The SushiSwap protocol is a decentralised exchange that solves liquidity problems using smart contracts. SushiSwap (SUSHI) is the native token that powers the network.

This review breaks down the intricacies of how to invest in SushiSwap. We also cover the price performance of the SUSHI token and why the SushiSwap protocol is so revered in crypto circles.

How to Buy SushiSwap – Quick Steps

If you are in a hurry to buy SushiSwap, then you can make use of our quick-fire steps to get started in as little as five minutes on our recommended platform, eToro.

Open an account with eToro: Navigate to the eToro website and tap on the ‘Join Now’ button. Fill in the required details and click on ‘Create Account’ to sign up.

Deposit: Verify your account and tap on the ‘Deposit Funds’ button to make a deposit. The deposit should be on par with the minimum figure or above the stipulated amount.

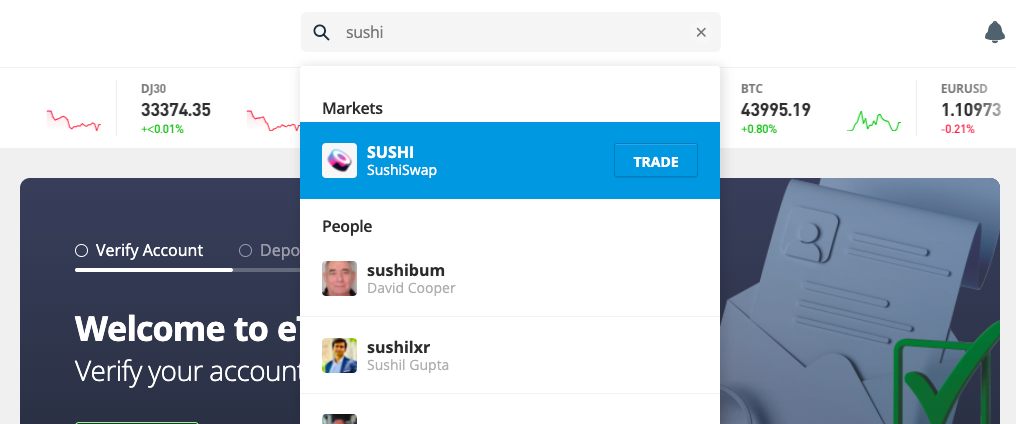

Search for SushiSwap: Type ‘SUSHI’ into the search bar and click on the first popup result.

Buy SushiSwap: Click on the ‘Trade’ button to open up the order page. Then insert how much you want to invest in SushiSwap. Click on ‘Open Trade’ to complete the process.

Where to Buy SushiSwap

There are several crypto platforms that allow customers to buy and sell SushiSwap. While this offers flexibility for crypto investors, it could be confusing on selecting the best platform to buy SushiSwap for strong security, low fees, and deep liquidity.

Here are some of the best places where you can buy SushiSwap with ease.

1. eToro – Overall Best Place to Buy SushiSwap

If you are considering where to buy SushiSwap, eToro ranks as our number one top platform due to a number of reasons. Founded in 2007 by David Ring and the Assai brothers, eToro is a one-stop-shop for all financial investment services.

The major appeal for its 23.2 million users spread worldwide is its infusion of a social element into its services. eToro is considered as the Facebook for traders and investors. This is because the eToro platform allows investors to share ideas and insights about market trends with one another.

Adding to this, eToro is one of the best crypto apps thanks to its unique trading tools including the CopyTrader and CopyPortfolio. CopyTrader is ideal for investors just taking the plunge into the crypto space and the financial market as a whole. New users can easily mirror the trading activities and strategies of more advanced traders while mitigating losses. Another major appeal with the eToro CopyTrader is that investors can make profit from copying others.

The CopyPortfolio takes this a step further and enables investors to better diversify their portfolios across top-performing market segments and regions. The in-house developed asset management tool automatically rebalances and realigns an investor’s investment basket based on the highest yield investment vehicle at the moment.

eToro also does not compromise with security and employs industry-standard procedures to safeguard your funds and details.

In addition, eToro is one of the most regulated entities in the crypto trading ecosystem. The crypto broker has operational licenses from the UK’s Financial Conduct Authority (FCA), Australian Securities and Investment Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and the Financial Industry and Regulatory Authority (FINRA).

In terms of fees, eToro is one of the most affordable platforms to invest in SushiSwap. You enjoy zero deposit and maintenance fees for its vast array of supported payment methods. However, you will need to pay $5 for withdrawals.

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Best Platform to Invest in SushiSwap for Cashbacks

Another top choice to buy SushiSwap is Singapore-based Bitcoin exchange Crypto.com. Launched in 2016, Crypto.com is over 10 million customers strong and allows investors to buy crypto at true cost.

The crypto exchange is also well-known for its bold approach to crypto trading and allows investors to buy, sell, and exchange over 250 digital assets. Added to this, Crypto.com supports multiple payment methods including over 40 fiat currencies for direct crypto-to-cash purchase. You can also snap up your favourite project using crypto payments as an option.

While enabling crypto investments, Crypto.com also allows for cashback rewards for investors. The Crypto.com Visa Card is a set of 5 crypto-enabling transaction mechanisms that allow its users to earn rewards for settling their financial obligations with it. This reward can span as high as 8% for the Obsidian Crypto.com Visa Card.

Crypto.com also comes with a lot of perks and advantages. One of such is the Crypto.com Earn platform which allows investors to earn over 14% on their crypto holdings and as much as 14% on their fiat-backed digital assets.

Fee-wise, Crypto.com charges a flat rate of 0.4% for Level 1 traders with a 10% discount cutting this down to 0.36%.

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Top Platform to Buy SushiSwap for Beginners

Just like several Bitcoin exchanges come with unique capabilities, Coinbase’s superpower lies in its easy-to-use interface. The crypto trading experience is basically toned down for those making their first foray into the world of investing and cryptocurrencies as a whole.

To enable a feature-rich beginner-friendly platform, Coinbase comes with rich materials and resources. Coinbase also allows the trading of 300+ digital assets and investors can get started with as little as $2.

Supported deposit methods include automated clearing house (ACH), debit cards, Apple Pay, and Google Pay. However, you will be charged a standard deposit rate of 3.99% for debit card transactions. You can also turn to the ACH for free deposits.

Coinbase also comes with a Pro variant which affords more advanced tools and trading indicators. This also comes with lower trading fees and a more streamlined trading experience. Coinbase also features regularly as a crypto custodial company for institutional investors and the Coinbase Prime platform is used by deep-pocketed companies to trade the crypto market.

Fee-wise, Coinbase operates a variable fee structure dependent on the crypto asset in question.

Cryptoassets are a highly volatile unregulated investment product.

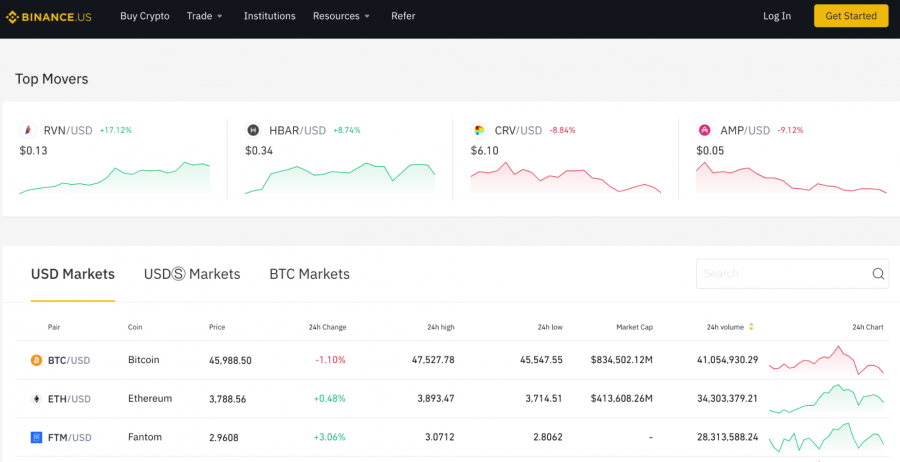

4. Binance – Best Platform to Buy SushiSwap and Asset Diversity

Binance is regarded as the world’s largest crypto exchange and for good reason. The Bitcoin exchange launched by Changpeng Zhao in 2017 processes over $65 billion in trading volume daily and is one of the best crypto day trading platforms in the space.

The Binance exchange has the most advanced crypto earning platform in the blockchain ecosystem. Its passive income-generating tool is divided into several categories including Flexible, Locked Stakings and High Yield. Each comes with different lockup periods, risks, and most importantly disparate interest rates.

Binance offers a rich educational platform called the Binance Academy. Here, new users are exposed to both video courses and online content to educate them on cryptocurrencies and how to trade them.

In regards to fees, Binance charges 0.10% for all traders; however, holders of its discount token Binance Coin (BNB) can enjoy low fees up to 0.025%. So when researching where to buy Sushiswap with low fees, Binance is a strong option.

New users are required to undergo a compulsory know-your-customer (KYC) process to verify their identity. But the Binance exchange is not regulated by any global body. Supported deposit methods include bank wire transfer, debit cards, peer-to-peer (P2P) payment options.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection

5. Webull – Best Platform to Buy SushiSwap Commission-free

Webull is one of the top crypto platforms you can use to buy SushiSwap. Traditionally a stockbroker, Webull offers crypto trading support for over 11 digital assets.

This is also topped with zero minimum balances as well as zero commission trading. This goes a long way to cut down on expected fees paid in opening and closing a position. Concerning regulation, Webull is under the supervision of the US Securities and Exchange Commission (SEC) as well as FINRA.

Webull is also a member of the Securities Investor Protection Corporation (SIPC) which guarantees investor funds’ protection up to $500,000.

Webull comes with a number of advanced trading resources including the Nasdaq TotalView. This is meant to help investors properly analyze companies, market trends, and easily identify trading opportunities.

The Webull interactive is visually appealing and easy to use and investors can easily fund their account using a bank wire transfer, debit card, and e-wallet solutions.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection

What is SushiSwap?

Before you learn how to buy SUSHI, the first step is to know what the project is all about and what challenges it is addressing.

The Sushi crypto project is an Ethereum-based decentralized exchange (DEX) platform that allows investors to easily swap and trade different decentralized finance (DeFi) tokens. Also an automated market maker (AMM), it matches investors’ transactions to the best possible price allowing them to swap tokens.

SushiSwap is a fork of the popular Ethereum DEX platform UniSwap. Launched sometime after UniSwap, SushiSwap aims to be a better and more advanced option to UniSwap and allow users to create and fund liquidity pools in exchange for the SUSHI token. As an AMM, SushiSwap eliminates the use of order books and instead uses smart contracts to hold digital assets in liquidity pools for users.

Each liquidity pool is pegged against another digital asset. For instance, the SUSHI-ETH smart contract pool would require users to deposit at least 50% of the SUSHI token and 50% of the ETH token into the highlighted liquidity pool. Then SushiSwap calculates the price of each crypto asset based on a preset mathematical formula.

Every trade executed on the platform commands a standard transaction fee of 0.30% and this fee is then distributed among the liquidity providers in proportion to the liquidity they provided.

The SUSHI token is used for governance duties and enables holders to vote on upcoming upgrades to the platform. SUSHI is also used as an incentive mechanism for liquidity providers on the SushiSwap platform.

Is SushiSwap a Good Investment?

If you are planning to invest in SushiSwap, you may be wondering if the digital asset holds promise for the future. While the broader crypto market is facing stiff bearish opposition, a number of top projects like SushiSwap are still one of the best means to tap into the burgeoning crypto space. Here are a few reasons why you should buy SushiSwap.

-

DeFi Hub for Passive Income

SushiSwap allows users to access liquidity pools. These pools are used to earn fees on the SushiSwap protocol on tokens supported by the platform. This functionality is not unique to many DEX platforms.

Added to this, SushiSwap offers this functionality on 14 different blockchain platforms making SushiSwap a more robust offering than its older DEX cousin UniSwap. These pools reward liquidity providers with LP tokens which can be further used for yield farming. Given this, users can find multiple ways to derive a good chunk of income all on the SushiSwap protocol.

The SushiSwap protocol is also brimming with useful tools for developers and users alike. One of such is BentoBox which serves as a token vault for the SushiSwap protocol. Operating on several blockchain-based applications or dApps, BentoBox is used in tracking user’s deposits using artificial balance.

This is useful in making sure that idle funds are properly applied to the right yield strategies. This in-house vault can be used to deposit tokens on Compound Finance or on the Sushi Bar to earn more SUSHI tokens. The main benefit of BentoBox is its low-gas cap for carrying out these complex processes. Operating on top of the Ethereum protocol means users have to battle with high gas fees. Understanding the challenges of executing transactions on Ethereum, the BentoBox was installed to make complex transactions with minimal number of actions. This goes a long way to save on gas fees used in executing these transactions.

Another useful tool you will come across on the SushiSwap platform is the lending protocol called Kashi. This is useful for creating smart contract lending pools that investors can easily loan a token. As a reward, lends are able to generate high yields on their assets while also cutting out impermanent loss – a major issue in the DeFi ecosystem. Impermanent loss is when the value of your deposit tokens changes compared to when you initially made the deposit.

Kashi Lending allows investors to also gain insight on the amount of collateral available as well as when the insolvency of an asset.

While BentoBox has been an ace in one, the SushiSwap team is not currently resting on its laurels. The DeFi protocol is currently working on a major upgrade to the network called Trident. According to a press release, Trident is a next-generation AMM protocol and has been developed fully in-house as a direct response to criticisms that SushiSwap is just a fork of UniSwap.

Coming in hot on the wheels, Trident will boast of a wider range of liquidity pools, with the total number coming in at 4 pools at its launch. This is expected to be much wider than the single product pool SushiSwap boasts of. Also, SushiSwap users will now have the privilege of selecting a pool that fits their risk profile in a bid to tone down on frequent crypto volatilities.

Crazily enough, Trident will be built directly in the BentoBox solution. This would exponentially increase the multiple ways investors will be able to generate passive income on their assets.

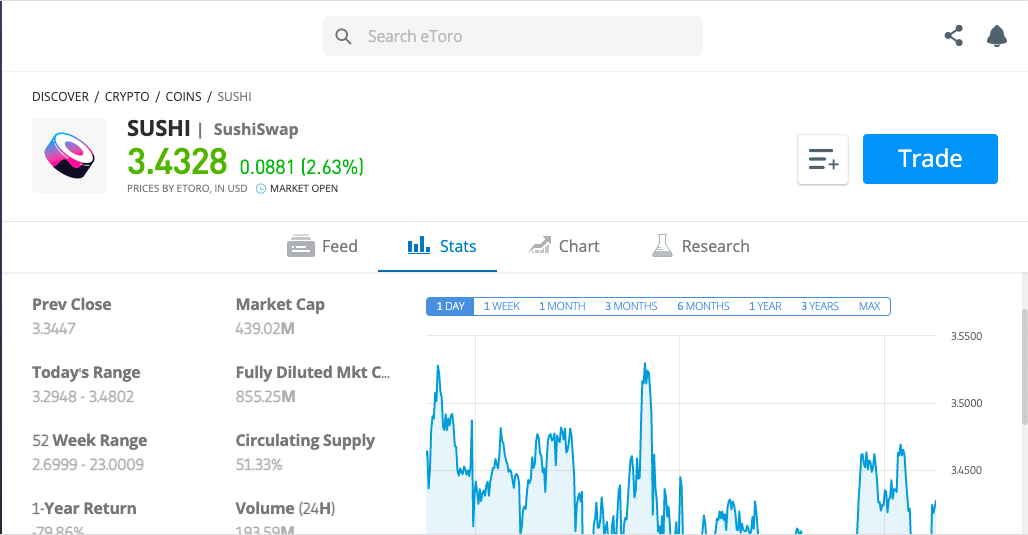

SushiSwap Price

SushiSwap has for the most part been the victim of the broader crypto market movement spearheaded by Bitcoin.

At the start of 2021, SUSHI traded at $3.3 before skyrocketing to $22.91, following a 500% increase in mid-March. The DeFi token dipped to $10.92 on April 24 before reversing to $21.44 on May 18.

A successful spell in late December saw the ERC-20 token surge 100% to $10.25. However, a trend reversal has led SUSHI down the bearish ranks.

SushiSwap price is currently pegged at $3.236, down 1.99% in the last 24 hours.

SushiSwap price is currently pegged at $3.236, down 1.99% in the last 24 hours.

SushiSwap Price Prediction

Much like most digital assets, several forecasts on the SushiSwap price have become popular in a bullish 2021 for the nascent industry. Some of the most well-known is by Wallet Investor which puts the SUSHI price forecast at $7.865 in the coming month.

DigitalCoinPrice puts its price prediction at $9.06 in the next 5 years.

Ways of Buying SushiSwap

While you can easily buy SushiSwap using another cryptocurrency, say Bitcoin, you can also turn to traditional payment rails to interface with the crypto space.

- Buy SushiSwap with PayPal

PayPal is one of the most recognised online payment rails in the world. Catering to over 100 million merchants globally, PayPal is a popular solution for settling online transactions for several users. The company has been pro-crypto for the last couple of months. However, you cannot directly buy SushiSwap on the PayPal platform.

A more suitable option would be to use a crypto platform that supports PayPal deposits and withdrawals. One of the best options is eToro which allows you to make deposits via PayPal while paying zero fees.

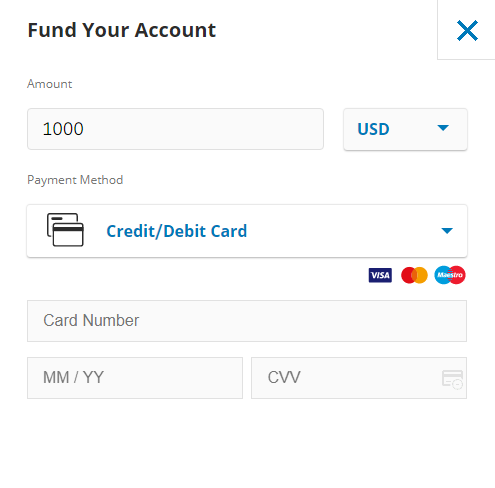

- Buy SushiSwap with Credit or Debit Card

You can also turn to more established payment solutions like your credit or debit cards to buy SushiSwap. While there are several Bitcoin exchanges, only a few support one or even both payment solutions.

eToro allows you to easily buy SushiSwap without incurring any deposit expenses. This will go a long way in protecting your capital as well as increasing your purchasing capability.

Best SushiSwap Wallet

Much like every item, crypto assets need to be stored for safekeeping. Given that these assets are only lines of code and cannot be physically held or touched, you would need an appropriate tool to secure them.

A crypto wallet does this and there are different types of crypto wallets. The most popular is the software or online wallet which is basically a crypto-native software application. This is accessible on mobile devices and requires an internet connection to access your token balance.

The hardware wallet is more utilitarian in nature and is ideal for storing large quantities of crypto assets. They do not require internet connection and are usually offline storage capacities. They also look like a regular USB stick and you always need to connect it to your desktop to access your funds.

While there are several options to choose from, we recommend using the eToro Crypto Wallet due to a number of reasons. For one, you get to store your SUSHI tokens and 120 more like it. You also get real-time quotes for price action of your crypto watchlists. You can also trade upwards of 500 crypto-to-crypto pairs as well as enjoy backup recovery service in the event you lose your private keys.

Added to this, eToro Crypto Wallet has an extra layer of security as it is regulated by the Guernsey Financial Service Commission (GFSC).

How to Buy SushiSwap – Tutorial

If you are wondering how to invest in SushiSwap, then this section will address this need in a few minutes. We will be illustrating the steps using our recommended crypto broker, eToro.

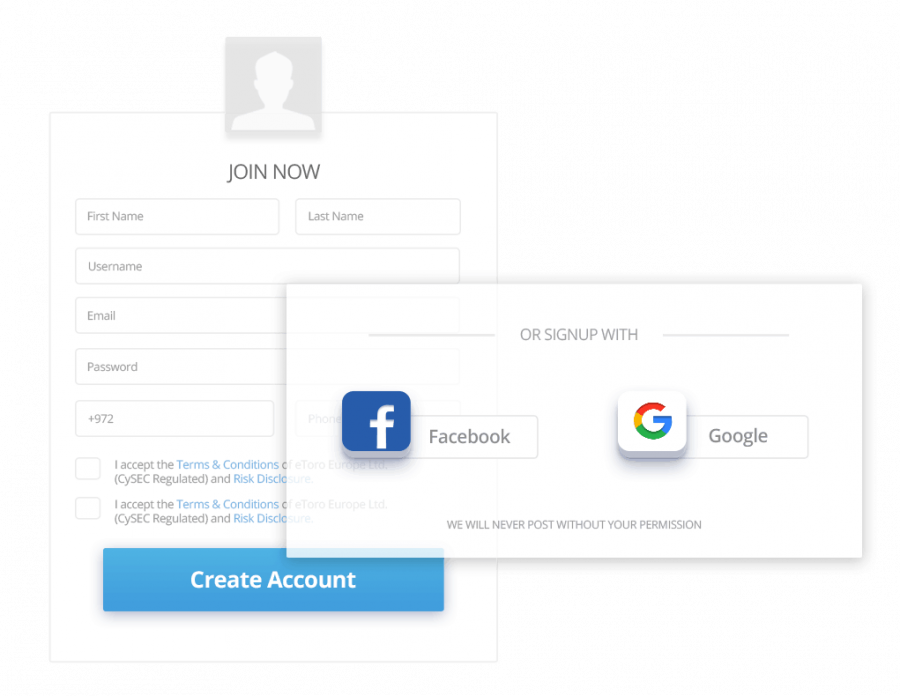

- Open an account with eToro

The first step will be to create a free account on the social trading platform, eToro. To do this, head over to the eToro website and tap on the ‘Join Now’ button. You will be redirected to the registration page where you will be required to fill in your full name, email address, mobile number, username, and password. Click on the ‘Create Account’ to move to the next stage.

The first step will be to create a free account on the social trading platform, eToro. To do this, head over to the eToro website and tap on the ‘Join Now’ button. You will be redirected to the registration page where you will be required to fill in your full name, email address, mobile number, username, and password. Click on the ‘Create Account’ to move to the next stage.

You can also fast-track the process by signing up with your Google or Facebook account.

eToro is a regulated crypto platform which means you will need to complete the KYC process to access all the platform’s features. To do this, quickly tap on the ‘Verify’ button and submit your driver’s license or government-issued ID card. You will also be required to submit a copy of your recent utility bill or bank statement.

Tap on the action button and click the ‘Deposit Funds’ button to access the deposit page. Insert how much you want to invest in SushiSwap and select a payment method. Click on the ‘Deposit’ button to complete the process.

Tap on the action button and click the ‘Deposit Funds’ button to access the deposit page. Insert how much you want to invest in SushiSwap and select a payment method. Click on the ‘Deposit’ button to complete the process.

eToro provides two options for accessing the digital assets you want. The first option is to click on the ‘Discover’ button and go to the ‘Crypto’ page. However, the easiest means to find SushiSwap is to type ‘SUSHI’ into the search bar and click on the relevant result.

Once you are on the SushiSwap page, you can click on the ‘Trade’ button to access the order page. Then insert how much SUSHI you want to buy and click on the ‘Open Trade’’ button to complete the process.

How to Sell SushiSwap

After making a profit on your investment, you may want to sell SushiSwap. To do this on eToro, click on the ‘Sell’ button to close your position. Then you can click on the ‘Withdraw’ button to take out your profit. Select a payment method and follow the on-screen prompts to conclude the sales.

Conclusion

SushiSwap is one of the thriving members of the rapidly-expanding DeFi ecosystem. A fork of UniSwap, SushiSwap has been able to carve a strong following of its own due to a dogged approach to enabling more penetration of decentralized services.

Making an investment in SushiSwap is considered by many crypto experts as a smart move given the protocol’s growing relevance. Using eToro to buy SushiSwap is also considered another smart move due to the competitive fees, user-friendliness, advanced tools, and high security you will enjoy.

Cryptoassets are a highly volatile unregulated investment product.

Frequently Asked Questions on How to Buy SushiSwap

Where can I buy SushiSwap?

Should I buy SushiSwap?

Can I buy SushiSwap on Coinbase?

How much will SushiSwap be worth?

Can I buy SushiSwap?

This news is republished from another source. You can check the original article here