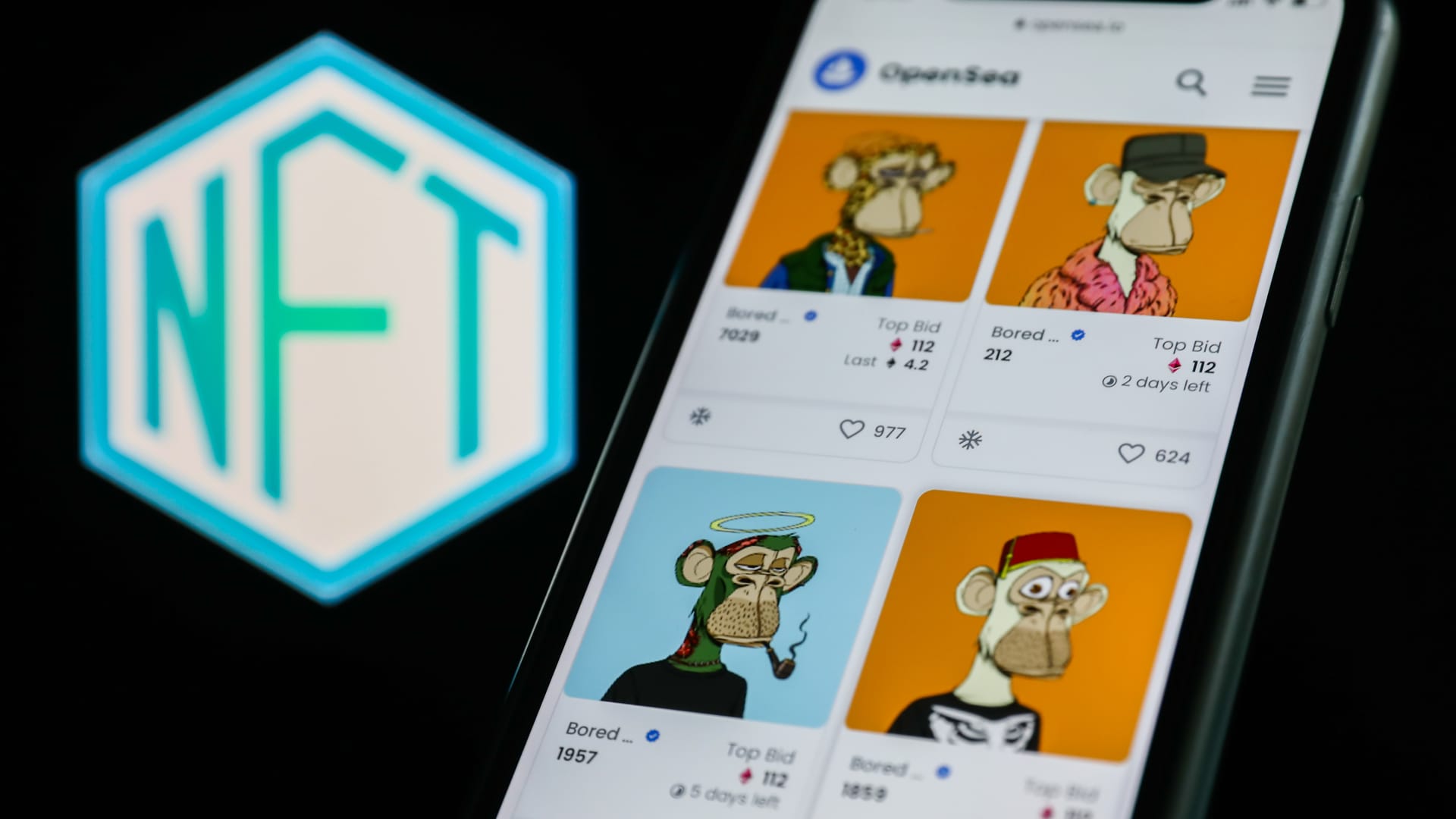

The Bored Ape NFT collection has garnered a cult-like following since its inception in April 2021.

Jakub Porzycki | Nurphoto | Getty Images

Elon Musk on Wednesday changed his profile picture on Twitter to an image featuring various avatars from the Bored Ape non-fungible token collection, sending the price of the project’s digital token soaring.

ApeCoin, the token launched by Bored Ape creators Yuga Labs, surged 19% in an hour at around 8 a.m. ET to a daily high of $17.64 following Musk’s profile picture change, according to Coinbase data. It’s since pared back its gains and was last trading at about $15.43.

It’s not clear whether Musk actually bought a Bored Ape NFT. The billionaire liked a tweet from Michael Bouhanna, an executive at auction house Sotheby’s, who said the image was “created for our Sotheby’s sale.”

“Happy to send you the original file minted with the buyer approval,” Bouhanna wrote in the tweet.

It suggests Musk may have merely right clicked and saved the picture to make it his profile image. Twitter has a dedicated feature that allows users to set their NFT as a hexagonal display picture, but Musk’s avatar is just a standard profile image.

NFTs are meant to authenticate ownership of everything from digital art to sports memorabilia on the blockchain. But they’ve attracted ridicule from skeptics, given it’s easy to continue replicating and distributing the associated content online without buying a token.

Musk — who recently agreed a deal to buy Twitter for $44 billion — appeared to poke fun at NFTs in a follow-up tweet.

“I dunno … seems kinda fungible,” the Tesla and SpaceX boss posted.

NFTs are designed to not be fungible — in other words, they can’t be exchanged interchangeably.

It’s not the first time Musk’s activity on Twitter has led to wild movements in asset prices. Numerous tweets by the Tesla and SpaceX boss have caused the price of bitcoin and dogecoin — a “meme” cryptocurrency favored by Musk — to rise or fall dramatically.

The Bored Ape NFT collection has garnered a cult-like following since its inception a year ago, with everyone from diehard crypto investors to celebrities like Jimmy Fallon buying up the buzzy ape icons.

This weekend, Yuga Labs minted a collection of deeds to virtual land in an upcoming “metaverse” game called Otherside. Demand for the NFTs, known as Otherdeeds, was so high that it clogged up the Ethereum blockchain, which underpins the world’s second-biggest cryptocurrency.

That caused Ethereum’s “gas fees” — costs required to approve transactions — to skyrocket. Some users reported having to pay fees in excess of $4,000. Yuga Labs subsequently apologized over the debacle, and said it would refund users gas fees for any failed transactions.

“We’re sorry for turning off the lights on Ethereum for a while,” the company tweeted Saturday. “It seems abundantly clear that ApeCoin will need to migrate to its own chain in order to properly scale.”

In a further tweet Sunday, Yuga Labs said it was “still working on refunding all Otherdeed minters with failed transactions their gas.”

Despite the brief boost Wednesday, the ApeCoin token has fallen roughly 17% in the past week. With a market value of $4.4 billion, it ranks among the top 40 digital currencies on CoinGecko.

This news is republished from another source. You can check the original article here