While investors are still reeling from the recent #cryptomeltdown, the market seems to have stabilized (for now). This uncharacteristic lull is providing a chance for crypto enthusiasts to step back and take in the latest crypto and NFT news from a safe distance while Bitcoin remains (fairly) stable around the 20K mark. Having said this, readers should be prepared for a healthy dose of damage calculation as consequences become baked into the markets. Are you ready for this week’s crunch? Let’s dive in!

Ringo is the First Beatle to Release an NFT Collection

Julien’s Auctions presented an exclusive auction offering a collection of original and one-of-a-kind digital works of art with their accompanying exclusive signed canvas prints created by the first Beatle to lift off into the NFT galaxy, Ringo Starr. The “Ringo Starr NFT Collection – The Creative Mind of a Beatle” auction took place Monday, June 13th online, with a portion of proceeds benefiting The Lotus Foundation.

Conceptualized and composed in Ringo Starr’s latest studio in the metaverse, “The Creative Mind of a Beatle” invited fans on a virtual tour of Starr’s digital gallery experience ‘RingoLand.’

The collection pieces feature an original animated painting with a custom-made drum composition recorded and played by Starr – with his drumming striking to the beat of the moving images flashing throughout each NFT – and minted with a special audio/visual motif of the time back when Starr played as part of the Fab Four, as well as signposts of his present and future creative journeys.

Billions in Crypto Trapped in Lending Platforms

Billions of dollars in cryptocurrency is currently “trapped” in crypto lending platforms like Celcius, Anchor, and Voyager Digital. Plunging token prices have forced platforms to temporarily suspend or limit withdrawals, leaving customers’ cash tied up for over three weeks.

Celsius, during its current solvency crisis, is still advertising an 18.63% annual yield on its website. While traditional banks offer insurance on deposits, there is no formal system in place for DeFi consumers to recoup their investments.

However, the U.S. tax code may provide some relief to these investors by way of an obscure deduction.

If funds become worthless and irrecoverable, investors may be eligible to write them off as a nonbusiness bad debt on their taxes, according to CPA and head of tax strategy at CoinTracker.io, Shehan Chandrasekera. The write-off will not cover the entire debt, but can soften the blow of hard-hit investors.

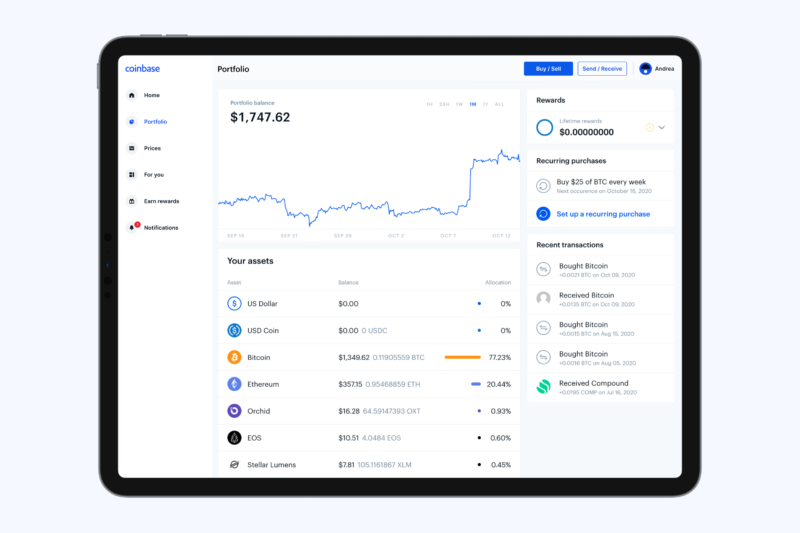

Coinbase Stock Slips

Coinbase Global, a popular crypto trading platform, dropped 3.8% in pre-market trading Wednesday. The drop in stock price was precipitated by Atlantic Equities analyst Simon Clinch downgrading the cryptocurrency exchange company to Neutral from Overweight on concerns over its ability to attract talent in the longer term.

Clinch also expressed concerns over the spread of misinformation about the company’s financial strength and assets.

“Our hopes for some stabilization in crypto prices and volumes have been dashed, with both tracking much weaker than expected,” Clinch wrote in a note to clients.

Voyager Files for Bankruptcy

After pausing all trading, deposits, and withdrawals on its platforms last week, crypto lending company Voyager Digital has filed for chapter 11 bankruptcy. The announcement was made late Tuesday, and in a statement, Voyager admitted to having liabilities in the range of $1-10 billion.

Voyager is the second firm to petition for bankruptcy after the recent crypto meltdown, with prominent hedge fund Three Arrows Capital, filing for chapter 15 Friday.

Three Arrows Capital defaulted on a loan to Voyager last week, showing the domino effect playing out in the industry.

Brutal Crypto Market Consolidation

This news is republished from another source. You can check the original article here