than 40% of all cryptocurrency investments are held in Bitcoin. This clearly highlights that across the board – Bitcoin is the most popular cryptocurrency.

Out of more than 17,000 digital currencies listed on CoinMarketCap – more than 40% of all cryptocurrency investments are held in Bitcoin. This clearly highlights that across the board – Bitcoin is the most popular cryptocurrency.

Bitcoin is also the de-facto cryptocurrency in terms of market capitalization and mass awareness. Taking these points into account, Bitcoin is arguably the best cryptocurrency to buy for beginners.

Although it trades for tens of thousands of dollars, you can invest in Bitcoin in fractional amounts. At eToro, you only need to invest $10. In terms of growth, we mentioned earlier that Bitcoin was worth just $1 a decade prior to writing this guide.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

BNB – Top Cryptocurrency to Buy for Long-Term Growth

The next cryptocurrency that we like is BNB – which is a top digital asset to consider for long-term growth. This digital asset is backed by Binance – the largest cryptocurrency exchange globally.

The next cryptocurrency that we like is BNB – which is a top digital asset to consider for long-term growth. This digital asset is backed by Binance – the largest cryptocurrency exchange globally.

When the token was first launched in 2017 – its primary purpose was to allow users of the Binance exchange to reduce their trading commission. But, since then, BNB has grown to a whole new level.

For example, the digital token is now the primary currency of the Binance Smart Chain. This decentralized blockchain network is home to tens of thousands of cryptocurrencies – and most transaction fees are paid in BNB.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Decentraland – Great Cryptocurrency to Buy to Invest in the MetaVerse

Another cryptocurrency to consider buying for your investment portfolio is Decentraland – which is focused on creating a global MetaVerse via its decentralized 3D gaming world. Players within the Decentraland virtual world can build characters, wearables, and even real estate.

Another cryptocurrency to consider buying for your investment portfolio is Decentraland – which is focused on creating a global MetaVerse via its decentralized 3D gaming world. Players within the Decentraland virtual world can build characters, wearables, and even real estate.

These digital products can then be traded with other users – with MANA the native digital currency backing the Decentraland project. To illustrate how lucrative this game can be, a virtual plot of land was sold for over $2 million in late 2021 – with the transaction settled in MANA.

In terms of performance, MANA was priced at just 0.025 in 2017. When the token last hit all-time highs of 2021, MANA surpassed a value of $5.20. This means that in just over three years of trading, Decentraland and its MANA token grew by more than 20,000%.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Ethereum – Leading Cryptocurrency to Buy for Smart Contracts

Ever wondered if you should buy Ethereum right now? As noted earlier, Ethereum is the second-largest cryptocurrency for market capitalization – behind Bitcoin. This project was launched back in 2015 and it dominates the smart contract niche. These are pre-programmed blockchain contracts that facilitate trustless agreements.

Ever wondered if you should buy Ethereum right now? As noted earlier, Ethereum is the second-largest cryptocurrency for market capitalization – behind Bitcoin. This project was launched back in 2015 and it dominates the smart contract niche. These are pre-programmed blockchain contracts that facilitate trustless agreements.

On the one hand, there are actually better-performing smart contract blockchains in this space – namely Neo and Solana. This is in terms of transaction speed, fees, and scalability. However, Ethereum is getting close to its 2.0 migration – which will see it move to Proof-of-Stake.

And, in doing so, Ethereum 2.0 will take its smart contract blockchain to the very next level. Not only in terms of lower fees and even faster transactions – but being able to scale on a much larger level. As such, Ethereum is still one of the best cryptocurrency to buy in 2022.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Yearn.finance – Promising Cryptocurrency to Buy for Decentralized Financial Services

Another area of the cryptocurrency arena that is growing in prominence is the availability of decentralized financial services. More specifically, there are platforms in existence that allow users to engage with traditional financial products on a peer-to-peer basis.

Another area of the cryptocurrency arena that is growing in prominence is the availability of decentralized financial services. More specifically, there are platforms in existence that allow users to engage with traditional financial products on a peer-to-peer basis.

One of the best decentralized platforms in this regard is Yearn.finance. In a nutshell, the Yearn.finance protocol allows users to take out loans – in return for putting up a percentage of the financing agreement as collateral.

At the other end of the agreement are investors. That is, those holding idle cryptocurrencies can loan their funds to borrowers. And, as a result, investors will earn interest. The YFI token – which backs Yearn.finance, is, therefore, a top cryptocurrency to keep an eye on this year.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Guides to Investing in Cryptocurrency

Are you looking for guidance on buying cryptos, the best exchanges, or how to invest in NFTs? Check out our expert guides below.

Risks of Buying Cryptocurrency

Now that we have talked about the benefits of buying cryptocurrency, we need to discuss some of the main risks that need to be considered.

The most pressing risks of buying cryptocurrency are outlined below.

Volatility

We have mentioned several times throughout this guide that cryptocurrencies are extremely volatile. This means that the value of your investment can go up or down by a large percentage in a very small period of time.

For example, had you bought Dogecoin at the start of 2021 and sold just seven months later, your investment would have increased in value by more than 10,000%.

On the other hand, if you had bought Dogecoin in July 2021 and held on until the start of 2022 – you would be looking at losses of over 75%.

As a result, before you buy cryptocurrency for your portfolio – you must be prepared for rapid pricing swings.

Oversaturated Market

The next risk that you need to consider when learning how to buy cryptocurrency is that this marketplace is now oversaturated.

As noted, more than 17,000 cryptocurrencies are listed on CoinMarketCap – and even more that are yet to be added to the platform.

This means that outside of the top-100 projects, the cryptocurrency market is extremely fragmented. In simple terms, this means that the total amount of money being injected into the markets is now being allocated across a huge number of tokens.

As such, your chosen cryptocurrency might struggle to make an impact when you consider the amount of competition in this space.

Hacks and Security

Another major risk to consider is that over the course of the past few years – billions of dollars worth of digital assets have been stolen from cryptocurrency exchanges. If you had funds at one of these platforms, you might have had your tokens stolen with nowhere to turn.

As such, it is crucial that you stay away from unlicensed platforms and only buy cryptocurrency from a regulated exchange or broker – of which there are very few. Additionally, if you are looking to store your cryptocurrency tokens in a private wallet – further risks are at play.

This is because if you lose your private keys and do not back your wallet up with a recovery passphrase, your funds will be lost forever. Moreover, if your cryptocurrency wallet is hacked, this will also result in a loss of funds.

Ways of Buying Cryptocurrency

The next thing to consider when learning about digital asset investments is the many ways to buy cryptocurrency.

By this, we mean the specific payment method that you will use to fund your cryptocurrency purchase.

The best ways to buy cryptocurrency in 2022 are discussed below.

Buy Cryptocurrency With Paypal

You can buy cryptocurrency with Paypal at a very select number of online exchanges and brokers. In most cases, you will be charged a premium – as Paypal offers users the ability to execute a chargeback request.

This is, of course, a big risk for exchanges and brokers – which is why fees are typically high. With that being said, if you are depositing funds in US dollars, eToro allows you to buy cryptocurrency with Paypal on a fee-free basis.

If you’re using an alternative currency – then you will simply pay an FX fee of 0.5%.

Buy Cryptocurrency With Credit Card or Debit Card

The best way to buy cryptocurrency online is with a debit or credit card. This is because your purchase will usually be completed instantly.

For instance, if you buy crypto with a debit card at eToro, you will not only benefit from an instant deposit, but USD payments are fee-free.

This is also the case with credit cards, but the respective issuer might charge a premium – so be sure to check this yourself.

Buy Cryptocurrency With Neteller or Skrill

Another way to buy cryptocurrency online is with an e-wallet like Neteller or Skrill. You can use both of these popular e-wallets at eToro at a fee of just 0.5%. Or, if you’re funding your account in USD, this fee is waived.

Buy Cryptocurrency with Bank Transfer

Many exchanges and brokers allow you to buy cryptocurrency with a bank transfer – not least because this option is more cost-effective for platforms to process.

From your perspective, you will likely be able to deposit funds via ACH for free – albeit, the transaction might take a few days to arrive. Bank wires are usually supported too – but some platforms will charge a small fee.

How to Buy Cryptocurrency Safely

The most important part of this guide is the safety aspect of buying cryptocurrency. Not only in terms of staying away from unregulated platforms but how you intend to store your tokens.

With this in mind, below we explain the fundamentals of how to buy cryptocurrency safely.

Regulated Brokers

When you buy cryptocurrency from a broker that is regulated by a tier-one licensing body – you can be confident that you are using a trusted provider.

- For instance, eToro is regulated by the SEC and registered with FINRA.

- eToro is also licensed by the FCA, ASIC, and CySEC.

At the other end of the scale, you have Binance. Although Binance is the largest cryptocurrency exchange for volume and registered users, the platform is currently being investigated by a number of national regulatory bodies for operating without the required approval.

Avoid Peer-to-Peer Trades

You might be tempted to buy cryptocurrency on a peer-to-peer basis. This means that you will be purchasing your chosen digital currencies directly from the seller – as opposed to going through a centralized exchange.

Peer-to-peer cryptocurrency trades are extremely risky, especially for buyers – as you will be required to pay for your purchase before you receive the tokens. As such, you should never buy cryptocurrency from a peer-to-peer website.

Check Fees

Another thing to consider when learning how to buy cryptocurrency safely is to make sure that you have a firm understanding of what fees you are paying.

- As an example, there are now thousands of Bitcoin ATMs scattered around the world.

- These are targeted at the Average Joe who wishes to buy Bitcoin in exchange for cold-hard cash.

- However, buyers are often unaware that Bitcoin ATMs charge huge fees – which will oftentimes average 10-20%.

- The fee is often not shown in percentage terms.

- Rather, you are shown how many BTC tokens you will receive for the amount of cash you are looking to invest.

For those without knowledge of cryptocurrency prices – this can be difficult to recognize.

On the other hand, if you buy cryptocurrency from an online broker like eToro -which is regulated by the SEC – you can be sure that the platform is transparent in what it charges.

In fact, at eToro, you only need to cover the difference between the buy and sell price – which starts at just 0.75%.

Cryptocurrency Wallets

When it comes to keeping your cryptocurrency funds safe, you generally have two options. First, many investors will look to withdraw their tokens to a private wallet – perhaps on their mobile phone or desktop device.

These private wallets are typically non-custodial – which means that you are 100% responsible for keeping your tokens safe.

You then have custodial wallets, which are usually offered by online brokers and exchanges. On the one hand, trusting an unlicensed exchange with your tokens is not a good idea.

However, in using a regulated broker like eToro, Coinbase, or Gemini – you can be sure that the platform has a range of institutional-grade security tools in place to keep your cryptocurrency safe.

How to Buy Cryptocurrency – Tutorial

This ultimate guide on buying cryptocurrency has covered each and every metric that you need to consider before you proceed with an investment.

- If you have considered the risks involved and decided which digital asset interests you – then we are now going to walk you through the step-by-step process of how to buy cryptocurrency at eToro.

- In using this SEC-regulated broker in our tutorial, this will allow you to buy cryptocurrency on a spread-only basis from just $10 – and you can deposit funds instantly with a debit/credit card.

Here’s’ what you need to do:

Step 1: Open an Account

The first part of the process will require you to visit the eToro website and open an account.

This will take you less than a couple of minutes and will simply require the following information from you:

- First and Last Name

- Email Address

- Cell Phone Number

- Home Address

- Date of Birth

- Social Security Number

Next, you will need to confirm your cell phone number. You can do this by entering the PIN that eToro sends to your phone via SMS.

Step 2: Upload ID

The final part of the registration process will require you to upload some ID.

This is standard across all regulated brokers – as eToro is required to comply with AML laws set out by its licensing bodies.

To complete this step near-instantly, you can upload a copy of your passport or driver’s license.

Step 3: Deposit Funds

Now you will need to add some capital to your eToro brokerage account. US clients only need to deposit $10 and no transaction fees will be charged.

You can choose from a bank wire, ACH, Paypal, Skrill, Neteller, or a debit/credit card.

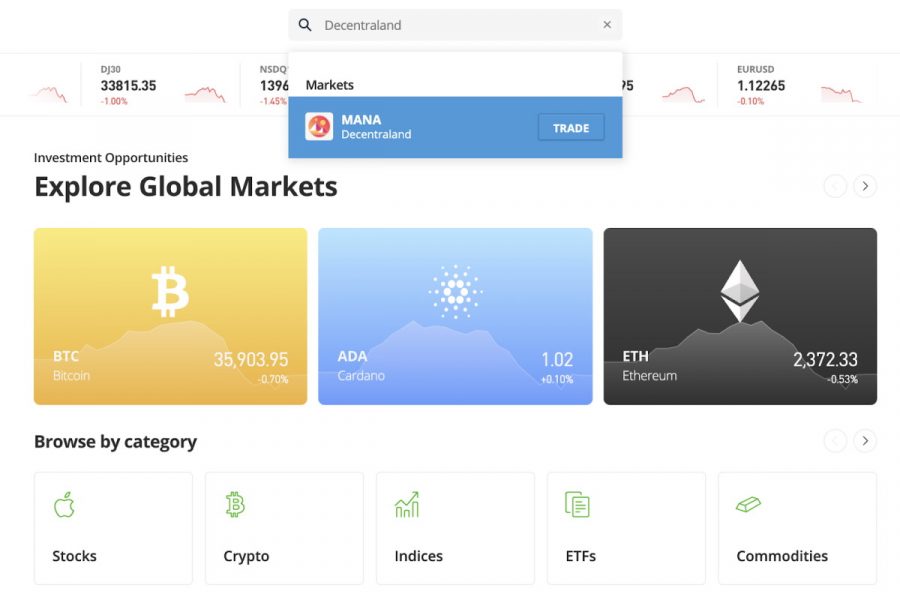

Step 4: Search for Cryptocurrency

Assuming that you already know which cryptocurrency to buy for your portfolio – you can now complete the investment process.

To get the ball rolling, enter the name of the digital asset into the search box at the top of the page.

In our example above, we are searching for ‘Decentraland.’ When we see the relevant token pop up – we click on ‘Trade’.

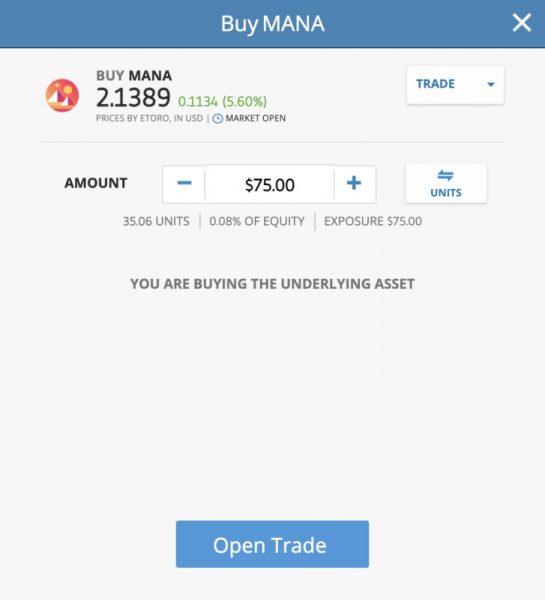

Step 5: Buy Cryptocurrency From $10

The final step is to create an order. As you will see from the image below, we are looking to buy $75 worth of Decentraland (MANA) tokens.

However, you can invest any amount of your choosing – from just $10 upwards. Once you have entered your investment stake – you can complete your cryptocurrency purchase by clicking on the ‘Open Trade’ button.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Conclusion

This beginner’s guide on how to buy and sell cryptocurrency online has covered every nut and bolt that you need to know to start your investment journey safely.

To recap, it’s important to do plenty of research before proceeding – both in terms of the cryptocurrency you decide to add to your portfolio and the exchange or broker you plan to open an account with.

If you’re ready to buy cryptocurrency today – eToro is a safe and regulated platform that allows you to invest from just $10 across more than 40+ digital assets.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Frequently Asked Questions on How to Buy Cryptocurrency

How do I buy cryptocurrency?

What is the best site to buy cryptocurrency?

Is buying cryptocurrency a good investment?

What is the best cryptocurrency to buy now?

What is the cheapest cryptocurrency to buy?

What are the best cryptocurrency stocks to buy?

Where can I buy cryptocurrency for free?

What is the best app to buy cryptocurrency?

This news is republished from another source. You can check the original article here