- Ethereum price hovers around $1,550 after a bullish start to 2023.

- Investors are already detailing fundamental reasons why the current levels are the best place to accumulate ETH.

- Developer activity, deflationary status, and staking are a few of the most important reasons that make the smart contract token stand out from the rest.

Ethereum has played an extremely important role in building the cryptocurrency ecosystem in the world. Although many blockchains were launched after Bitcoin’s start in 2009, ETH became a major focus of speculation due to the wide range of potential applications it could offer if it were to be successful. Now, Ethereum is the second-largest cryptocurrency in the world, with a market capitalization of $187 billion.

Let’s take a look at three reasons why Ethereum may be a good long-term investment.

Developer Activity

Despite a good start to 2022, the latter half of the year was brutal and caused investors to suffer significant losses as key players in the industry collapsed. This caused many projects to go under due to affiliation or lack of funds. Regardless, the developer activity seen in the Ethereum blockchain failed to decline.

The ETH blockchain saw an addition of 234 new developers between December 2021 and 2022, with a total of 5,750 developers working on the smart contract platform. The number of developers combined with the activity of these builders is one of the best ways to measure the value of a particular blockchain. Additionally, as noted in Electric Capital’s developer report, ETH’s ecosystem of developers is 2.8x higher than the next one, which is Polkadot.

Electric Capital’s developer report

Deflationary status

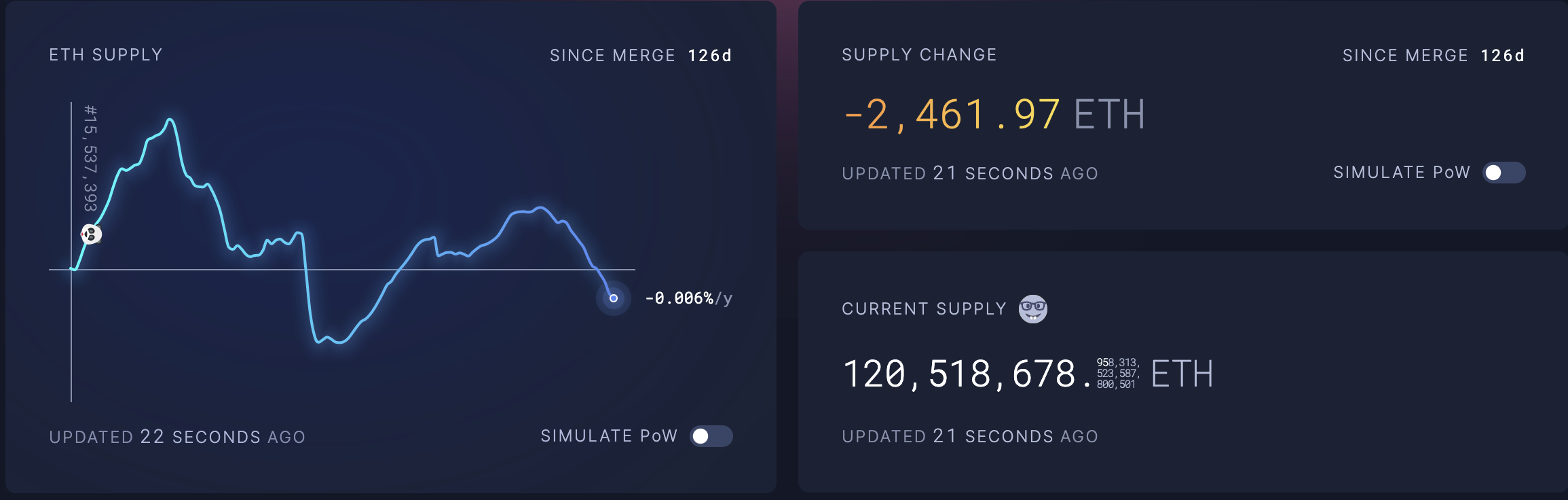

Since the implementation of the Merge update 126 days ago, a total of 2,464 ETH have been burned or taken out of existence. The Merge was a hard fork that migrated Ethereum from a Proof-of-Work (PoW) to Proof-of-Stake (PoS) protocol. In contrast, if Ethereum had stuck with PoW, there would have been 1.48 million ETH added to the network.

From a long-term perspective, the deflationary aspects make Ethereum one of the best investment vehicles as Bitcoin is still an inflationary asset since roughly 328,000 BTC are minted per year until all 21 million BTCs are mined.

ETH ultrasound

Staking

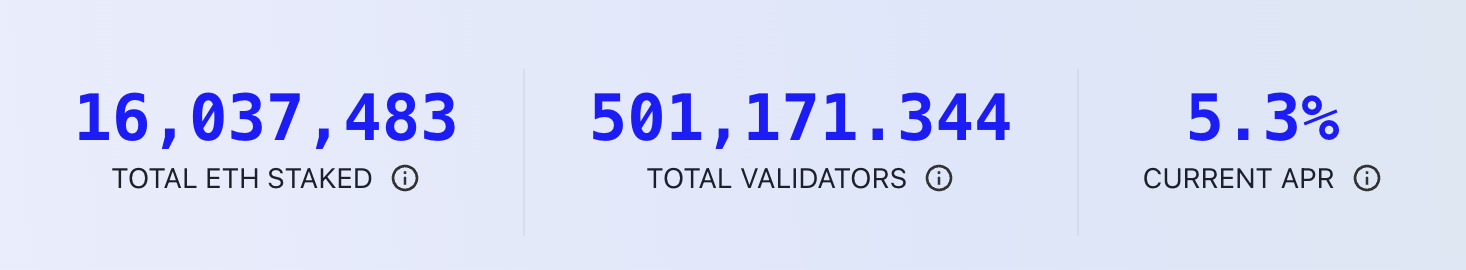

Ethereum enabled staking when it moved from PoW to PoS, and since then, 16 million ETH have been staked. The current staking reward sits around 5.3% Annualized Percentage Rate (APR).

More recently, it was announced that the Ethereum blockchain would soon undergo another upgrade known as Shanghai, which will enable withdrawals of staked ETH.

ETH staked

Combining this information with the Ethereum being a deflationary asset, the real staking yields will only increase in the future. Additionally, with the Shanghai upgrade, users can stake and unstake at will, which is likely to result in a high participation rate, pushing the total staked ETH much higher by 16 million ETH.

This news is republished from another source. You can check the original article here