- A look at how the upcoming FOMC meeting will influence the Shiba Inu demand.

- Bullish bias forming but investors still moving with caution in anticipation of final results.

The Shiba Inu community is undoubtedly pleased with SHIB’s performance in January. But now that the month is coming to its conclusion, a sense of uncertainty has returned to the market, especially in regard to its performance in February.

The upcoming FOMC meeting will likely have the biggest impact on Shiba Inu holders’ portfolios.

A good understanding of what the FOMC meeting is will allow Shiba Inu holders to better understand how it influences their portfolio.

Well, for starters, the meetings are held once every three weeks and one of the key highlights is the revision of the Federal Fund rate. The latter is the rate at which banks borrow from the Federal Reserve.

The link between the FOMC and Shiba Inu price action

The Federal Reserve uses the Federal fund rate as a tool for balancing the economy. A lower rate means it is cheaper to borrow, making it easier for people to access liquidity and thus an easier investment environment.

On the other hand, a higher rate makes borrowing less appealing and discourages investment.

The Federal fund rate has been rising for the most part in 2022 as part of the FED’s quantitative tightening measures to curb inflation.

Shiba Inu and the rest of the market experienced a bullish surge after the last FOMC meeting. This is because the FED only increased interest rates by 0.5% or 50 basis points compared to 0.75% or 75 basis points in the previous month’s announcement.

Source: Macrotrends

The market interpreted the lower FFR as a sign that the FED was easing off its aggressive rate hike. This was also accompanied by reports that the FED was seeing positive results in its battle against inflation. The next FOMC meeting is scheduled to take place on 31 January and 1 February.

How will the FOMC’s next FFR affect Shiba Inu?

There is speculation that the FED will hike the FFR by 25 basis point. If this turns out to be true, then it may support a bullish sentiment, and thus SHIB may experience renewed buying pressure.

Such an outcome would allow it to overcome the resistance we observed in the last few days at the $0.0000123 price level.

Source: TradingView

If a rally is an outcome, then Shiba Inu investors can expect the price to surge by as much as 14% to the next Fibonacci resistance line.

If the rate hike is higher than that, it may spoof investors, triggering another selloff for Shiba Inu.

A 10% or more pullback may be on the cards and that outcome will push it back closer to or below its 200-day MA.

The week ahead 🫡

Wednesday: US FOMC [25bps hike priced with 98% probability, another 25bps in March is likely]

Thursday: UK + European central bank meetings

Friday: US NFP job market data [Unemployment rate to tick higher from 3.5% to 3.6%, 193k jobs exp. to have been added]

— tedtalksmacro (@tedtalksmacro) January 29, 2023

How are the markets reacting so far?

Sometimes the market starts to react even before the actual FOMC minutes are released. Some speculate that this is because people in privileged positions know about the FED’s rate decision before it is officially released.

As such, some market participants may have privileged access, allowing them to react accordingly.

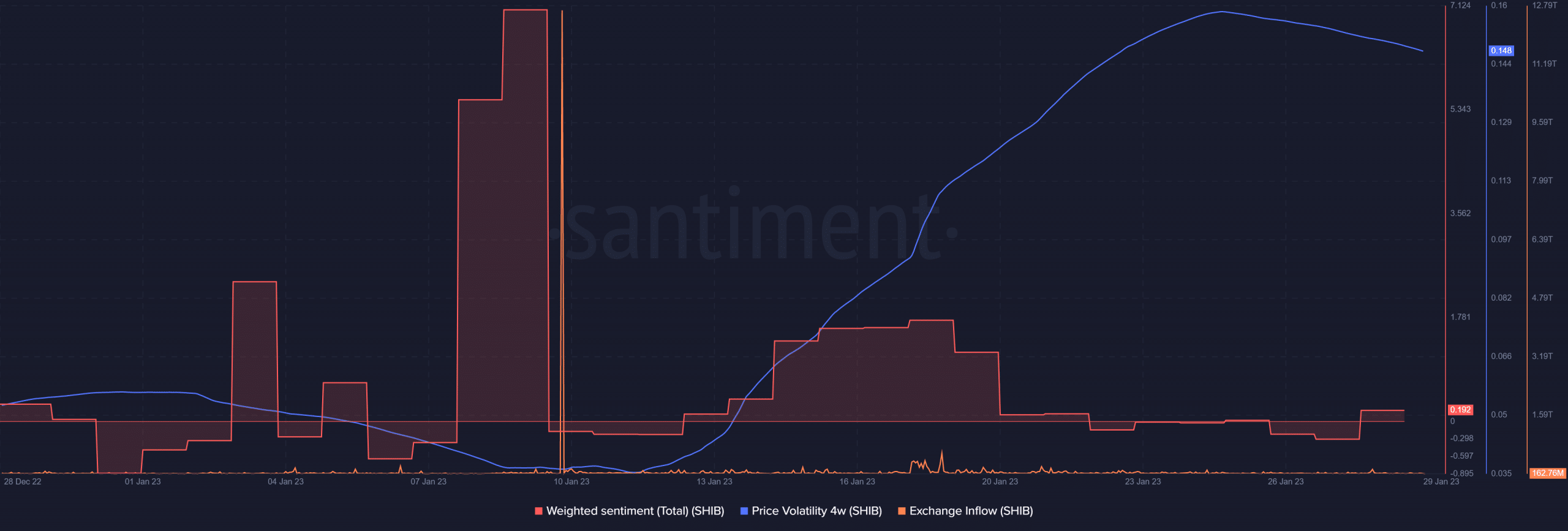

Interestingly, Shiba Inu’s weighted sentiment metric did register a slight uptick in the last two days. This may suggest that optimism is returning to the market.

Well, this is not necessarily a confirmation that investors anticipate another surge especially now that the expectations are leaning towards a 25 basis point hike.

Source: Santiment

Meanwhile, the price volatility has tanked slightly in the last few days but another surge might be on the way. This is because the FOMC data may trigger more trading activity this week.

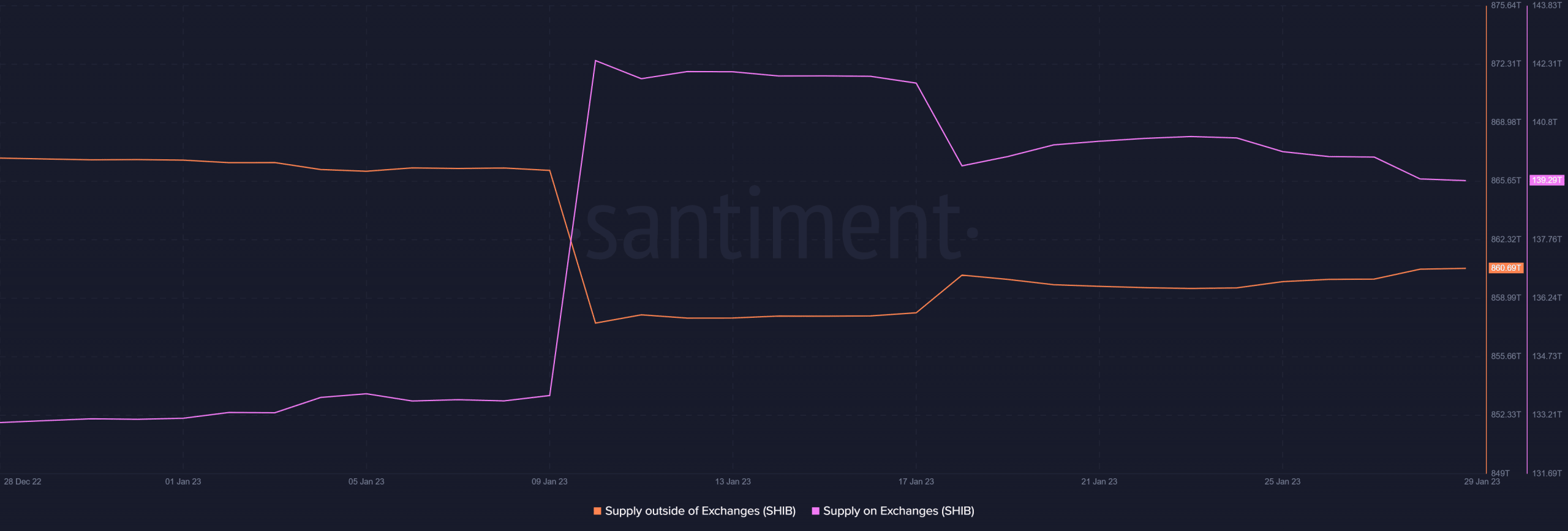

Exchange flows also highlight a similar outcome. The supply on exchanges has dropped significantly in the last few days, while the opposite is true for supply outside exchanges.

Source: Santiment

The above metrics confirm that there is a higher demand for SHIB than selling pressure. Nevertheless, this is not confirmation that the bulls will prevail.

There is still ample time for a bearish pivot especially if the FOMC decides to go with a higher rate hike than anticipated.

Once the official data is out, we will likely see an increase in directional momentum. SHIB traders and investors can take advantage of the subsequent trend which will offer opportunities for short-term gains.

But, for now, the best strategy would be to ‘wait and watch’ the market’s play.

This news is republished from another source. You can check the original article here