Crypto investors: there are two cryptocurrency coins that were added to the list of approved digital assets in Malaysia, and they are called Chainlink (LINK) and Uniswap (UNI). They are available on Luno, the first Securities Commission-approved digital asset exchange in Malaysia with the largest variety of cryptocurrency investment options of seven approved coins.

Since the launch of these new cryptocurrency coins in the country, Malaysians have traded more than RM 50 million worth of these digital assets on Luno. So, are you ready to learn more about the two cryptocurrency coins before you get into the game?

Chainlink (LINK): Bridging The Gap Between Real-World Data And The Blockchain

Chainlink is a platform that assists in connecting blockchain-based smart contracts with external data, such as stock prices or weather data in real-time. Smart contracts can be considered as apps that execute an action automatically when certain conditions are met and the cryptocurrency network they live on approves that these conditions have been fulfilled.

Chainlink helps these smart contracts by connecting them to real-world data sources. It does this by using oracles, which are essentially intermediaries that gather external data and translate it into a language that the blockchain is able to understand.

Meanwhile, LINK is the native token of the Chainlink network. It is mainly used to pay for services carried out on the network by oracles.

The Chainlink network is also decentralised, which means that not even one person or group is in absolute control of providing the data; but rather responsibility is spread across the network. This prevents the network from a single point of failure and helps with enhancing its security.

A couple of examples involving Chainlink utilisation include:

Enhancing smart contract-based gaming applications (if you’re a game developer)

Chainlink offers Verifiable Random Function (VRF), a solution which generates a random number and delivers it to the smart contract where users can identify whether it is fair and unbiased; as neither the players, game creators, nor external entities can tamper with or manipulate the randomness to their advantage. In other words, the contract is untouchable.

Paying out insurance compensation

Flight insurance policies pay travellers compensation in the event of a delay. Using smart contracts, insurers can pay these automatically when certain conditions have been met. Chainlink is vital to this process because it feeds external data set out in the details of the agreement such as the weather and flight times to the smart contract. If they meet the terms of the agreement, then the smart contract can decide whether or not to pay depending on if the causes of the delay satisfy the terms of the original agreement.

Uniswap (UNI): Experience Cryptocurrency Investment Activities On A Peer-To-Peer (P2P) Network

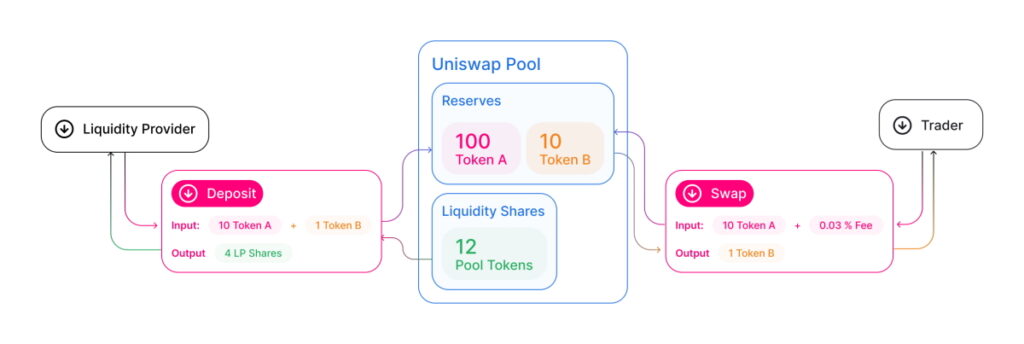

A software and cryptocurrency investment platform that runs on Ethereum, Uniswap gives its global network of users a place where cryptocurrencies can be bought and sold in a P2P manner. UNI is the native token of Uniswap, and anyone holding UNI has the right to vote on new developments and changes made to the platform.

There are currently hundreds of tokens available on Uniswap. New tokens can take a long time to be verified and listed on large exchanges but because Uniswap is decentralised, anyone can access it. This is possible because transactions between the parties involved in the swap are facilitated by smart contracts.

Uniswap doesn’t hold any assets on behalf of its users. Instead, it uses what’s known as ‘liquidity pools’, which are digital piles of cryptocurrency locked in a smart contract. Any user who trades against the pool’s assets would have to pay a fee which is later distributed to all liquidity providers in a proportional manner, according to their contribution.

Uniswap was created with the intention of being a decentralised exchange, known as DEX for short, that did not require users to make a deposit before using it nor open an account and provide personal information.

Uniswap’s reliance on liquidity pools rather than last trade prices and order books such as those used by Bitcoin has proven very successful, and it has received financial backing from large venture capital firms.

Start Your Cryptocurrency Investment With Luno, The Leading And Regulated Digital Asset Platform In Malaysia

So, are you team LINK or UNI? Consider your options carefully before you proceed.

Whatever type of cryptocurrency investment you choose to trade, getting started with cryptocurrency investment is actually convenient and fast. If you’re wondering how to start investing in Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin Cash, Chainlink, or Uniswap, you can log on to Luno’s website and register for an account today.

By the way, for those of you who have friends or family who has not signed up for an account with Luno in Singapore, you can refer them to Luno and enjoy SGD 30 (~MYR 97) in Bitcoin! Here are the steps to invite your friends:

- Share your unique invite code to your friend from the Rewards Page

- Your friend signs up, deposits and buys SGD 200 (~RM644) worth of crypto

- You both get SGD 30 (~MYR 97) worth of free Bitcoin

This article is brought to you by Luno.

This article is for educational purposes only and you should not construe any such information as investment or financial advice. Investing in cryptocurrency is high risk and may result in the loss of capital as the value can fluctuate. We recommend individuals to consult with a licensed financial planner for detailed financial advice on whether cryptocurrency is a good investment option.

Read more on Luno’s Terms of Use and risks associated with cryptocurrencies here: www.luno.com/en/legal/terms

Read more on the Terms & Conditions for Luno’s referral programme here: www.luno.com/en/legal/rewards-and-promotions

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.

This news is republished from another source. You can check the original article here