May 2021, Alex Mashinsky of Celsius Network—a lending protocol—speculated that Dogecoin (DOGE) will transition to proof-of-stake (PoS) within two years to make it more appealing. Fast-forward to last Christmas, and the Dogecoin Foundation published a proposal to do just that. Dubbed “Community Staking,” the proposal would make the cryptocurrency free from energy-intensive proof-of-work consensus.

Furthermore, Vitalik Buterin—the co-founder of Ethereum—made a Dogecoin remark on January 20 on the UpOnly podcast. For the first time, the crypto billionaire publicly noted that he is getting involved with Dogecoin to get things running. The question is, what do meme coin enthusiasts get out of it?

What Is the Current State of Dogecoin Compared to Alternatives?

Outside of being the most successful meme coin, Dogecoin doesn’t have much going for it. Even its founders, Billy Markus of IBM and Jackson Palmer of Adobe were surprised by DOGE’s success.

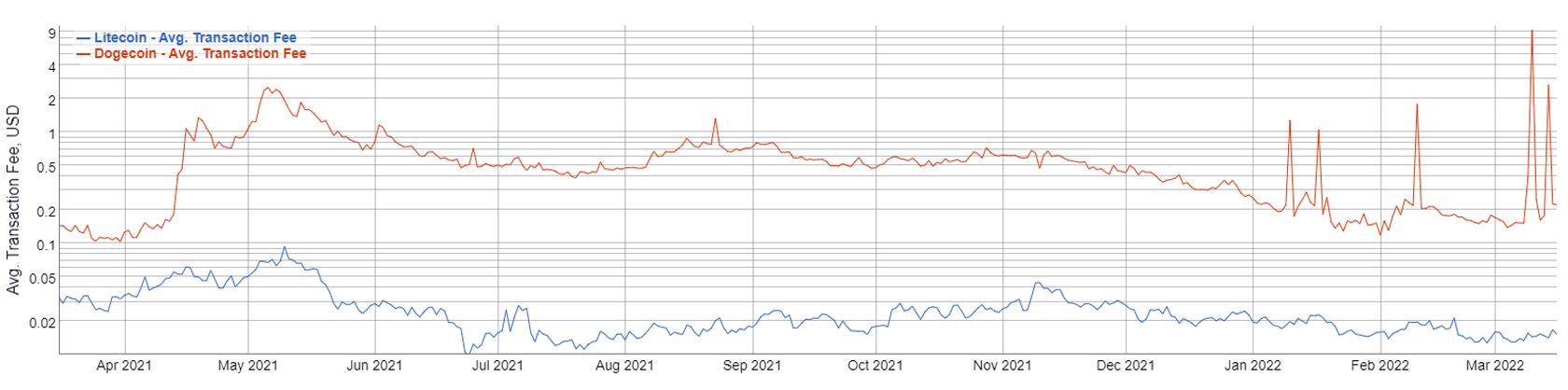

That’s because Dogecoin doesn’t do anything special that other altcoins don’t already do better. Case in point: Markus and Palmer effectively copy-pasted Litecoin’s code and tweaked it to make Dogecoin. However, Litecoin is better at being a daily transaction cryptocurrency because it has negligible transfer fees compared to Dogecoin.

As the chart shows, Litecoin doesn’t just have flatter transaction fees, but it is presently 91% cheaper to transact with than DOGE. A single transaction fee for DOGE is $0.223 vs. LTC’s $0.015. And this is just if we view DOGE as a cryptocurrency.

When we view it as a store of value like Bitcoin, it is even worse. While Litecoin, and many other altcoins, have a fixed maximum supply of coins that could ever exist, at 84 million, DOGE has an inflation mechanism coded in. It has over 132.6 billion coins, set for doubling in the next 20 years.

Because the Dogecoin network issues block rewards worth 10,000 DOGE, its inflation rate is substantial at 4.1%. That means that Dogecoin’s use has to outdo its inflation rate for it to appreciate in value. Otherwise, it sinks.

PoS Would Add Positive Eco-Sentiment to Dogecoin

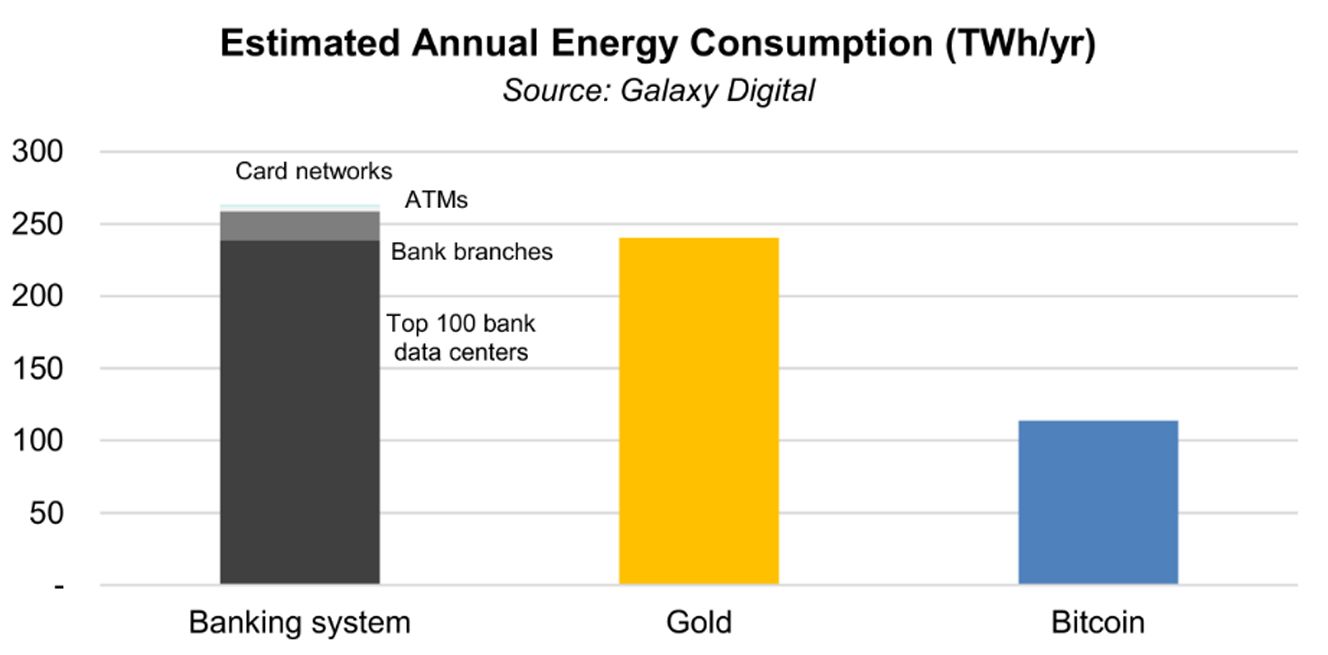

Now that all the negative aspects related to Dogecoin are listed, how would PoS make it better? The mainstream media loves to smear Bitcoin with the accusation that it is not eco-friendly. The Bitcoin network uses proof-of-work consensus mechanism to verify transactions and add new data blocks to the blockchain.

However, this mining process uses computational power that hogs electricity. Hence, why it is called proof-of-work, with expended electricity being that work. While the banking sector still uses over two times more electricity, the legacy media still loves to attack Bitcoin on that ground.

Now, because both Bitcoin and Dogecoin use such PoW consensus, this places Dogecoin in a bad spot. Bitcoin has a limited supply of 21 million, while the Dogecoins keep increasing. Moreover, Bitcoin now has a Lightning Network scalability solution to make its fees even lower than DOGE.

For these reasons, DOGE desperately needs any kind of edge that would make it viable beyond memeing. And that edge is proof-of-stake (PoS). Unlike PoW, PoS uses economic miners instead of electricity miners. The word “stake” tells us this.

Instead of using specialized ASIC mining machines, PoS-based cryptocurrencies use coin holders. The more money they have staked in, the more likely they will be picked by the consensus mechanism to verify a transaction and get a reward.

Therefore, the proof is in the stake, while Dogecoin’s current proof is in the energy expended. Although it is possible to mine DOGE with commercially common GPUs and CPUs, profitability is still much higher with proper ASIC mining hardware. By becoming PoS, the Dogecoin community would benefit because everyone would be able to stake their coins regardless of the hardware they have.

Can Dogecoin Become Viable?

At the time of writing, DOGE’s market cap sits at $17.1 billion, ranked 13th under Binance USD (BUSD). This is a remarkable feat considering it is a meme coin that was supposed to die off. Moreover, year-to-date, Dogecoin outperformed Bitcoin by 111%.

By the same token, it is clear that Dogecoin’s price move relies on social media engagement. Specifically, if the “Doge Father,” Elon Musk, will tweet something about it. As fundamentals go, this is not a solid one compared to Bitcoin—which was designed to replace central banking.

Is Dogecoin a Worthwhile Investment?

Even if Dogecoin transitions to PoS and exerts a lighter carbon footprint, it will still suffer from inflation. With so many other altcoins around with stronger fundamentals, we can then see that DOGE’s meme magic is eventually going to run out.

Lastly, Dogecoin’s developer activity is as minimal as it gets for a blockchain project. A serious investor would probably take a step back and consider alternative investments.

Read Next

About The Author

This news is republished from another source. You can check the original article here