salarko/iStock Editorial via Getty Images

This article originally appeared in Try Technically Crypto.

Overview

Polkadot (DOT-USD) is one of the most interesting projects in the blockchain space at the moment. This “blockchain of blockchains” promises to create a secure and scalable ecosystem where multiple “parachains” can interact with each other through a “central relay chain”.

The beauty of this approach is that one can create a highly specialised blockchain for particular use cases, but allow these to be part of an environment where they can easily interact with each other, and all benefit from a common security protocol.

Polkadot was founded in 2017 by Ethereum co-founder and CTO Gavin Wood. Polkadot has not been fully released yet and is currently only a handful of projects on its blockchain, but many more are testing out Polkadot through its cousin blockchain, Kusama.

Technology

The first thing we must understand about Polkadot is how this ecosystem with multiple chains works.

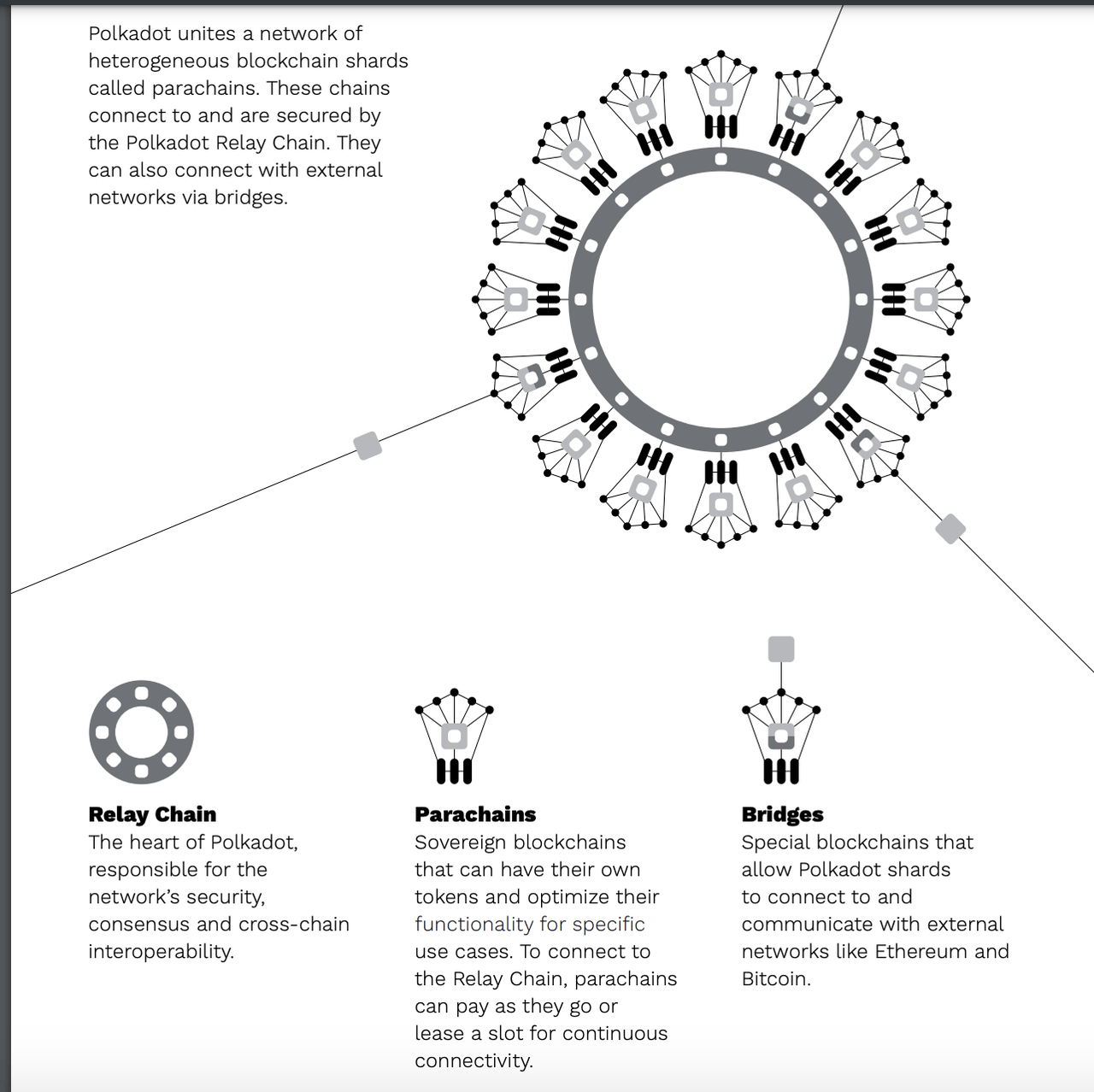

Polkadot Lightpaper

At the centre of the system, we have the relay chain, which is responsible for the security and connecting the parachains. Parachains can be launched by anyone who rents a “slot” on Polkadot’s ecosystem. Each parachain is like a “shard” of the original chain. Finally, we have bridges, which connect all the parachains.

In terms of operation and consensus mechanism, Polkadot uses nominated Proof-of-Stake. In this particular case, there are 4 different entities involved in the consensus mechanism. Validators, nominators, collators and fishermen.

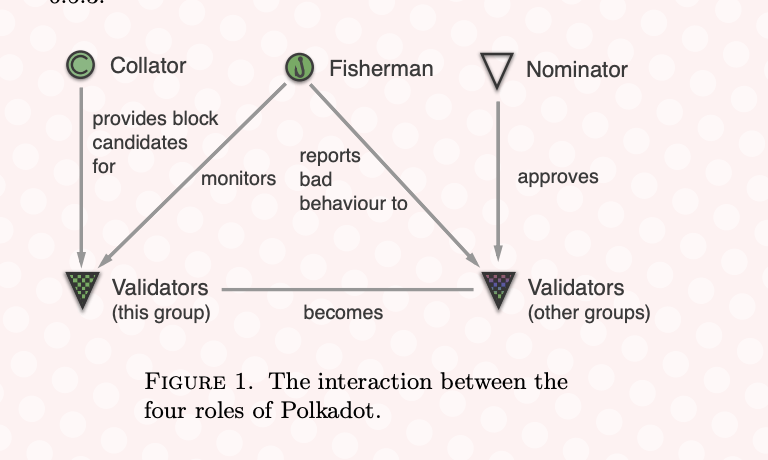

Polkadot Whitepaper

The chart above explains the process quite well. First off, we have validators, who validate blocks through the usual PoS system. However, we also have nominators, who can give their capital, in this case, DOT, to what they consider to be trustworthy validators. Nominators, like validators, are staking DOT. Collators act as the miners/validators for parachains. They submit parachain blocks to validators and receive rewards in the form of transaction fees. Lastly, we have fishermen, who are independent “bounty hunters” that get rewarded for reporting bad behaviour. Collators and any parachain full nodes can perform the fisherman role.

The objective of this system is to combine the security of a large and robust blockchain backed by numerous validators and a large amount of staked DOT, but also give parachains the flexibility to operate independently, therefore reducing costs and other inefficiencies.

The main advantages of Polkadot are indeed security and scalability. Consensus mechanisms work best with a large number of validators and an underlying coin that has a large value. Everyone knows that altcoins with small market caps and fewer miners/validators are much more susceptible to attack. In the end, a system with thousands of different blockchains won’t be feasible. Polkadot addresses this issue through shared security.

When a parachain connects to Polkadot, the Relay Chain validator set to become the securers of that parachain’s state transitions. The parachain will only have the overhead of needing to run a few collator nodes to keep the validators informed with the latest state transitions and proofs/witness. Validators will then check these for the parachains to which they are assigned. In this way, new parachains instantly benefit from the overall security of Polkadot even if they have just been launched.

Source: Polkadot Wiki

The level of security won’t be affected by more parachains being added to the network. The important variable here is the number of DOT staked through honest validators.

Polkadot’s parachains also solve scalability issues by allowing transactions to run on separate parachains. Polkadot can already carry out 1000 tps and aims to be able to do 1 million tps in the future.

Tokenomics

There are three uses for Polkadot’s native currency, DOT: Governance, Staking and Bonding.

Everything in Polkadot is decided on-chain, and owning DOT gives you voting rights. Staking is key to ensuring the security and proper functioning of the network, and it provides monetary rewards. Finally, DOTs are necessary for bonding.

Bonding is the process by which parachains become part of the Polkadot ecosystem. To use Polkadot, projects have to bid, DOT, for a parachain slot in an auction. The winner of the auction has his DOT “bonded” for the duration of the lease. The bonded DOT can’t be used for anything else at this point. The DOTs are released after the lease, so the only real cost involved here is the opportunity cost. Also, there is a crowdfunding element to this process. DOT holders can lend their currency to different projects, in return for anything really, though most likely an amount of the native token of the project.

For now, Polkadot plans to have 100 parachains, though hypothetically the amount could be unlimited.

DOT is also used to pay for fees on the relay chain. There are no DOT fees within separate parachains, but to connect to Polkadot’s relay chain, parachains do have to pay fees in DOT. Fees are calculated based on “weight”, “length”, and an optional “tip”. Fees on Polkadot are subject to change as frequently as every 24 hours since fees are adjusted based on how “full” the previous block was.

Lastly, let’s talk about inflation. DOT has no theoretical supply limit at the moment, and inflation could vary depending on the amount of DOT being staked. On the other hand, DOT is removed from circulation through bonding and fees. The inflation rate for Polkadot is designed to stabilise at around 10%.

Polkadot TAM

As is mentioned in the whitepaper, Polkadot does not aim to be a currency itself, so we shouldn’t think of it like this. Rather, DOTs represent ownership of the Polkadot network and should be a reflection of the value it holds.

After all, Polkadot is the vehicle through which investors can get access to new projects, by crowdfunding them. It stands to reason, therefore, that the value of DOT will increase with the market capitalization and value locked of the projects it holds within it.

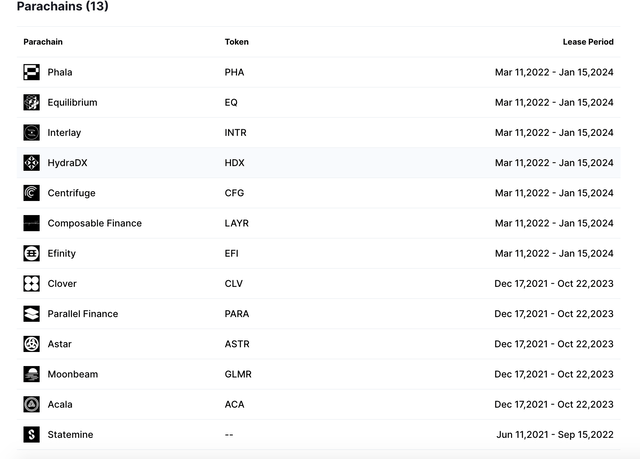

There are currently thirteen active projects on Polkadot:

Polkadot Parachains (Coinmarketcap)

Acala, Moonbeam, Clover, Astar and Parallel are some of the oldest. We also have Statemint, but this is a “generic asset parachain” that was proposed to act as a “common good” for other parachains.

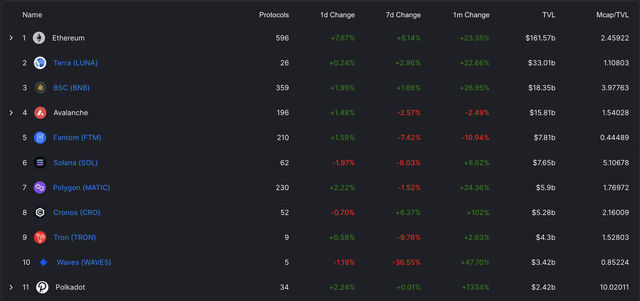

DeFi TVL (DefiLlama)

Polkadot is currently the 11th largest chain by value locked, with a TVL of $2.4 billion. It’s interesting to note that Polkadot has one of the highest market caps/TVL ratios. This is kind of like saying that Polkadot has a high P/E. On the one hand, one could say Polkadot is expensive, but it is also proof that investors believe there is a baked-in potential and are willing to pay this premium.

With that said, what could be a potential TVL for Polkadot in 5 years? One simplistic analysis would be that with 100 parachains, it could have at least 7 times more value. Probably considerably more, as these projects are fairly new. DeFi’s value has been growing rapidly over the last few years, and currently, there is $280 billion locked in the space. DeFi could easily more than double in the next 4 years.

And Polkadot is not limited to DeFi, it is multipurpose and could easily find a niche in the NFT market. Efinity is one example of a project on Polkadot that would allow for the interoperability of NFTs.

However, the price could be even higher, as it doesn’t necessarily follow fundamentals. Months ago, during the bull market, DOT had fewer parachains and less TVL and yet its token traded at much higher prices.

Is now a good time to buy Polkadot?

Polkadot is down over 50% from its ATH, and I expect this level to be broken, so I would recommend buying now.

From a fundamental perspective, Polkadot has technology and system that does well at addressing the blockchain trilemma. Security, scalability and decentralization can’t perfectly coexist. More centralized blockchains like Solana (SOL-USD) can be more scalable and fast, but also give up security in the process.

Polkadot, however, scores quite well on all these elements. The network is highly decentralized, with all governance made on-chain. The relay chain provides security to all other blockchains, but high levels of tps can also be achieved thanks due to the way parachains work.

Polkadot does have the ability to compete with the likes of Ethereum (ETH-USD), and this makes it crypto worth investing in. DOT also offers owners great staking rewards, and even the opportunity to participate in parachain crowdfunding, which is also something to take into account.

Lastly, it is worth mentioning that I do believe we are in an altcoin bull market, and this should also really help DOT’s price appreciate.

Other considerations

With that said, Polkadot is an ambitious project, which aims to compete head to head with Ethereum, and that’s a tall order. The appeal of Polkadot’s interchain connectivity works best if a lot of projects are built on Polkadot, but so far there is a limited number of these. It is still early days.

Meanwhile, Ethereum is a well-established blockchain, and it is taking steps in the right direction to become a more scalable and efficient blockchain. Plus, there are also many layer 2 solutions out there that enhance the appeal of Ethereum, like Polygon (MATIC-USD).

Also, Polkadot is reliant on a few projects, some of which haven’t performed so well in the last few months. Stafi, a DeFi protocol on Polkadot, lost 78% of its TVL from February to March.

Ultimately, given the nature of how Polkadot does things, which involves auctioning limited slots, growth could be much slower than in the “wild west” of the Ethereum blockchain.

Takeaway

All in all, Polkadot offers a smart and comprehensive solution to the crypto trilemma. Polkadot has one of, if not the best, balance of security, scalability and decentralization of any coin that I have reviewed, which makes it a strong buy.

This news is republished from another source. You can check the original article here