Leonid Sorokin

Why track inflation?

“Don’t fight the Fed.” It’s a lesson I’ve had to learn the hard way in my career. The Fed is the most powerful financial institution that the world has ever known. Mere commentary from the Fed is enough to move markets; Fed policy moves the economy.

Some of the smartest people I have met in my career are avid “Fed watchers”, and no doubt, I’ve come to respect why. Most investors are convinced that the major indices (SPX) (SP500) (DIA) (QQQ) (NDX) are now “in the hands of the Fed”, and will “bottom out” once Fed policy pivots to a less aggressive stance.

That is to say, once inflation cools down. As most readers here understand, the Fed is increasing (or “hiking”) interest rates in order to slow down the economy, with the goal of taming inflation. The Fed uses a wide variety of economic data to drive its policies, carefully monitoring the relationship between rates and growth. The Fed is steadily ratcheting up rates to 4%+, where it will likely pause, and wait for inflation to come down to its 2% target rate.

Because stocks are intrinsically valued based on the present value of future cash flows, they are sensitive to changes in interest rates. Higher interest rates mean higher discount rates on these future cash flows. The types of companies that I am most interested in – tech companies – are particularly sensitive because so much of their present value depends upon their future cash flows, their growth.

There is another, more intuitive way to think about it. If the Fed is hiking rates to slow economic growth, companies that derive significant portions of their value from future growth will be the ones most affected. This is why there has been a “great rotation” into lower growth companies, that will be less impacted.

Either way, you cannot totally wash out the risks of inflation by moving to a more defensive portfolio. In a market that is driven so heavily by passive investment flows, all stocks will exhibit a significant level of correlation. Therefore, even for the totally passive investor only buying index funds, tracking inflation is important.

Problems with Tracking Inflation

Institutional investors can get some sense of where inflation is headed by using futures to back into the implied Fed Fund rates. These futures are reflective of market expectations, which are, of course, driven by inflation expectations.

This is useful, but the data required is not available to most people. Most of the people have to wait for CPI (Consumer Price Index) reports from the U.S. Bureau of Labor Statistics, that detail the official inflation numbers. The latest report will be released today (December 13th). The next report, for December 2022, will come on January 12th.

Aside from waiting for an entire month to get a snapshot of the data, there is also the fact that the methodology is often changed. This has come with significant criticism, as it has led to wide distortions over time:

In the conventional economic world, you would treat inflation as the rate of increase in price of a market basket of consumer products, defined by a government agency…

…They Define a synthetic metric, right? I’m going to say you should have a 1,000 sqft apartment, and you should have a used car, and you should eat three hamburgers a week.

Now 10 years go by and the apartment costs more; I could adjust the market basket–they call them hedonic adjustments. I could decide that, in 1970, you needed 1,000 sqft. But in the year 2020, you only need 700 sqft because we’ve miniaturized televisions, and we’ve got more efficient electric appliances, and because things have collapsed out of the iPhone you just don’t need as much space.

So now it may be that the apartment costs 50% more, but after the hedonic adjustment, there is no inflation. Because I just downgraded the expectation of what a normal person should have.

-Michael Saylor (CEO of MicroStrategy & bitcoin advocate)

What is Chainlink?

In response to my articles related to cryptocurrency, the comments I have received are often filled with the same old platitudes about crypto being “pointless”, “worthless”, “a scam”, as so on…

So I wanted to write this article as a rebuttal to those sorts of opinions. Not another philosophical piece about monetary theory, but a practical example of a cryptocurrency mechanism people might want to use – One that I use myself.

I won’t get into all of the complexities here, only a brief summary is necessary: Chainlink is a type of cryptocurrency that is designed to validate high-quality data for use in smart contracts (a type of contract that is written in code and stored/executed on the blockchain).

The validators of the Chainlink blockchain/network effectively run a highly secure data platform that the broader crypto ecosystem can use to engineer more sophisticated decentralized applications. Chainlink falls into the category of cryptocurrency projects that I follow, but don’t hold a position in given that we are going through another “crypto winter” and what that means for smaller projects.

Truflation

Truflation is an application that uses the infrastructure of this decentralized and independent network to calculate inflation in real-time. This can give any investor an up-to-the-minute look at the inflation rate, between the official CPI releases. You can access it straight from a normal web browser at (https://app.truflation.com/).

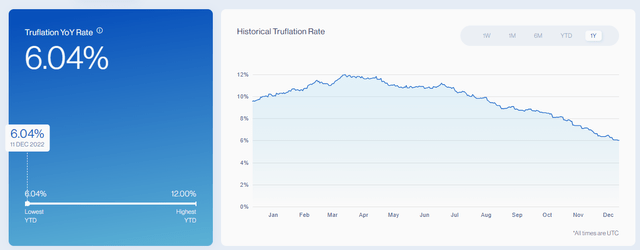

Truflation data for the US (Truflation)

From this data, we can see that inflation is at its lowest point for the year. The inflation rate is not only down close to 50% from its high of 12% annually. If you drill down into the different categories, you will see that this has been driven by a dramatic drop in transportation costs.

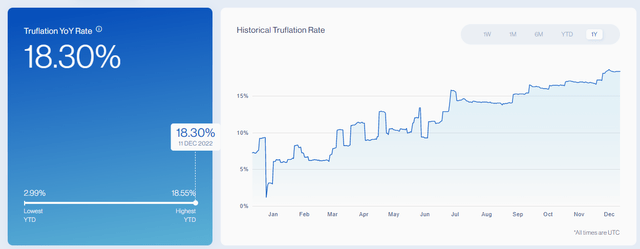

Truflation data for the UK (Truflation)

Interestingly, Truflation also offers a look into inflation rates in the UK. Here we see an eye-watering 18.3% annual inflation rate! This has been mostly driven by skyrocketing utility/energy costs, as a result of the war in Eastern Europe. In addition, rising housing costs.

Conclusion: Will it match the CPI?

And so, it begs the question: How close will the Truflation data be to the official numbers that will be released this morning? We will find out in a few hours, but I suspect that Truflation will correctly predict the momentum, showing that the rate of inflation has meaningfully declined.

This news is republished from another source. You can check the original article here