A couple of weeks ago, a friend of mine asked me about my opinion on IOTA, its usability, and future prospects. I would like to share my thoughts about IOTA on Seeking Alpha, I am always open for feedback and willing to discuss about the things I say in my article.

Source: tangleblog.com

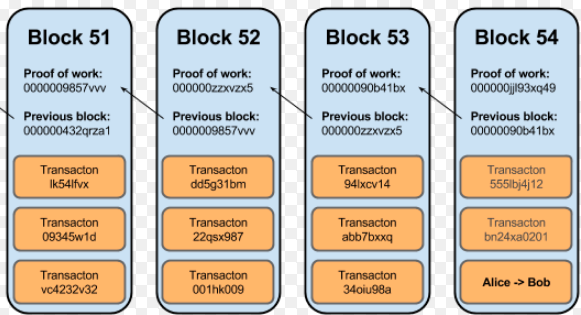

To understand the benefits of IOTAs “tangle” against the blockchain, we have to get some facts about the blockchain. As an example, we will use Bitcoins blockchain and its classical proof-of-work system.

Source: Deep Web Sites Links

In the Bitcoin-blockchain, we can and now have to distinguish between miners and issuer of transactions. The transaction process is the following:

- The issuer of a new transaction digitally signs a hash of the previous transaction, includes the amount that ought to be sent, and the public key of the next owner and adds them to the end of the coin.

- Issuer publishes the transaction to all nodes in the network

- Each node will accumulate transactions and put them into a block

- The nodes are working on finding a solution for a puzzle, “proofing their work”

- If a solution is found the node which found it will broadcast to all other nodes

- If the solution is accepted, the block is added to the chain

These are roughly the steps a transaction on the bitcoin network has to go through to be part of the blockchain and therefore accepted, but even after these steps, it is recommended (or was since the 6-block-rule is from the very beginning) to wait until 6 blocks are added to the block where the transaction has been issued. The network matured to a point where for small transactions a depth of one block is enough. All in all from issuing the transaction until final verification it takes up to 20 min (not counting in that nodes prefer transactions with a fee applied to it).

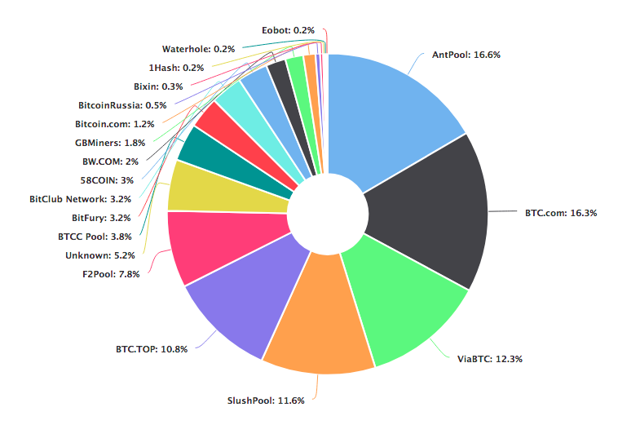

Now, a quick glance about how decentralized the bitcoin network is.

Source: Bitcoin Block Explorer – Blockchain

On the graph, we can see that the biggest 5 mining pools hold more than 50% of the total mining power, giving them some kind of authority over accepting updates in the code (which has been an issue in the past), therefore, they have the power to impede hardforks that could be in favor of the community.

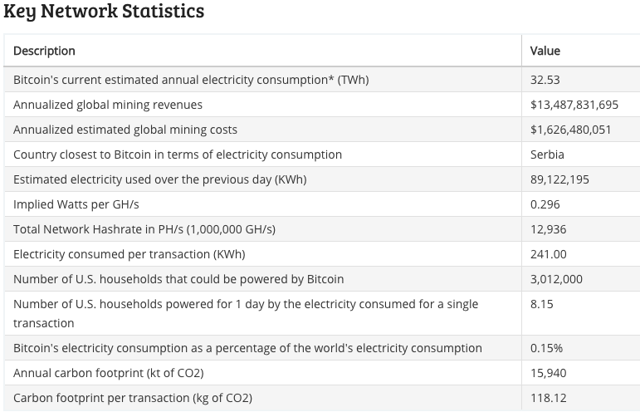

Next, we take a look at the energy consumption.

Source: digiconomist.net

Electricity consumed per transaction is 241 KWh. If we take the average US price for one KWh (approx 10 cents), we get approximately $24 energy consumption per transaction. I am well aware that the mining pools are based in area with low energy costs, therefore, making my number a very high approximation.

Higher Bitcoin values attract more people that will add their calculation power to the network, therefore increasing competition in order to receive the reward. The bitcoin protocol will determine the moving average of blocks per hour and increase the difficulty of solving the puzzle to keep the pace at 6 blocks per hour.

We get this rule out of the protocol:

- The more computing power the network provides, the more difficult the mining will become

These are the main facts about the blockchain Proof-of-Work-protocol that I want you to keep in mind when we start talking about IOTA.

- Split the network between miners and transaction issuers

- Transactions need at least 1 block depth to be verified (10-20 mins)

- Blockchain is a linear transaction proofing system, where each block is consecutively added to the next one

- Micro-Payments are economically not feasible due to energy consumption and fees

- The bigger the network becomes the more difficult the hash puzzle becomes

- Majority of computing power are held by 5 mining pools

There are more points about the Bitcoin protocol current state, future prospects, its economical and ecological value that can be discussed. For this article, I will keep to the points stated above.

So what makes IOTA’s tangle beneficial to the classical bitcoin blockchain, and what are its disadvantages?

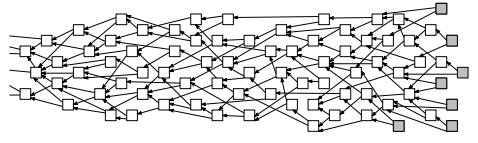

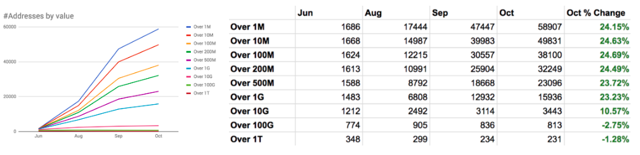

IOTA is not relying on a blockchain anymore. Its innovation is called “tangle”. It is a tree-root system, starting with the genesis payments and growing into more and more branches that are interconnected. Let’s call it tangle.

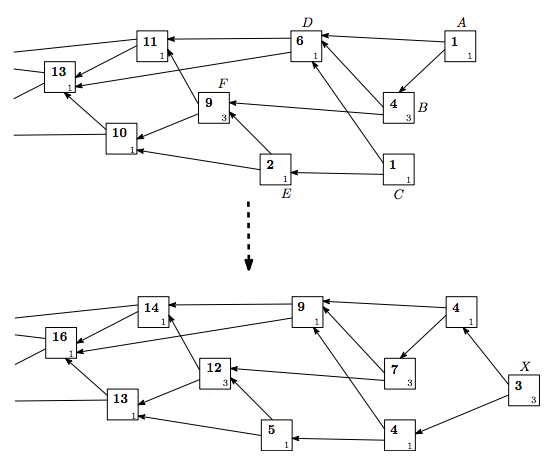

Source: IOTA-Whitepaper

The main point is: “Every new transaction must approve two other transactions.“

Resulting that the network consists of only one kind of participant that has to provide computing power to the network in order to issue transactions. All tokens have been premined, and there will be no new tokens issued, which will be an interesting analysis point in regard of the monetary system build on IOTA (More details in the financial outlook)! In order to use the tangle, the user doesn’t necessarily have to own IOTA tokens. Empty transactions are possible on the tangle. The only “payment” the network expects is the verification of two transactions and the proof of work. After the issuer of a transaction has approved good transactions or disapproved conflicting transactions (transactions that are in conflict with tangle history), it will become a tip that is waiting to be approved by the next issuer of a transaction. Double-spending or in general conflicting transactions (IOTAs team introduced the “parasite chain”- as well as the “splitting”-attack) are prevented by a weight system (seen in the figure below) with which every transaction is valued, a tip selection algorithm (Markov Chain Monte Carlo (MCMC) algorithms) and a “sharp-threshold” rule. In contrast to the blockchain where double-spending is prevented by only using the transaction with the earliest time-stamp, the tangle doesn’t have a linear system, and synchronization between nodes doesn’t have to be up to date at any moment. The tangle accepts that conflicting transaction may be present but will be orphaned when the correct transactions get more approval (IOTA-Whitepaper, page 3, last paragraph). I refer to the IOTA-Whitepaper for further explanations on these prevention systems, since statistical models are used to proof the reliability, which would exceed the scope of this article. IOTA is still in a very early phase and only recently reached a big scale to test its tangle. Problems may occur with its new protocol of which it is or was not aware, as researchers from the MIT and BU uncovered and published in their report.

Source: IOTA-whitepaper, in this figure, we see the weight system which is applied on the tangle (time increases from right to left). New tips are attached on the right side with their own weight (the small number on the bottom right) and the cumulative weight (top left corner of the boxes)

IOTA offers a full node wallet and a light wallet. The difference between those is that the full node wallet downloads the full tangle or a snapshot of the tangle, synchronizes with it, and it is completely independently participating in the network. IOTA’s developer introduced the snapshot system in order to reduce the size of the tangle downloaded by its full node participants. There are some fixed-full nodes that will always keep the full tangle on its disk. The light wallet will connect to a full node and get status updates about available tips on which it has to run the tip selection algorithm. Even if running a light wallet a majority of the work, the proof of work as well as the signing will be done locally on the light wallet, independently from the full node. So yes, even on the light wallet, the proof of work is done before broadcasting the transaction to the network through the full node. The difficulty for IOTA’s proof of work, in contrast to the blockchain, will not increase. Since there is no mining, no competition for a reward per block and no blocks, the proof of work algorithm is not designed to need more computing power with an increasing network. Therefore, the “tangle” is said to be infinitely scalable since the amount of work that has to be done in order to send a transaction will always stay the same.

Let us summarize the facts about IOTA:

- Everyone who issues a transaction has to verify two randomly chosen transactions

- The issuer has to do some proof of work to verify its transaction and be accepted by the network

- The new transaction is now a new tip that is waiting to be verified by a new incoming transaction

- Proof-of-Work difficulty remains always the same, no monetary incentive to run a full node and no fees applied to transactions. Resulting that micro-payments are possible.

- Infinite scalability*, network speed is directly proportional to number of users

*has yet to be proven

One question that appeared is about the incentive to run a full node, which requires a certain amount of computing power, a strong internet connection that should be online and update the tangle continuously. While the benefits of a full node are its direct access to the whole tangle, which could be beneficial in some regard, low latency, and independency. Merchants that are running a full node can decide with how much probability they accept a transaction. One has to weigh the costs that he or she is paying to run the full node to the benefits that can be earned.

I personally would split the network in the first instance into a “payment system” and a “data system”.

The payment system includes people who would use the network to transfer funds to each other. I would further split the payment system into merchants and customers. Customers are the most infrequent (in regard of their connectivity) users of the network, therefore mainly using the light wallet. The merchant on the other hand can use the benefits of running the full node in order to check and verify the transaction of their customers, working with low latency and get a full overview of the customers’ tangle history at the same time.

The data system would include the machine-to-machine payment system and the sensor-data market. With the machine-to-machine payment system, renewable power system could more easily interact with each other, computational power can be rented by machines, or services between systems could be bought with micro-payments. The scope of this market has yet to be found, and the imagination of innovators and entrepreneurs is necessary to do so. The sensor-data market is a big summary of what is meant. A lot of companies nowadays rely on unmodified and verified data. The tangle is a way to grant those companies trustworthy and reliable data from all over the world in exchange for a payment. We can further split this market into the machine system and the human system, where machines will automatically send their data in exchange for those micro-payments and humans who will set up special sensors to collect data and sell them on the market. Full node and light wallet distribution will be allocated the same way as in the merchant and payee system mentioned above. Companies who want access to those data will logically deploy the full nodes to take advantage of the benefits and most of the data-sellers will deploy the light wallets.

These are just some, more or less widely discussed, possibilities to use the IOTA network.

Investing into IOTA

An estimate about the size of the IoT market is hard to make. While doing some research, I found a variety of estimates, and I decided not to include any of them in my article. Here, I would also like to talk about the current discussion that the crypto-market is currently in a bubble or not. I will keep it to the individual investor deciding if it is a bubble or not, but I want to highlight lessons learned from the dot.com bubble. The value of many internet-related companies increased drastically in the internet bubble. After the bubble bursted, a lot of the dump companies that used the hype in order to make money vanished, but some of the well chosen companies have recovered (Microsoft (MSFT) and Nvidia (NVDA)), and others that still haven’t recovered (Cisco (CSCO) and Intel (INTC)) are still there and working well and could be worth an investment.

Choosing the right company that someone believes in, with good future prospects may endure a bubble-burst and recover afterwards if the fundamentals are tested and the technology is well worth it. Further, taking advantage of the dollar-averaging effect is a way to hedge the downside risk in times of market overvaluation.

Source: Coinmarketcap.com

IOTA’s current market cap is $12 billion and 1MIOTA (MIOTA = 1 Million IOTA), at time of writing, is worth $4.38.

Even though there are some news about partnerships with Microsoft, Fujitsu (OTCPK:FJTSY), Cisco (CSCO) and other companies, those news are not correct. There are no official statements from any of these companies stating an official partnership with IOTA. Most of these companies and IOTA are members of the Trusted IoT Alliance, which is by now the only connection between IOTA and those companies. As soon as official partnerships are announced and new investments into IOTA will be declared, a redistribution of IOTA tokens will begin, having major influence on the price. As stated before, all tokens have been mined and at the beginning only a few addresses contained the majority of tokens. It is interesting to follow the distribution of tokens, because one of the main conflict points of anyone reading this may be that the developers of IOTA make a big profit on their IOTA tokens selling them on the market. The market is trading with a fraction of available tokens and distributing all tokens once may seem illogical adding high amount of liquidity and devaluing the token.

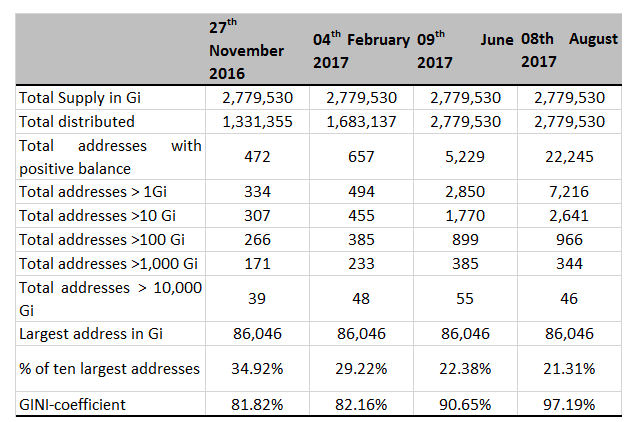

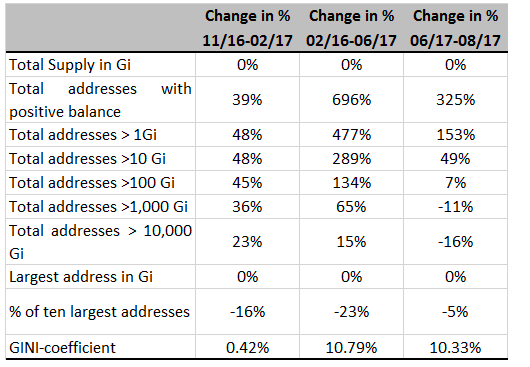

I would like to refer to two authors at “medium.com”, who analyzed the token distribution over a bigger time frame. The first table covers the token distribution from November 2016 until August 2017. The second table contains the changes in number of addresses and the third table contains the token distribution beginning in June 2017 until October 2017.

Source: Medium.com, by Ingo Fiedler

Source: Medium.com, by Ingo Fiedler

Source: Medium.com, by Roman Semko

I cannot make any assumptions about the intention of the owners in regard of token distribution. Therefore, I will leave conclusions to the individual investor and future statements of IOTA’s team.

Conclusion:

IOTA is still an early-stage project looking for official partnerships with big technology companies in order to test the tangle on a big scale with real world applications. The tangle offers high scalability, no fee transactions, empty transactions, and machine-to-machine transaction availability. IOTA’s developer team has to process the first round of feedback and improve the system for further real world applications. The token distribution remains questionable, requiring the public paying deep attention to. The tip selection algorithm, which can be chosen to be used or not used by the full node, remains part of an open discussion as the full node provider could use its own tip selection, preferring transactions with a fee applied to them that could lead to network discrimination.

I am personally very excited about the tangle and therefore seeing it as an investment opportunity which I keep a close eye on.

The investor should always do his or her own research and be well aware of the risk investing in high volatility securities especially in the crypto-market and new technologies with no direct liability attached to them from the company offering those.

This news is republished from another source. You can check the original article here