Although traditional banks do not have the framework to accept digital currency deposits – there are a number of financial institutions that are crypto-friendly.

This means that you can buy and sell crypto without fear of having transactions reversed or worse – your account shut down.

In this guide, we compare the best crypto bank accounts to consider opening in 2022 – in terms of fees, eligibility, and core features.

The Best Crypto Banks for 2022 List

If you’re looking for a crypto banks list – check out the providers below.

- Revolut – Overall Best Crypto Bank (US-Friendly)

- Monzo – One of the Best Crypto-Friendly Banks in the UK (FSCS Protection)

- Nuri – Traditional and Crypto Banking Services for Europeans

- Coinbase – Regulated Crypto Exchange With FDIC Protection on USD Balances

- BankProv – Banking Services for Crypto Businesses

No two crypto bank account providers offer the same service, so it’s important to read out in-depth reviews before proceeding.

Aqru – A Better Alternative to Crypto Banks

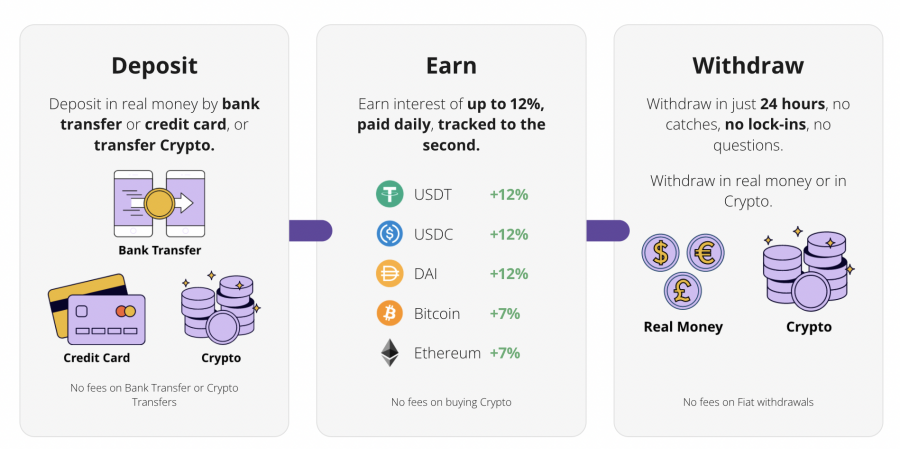

Before getting to our reviews of the best crypto banks for 2022 – our research team actually found a more viable alternative for those looking to access traditional financial services across both fiat money and digital currencies. And that alternative comes in the shape of Aqru.

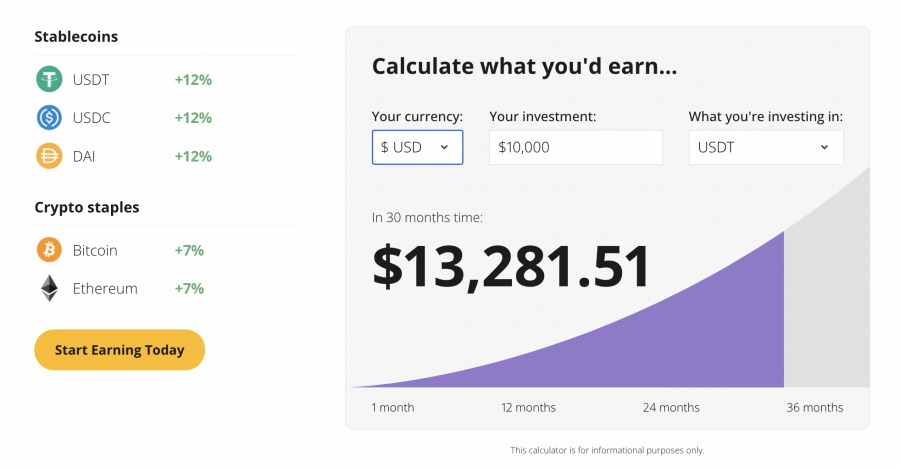

In a nutshell, Aqru offers an online platform and mobile app that allows you to earn interest on crypto deposits, making it one of the best crypto staking platforms out there.

Yields are very competitive, with Bitcoin and Ethereum attracting an APY of 7%. Stablecoins at Aqru pay an even higher rate of interest at 12% annually. Not only does Aqru offer industry-leading APYs on its crypto savings accounts, but there are no lock-up terms to meet.

And as such, this means that you have the freedom to withdraw your digital currencies at any given time – 24/7. We also like the fact that your interest is paid daily at Aqru and you can view your balance in real-time by simply logging into your account. Another stand-out feature of choosing Aqru is that you can also deposit fiat money via a bank transfer or debit/credit card.

Therefore, you have the freedom of funding your account with US dollars, pounds, or euros and then converting the money to a crypto interest plan. And, when electing to make a withdrawal, you can also cash out in fiat money should you wish. Aqru utilizes multi-sig technology via Fireblocks, alongside a multi-layered insurance policy to protect your account against hacking.

When it comes to fees, there are no deductions from the aforementioned APYs that you get from an Aqru crypto interest account. The only fee that does come into play is when you make a crypto withdrawal – which stands at a flat charge of $20. Fiat currency withdrawals can be made fee-free. Finally, Aqru is approved to offer crypto and fiat savings accounts by regulators in Lithuania.

Pros

- Earn 7% per year on Bitcoin and Ethereum

- Stablecoins yield 125 annually

- Regulated in Lithuania

- Supports fiat money deposits via bank transfer and debit/credit card

- Withdraw your balance at any time

- One of the best crypto lending platforms

Cons

- Limited number of crypto assets supported

Cryptoassets are a highly volatile unregulated investment product.

Top Crypto Banks Reviewed

In this section of our guide, we’ll compare the five best crypto bank accounts for 2022 through comprehensive reviews.

We cover a variety of core metrics when discussing our list of top crypto bank providers – such as eligibility, supported currencies and crypto assets, whether interest accounts are offered, fees, and safety.

1. Revolut – Overall Best Crypto Bank (US-Friendly)

We found that Revolut is the overall best crypto bank in the market right now. Founded in 2015, Revolut is now one of the most popular challenger banks globally – with the provider now home to over 18 million personal accounts. This digital-only bank operates via a mobile app that is fully optimized for both iOS and Android smartphones.

In terms of eligibility, Revolut is one of the few US-approved banks for crypto services. The bank also accepts customers from Europe, the UK, Australia, Singapore, Japan, and Switzerland. By opening an account with Revolut, you will be able to add funds in your local currency. You will also be able to send and receive funds just like you would with a traditional bank account.

Revolut is also great for cross-currency payments – as it offers industry-leading exchange rates. As a Revolut customer, you will also be offered a debit card that links to your account – and this can be used online, in-store, or at an ATM. In terms of its relationship with crypto, this comes in two forms.

First and foremost, you can use your Revolut account to buy cryptocurrency with ease. And – providing that the crypto exchange in question is regulated, you can withdraw your cash proceeds back to your Revolut account. Second, and perhaps most pertinently, Revolut also allows you to buy crypto from within the app itself.

This covers over 30 leading crypto assets – including but not limited to Bitcoin, Ethereum, XRP, and Dogecoin. Moreover, the minimum trade size buying crypto via the Revolut app is just $1. The main drawback with Revolut is that it charges hefty fees when buying and selling crypto.

For example, you will first need to cover the spread – which is essentially the mark-up that Revolut adds to the current exchange rate. This will vary throughout the day depending on market volatility and trading volume. Furthermore, you will also need to pay a commission of 2.5% per slide, or 1.5% if you are a Revolut premium plan account holder.

| Eligible Countries | US, Europe, Australia, Singapore, Switzerland, Japan, UK |

| Supported Crypto Assets | 30+ |

| Core Features | Local bank accounts, debit card, buy and sell crypto |

| Mobile App? | Yes |

Pros

- Crypto-friendly bank

- US clients accepted

- Send and receive funds just like a traditional bank account

- Debit card offered to all account holders

- Great for cross-currency payments

Cons

- Crypto trading fees are high

- Crypto investments are held by a third party

2. Monzo – One of the Best Crypto-Friendly Banks in the UK (FSCS Protection)

Next up on our list of the best crypto bank accounts for 2022 is Monzo. First and foremost, Monzo is a challenger bank that is only available to those residing in the UK. If you’re UK-based, you will like the fact that Monzo is authorized and regulated by the FCA, and most importantly, your GBP balances are covered by the FSCS up to the first £85,000.

Monzo, like Revolut, is a mobile-only bank account that is available via an Android and iOS app. You will be given a local UK bank account number and sort code, alongside a debit card issued by MasterCard. This means that you can perform everyday financial services with a Monzo account.

There are no fees for opening or maintaining a standard account. With that said, premium accounts – which offer higher ATM withdrawal limits, regular credit reports, and a number of other core features, cost £5 per month. Either way, we should note that Monzo does not allow you to buy or sell crypto through its app.

The bank does, however, offer a crypto-friendly ethos, meaning that you can use your Monzo account to deposit funds into digital asset exchanges. Most importantly, as long as your chosen exchange is regulated, you will have no issues withdrawing money back to your Monzo account. As a prime example, while eToro and Coinbase are perfectly fine, Binance transactions will be blocked.

| Eligible Countries | UK |

| Supported Crypto Assets | N/A |

| Core Features | UK bank accounts, debit card, crypto-friendly |

| Mobile App? | Yes |

Pros

- Allows you to deposit and withdraw funds into and from regulated crypto exchanges

- Free UK bank accounts

- Debit cards issued by MasterCard

- Competitive FX fees

Cons

- No crypto exchange services

- Customer support not as good as it used to be

- Reports of debit card not working at ATMs in certain countries

3. Nuri – Traditional and Crypto Banking Services for Europeans

Nuri – which describes itself as ‘new reality banking’, offers a mobile app that bridges the gap between crypto and traditional fiat money. Once you have registered and verified your identity, Nuri will offer you a fully-fledged German bank account. This comes alongside a local IBAN, meaning that you can perform SEPA payments within Europe and SWIFT transfers internationally.

You will also be offered a debit card issued by Visa, which enables you to make online payments and withdraw cash from ATMs. Most importantly, Unri’s partner financial institution – Solarisbank, is covered by a EUR deposit protection scheme of up to €100,000 per account. Additional security features include biometric logins and real-time transaction notifications.

When it comes to the crypto side of things, Nuri allows you to invest in digital currencies directly from within your account. You will pay a standard trading commission of 1% per slide – which is charged when you buy crypto and again when you cash out. The minimum investment per crypto trade is €30.

Crucially, you can choose to keep your crypto assets in a custodial or non-custodial wallet – with the latter giving you the option of controlling your private keys. Another thing we like about Nuri is that it offers crypto savings accounts. The APY on offer is 5% on Bitcoin, which is less than the 7% available at Aqru.

With that said, you can withdraw your crypto assets at any time – meaning that Nuri does not require a minimum lock-up period on interest accounts. Any interest that you generate will be paid out on a weekly basis. The final thing to note is that Nuri allows you to create savings plans – whereby you will set targets and receive real-time updates on whether or not you are on track.

| Eligible Countries | UK, Europe, and 70+ other countries |

| Supported Crypto Assets | 2 |

| Core Features | German bank account, earn interest on crypto, buy/sell crypto |

| Mobile App? | Yes |

Pros

- Buy and sell crypto at 1% per slide

- Crypto savings account offers 5% APY on Bitcoin

- German bank accounts offered

- Debit card issued by Visa

Cons

- Minimum crypto trade of €30

- Only Bitcoin and Ethereum are supported

4. Coinbase – Regulated Crypto Exchange With FDIC Protection on USD Balances

Coinbase is one of the largest and best crypto exchanges globally in terms of account holders and daily trading volume. Founded in 2012, this top-rated platform is regulated by the SEC and it is now a public company that trades on the NASDAQ. As such, Coinbase is a trusted place to buy, sell, and store crypto.

Although Coinbase is not a bank, it does allow you to deposit and withdraw funds in fiat money. This covers US dollars, euros, British pounds, and several other currencies. Moreover, if you are a US client and you hold a USD balance with Coinbase, your funds are protected by the FDIC.

This means that if Coinbase collapsed, your USD balances would be covered up to the first $250,000. Coinbase does not offer interest accounts, but it does allow you to engage in crypto staking. For all intents and purposes, staking operates much like an interest-bearing account, insofar that you will be paid an APY on any deposits you make.

This is, however, available on just six digital currencies – Ethereum, Dai, Tezos, Algorand, Cosmos, and Cardano. Moreover, the rate of return on offer is poor in comparison to the likes of Aqru, with Ethereum yielding just 3.68% annually. Another drawback with Coinbase is that it charges hefty fees. Coinbase also offers one of the best crypto credit cards on the market. The Coinbase Card is funded by your Coinbase account balance and is amongst the fastest and most convenient ways to spend your cryptocurrency holdings in 2022.

For example, although accounts are free to open, when you deposit funds with a debit or credit card and proceed to buy Bitcoin or any other supported crypto asset, you will pay a fee of 3.99%. Bank transfers are free but you still need to pay a commission of 1.49% when you buy or sell crypto.

| Eligible Countries | US, UK, Europe, Singapore, Australia, Canada. |

| Supported Crypto Assets | 50+ |

| Core Features | FDIC on USD balances, crypto staking, regulated by the SEC |

| Mobile App? | Yes |

Pros

- Founded in 2012 and regulated by the SEC

- 50+ coins supported

- Debit and credit card payments accepted

- Great choice for beginners

Cons

- 3.99% fees on debit/credit card payments

- FDIC insurance only offered to US clients on USD balances

Cryptoassets are a highly volatile unregulated investment product.

5. BankProv – Banking Services for Crypto Businesses

BankProv – which is located in the US, traces its roots back to 1828 when it initially traded as The Provident Bank. Since then, BankProv has modernized its services to include crypto-focused products. With that said, BankProv is largely targeted to businesses that have an involvement with digital currency services.

Nevertheless, personal accounts are still offered by BankProv – which can be opened and maintained online or via the native iOS and Android mobile app. In addition to personalized checking accounts, you will also be offered a debit card that can be used at ATMs, in-store, and online.

Security features include the ability to freeze your card at the click of a button, alongside fingerprint or face ID. You can also access customer support on a 24/7 basis via a simple live chat facility. Perhaps most importantly, USD balances are covered by the previously discussed FDIC.

When it comes to crypto, its exchange and other related services are, as of writing, only accessible by business account holders. As such, if you’re only seeking a personal account that provides access to crypto investment services, BankProv won’t be for you.

| Eligible Countries | US |

| Supported Crypto Assets | Business clients only |

| Core Features | FDIC on USD balances, 24/7 support, debit card |

| Mobile App? | Yes |

Pros

- First established back in 1828

- FDIC insurance on USD balances

Cons

- Crypto services only offered to business clients

- Poor functionality

- Mobile app has poor reviews

How Do Crypto Banks Work?

The term crypto bank is somewhat subjective, as it can refer to a number of different services. First and foremost, there are no traditional financial institutions that allow you to deposit and store crypto assets. There are, however, digital-only challenger banks like Revolut that, in addition to checking accounts and debit cards, allow you to buy and sell cryptocurrencies.

You then have so-called crypto-friendly banks. For instance, Monzo is a great example here – not least because it allows you to use your account at crypto exchanges. This is means that – on the proviso, the exchange is regulated, you can deposit and withdraw funds to and from exchanges without having the transaction blocked.

Ultimately, the best Bitcoin bank accounts in the market form a crucial bridge between fiat money and digital currencies. That is to say, you should be able to perform everyday financial services – such as sending and receiving funds and withdrawing cash from ATMs, as well as having access to crypto exchanges and investment products.

On the other hand, our research concluded the best alternative to a crypto bank is Aqru. As we discussed in our Aqru review, this provider allows you to deposit funds in US dollars, euros, or British pounds. You can also fund your account with crypto and best of all – earn up to 12% per year in interest. In essence, Aqru offers a similar framework to a conventional savings account.

Cryptoassets are a highly volatile unregulated investment product.

Are Crypto Banks a Good Idea?

Over the course of the next decade, there is every chance that traditional financial institutions will begin offering bank accounts that support both fiat money and crypto assets.

After all, some of the biggest banks in the US – notably, Wells Fargo, JPMorgan Chase, and Goldman Sachs already have departments that are dedicated exclusively to cryptocurrency.

With that said, in its current form, crypto bank services available in the market are fragmented.

- For example, if you’re looking to deposit crypto into a safe interest-bearing account, the best option in 2022 is Aqru.

- However, Aqru does not offer local checking accounts or a personalized debit card.

- You then have the likes of Monzo – which allows UK clients to use their accounts at crypto exchanges – alongside access to a debit/credit card issued by MasterCard.

- However, Monzo itself does not offer crypto trading services.

The key point here is that there is no provider offering all of the crypto/fiat banking services that you might require through a single hub.

Instead, you will likely need to open an account with various providers.

Are Crypto Banks Safe?

The best crypto bank account providers in the market will ensure that your funds are kept safe at all times. Safety and security will, however, vary from provider to provider.

In the sections below, we discuss some of the most important safety nets that you should look for when choosing the best crypto bank account for your needs.

Deposit Insurance

If you’re looking for a Bitcoin bank account that supports fiat money in addition to digital currency – then it’s a good idea to assess whether or not there is an insurance program in place.

For example:

- When using Monzo, GBP deposits are covered by the FSCS up to the first £85,000

- US clients with USD balances are covered by the FDIC at Coinbase up to the first $250,000

- Nuri accounts are covered by the European deposit guarantee scheme up to the first €100,000

It is also important to check whether the deposit protection scheme is offered by your chosen crypto bank account – or through a third-party partnership.

Moreover, the deposit scheme in question might only be available to residents of certain countries, so this is another metric to check off before choosing a provider.

Regulation

In addition to a deposit protection scheme, you should also explore the regulatory standing of your chosen crypto bank.

For example, Coinbase is regulated by the SEC while Monzo is authorized and licensed by the FCA. In the case of Aqru, the platform is approved by regulators in the European nation of Lithuania.

Ultimately, if you come across an unregulated entity when searching for the best crypto bank for your requirements – the provider in question should be avoided.

Crypto Deposit Security

Another thing to consider in your search for the best crypto bank in the market is the security offered on your digital asset deposits. After all, when you deposit cryptocurrencies into a platform, your chosen provider will be responsible for keeping the funds safe.

At a minimum, the crypto bank should keep the vast majority of client digital tokens in cold storage. Additionally, multi-sig technology should also be a minimum requirement, as should the implementation of an insurance policy.

Account Security

The best Bitcoin banks that we came across offer a range of security tools on client accounts. For instance, two-factor authentication ensures that log-in attempts require access to a secondary device.

This can come in the form of an SMS code sent to your cell phone or an email confirmation link. Additionally, some Bitcoin banks require an extra security step when you sign in from a new device.

How to Choose the Best Crypto Bank Account?

When searching for the best crypto bank account for your requirements, there are a number of important metrics to consider.

We discuss these core factors in more detail in the sections below:

Eligibility

The first thing to check is whether or not you are eligible to open an account with your chosen crypto bank.

For example, while Revolut accepts clients from the US, Europe, and several other regions, Monzo accounts can only be opened by those based in the UK.

Conventional Banking Services

Next, you’ll need to see what conventional banking services are offered by your chosen provider. At a minimum, you should be offered a local bank account in your desired region.

For example, Revolut offers unique UK, EU, US, and a number of other regional bank accounts to all registered users. Monzo and Nuri, on the other hand, only offer a local UK and German bank account, respectively.

Debit Card

You will likely want access to a debit card when you open an account with a crypto bank. In doing so, this will allow you to spend your fiat and crypto funds in the real world.

This should include ATM withdrawals as well as online and in-store purchases. As long as the card is issued by Visa or MasterCard – you should be able to use it anywhere globally.

Crypto Services

By searching for the best crypto bank for 2022, you likely want access to specific services linked to the digital asset industry.

For example, if you want a crypto bank account that allows you to buy and sell digital assets at the click of a button, you might consider Revolut. If crypto staking is more of interest, Coinbase is worth considering.

It is, however, important to check whether your chosen crypto bank offers digital asset services directly – or if they are using a third-party provider. If it’s the latter, you might want to consider it.

Interest Accounts

When you deposit funds into a traditional bank account, you will likely be paid a rate of interest. With that said, it goes without saying that banks in the US and Europe pay virtually nothing in interest – with yields rarely exceeding 1%.

Once again, this is why we like Aqru as the best alternative to a crypto bank, as you will earn an APY of 7% on Bitcoin and Ethereum, and 12% on stablecoin deposits.

How to Set Up a Crypto Savings Account

If you’re ready to start earning interest on your crypto deposits in a safe and secure environment, we will now show you how to get started with Aqru.

As noted, you can deposit fiat money or crypto assets here and earn interest without needing to lock your funds away.

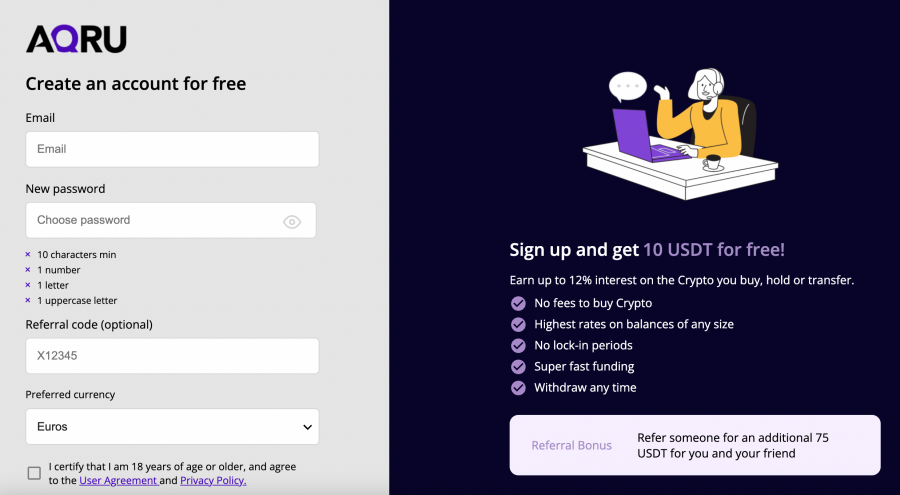

Step 1: Register an Account

To get started with Aqru, you will first need to register an account. This is somewhat similar to opening a bank account, insofar that you will need to provide some personal information and contact details.

However, unlike a traditional bank account – which can take several days to open, registering at Aqru takes a matter of minutes.

Step 2: Verify Identity

Similarly, just like a traditional bank account, Aqru is legally required to verify your identity before it can start offering you fiat or crypto services.

To get verified near-instantly, you will need to upload a copy of your government-issued ID – such as a passport or driver’s license.

You will also need to have your country of residency validated via a proof of address document. This can be a bank account statement, for instance.

Step 3: Deposit Funds

Now that you have a verified account with Aqru, you can now make a deposit. As we mentioned earlier, this top-rated provider accepts deposits in both crypto assets and fiat money.

If opting for the latter, you can deposit US dollars, euros, or British pounds via a debit/credit card payment or bank transfer.

If you wish to deposit crypto, Aqru will provide you with a unique wallet address for the respective token. Then it’s just a case of transferring the funds from an external wallet or exchange.

Step 4: Earn Crypto Interest

As soon as you have made a crypto deposit, you will start earning interest. This will be paid out on a daily basis and you can your balance in real-time 24/7.

If you made a deposit in fiat currency, you can choose the crypto that you wish to earn interest on. For the highest rate possible with virtually no volatility risk – consider a stablecoin. In doing so, you’ll earn an APY of 12%.

Conclusion

In its current form, the crypto bank industry is extremely fragmented. For instance, while one provider might offer local bank account numbers and the ability to buy crypto, interest-earning opportunities might be non-existent.

In conclusion, we found that the best alternative to a crypto bank account is Aqru – which enables you to deposit fiat and crypto money – and earn a yield of up to 12% per year.

And, as all interest accounts are flexible, you can withdraw your funds at any given time – 24/7.

Cryptoassets are a highly volatile unregulated investment product.

Frequently Asked Questions on Crypto Bank Accounts

Is there a crypto bank?

What banks are crypto-friendly?

Should I use a crypto bank?

What is the best crypto bank?

Are regulators exploring how banks could hold crypto?

This news is republished from another source. You can check the original article here