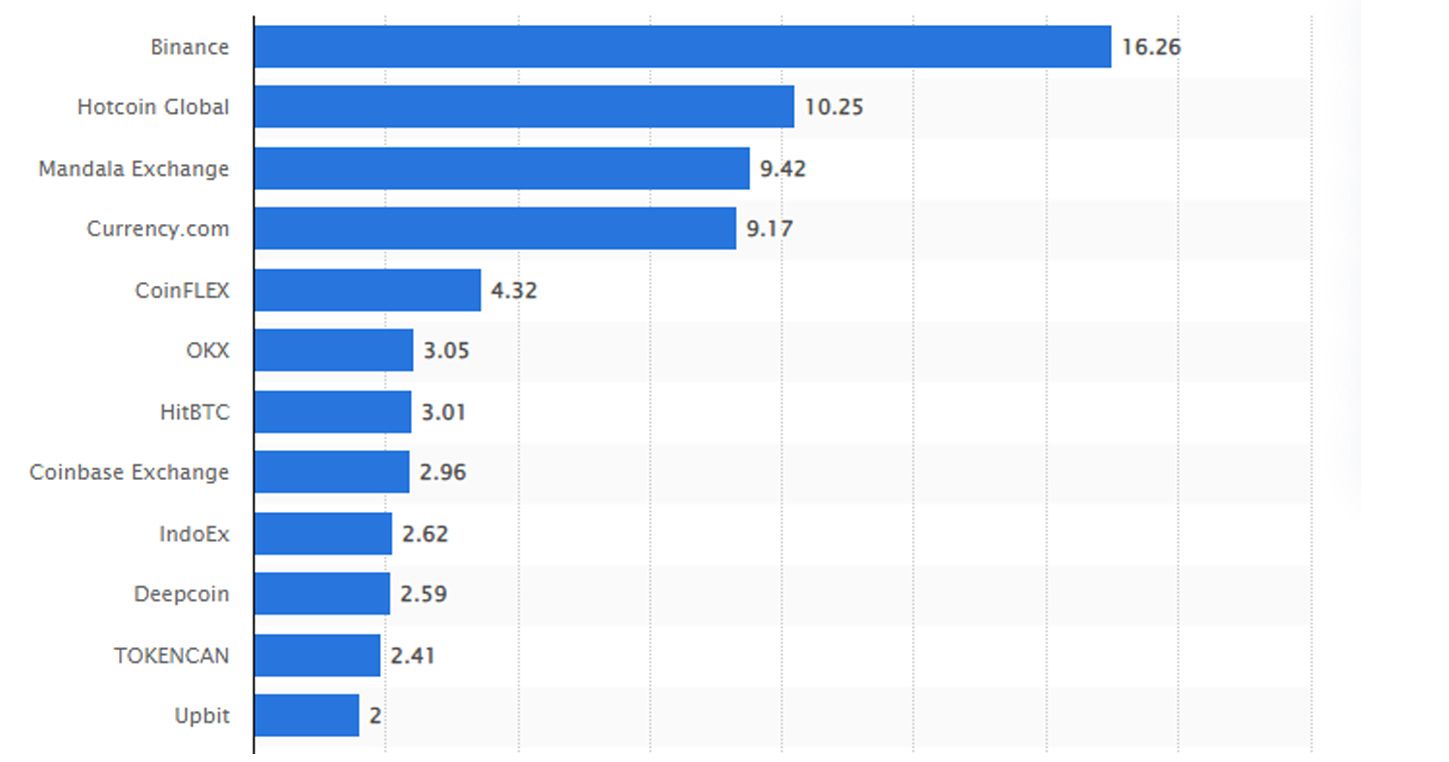

When you enter the world of cryptocurrencies, you inevitably encounter Binance, the world’s largest crypto exchange. Reporting 28.6 million active users by the end of 2021, Binance is in its own category by market share, handling over 15% of global cryptocurrency traffic. That is, if we exclude the third-ranked crypto exchange, Mandala, with which it shares its liquidity.

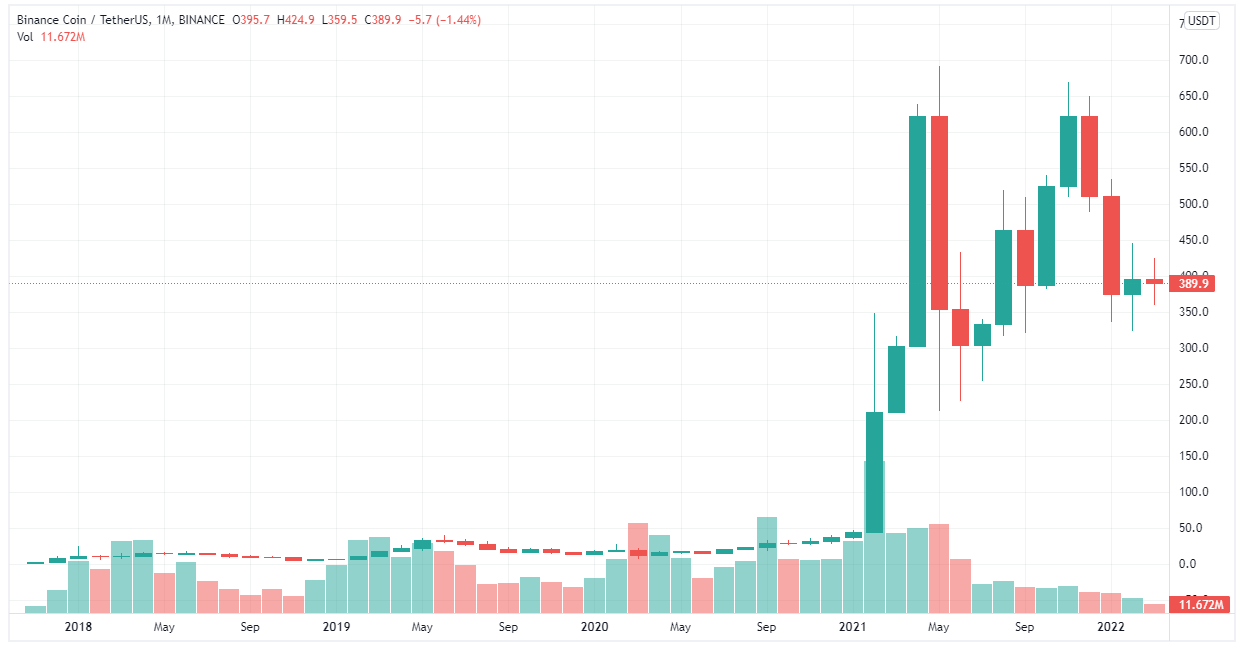

To service all those millions of users, Binance launched Binance Coin (BNB) in the same year it was founded, 2017. There are many uses for Binance Coin, but let’s first start with how and why it was created.

Why Did Binance Launch Binance Coin (BNB)?

Just like private companies go public with an IPO (Initial Public Offering) to attract investors, cryptocurrency companies go with an ICO (Initial Coin Offering) to do the same. With traditional IPO launches, investors gain a stake in a company through stock shares. In turn, ICOs launch tokens on blockchain networks.

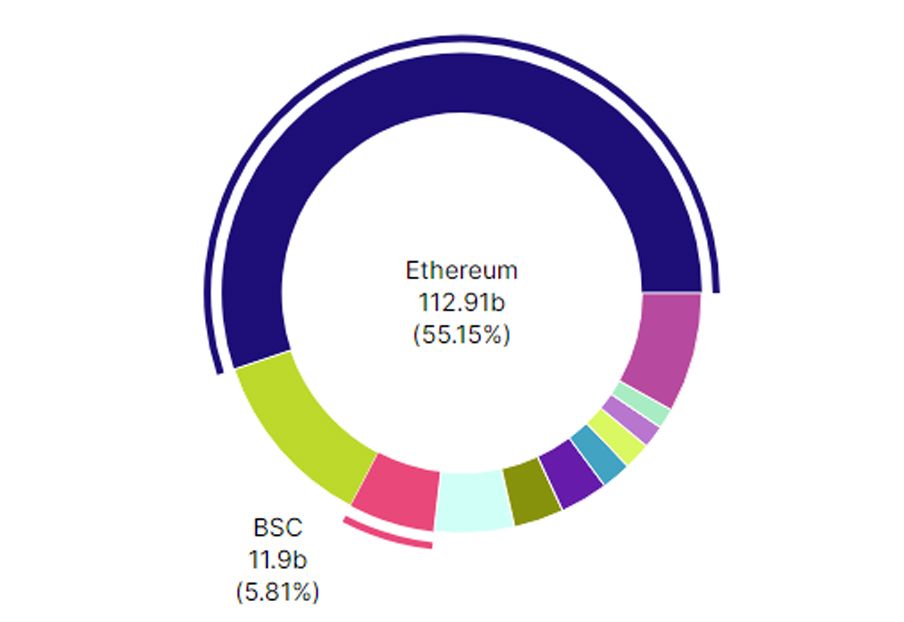

In the case of Binance, the company headed by Changpeng Zhao launched Binance Coin with a ticker BNB on the Ethereum blockchain. Ethereum is still the largest smart contract platform with 55% of the market share, so it was a good call to pick Ethereum to launch BNB as an ERC-20 token, an Ethereum smart contract standard.

Three years after the launch of Binance Coin, Zhao launched Binance Smart Chain (BSC). This is Binance’s version of Ethereum. However, BSC still has a 9x lower market share than Ethereum, at less than 6% compared to Ethereum’s 55%.

With the BNB ICO launch, Binance distributed 10% (20 million BNB) of the tokens, at $0.15 each, to so-called angel investors. These are private, wealthy individuals who provide companies with enough seed money to fully develop their business roadmap. Binance retained 40% (80 million BNB) of tokens for itself, which left 50% of the remaining BNB supply to the public.

The maximum supply of Binance Coin was set at 165,116,760 BNB. As Binance grew larger, BNB coin appreciated, just like the company’s shares do in the stock market. In other words, imagine getting a hold of BNB in 2017. It would have appreciated by 368,137 percent! Therefore, if you had been a Binance investor with just a $1,000 worth in BNB, you would now be able to turn that one grand into $2.5 million.

Now that you understand the difference between BSC and BNB, and its service as a funding vehicle, it’s time to see what you can actually do with Binance Coin as a utility token.

Uses for Binance Coin Explained

First and foremost, Binance Coin (BNB) represents your stake in Binance itself. If you believe that the company is poised to grow even further, this will be reflected in the BNB’s price, allowing you to sell it later for a much higher price than when you bought it.

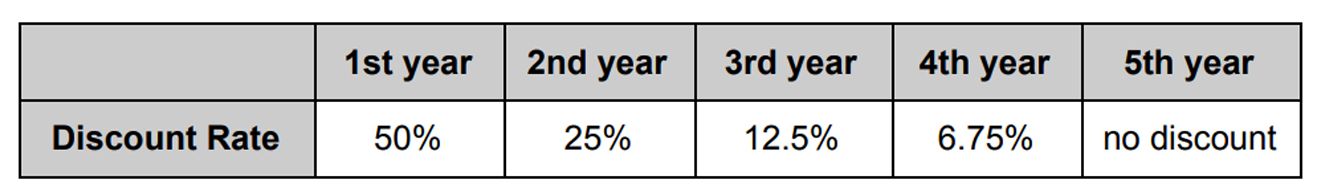

Outside of that, BNB is just like all other cryptocurrencies on other blockchains. You can exchange BNB for any other token available on the Binance exchange. Furthermore, the company incentivizes you to hold BNB because it gives you a discount when you pay your transfer/exchange fees in BNB instead of other currencies.

Expanding out further with other exchanges, Binance made a deal with Crypto.com. This exchange made a deal with credit card companies to issue credit cards backed up by crypto assets. In turn, Binance saw this as an opportunity for Crypto.com to include BNB as a form of payment for credit card bills. This way, Crypto.com gained inroads to Binance’s larger user base, while Binance gained more mainstream acceptance of its native cryptocurrency.

Likewise, online merchants can opt to choose BNB to pay for their services. This ranges from booking hotels and flights to paying for lottery tickets and gifts. This list has all online platforms where BNB can be used.

Lastly, Binance has its own version of PayPal, called Binance Pay. With BNB in your Binance wallet, users can use them directly to shop at these merchants, without having to make any fiat-crypto conversions.

BNB Burning Mechanic

On a final note, Binance has a mechanism that ensures BNB will appreciate in value by making them scarce. It does this by quarterly burnings, as explained in the official Binance whitepaper. Burning tokens just means removing them from circulation, so they form a more scarce pool.

“Every quarter, we will use 20% of our profits to buy back BNB and destroy them, until we buy 50% of all the BNB (100MM) back. All buy-back transactions will be announced on the blockchain. We eventually will destroy 100MM BNB, leaving 100MM BNB remaining.”

After all, Bitcoin became so valuable because of its finite limit at only 21 million BTC. By the same token, when the Federal Reserve increased the USD money supply by trillions, it greatly devalued the dollar, causing a 40-year-high inflation. It just goes to show that, more often than not, entrusting your money to companies is a better bet than in governments.

Read Next

About The Author

This news is republished from another source. You can check the original article here