SINGAPORE / ACCESSWIRE / August 26, 2022 / The DeFi sector was one of the biggest casualties of the unfortunate demise of Terra Luna and cascading blowups elsewhere, such as Celsius, Voyager and 3 Arrows Capital. But despite all the gloominess, one area of DeFi has had a great year so far in 2022, and that is DeFi Options Vaults (DOVs) which now has over $350 million in TVL, despite the recent drawdowns.

A protocol which has been taking rapid strides forward in this space is Polysynth, a decentralised options protocol enabling investors to earn sustainable yields across market cycles. Polysynth is backed by Jump Capital, Alliance DAO, Brevan Howard, Ledger Prime, QCP Capital, and angels such as Polygon founders Sandeep Nailwal & Jaynti Kanani. The team consists of 14 members, some of whose experience in crypto date back to 2014. 7 of them are ex-founders and have worked at top firms like J.P. Morgan, McKinsey, Twitter, Uber and Moody’s Analytics.

Options can seem complex and intimidating, as strategies can involve multiple strikes, expiries, and several other factors that an investor needs to consider, and this is what DOVs solve. Investors simply need to stake their assets in the DOVs, and the smart contracts take care of the rest via automated options selling.

Polysynth’s DOVs are available on Ethereum and Polygon and supports depositing assets through 10+ other EVM chains via popular bridging solutions such as Hyphen, Wormhole, O3 Swap and Polygon Bridge. Polysynth has delivered consistent double-digit returns for all its DOVs, while some DOVs are earning as high as 37%+ APY despite the tumultuous crypto markets. Polysynth has crossed $2.2 million in TVL and over $27 million in trading volume within two months of its launch in June.

Polygon Network’s native token MATIC has gained over 178% in the last two months. Polysynth is among the few DOV platforms with Covered Call and Cash Covered Put DOVs for MATIC, enabling investors to earn up to 18% APY on MATIC without selling. That explains why Polysynth has garnered over $0.5 million in MATIC DOVs within a week of its launch.

Roadmap

Polysynth is set to launch Leveraged Options Vaults, which allows investors to leverage their options positions by up to 5X. According to a backtest on last year’s data published by Polysynth, an investor would have earned 376.84% APY on ETH Covered Call. Leveraged Options Vaults will be an industry first and will be powered by a lending pool, which will also serve as another venue to earn passive income on Polysynth. Investors can contribute assets such as BTC, ETH, MATIC and USDC to the lending pool and earn anywhere between 10% to 75%+ APY based on the utilisation level.

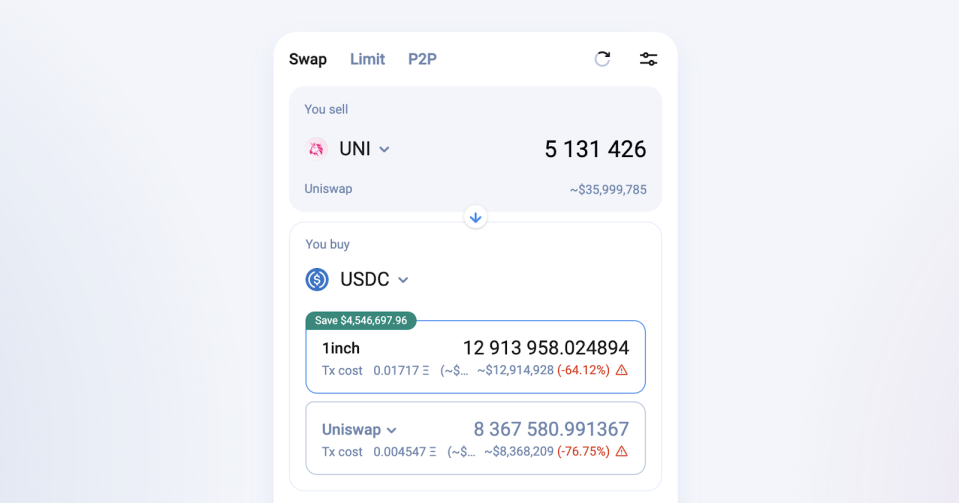

Another area where Polysynth works is enabling DAOs to better manage their treasuries. The top 50 DAOs today have over $10 billion worth of assets in their treasury but mostly are denominated in their native tokens. Though it’s well-known that DAOs need to diversify their treasury, the options available are far from optimal. For example, if Uniswap tries to sell 1% of its UNI treasury for DAI on 1inch, it would incur more than 64% slippage.

Another stifling thing about native tokens is that most don’t have much utility beyond safety staking, the yields for which can be minuscule. Another avenue can be lending the native token on AAVE, but the yields on AAVE can also be meagre. For example, if you were to lend UNI on AAVE, the yield would be 0.19%, clearly not what you want.

Polysynth has a three-prong Treasury Management Solution which solves all these:

-

Treasury Diversification without selling native tokens – Selling covered calls is one of the most popular yield-generating strategies. Polysynth enables DAOs to sell covered calls on their native tokens to earn 30%+ APY in chosen tokens such as USDC, ETH or BTC. This serves the dual purpose of diversifying the treasury and generating sustainable yields.

-

Dollar value protection of the treasury – This strategy combines selling a covered call and using the premium to buy a put on the DAOs native token to safeguard the treasury’s dollar value. The difference in the premiums between the call and the put options is minuscule and can be considered an insurance premium to protect the treasury’s dollar value.

-

Creating on-chain options liquidity for native tokens – Since most native tokens don’t have a burning mechanism or other ways to earn meaningful yields, having on-chain options liquidity for the native token will enable the community members to earn sustainable yields.

Polysynth has already inked partnerships with some major DAOs. Soon will see custom DOVs for those DAOs’ native tokens on Polysynth. They are also working on raising the literacy and adoption of DeFi with initiatives such as Polysynth Academy and a video series Earn Like a PRO.

Truly exciting times ahead in DeFi. The innovation continues unabated despite the choppy markets.

Follow Polysynth on Twitter and Discord to stay up to date with major partnerships and other announcements and visit polysynth.com/trade to check out the ongoing yields on their DOVs.

Media Contact:

Shailesh Gupta

https://polysynth.com/

sg@polysynth.com

SOURCE: Polysynth

View source version on accesswire.com:

https://www.accesswire.com/713618/DeFi-Options-Vaults-Protocol-Polysynth-Crosses-27Mn-in-Trading-Volume-Within-2-Months-of-Launch

This news is republished from another source. You can check the original article here