Understanding the crypto market’s sentiment is a big plus for you as a trader. It helps you aggregate the majority opinion and thoughts about the crypto market, and with such information, you can leverage the market’s changing directions.

However, can that crypto market sentiment be used to make accurate crypto trades?

What Is Market Sentiment?

Every trader has an opinion and explanation of different market conditions. However, no matter the trader’s convictions, the market can still move in an unanticipated direction, making the trader lose his money. Why is this so? An individual’s, that is, a retail trader’s trade sentiment isn’t enough to move the market; it is usually a combination of all trading views and opinions, and such a combined feeling is known as market sentiment.

Market sentiment is investors’ overall and prevailing attitude and mood toward the crypto market. It is the summation of the market views. A positive market sentiment signals a bull market, while a pessimistic market is a bear market. The combination of the two drives price action, creating short-term and long-term investment opportunities.

Market sentiment is affected by anything and everything, making it important that you get as much information as possible about the market when conducting a sentimental analysis. Carrying out sentimental market analysis usually involves a combination of various indicators and market factors, some of which we will consider in this article.

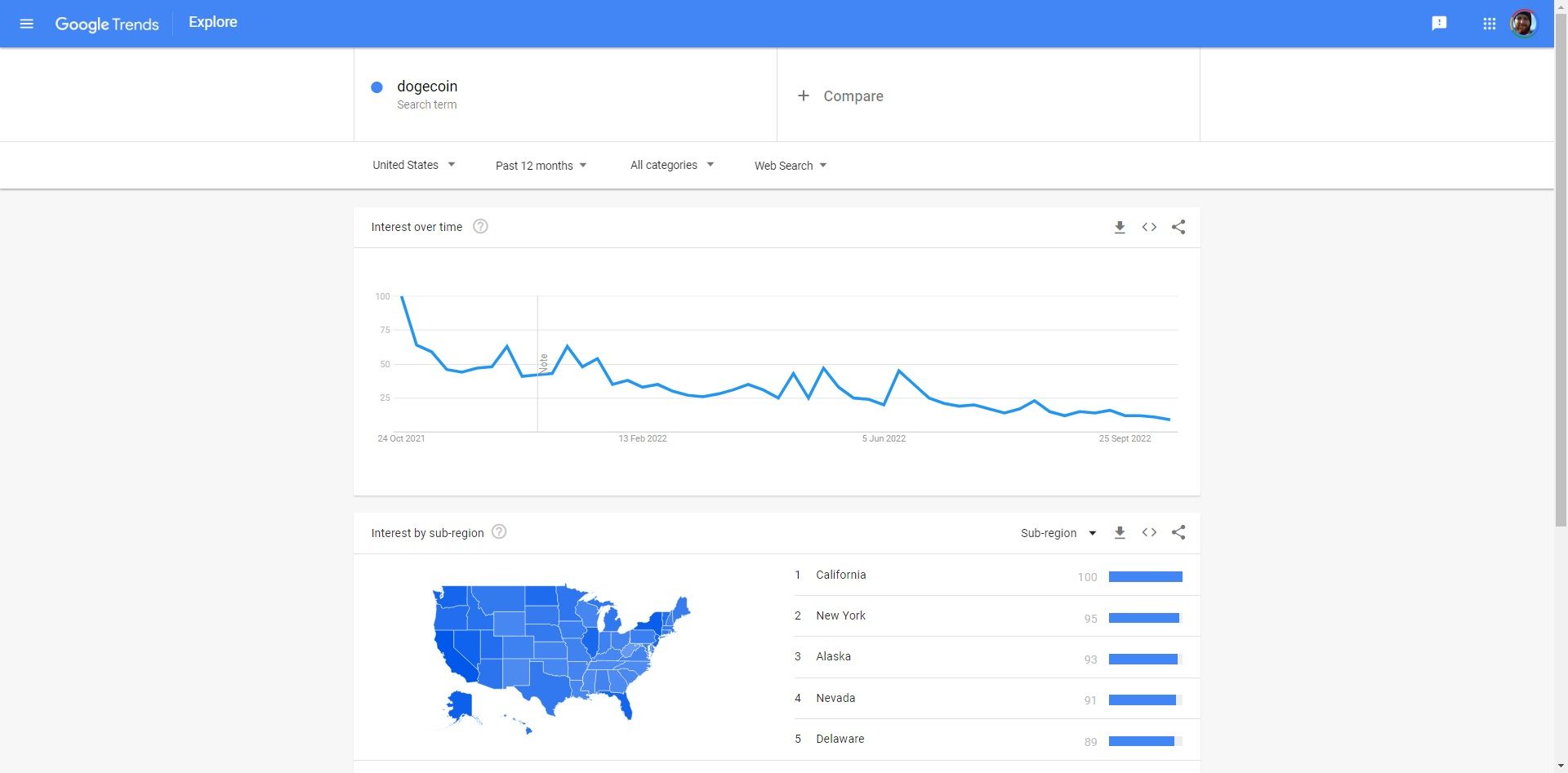

An example of how sentiment affects a market price are Elon Musk’s tweets about Dogecoin in 2021, which made the price of Doge spike. His tweets gave many investors more hope in Dogecoin, and during that period, the price rose dramatically.

How to Gauge Crypto Market Sentiment

There is no particular way to measure the market mood and traders’ predominant trading psychology because different factors affect general market sentiment. For example, a major crypto exchange crash or hack can cause traders and investors to lose trust in the market and start withdrawing their investments from other exchanges. Such a happening can trigger an unexpected bearish sentiment.

Instead of trying to find a precise way to measure market sentiment. You should get a way to know the views, ideas, and thoughts of different people involved in the crypto market. Some things you should be on the lookout for are:

Crypto Hype

Crypto hype can affect the market’s sentiment towards a particular cryptocurrency. Such hype can be triggered by an influencer or major crypto project leader. Sometimes it could be a rising interest in a token. The Elon Musk example we gave earlier is an example of market hype.

One of the ways to gauge the hype surrounding a crypto project is to use Google Trends. A high search volume for a specific cryptocurrency can indicate what many investors think.

Crypto-Related News

You must be updated with the latest industry news and market happenings from trusted crypto news platforms. A major event, such as the prohibition of crypto in a country with many crypto investors or the failure of a major crypto exchange, can negatively impact the market.

News related to an increased acceptance of cryptocurrency as a payment system in major countries or a big investor choosing to invest heavily in crypto could be positive for the market.

Social Media Pages

Checking social media pages to know what a project’s community members think about it is a good way to measure the sentiment around such a project. Telegram and Discord have become popular platforms for many crypto users and investors, and you will also find them useful for gathering information. Some other platforms where you can gather information include Twitter and Reddit.

Using Crypto Market Sentiment Indicators

Using sentiment indicators can also help you aggregate market sentiment information. The major challenge with this method is that most crypto sentiment indicators are based on Bitcoin. As a result, you may not be able to use this method for a wide range of cryptocurrencies.

2 Bitcoin Market Sentiment Indicators

You can use a combination of different market sentiment indicators to check for bullish or bearish tendencies in the crypto market. Typically, these indicators represent information in the form of a scale. Let’s consider two indicators you can use to get an idea of Bitcoin market sentiment.

1. Bitcoin Fear and Greed Index

This indicator shows the Bitcoin fear and greed level on a scale of 0 to 100. In addition, the indicator analyzes different information like market volatility, volume, social media, trends, and dominance.

This indicator attempts to weigh fear and greed in the market. When Bitcoin’s price increases, more investors want to get in for fear of missing out (FOMO). Thus, many get greedy in the market. Conversely, when the Bitcoin price starts to drop, investors want to get out of the trade for fear of losing their money.

A reading of zero on the Bitcoin fear and greed index indicates that the market is in an extreme state of fear, while a reading of 100 shows that the market is in an extreme state of greed.

2. Bull and Bear Index

This indicator analyzes social media conversations to show how bullish or bearish they are. A reading of 0 shows an extremely bearish sentiment, while one signals an extremely bullish sentiment.

The software analysis data based on 93 sentiments and topics obtained from Reddit, Twitter, and Bitcointalk, and it updates every hour.

Importance of Market Sentiment Analysis

Conducting a sentimental analysis helps you understand how the price will likely move in the short term. It becomes more convincing when combined with technical analysis and fundamental trading metrics. Identifying potential price trends before they even occur in the market puts you in a better position to make the most of the information.

Constantly executing trades that result from analyzing the market with general market sentiment, technical indicators, and fundamental indicators will give you better results. Combining sentiment analysis with your trades will also help you trade with more confidence and purpose and fewer emotions.

Sentimental Analysis Is Not Enough

You cannot rely solely on market sentimental analysis to execute trades. To be successful, you need to combine sentiment analysis with technical and fundamental analysis. There is also no guarantee that some major events will affect the market price significantly. Thus, it is hard to predict the market’s reaction at all times.

The information on this website does not constitute financial advice, investment advice, or trading advice, and should not be considered as such. MakeUseOf does not advise on any trading or investing matters and does not advise that any particular cryptocurrency should be bought or sold. Always conduct your own due diligence and consult a licensed financial adviser for investment advice.

This news is republished from another source. You can check the original article here