AndreyPopov/iStock via Getty Images

Decentralized Finance, or DeFi, has stirred a lot of attention in the last two years. The industry is seeing tremendous growth as more developers move into the space to build innovations in the hopes of disrupting the current financial and monetary system. We have seen the hype surrounding altcoins, NFTs, and the metaverse, as well as illicit financial activities, rug pulls, and major hacks.

The White House announced last week that President Biden would be signing an executive order to ensure the “responsible development of digital assets.” Six key priorities are stated. Given the current state of DeFi, I see the EO as an overall positive for the industry. In general, it should bring more trust to the space as regulations and risk assessments are imposed. Furthermore, DeFi’s philosophical aim of being more inclusive to everyone (the so-called “democratization of finance”) is largely consistent in principle with the priorities listed.

A Brief Overview of How DeFi Got to Where It Is Now

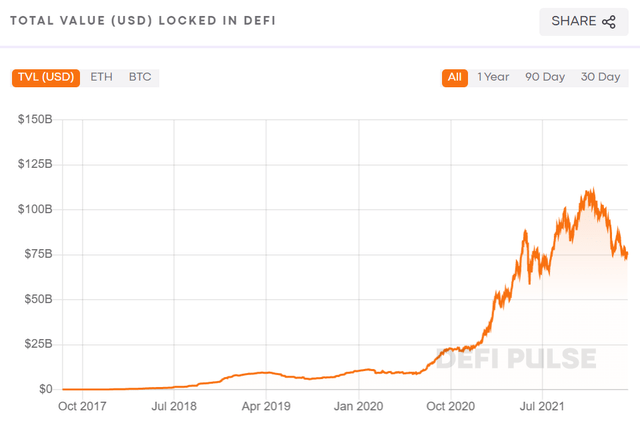

DeFi’s Progress (DeFi Pulse)

(Source: DeFi Pulse)

Many things have developed since Satoshi Nakamoto released the Bitcoin (BTC-USD) whitepaper in 2008. The concept of using blockchain to support a completely decentralized (read: unable to be controlled by any government) digital currency was revolutionary and the de facto starting point for DeFi. Bitcoin’s design solved the double-spending problem of digital currencies. It also ensured that historical record of transactions could be verifiably untampered. Also, these records are publicly distributed (often referred to as a public or distributed ledger), and each entry required a majority of the network to agree that the entry is legitimate. In general, solving these problems is what allows Bitcoin and blockchains to be considered decentralized. Bitcoin is intended to be money. Economists assign three functions to money: a unit of account, a store of value, and a medium of exchange. Bitcoin’s current volatility means that it is good at none of those (whether it will be is not the topic of this article).

However, today’s DeFi has evolved from simply creating a new form of money. Rather, it is more related to reducing the role of financial intermediaries, automating and simplifying complicated steps, and creating economies grounded in financial accessibility and decentralization. The hundreds of altcoins are not all separate digital currencies which people really believe will replace any fiat currencies. Rather, the hype around DeFi is that blockchains can do more than simply record transactions on a public ledger. Ethereum (ETH-USD) ushered in this second revolution in 2015 with idea of a smart contract. A smart contract is code stored on the blockchain which can be executed by people. Smart contracts meant that people could create specific instructions which could be used by others. The code would perform exactly as written. In a way, this is a lot like an application you would use on your phone. Because the smart contracts are executed on the blockchain, they are decentralized. The applications created by smart contracts are called decentralized applications, or dapps.

Another important part of this story is that Bitcoin and Ethereum both relied on the proof-of-work consensus algorithm. The important consequence of this was that transactions were very slow and expensive. Dapps need to be fast to be useful to people. This need for speed (along with attempts to address other issues) paved the way for other blockchains to develop. Notably, variations of the proof-of-stake consensus algorithm is what most of today’s blockchains use. This allowed transactions to be faster, which meant faster dapps.

Recall that Bitcoin’s network required a majority agreement to approve an entry to the ledger of transactions. Proof-of-stake blockchains use ownership of the native cryptocurrency to signal “stake” in the blockchain. Those with higher stake would have a vested interest in ensuring the soundness of the network, and so they are tasked with approving transactions for the network. In fact, many of the top coins by market cap are signals of stake in their respective blockchains.

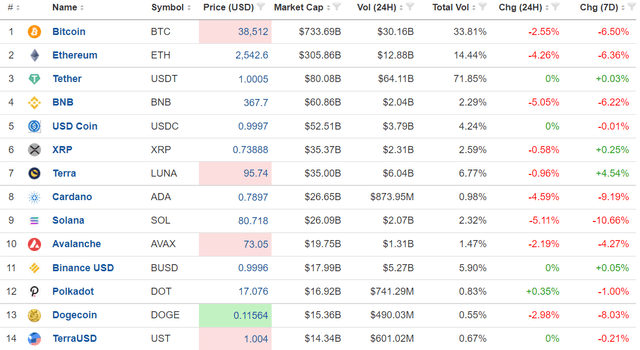

Top 14 Coins By Market Cap (Investing.com)

(Source: Investing.com)

In the picture above BNB, LUNA, ADA, SOL, AVAX, and DOT are native coins whose blockchains all use variants of proof-of-stake. If Ethereum moves to Ethereum 2.0 and implements a proof-of-stake consensus, ETH will also join this list. In general, those who stake cryptocurrencies earn a fee for helping the network validate transactions. Therefore, many of these coins can be viewed almost like equities in the sense that they represent a proportional claim on certain cash flows the blockchain would generate.

Likewise, some of the coins in the top 100 of the investing.com list are tokens which represent involvement in a certain dapp. For example, Uniswap (UNI-USD) is a dapp on the Ethereum blockchain which facilitates on-chain exchange of coins. The UNI token is 25th on the ranking of coins by market cap. It is largely a governance token, which means owners can use it to vote on changes for Uniswap. It is common for dapps to have their own token, even though the dapp is built on top of a blockchain with a native cryptocurrency. Think of an office building with different companies working inside it. The office building may be owned by a REIT. The companies which work inside may all have different governance and ownership structures. In fact, initial coin offerings (ICOs) are ways to raise money for dapp development in a similar way an IPO raises money for a company. There are many different dapps but most can be broadly classified as some sort of financial services. They tend to move coins and digital assets (think NFTs) around in various ways and create systems which make trading easier.

So now that all these different dapp tokens and native cryptocurrencies have appeared, the next question is how people can exchange them. What is a BTC, ETH, or SOL worth? How do they compare to each other, especially given their enormous volatilities? DeFi’s current solution simply repackages fiat in an on-chain form. These are called stablecoins—because unlike all the other volatile, on-chain coins, stablecoin prices are stable. Because the US Dollar is the world reserve currency, most on-chain trading involve currency pairs of some volatile coin and some stablecoin which is pegged to USD. Revisiting the list above, Tether (USDT-USD), USD Coin (USDC-USD), Binance USD (BUSD-USD), and TerraUSD (UST-USD) are all stablecoins pegged to the USD. Their prices rarely deviate from $1. The fact that stablecoins hold such market cap indicates that DeFi is still very much grounded in fiat to fulfill the functions of money.

There are two types of stablecoins: reserve-backed and algorithmic. Reserve backed stablecoins like USDC and USDT are issued by companies which hold the fiat currency in a reserve. For every dollar of USDC on blockchains, there is (supposedly) a dollar in a bank account owned by Circle, the issuer of USDC. The issuing entity promises to redeem the USDC token for fiat USD. This isn’t always the case as Tether’s USDT was recently found to be not fully backed by reserves. Reserve backed stablecoins have been the subject of regulatory scrutiny recently because of their potential to pose systemic risks. Functionally, the issuer is acting very much like a pre-fractional reserve system bank which issues banknotes on their gold reserves. Gradually, banks understood they could write more banknotes than they had gold and so fractional reserve banking was born. To the issuers of reserve backed stablecoins, this is an obvious temptation. If they buy bonds with their reserves to earn an interest, a sudden rush to redeem stablecoin for fiat would mean a mass liquidation of bonds which could trigger contagion and constitute systemic risk. In DeFi, reserve backed stablecoins is also seen as a risk because they invite centralization. The issuer is a single point of failure. Issuers wield tremendous power because they can decide to “freeze” certain stablecoin-holding accounts and renege on fiat redemption. The implication is that this grants them the ability to decide which transactions are legitimate, which bypasses the whole point of consensus. Furthermore, the bank reserves of issuers are easy targets for regulators.

Algorithmic stablecoins are more interesting because they remain pegged to fiat without using a reserve. Also, they are truly decentralized in the sense that there is no single point of failure. Regulators cannot get to them without shutting down the entire blockchain network (which would be very hard). Though they may not seem “algorithmic,” there are a set of algorithmic stablecoins backed by cryptocurrency reserves which are held by a smart contract on-chain. Dai (DAI-USD) is an example, being backed by a mix of ETH and other cryptocurrencies. Interestingly, USDC makes up 50% of its reserves, so in truth DAI has issues of centralization as well.

Regarding a truly algorithmic and decentralized stablecoin, the Terra blockchain has been the most successful at producing one. Terra’s native cryptocurrency is LUNA and Terra coins represent the fiat-pegged stablecoins produced by the blockchain. TerraUSD (UST-USD) is the Terra stablecoin which is pegged to the USD. The algorithm works by dynamically adjusting the supply of UST and LUNA to ensure UST is always $1. Basically, if the price of UST is above a dollar, traders can redeem UST from the blockchain for $1 worth of LUNA (LUNA is destroyed and UST is created). They can then sell the UST at the higher price and earn a risk-free profit. When the price of UST is below a dollar, traders can buy UST for less than a dollar and use it to redeem $1 worth of LUNA (UST is destroyed and LUNA is created). They can then sell the LUNA for a dollar and earn a risk-free profit. In either case, the buying or selling pressure on UST will force it to return to $1. This procedure can be done for any fiat currency. Terra also offers stablecoins pegged to the IMF’s SDR, Euro, British Pound, Yen, etc. The supply volatility of the LUNA coin essentially absorbs the price volatility of Terra stablecoins. LUNA itself is supported by the fact that the dapps of the Terra blockchain will require LUNA to be staked so that the entire network may run. Interestingly, much of Terra dapps are running because of the reliability of Terra stablecoins. For example, Chai is a payment dapp already used in Korea. It uses the Terra stablecoins to settle transactions at much faster speeds than with traditional financial institutions.

This seemingly circular reasoning to explain the existence of either coin is a somewhat uncomfortable realization. The notion that the existence of dapps supports the blockchain and native cryptocurrency (by way of providing services which people can use, thereby increasing the total transaction and value locked on-chain) and then the existence of the blockchain supporting the dapps (by providing the common infrastructure which dapps are built upon, thereby creating a useful interconnectedness between dapps) is a curious reality of DeFi. It is synergistic in a way. Even more alarming is that most of the services offered by dapps thus far have been different ways of catering to the speculation on various coins and digital assets. In this way, DeFi seemingly creates both an issue and a (partial) solution in one stroke (whether this is good is not the topic of this article). What should be irrefutable is the fact that Ponzi schemes and capitalistic progress share this similarity. To scam people, value is seemingly created from thin air and the next round of victims is used to pay off the last round. To create progress, new issues are identified and then resolved in a way which ends up being profitable to almost everyone involved. I personally think DeFi’s intention and general motion is the latter, but there will always be bad apples which makes the former a compelling conclusion to observers.

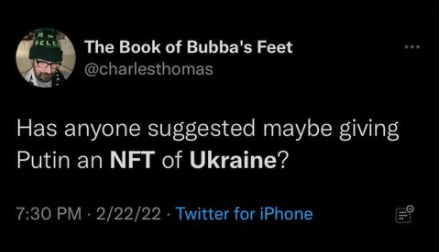

The rise of NFTs is another expression of DeFi solving issues it seems to have invented. No one really asked for the tokenization of a bunch of different things. Verifiably ownership of some physical item is counterintuitive when you do not have the physical item. It does not matter that the ownership is immutable and stored on-chain. For a (poignant) example of this, consider the tongue-in-cheek post below.

NFT (Instagram)

(Source: Instagram)

But suppose on-chain ownership was connected to digital things which all exist within a rules-based context of a digital space where people can interact with each other. Now, NFTs could have value because they would be the mechanism to verify ownership in that space, much like deeds are used to verify ownership of a house. Suppose this space gave people joy or excitement when they participate. Now NFTs definitely have value because they would be a large part of what facilitates interactions in that utility-generating space. This alludes to the metaverse concept which is so often talked about. In short, the metaverse can be thought of as a virtual, video game reality. When it is powered by a blockchain, this virtual space cannot be shut down by the video game producer or some third-party. It is decentralized. The economies which can then develop on these virtual spaces will be transacted in virtual currency and property ownership will be denoted by NFTs.

There are already dapps being built on this concept. Star Atlas is built on the Solana (SOL-USD) blockchain, and it is meant to be an intergalactic, space-themed video game. In-game spaceships are NFTs which can be bought at a marketplace here. Star Atlas connects many of its in-game items to the Serum (SRM-USD) exchange built on Solana. Notably, Solana is the fastest blockchain in the world and Serum is the first on-chain exchange which uses a central limit order book like centralized exchanges. Most other blockchains lack the throughput to do this efficiently, which really makes Solana and Serum stand out in DeFi. Serum is connected to most dapps on Solana because their dapp tokens receive the most liquidity when they are listed on the Serum exchange. Here, we can see dapps being used together for something other than moving miscellaneous coins around. Star Atlas would be a genuine source of utility for its users, and it will be connected to the growing Solana ecosystem through Serum.

It’s important to note that these innovations are not exclusive to America. Developers come from all over the world and the internet has allowed them to collaborate to create the DeFi we see today.

Regulations and Oversight

It’s no secret that everything above is a largely unregulated. Fraud has been notoriously common. Even before the DeFi explosion in the last two years, people have been using Bitcoin to launder money or do drug deals. A “rug pull” is when dapp developers release their dapp’s coin to be sold and then disappear after they receive the money. Investors who bought the coin in hopes getting early exposure to a very useful dapp are left holding worthless tokens because they no longer point to a viable project. Furthermore, smart contract code sometimes has bugs which hackers exploit to the detriment of users. Also, the design of blockchains—specifically its reliance on public-private key encryption—forces the user to take more ownership than they may be used to with a centralized service. Losing your bank account password results in a simple process of verification and then changing it. At worst, it is a phone call with the firm to set things straight. Losing your private key means you have permanently lost all access to your assets which were connected to your account. Are people prepared to take on this level of personal responsibility?

Furthermore, approaches governments have taken regarding cryptocurrency have varied. China has famously banned all cryptocurrencies and then seriously cracked down on it in mid-2021. It also started the first state-backed fiat cryptocurrency, the ECNY. ECNY is built with smart contracts on the Binance Smart Chain. Its supply is controlled by the People’s Bank of China (which, like all things in China, is controlled by the Chinese Communist Party). Other countries have fully embraced cryptocurrency. El Salvador famously became the first country to recognize Bitcoin as legal tender.

All these issues are a part of what is prompting President Biden to sign the executive order directing efforts to ensure the responsible development of digital assets. The points the White House pushed out:

- Protect U.S. Consumers, Investors, and Businesses

- Protect U.S. and Global Financial Stability and Mitigate Systemic Risk

- Mitigate the Illicit Finance and National Security Risks Posed by the Illicit Use of Digital Assets

- Promote U.S. Leadership in Technology and Economic Competitiveness to Reinforce U.S. Leadership in the Global Financial System

- Promote Equitable Access to Safe and Affordable Financial Services

- Support Technological Advances and Ensure Responsible Development and Use of Digital Assets

- Explore a U.S. Central Bank Digital Currency (“CBDC”) by placing urgency on research and development of a potential United States CBDC

In general, these goals should not conflict with the development of DeFi. DeFi is not by nature malicious or predatory. Also, the unparalleled transparency of public ledgers and open-source development characteristic of DeFi mean that there is very little secrecy going on. The risk here is that there is no standard by which protocols may be introduced and little common knowledge on DeFi which people can use to perform analysis. For example, when a company IPOs, it must file many documents with the SEC. These documents must meet a standard to be approved. This standard is meant to provide transparency each time investors consider the company. Also, business constraints are, to some extent, common knowledge. We know that a company should have a healthy cash conversion cycle so that cash inflow can be used to cover interest payments and operating expenses. We know the corporate tax rate which eats into EBIT before it becomes net income. These truths help investors think through investment decisions. The “common knowledge” in DeFi is lacking. Though code is often open source, most people cannot understand it. While protocols normally release white papers explaining their purpose and innovation, white paper quality tend to greatly vary. As regulators study this space, I anticipate that they will need to rely on industry experts to help guide them through this process. However, as more standards are constructed, either legally through regulation or informally as an outgrowth of the industry’s internal culture, the DeFi community at large will seem more approachable to the public. This would be good for DeFi.

I believe DeFi poses little systemic risk as a subset of financial services. I believe regulators will find this to be true as well. First, DeFi is too small right now to have a major impact on the financial economy. However, as the space grows and interconnectivity with traditional financial institutions grow, spillover effects may occur. Note that most systemic risk is traceable to a buildup of leverage. Whether it is margin or derivatives, the leverage is very sensitive to volatility. With DeFi, leverage is easy to obtain but requires consistent collateralization. In fact, most DeFi protocols that involve margin and leverage tend to be overcollateralized. The PsyOptions protocol on Solana allows users to sell options only when they can produce a fully covered amount of the corresponding asset to hold in an escrow account. Compare this to naked option selling retail traders can do on Robinhood. Logically, it does not make sense for DeFi to extend leverage in irresponsible ways. The trustless nature of blockchains assumes that people will act in their self interest and cheat the system (not pay back, overleverage to score big or let it go to zero). Creating incentives around that assumption implies conservatism.

On promoting American leadership in technology and economic competitiveness, DeFi will surely be recognized as an area with enormous, untapped potential. I think this will cause regulators to go easy on strict regulations. Some progressive cities have already seen mayors who are extremely friendly towards crypto, with some even demanding payment in cryptocurrency. This public embrace of DeFi by government officials acknowledges DeFi’s benefits and will soften strict regulators. As a capitalist society, America has historically embraced what makes money. With the metaverse and web3 receiving attention as the next frontier of the service economy, I find it unlikely that regulators will turn away from this rapidly expanding sector. As a result, scrutiny into the current state of DeFi should lead to these conclusions and therefore a safer regulatory path for DeFi moving forward.

DeFi probably shines brightest on the topic of better financial services. Blockchain transactions, even transactions between different blockchains, settle much faster than settlement between banks. Blockchain transactions on Ethereum can take a few minutes to settle while it takes just a few seconds for many proof-of-stake blockchains. In comparison, the settlement from one bank account to another in a different bank can take a few days. The removal of intermediaries has always been the quintessential thread of progress in the financial sector. Whenever it is possible to make transactions happen between two willing participants, finance has always sought to make this transaction easier by simplifying the intermediate steps. For example, the NYSE used to be an outdoor auction on Wall Street and the stocks exchanged were certificates carried in physical portfolios. Later, they brought in traders who stood on the floor of the exchange and yelled out bids and offers to make a market. Today, the NYSE floor has much fewer human traders and computers do most of the market making. The clear progression has been the simplification of intermediate steps for the benefit of the end-to-end market participants. DeFi, at least within the realm of payments, is the next step. Chai’s success in Korea should be an indication of this.

Where DeFi Might Experience Regulatory Friction and Why It’s a Minimal Concern

Where regulators may take issue is with a replacement for fiat. Governments know that the control of fiat currency is an enormous power they wield. The USD being the global reserve currency after 1945 is most responsible for the high quality of life enjoyed by Americans over the last 70 years. It is also directly responsible for the continued strength of the US capital markets. According to Ray Dalio, it is a power governments historically do not tolerate being threatened.

The rise of stablecoins should be an indication that there is no seriously accepted alternative to fiat. Even in the case of algorithmic stablecoins, the fact that the coins themselves are pegged to fiat acknowledges fiat’s superiority as a store of value and unit of account. So far, no cryptocurrency has displayed the three functions of money while being wholly separated from any fiat currency. While there are theoretical talks of creating a coin that is pegged to the real economy (the actual goods and services), there would be no way to measure the real economy in the first place without a fiat unit of account. Furthermore, if such a coin was pegged to CPIs and PPIs, the central entities which compile these statistics will be the point of failure that again taints the mission of decentralization. A true “onboarding” to a global currency based in decentralized cryptocurrency would first require the current USD-led global monetary system to collapse and people to collectively turn to crypto rather than another sovereign country’s fiat. Even if the dollar collapsed, I find it more likely that people will turn to another country’s fiat rather than crypto. And if the dollar does not collapse, then there is no room at all for crypto to displace fiat in any important economy. So, it is very unlikely that regulators will feel the need to ban cryptocurrency out of fear of it displacing fiat. I will add that algorithmic stablecoins like Terra’s can easily be repegged to any new fiat. If the USD is no longer the global reserve currency, Terra can easily readjust to be pegged to the new reserve currency. As such, algorithmic stablecoins are an interesting variable in this conversation, but altogether not important to the question of whether regulators will ban crypto outright.

How A US CBDC Could Cause Issues for DeFi and Why It’s Also a Minimal Concern

We cannot forget that the philosophy of DeFi is decentralization, and the movement was kicked off by Satoshi Nakamoto at the height of the Great Recession. On January 3 2009, within the genesis block (the very first block in the blockchain) of Bitcoin, Nakamoto embedded a quote of the recently published London Time’s cover story entitled “Chancellor on the Brink of Second Bailout for Banks.” This has become the stuff of legend among Bitcoin fanatics. To them, Nakamoto clearly meant it as a critique on the world of centralized finance where the rich received bailouts as the poor suffered the worst recession since the 1930s.

The focus on decentralization has not left DeFi (it is after all in the name) and even arguably centralized blockchains like Solana will still pay lip service to and insist on its decentralized nature. The threat of the government being able to freeze assets, like how Canada did recently, is very unattractive to many proponents of DeFi. This means that the introduction of true fiat in a digital, on-chain form as a CBDC may not be welcomed by many in the community. Another concern of having centralized mediums of exchange on-chain is that now the issuer may decide which transactions were valid, effectively usurping the role of the blockchains validators despite not having any stake in the network’s integrity. This is much like the concern about reserve backed stablecoins, except instead of a company being the issuer it is now the US government.

Any splintering in DeFi because of the entrance of a US CBDC will likely not cause the innovations in the space to dry up. There are many workarounds for the government freezing funds. For one, CBDC can be gathered in a smart contract and stablecoins representing the value of the CBDC reserves may be issued to people. This would be a simpler reserve backed stablecoin because the fiat CBDC reserves are in a verifiable smart contract instead of a private bank account. Most likely, people would just do on-chain transactions in the CBDC and not worry about frozen assets, exactly the way they are currently doing transactions using USDC and USDT. DeFi purists may leave projects, but they will likely be replaced by other equally talented programmers who do not mind the introduction of the CBDC. The current state of innovation would not be stifled, although DeFi may start to move away from decentralization and more towards simply using new innovations to improve on existing processes.

The Actual Possibilities for a CBDC

Right now, it looks like a US CBDC is unlikely. The Fed released a report in January which gave no recommendations. It concluded that it would only make the CBDC if there was both public and cross-government support for the project and if such a project would be superior to alternatives. The Governor Christopher Waller has stated his skepticism of a CBDC because he is not convinced that it would solve any problems. Right now, it looks like neither the Fed nor the public have a serious desire to create a CBDC.

Conclusion

DeFi is growing quickly. President Biden’s executive order will bring more scrutiny to the industry. This should bolster trust and help with the public adoption of DeFi. The government being more involved will be a threat to the decentralization tenet will not stifle innovation in its current trajectory.

This news is republished from another source. You can check the original article here