Unfortunately for most markets, it’s all about the US dollar at the moment. The DXY has been pummelling other currencies (particularly the British pound) and stock markets in its push higher. But crypto? Yeah, it’s not exactly in terrific shape, but it could be worse.

#bitcoin surprisingly up on the day in spite of equity markets getting hammered!

— Lark Davis (@TheCryptoLark) September 26, 2022

Right now finding the crypto bottom might have more to do with the US dollar finding its top. Where does the buck stop? That’s the question, as the thing’s been going practically vertical. The DXY is at 20-year-high levels near 114 and has been on a parabolic rise since May 2021.

You know we’ve reached a unique time in history when #Bitcoin suddenly is less volatile than fiat currencies.

— Sven Henrich (@NorthmanTrader) September 26, 2022

Meanwhile, Bitcoin perma-mega-bull Michael Saylor is bringing the stats. (Albeit adjusted to a four-year timeframe for Bitcoin.)

Over the past year currencies have collapsed against the dollar:

CAD -8%, CNY -9%, AUD -11%, ZAR -17%, KRW -18%, EUR -18%, PLN -21%, GBP -22%, JPY -23%, TRY -52%

Over the past four years the dollar has collapsed -67% against #bitcoin.

— Michael Saylor⚡️ (@saylor) September 26, 2022

Also thinking long term is the popular (200k+ Twitter subs) trader Josh Rager, who is comparing the current situation with the 2019 BTC bottom, which preceded a bull run of stupendously epic proportions. “Not saying history will repeat” – perhaps best to keep those words in mind, while keeping a close watch.

Uncertain if a bottom is in for Bitcoin but if $BTC price starts making its way back up to $24k+, I’ll certainly be paying attention

Not saying that history will repeat but April ’19 took most people by surprise

Current market environment is different from 2019 (recession, etc) pic.twitter.com/CFaWDtE8r7

— Rager 📈 (@Rager) September 26, 2022

Onto some daily price action and other happenings.

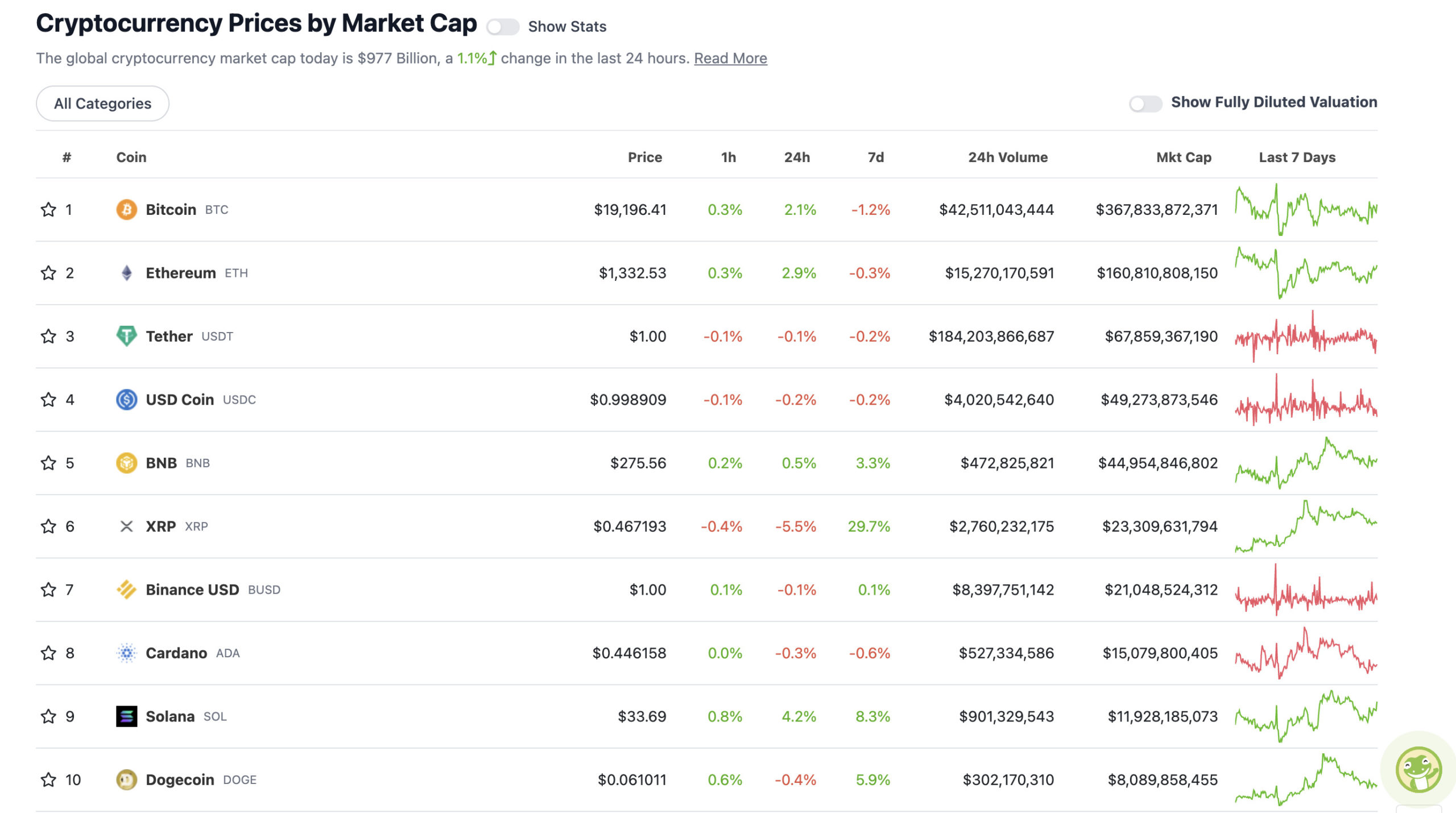

Top 10 overview

With the overall crypto market cap at US$977 billion and up about 1% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

There’s a surprising tinge of green in the crypto market majors today, with high-speed layer 1 blockchain Solana (SOL) leading the daily gains, while XRP has eased its foot off the gas after its recent surging.

Scanning some further Twitter-based analysis, Roman Trading seems impressed with Bitcoin’s resilience in the face of the macroeconomic turmoil and isn’t against the idea of a pump, but, frankly, still expects the crypto dominoes to fall again.

It’s amazing how well $BTC is holding up against the #stock market drop & $DXY parabolic advance.

Still holding support so I’ll continue looking for longs but expecting a crash.#bitcoin #cryptocurrency #cryptotrading

— Roman (@Roman_Trading) September 26, 2022

Dutchman Michaël van de Poppe is working in “ifs”, which is obviously fair enough. We like his “if”, below, as reclaiming and staying above the 200-week moving average is deemed an important marker for market health.

If #Bitcoin reclaims higher numbers, we’ll be able to reclaim the 200-Week MA on the total market capitalization of #crypto. pic.twitter.com/1HpzdBd42r

— Michaël van de Poppe (@CryptoMichNL) September 26, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.5 billion to about US$383 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Terra Luna Classic (LUNC), (market cap: US$2.13 billion) +48%

• Terra (LUNA), (mc: US$445 million) +21%

• IOTA (MIOTA), (mc: US$867 million) +15%

• Bitcoin SV (BSV), (mc: US$984 million) +6%

• Polkadot (DOT), (mc: US$7.56 billion) +6%

Okay, so the Terra coins are surging again. Why? At this point, other than thoughts of potential pumping-and-dumping whale manipulation it’s hard to fathom why.

That said, Interpol is said to be seeking the arrest of Terra founder Do Kwon, although the price surging on this news seems a little strange.

Interpol issues worldwide arrest warrant for failed crypto boss Do Kwon https://t.co/oZ4QOYbpy6

— BBC News (World) (@BBCWorld) September 26, 2022

Meanwhile, Kwon tweeted the following:

Yeah as i said im making zero effort to hide

I go on walks and malls, no way none of CT hasnt run into me the past couple weeks

— Do Kwon 🌕 (@stablekwon) September 26, 2022

Watch this space on that one, and in the meantime, enter LUNA and LUNC trading at your own risk.

As for IOTA, there are things afoot with this unique OG Internet of Things crypto project. It’s nearing the launch of its SMR token and Shimmer – the staging, layer 1 network for the IOTA network.

What does this mean in a nutshell? It means a greater capacity for the IOTA project to build its DAG-based applications geared towards the IoT space. Shimmer is also designed to bring a fee-less digital assets structure to IOTA.

This is the week where, for the first time since the start of #IOTA in 2015, we launch a new token to the world.

Couldn’t be more excited for what will follow. #Shimmer $SMR pic.twitter.com/jEe4hF4gsr

— Dominik Schiener ✨ (@DomSchiener) September 26, 2022

The launch of the SMR token and Shimmer is expected to take place on September 28.

DAILY SLUMPERS

• Algorand (ALGO), (market cap: US$2.55 billion) -6%

• ApeCoin (APE), (mc: US$1.73 billion) -3%

• Chain (XCN), (mc: US$1.57 million) -2%

• DeFiChain (DFI), (mc: US$446 million) -2%

• Stellar (XLM), (mc: US$2.89 billion) -2%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

British pound out here dropping like a shitcoin! pic.twitter.com/bswP3Pxyu6

— Lark Davis (@TheCryptoLark) September 26, 2022

The 🇬🇧 British pound is down 12% since Bank of England Governor said “Be prepared to lose all your money” in #Bitcoin and crypto.

— Bitcoin Magazine (@BitcoinMagazine) September 26, 2022

Central Bank Inflation Strategy 🤨

pic.twitter.com/QyWtTLPcLA— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) September 26, 2022

british people after losing 10% of their net worth in the last weekpic.twitter.com/KUTSEnzJ4I

— yzy.eth (@LilMoonLambo) September 26, 2022

Before you know it the Fed will be forced to “pause” QT.

— Sven Henrich (@NorthmanTrader) September 26, 2022

This news is republished from another source. You can check the original article here