If you’re like me, you always have a problem wrapping your head around a cryptocurrency exchange.

The first mantra of the crypto community is decentralization. Down with the establishment man! Decentralization leads to freedom from large institutions!

Yet the exact function of an exchange is centralization. Aggregating buyers and sellers in a free market economy to set equilibrium prices.

Coinbase by its very nature seems to be a self-conflicting entity when you look at it this way. But there’s more to it than that.

A hot topic as of late is decentralized finance (DeFi) which is the new-age version of traditional finance (TradFi).

A lot of this movement is built from decades of distrust and rent-seeking from the incumbent big banks. When you look at just how much money these big corporations make from transaction fees it’s a no-brainer to say, “Ok, this can be disrupted in order for consumers to capture a larger share of the value chain” AKA cut out the middleman.

We’ve also seen the largest payment players Visa and Mastercard enjoy almost a cartel-like status when it comes to clipping coupons on every transaction. With deep moats come high margins.

With high margins, comes Jeff Bezos-type thinking:

Enter DeFi.

This week, in <5 minutes, we’ll cover WTF is DeFi and some cool projects going on:

-

The Incumbents

TradFi Structure, Characteristics, Fees

-

The Basic Tenants of DeFi

What it is and where it’s going

-

Ethereum’s Role

Programmability, dApps, and PoW vs. PoS (Not that PoS…)

-

Current Projects

Uniswap, Chainlink, Maker

-

How GRIT’s Playing it

Introducing a Crypto-focused Newsletter

Let’s get started!

1. The Incumbents  TradFi Structure, Characteristics, Fees

TradFi Structure, Characteristics, Fees

TradFi is composed of retail, commercial and investment banks, but also even includes FinTech. These are institutions like Bank of America, Chase, RBC, and Visa but even Paypal and Square can mostly be categorized in this bucket.

Banks

TradFi offers products that include savings accounts, business loans, credit cards, mortgages, stock trading platforms, physical branch locations (yuck), and insurance. They need to implement practices of Know Your Client (KYC) and Anti-Money Laundering (AML) in order to ensure an identifiable and responsible way of verifying and auditing their client base.

TradFi is centralized by nature in order to be a one-stop-shop for all client needs. Their general roadmap goes like this: Start with a savings account, build trust, sign up for a mortgage, get ripped off on an insurance policy, then even more ripped off on in-house mutual funds with high management fees. Since everything is all in one location, it’s so easy you don’t even have to think about it!

Big banks can then leverage what’s called a reserve ratio requirement in order to make a return on the money that they have in deposits. The reserve ratio is the portion of reservable liabilities that commercial banks must hold on to rather than turn around and either invest that capital or lend out to others at a higher rate than they pay for keeping the money there in the first place.

These major institutions are also heavily regulated by government authorities in order to ensure stability (LOL…2008…) and proper conduct (LOL…1MDB).

TradFi has been sort of the default operating mode for far too long. We all just trudge along accepting the status quo because there weren’t really viable alternatives unless you wanted to stash your cash in your mattress which exposed it to two equally destructive forces – termites and inflation.

TradFi has also extracted far too many fees from the system as gatekeepers. There is no better example of this than the duopoly in the current credit card system: Visa and Mastercard.

Credit Cards

Credit cards may be a solid way to build credit history but are destructive forces to wealth creation on someone that continually maxes out their balances. Credit card companies collect have revenue lines like late fees, over-limit fees, annual fees, cash advance fees, and returned payment fees.

All these fees made sense when payment processing technology was a step-function improvement vs. dealing with physical cash. I don’t mean to sell short just how difficult of a problem these companies solved. There are many different parties to consider when simply tapping your card or phone at Chipotle in exchange for a huge burrito with guac. Seems like a pretty good trade to me.

I am surprised, however, the longevity of the moat that these companies have built. Visa and Mastercard have been incredible stocks over the last couple of decades because they were allowed to keep margins high due to lack of competition and recycle that capital back into growth initiatives. With such high margins for so long, it was only a matter of time until Square, Stripe, PayPal, and the likes started to pay attention to take a piece of the pie.

Fintechs

Stripe is undoubtedly the most interesting company in the payment space, and after the recent acquisition fell through (Visa no longer buying Plaid), we may actually get to see the guts of how it works if it files its S1. We could write an entire piece on the intricacies of Stripe (which I might do later), but for the topic of this discussion, Stripe is a company that is coming after the card players.

But still, the fundamental process in which Stripe, Paypal, and Square also operate in is as more efficient connectors of doing essentially the same thing. Sure, Square and Paypal are coming out with crypto products, but the core piece of their business is still heavily connected to the existing banking system and has attributes of centralization.

This is where a new, zero to one type of idea was created – DeFi.

All of this work is done through a blockchain which we know is an immutable, digitally distributed, decentralized, public ledger that exists across a network.

A key component here is peer-to-peer, so there is no routing through a centralized system. No middleman = no fees paid to big institutions (ideally… but we’ll see why we still have to pay gas fees).

Users typically engage with DeFi via software called dApps (decentralized apps), most of which run on the Ethereum blockchain. Unlike conventional banks, there is no heavy vetting and identification process, rather you can get started by obtaining a wallet with a couple of clicks.

But first, let’s check in with our Outrageous Chartered FinMEME Analyst Dr. Patel!

3. Ethereum’s Role  Programmability, dApps, and PoW vs. PoS (Not that PoS…)

Programmability, dApps, and PoW vs. PoS (Not that PoS…)

If we think of the two major cryptocurrencies, Bitcoin can be seen more as a store of value while Ethereum has programmable utility.

dApps are built on top of the Ethereum Network and many are financial services that aid in trading, borrowing, and lending. These dApps (more on these below…) use cryptocurrencies and smart contracts in order to eliminate the need for intermediaries.

A smart contract is a computer code that acts as a digital agreement between two parties. Smart contracts are run on a blockchain and are stored on a public database and can’t be altered. The code is the law.

Since blockchains networks are created to facilitate transactions, what every blockchain needs is a consensus mechanism. This is what cryptocurrency miners do when validating transactions. There are two different consensus mechanisms – Proof of Work (PoW) and Proof of Stake (PoS).

Miners in a blockchain network compete to find a cryptographic hash used in specifying a transaction. Although the hash is difficult to find, it’s easy to verify. Once verified, that transaction is added to the blockchain. The work that goes into verifying that hidden hash is called the “proof of work.” The computer on the network that completes the proof of work first gets rewarded in cryptocurrency. In the case of Bitcoin, it’s 6.5 Bitcoin. This is known as mining Bitcoin.

“Proof of stake” is an alternative form of consensus mechanism and key to the second generation of Ethereum (eth2). This is expected to take place sometime later this year.

In this case, the staking of an asset on the next block in a blockchain replaces the mining of blocks as it is done under proof of work.

One major downside of proof of work is energy. To find that rare cryptographic hash requires a lot of computing power. Dozens, even hundreds, of computers coalesce to form one high-speed brain to solve complex mathematical equations to be the first to do the proof of work and earn a block.

That proof of work consumes a lot of energy and is the reason why environmental groups are upset over blockchain and cryptocurrency mining.

Proof-of-stake changes the way blocks are verified using the machines of coin owners. The owners offer their coins as collateral for the chance to validate blocks. Coin owners with staked coins become “validators.”

Validators are then selected randomly to “mine,” or validate the block. This system randomizes who gets to “mine” rather than using a competition-based mechanism like proof-of-work.

To become a validator, a coin owner must “stake” a specific amount of coins. For instance, Ethereum will require 32 ETH to be staked before a user can become a validator.

Blocks are validated by more than one validator, and when a specific number of the validators verify that the block is accurate, it is finalized and closed.

Different proof-of-stake mechanisms may use different methods for validating blocks. When Ethereum transitions to PoS, it will use shards for transaction submissions. A validator will verify the transactions and add them to a shard block, which requires at least 128 validators to attest to. Once shards are validated and block created, two-thirds of the validators must agree that the transaction is valid, then the block is closed.

The So What?!

Right now, the core tenancy of DeFi is to remove the intermediary and limit fees. However, if you’re tapped into crypto Twitter at all, you’ll quickly discover that gas fees are a major problem.

To grossly oversimplify, think of gas fees as transaction fees that you pay to jump to the front of the line to get validated (mentioned above). As more and more transactions flood the network, more and more validation needs to get done, hence higher and higher gas fees.

By introducing both PoS and sharding, the hope is that the number of transactions per second will increase and gas fees will decrease, thereby enabling a much more frictionless system.

Eth 2.0 + Sharding = lower gas fees

4. Current Projects  Uniswap, Chainlink, Maker

Uniswap, Chainlink, Maker

Uniswap

Uniswap is a cryptocurrency exchange that uses a decentralized network protocol that facilitates automated transactions between tokens on the Ethereum blockchain through the use of smart contracts. It is the largest decentralized exchange and the fourth largest exchange by volume.

Uniswap (CRYPTO: UNI) has several different components:

-

Uniswap Labs: The company which developed the Uniswap protocol, along with the web interface.

-

The Uniswap Protocol: A suite of persistent, non-upgradable smart contracts that together create an automated market maker, a protocol that facilitates peer-to-peer market-making and swapping of ERC-20 tokens on the Ethereum blockchain.

-

The Uniswap Interface: A web interface that allows for easy interaction with the Uniswap protocol. The interface is only one of many ways one may interact with the Uniswap protocol.

-

Uniswap Governance: A governance system for governing the Uniswap Protocol, enabled by the UNI token.

On top of the Uniswap protocol, there are many dApps, integrations, and developer toolkits. This is somewhat similar to when entire companies used to be built within the Shopify or Salesforce ecosystems.

Chainlink

Chainlink (CRYPTO: LINK) is a third-party service built on Ethereum that connects smart contracts with the outside world, primarily to feed information in, but also the reverse. This is called a blockchain oracle. Chaink provides this decentralized oracle network services to many other blockchains.

If this is starting to sound familiar, those with a knowledge of software know all about APIs. This is a pretty close crypto-equivalent. Chainlink acts as a “bridge” between a blockchain and off-chain environments.

Maker

MakerDAO is a DAO that facilitates smart contracts to create a stablecoin called Dai. As a stablecoin, Dai aims to keep its value as close to one USD as possible through an automated system of smart contracts on the Ethereum Blockchain.

Dai and MakerDAO together are considered as some of the first examples of decentralized finance (DeFi) that has widespread adoption.

The concept of Dai is to make a currency that is stable and actually spendable, thinking it more as a note of record rather than a hedge against inflation. By staking assets, you can also earn interest on your Ether that you stake against Dai.

It is truly decentralized because a community of MKR token holders governs the Maker Protocol, which are the smart contracts that power Dai.

The more and more platforms and apps that adapt to accept Dai, the more ubiquitous this currency can become.

This is one that’s definitely worth doing a bit more work on for a deep dive and now has a $6.5B market cap.

5. How GRIT’s Playing it  Introducing a Crypto-focused Newsletter

Introducing a Crypto-focused Newsletter

There are so many interesting projects but for every 1 worth actually paying attention to, there are probably 100 scams and shitty ideas out there.

This new subsection of GRIT will have a direct focus on the evolving crypto landscape and arm you with the proper tools to navigate this incredibly complex ecosystem.

There will be something for amateurs and pros alike, and I can’t wait to bring it to you.

It will be launched at the end of this month, and everyone will get the first issue for FREE!

Wrapping Up…

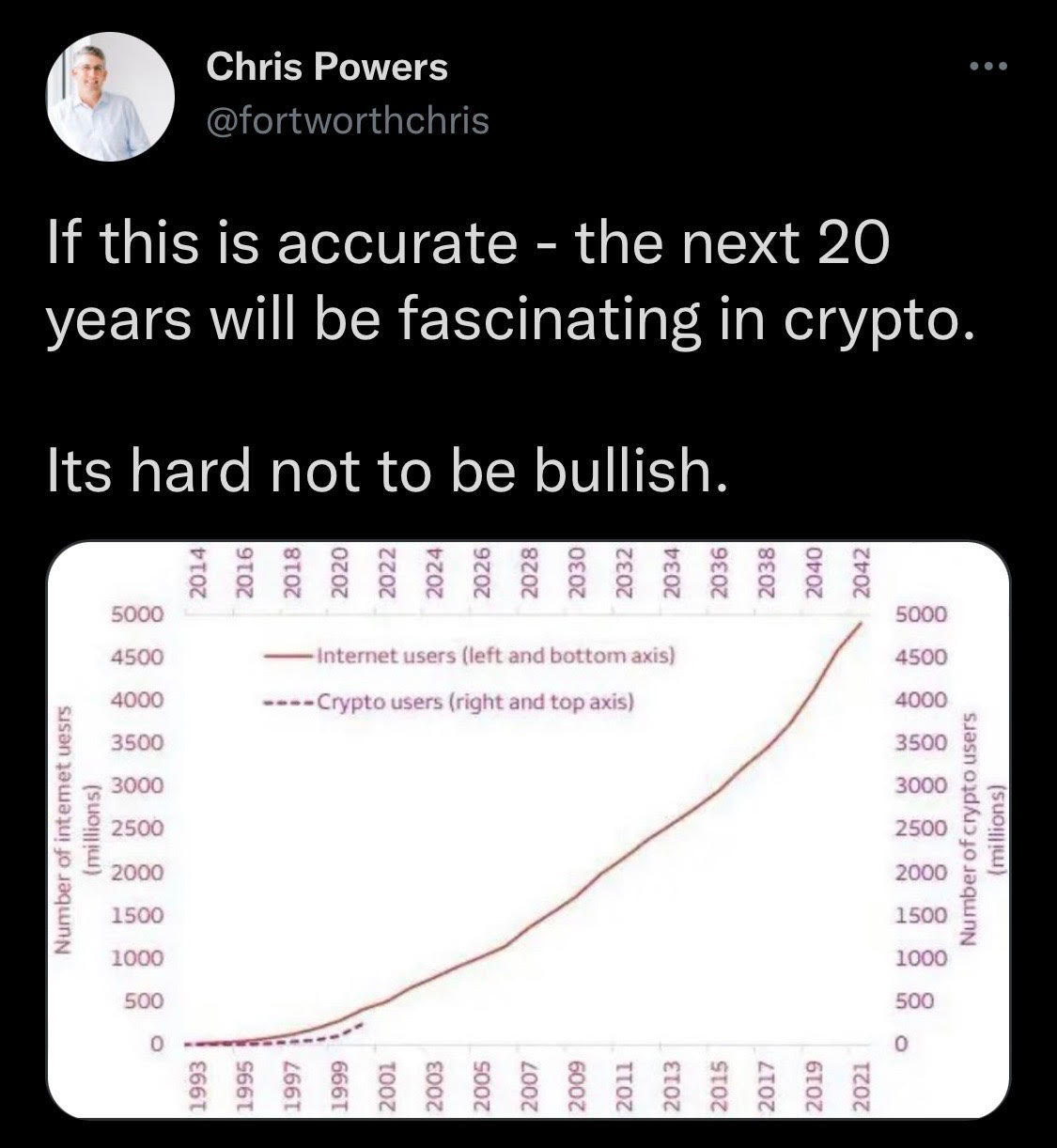

By now, I think it’s quite hard to deny that Web3 and crypto are going to be massive parts of the future. Crypto will be incredibly important not only as an asset class but as a protocol and a marketplace in itself.

Bitcoin was like the gateway drug into what decentralized technology could bring to the table, but I believe some programmable iteration on Ethereum is going to bring about entirely new incredible applications.

Until next time. Always Yours. Incessantly Chasing ROI,

-Genevieve Roch-Decter, CFA

This news is republished from another source. You can check the original article here