The always-volatile cryptocurrency markets have defied some analysts’ expectations since the start of the year, falling when they had been expected to rise and rebounding when they were anticipated to drop further.

Bitcoin (BTC) has ranged between $33,000 and $48,000 so far in 2022, with ether (ETH) also trading in a wide range of $2,100-$3,900.

Given the volatility, it is difficult to predict the direction the digital currency markets will take in the future. But looking at the top-performing cryptocurrencies year-to-date could be a starting point for your research.

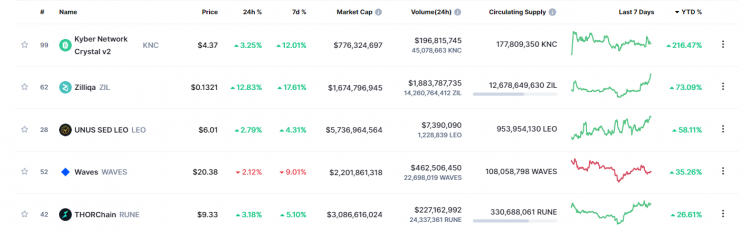

This article looks at the top five cryptocurrencies ranked by highest return so far in 2022, according to data from CoinMarketCap.

Best cryptocurrency to watch in spring

If you’re wondering what cryptocurrency to invest in, the top five tokens by market capitalisation have gained attention thanks to protocol upgrades and macro events that are driving investors toward certain types of cryptos. Here are the cryptocurrencies whose prices have increased the most so far in 2022 (as of 21 April).

Source: CoinMarketCap.com

Source: CoinMarketCap.comBut before we dive into the list, it is crucial to keep in mind that past performance is no guarantee of future returns. The best performing cryptocurrencies in the past might not be the best to invest in today.

When looking for a cryptocurrency to invest in, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision.

Top 5 cryptocurrencies to watch

1. Kyber Network Crystal v2 (KNC)

Kyber Network is a trading and liquidity hub that runs across blockchains to source the best rates from multiple liquidity protocols. Kyber is being used to provide liquidity for decentralised finance (DeFi) applications on chains including Ethereum, Polygon, Binance Smart Chain (BSC), Avalanche and Fantom.

Kyber Network Crystal (KNC) is the protocol’s utility and governance token, based on Ethereum’s ERC-20 standard. KNC is the top-performing cryptocurrency so far this year, rallying by 215% at the time of writing on 21 April to a market capitalisation of $773.7m and ranking as the 99th largest coin.

KNC holders can stake their tokens to vote on development proposals and receive a share of the network’s trading fees. The more liquidity protocols are added to the network and the more trades are processed, the more rewards token holders receive.

The KNC price bucked the downtrend across the crypto markets, gaining value in January as the network upgraded to Kyber 3.0 and its Dynamic Market Maker (DMM) protocol was rebranded as KyberSwap. Kyber Network now operates across 10 blockchains and has integrated with UniSwap v3, as well as participating in Avalanche’s developer incentive.

2. Zilliqa (ZIL)

Zilliqa claims to be the world’s first sharding-based blockchain, as it uses shards, or packets of data, to increase throughput and process a high number of transactions per second. This aims to address the scalability challenges that large blockchains are experiencing as they grow. Ethereum is introducing sharding as part of its major Ethereum 2.0 upgrade.

Zilliqa was launched in 2017 and its development team created Scilla, a peer-reviewed programming language designed to guarantee the safety of the blockchain’s smart contracts.

ZIL is the native token, enabling users to engage with each decentralised application (dApp) on the blockchain, pay for goods and services, trade non-fungible tokens (NFTs) and more. ZIL supply is capped at 21 million tokens and was designed to mine around 80% of its maximum circulation in its first four years, with the remaining 20% mined over a longer period of six years because of a declining block reward. There are currently 12.68 billion ZIL in circulation, according to data from CoinMarketCap.

ZIL has been a top 5 crypto to hold so far this year, gaining 73% at the time of writing. It had a market cap of $1.7bn, making it the 62nd most valuable cryptocurrency.

3. Unus sed leo (LEO)

Named after a Latin citation from one of Aesop’s fables, LEO is a utility token that was launched in 2019 by iFinex, which runs the Bitfinex cryptocurrency exchange. The token is a way for the exchange to return funds to investors after it was hacked in 2016 and funds from payment processor Crypto Capital were seized by the Polish, US and Portuguese government authorities in 2018.

Bitfinex created $1bn in LEO tokens to cover the shortfall in funds with $1bn in the Tether stablecoin (USDT). The token was designed with a buyback and burn programme, under which iFinex will gradually buy LEO back from the market until there is no circulating supply left. In the meantime, LEO token holders can use it to receive discounted transaction and borrowing fees on the Bitfinex exchange.

What is your sentiment on KNC/USD?

Vote to see Traders sentiment!

The LEO token has been moving up in value this year as the high volatility in cryptocurrency prices has pushed more cautious investors towards buying exchange coins. The LEO price had gained 58% year-to-date at the time of writing and had a market cap of $5.7bn, making it the 28th largest cryptocurrency.

4. Waves (WAVES)

Waves was among the earliest alternatives to bitcoin (altcoins) that launched after Ethereum in 2015. Waves held its initial coin offering (ICO) in 2016 and is focused on developing smart contract infrastructure for dApps.

Waves has recently become a trending cryptocurrency as it was founded by Sasha Ivanov, a scientist from Ukraine. The coin price spiked to an all-time high of $62.36 on 31 March, a gain of over 328% since the start of the year. The rally began after the Russian invasion of Ukraine, with the token trading around $9 on 24 February.

Cryptocurrency traders have sought to support projects with connections to Ukraine, and cryptocurrency usage has been growing in both Ukraine and Russia as users have moved their money out of the traditional banking system. The price has since retreated from the high but remained up by 35.5% year-to-date at the time of writing.

5. THORChain (RUNE)

THORChain is a decentralised, cross-chain liquidity protocol that allows users to transfer tokens across blockchains and earn yields on its decentralised exchange (DEX).

The price for THORChain’s native RUNE cryptocurrency was in a downward trend for the first two months of the year. But it has turned higher in March after the developers launched several updates.

On 9 March, THORChain launched THORSynths on the network, which are synthetic derivatives of other cryptocurrencies, to facilitate faster transactions while reducing fees.

Analysis by Delphi Digital shows that “since the beginning of March, THORChain has experienced a surge in activity”, with volume and total value locked (TVL) reaching new all-time highs. The analysis pointed to “three recent milestones which have laid the foundation for THORChain’s recent traction. Namely, they are: the activation of THORSynths, an integration with Terra, and the removal of liquidity caps”.

THORChain completed its first hard fork upgrade, or split, on 22 March, ahead of the launch of new features announced on 6 March, including support for more chains such as Terra and THORfi decentralised finance.

The RUNE crypto price slid in January but gains seen since the updates have lifted the token to a profitable 26% year-to-date hike.

When looking for what crypto to buy now, you should keep in mind that cryptocurrency prices are highly volatile and difficult to predict accurately. Past performance is never a guarantee of future returns. If you are considering investing in crypto, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. And never invest money you cannot afford to lose.

FAQs

This news is republished from another source. You can check the original article here