Regulated crypto investment products saw outflows of close to USD 100m last week, as capital continued to leave funds backed by both bitcoin (BTC) and ethereum (ETH) in droves. The outflows were partly explained by tax-related selling in the US, while one analyst said the macro landscape for crypto has now improved.

“The outflows represent the second week in what we believe is likely a result of recent profit-taking and a reaction to the more hawkish [Federal Open Market Committee, FOMC] statement,” CoinShares said. According to them, the prior week to last week saw outflows primarily from the US, while last week most of the outflows were from Europe (88%) in what might be a delayed reaction to the FOMC statement.

Also, per the analysts, investors look to have sold out of short-bitcoin investment products, following a few weeks of inflows.

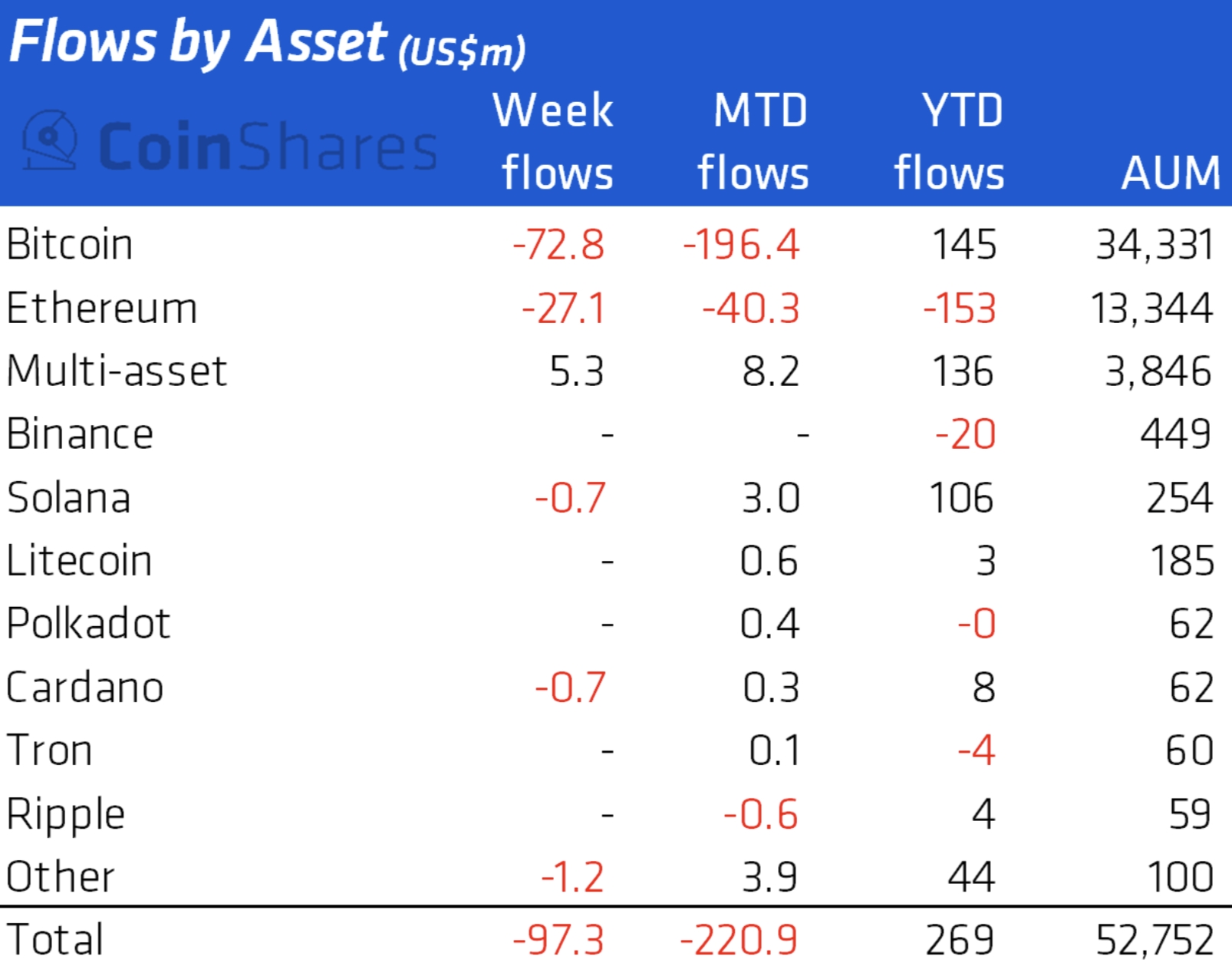

Meanwhile, over the course of last week, funds backed by ETH saw their outflows accelerate to USD 27m, up from USD 15.3m the week before, according to new data from the crypto research and investment firm CoinShares.

On the more positive side, however, BTC-backed funds saw outflows decrease compared to the week before. From seeing outflows of USD 132m two weeks ago, BTC funds last week saw USD 73m leave.

The only crypto fund category that saw inflows last week were multi-asset funds, which had USD 5.3m added to them, CoinShares’ data showed.

So far this year, outflows from BTC-backed funds stand at USD 196m.

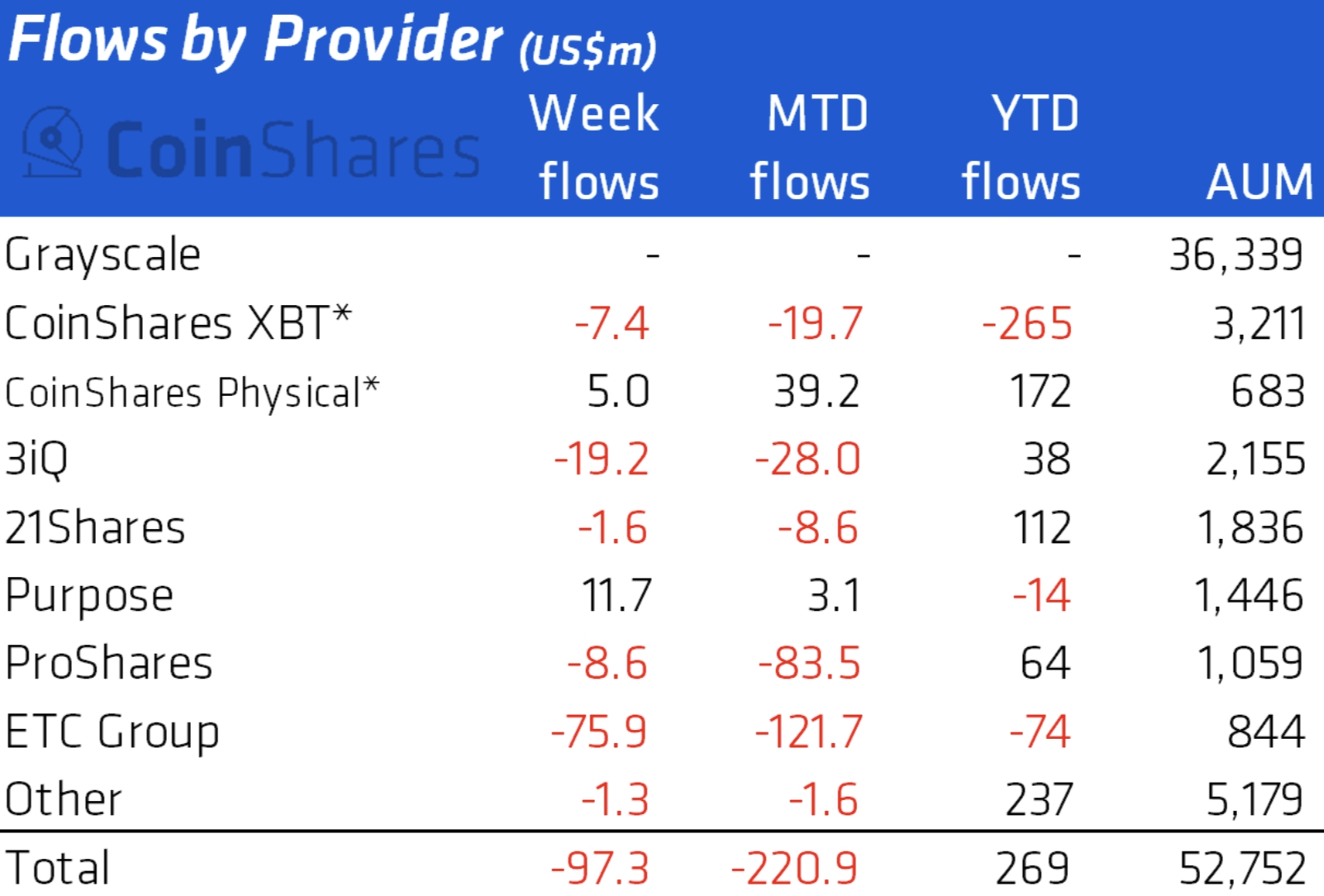

The fund provider with the largest outflows last week was ETC Group, which lost USD 75.9m. Meanwhile, Purpose had the largest inflows among the providers tracked with USD 11.7m added.

The outflows from crypto-backed investment funds are interesting given the current macroeconomic environment, which has experts divided on the medium-term outlook for the crypto market.

Commenting on the state of the market earlier on Tuesday, Marcus Sotiriou, an analyst at crypto broker GlobalBlock, said the macro backdrop is now “looking positive in my opinion.” What matters most is not how much the US Federal Reserve will raise interest rates next, but “how strong the consumer is,” said Sotiriou.

“Despite many funds and economists predicting a recession, the facts suggest we may have a soft landing. Therefore, I think the short term is bullish for Bitcoin and equities, even if there is a 50-basis point rate hike or not,” the analyst said in an emailed comment.

Meanwhile, crypto financial service provider Babel Finance said in its latest report that sentiment among short-sellers in the market has strengthened. This is evident from the 7-day average funding rate for perpetual futures contracts, which hit a new short-term low over the past week, the firm said.

It added that the month of April is also tax season in the US, with many investors having to file their taxes by April 18. This is known to cause some selling in the market, as traders sell crypto to pay taxes they owe.

As of 12:43 UTC on Tuesday, BTC was up 4% for the past 24 hours and almost 4% for the past 7 days, trading at USD 40,957. At the same time, ETH was up by 4% for the day and over 2% for the week to a price of USD 3,063.

____

Learn more:

– Global Economy Outlook Cut Again

– ‘Challenges’ to Crypto Traders as Lower Volatility Expected; Solana Derivatives Wanted

– Get ‘Mentally Ready’ for Lower Bitcoin Prices as Rates Rise, Bitcoin 2022 Panelists Warn

– Game Theory of Bitcoin Adoption by Nation-States

– Once the Fed Pauses, Bitcoin is ‘Going to the Moon,’ Novogratz Says

– Crypto Bottom is In and ‘Massive Rally’ Awaits, Pantera Capital Predicts

This news is republished from another source. You can check the original article here