If you’re looking to jump on the cryptocurrency bandwagon – you will be joining millions of other UK investors. But, if you’re completely new to this industry – the investment process can be somewhat intimidating.

Therefore, in this beginner’s guide, we will show you how to invest in cryptocurrency in the UK via an FCA-regulated broker in less than 10 minutes.

How to Invest in Cryptocurrency UK – Quick Guide

It only takes 10 minutes to purchase digital currencies at FCA-regulated broker eToro – as you can pay for your digital tokens with a UK debit/credit card or e-wallet.

Here’s a quick guide on how to invest in cryptocurrency in the UK at eToro:

Step 1: Open an account at eToro: Before you can invest in cryptocurrency, you need to open an eToro account. Simply enter some basic personal information and choose a username/password.

Step 2: Deposit funds: Next, you will need to make a minimum deposit of $10 (about £7). UK debit/credit cards, bank transfers, and several e-wallets are supported.

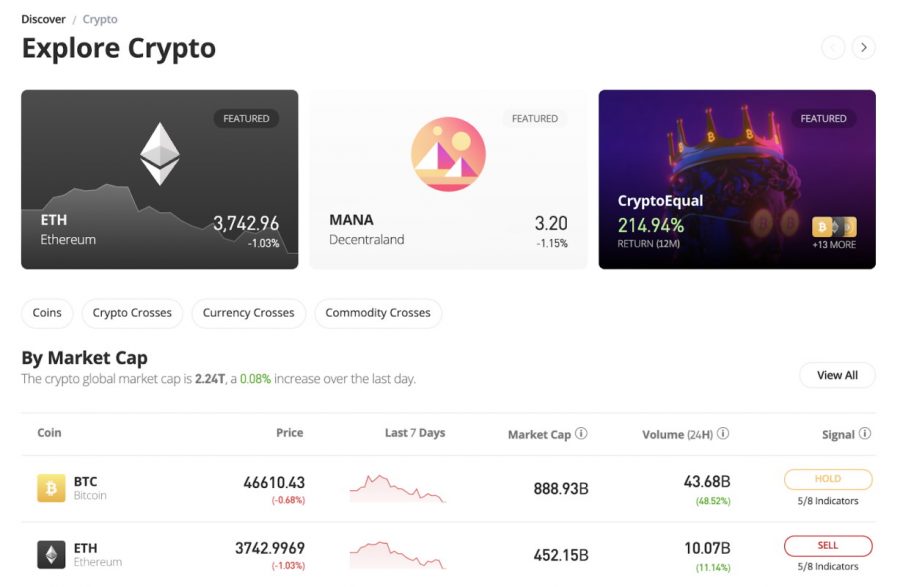

Step 3: Search for cryptocurrency: In the search, enter the cryptocurrency that you want to buy. Or, click on ‘Discover’ and then ‘Crypto’ to view the full list of supported digital tokens.

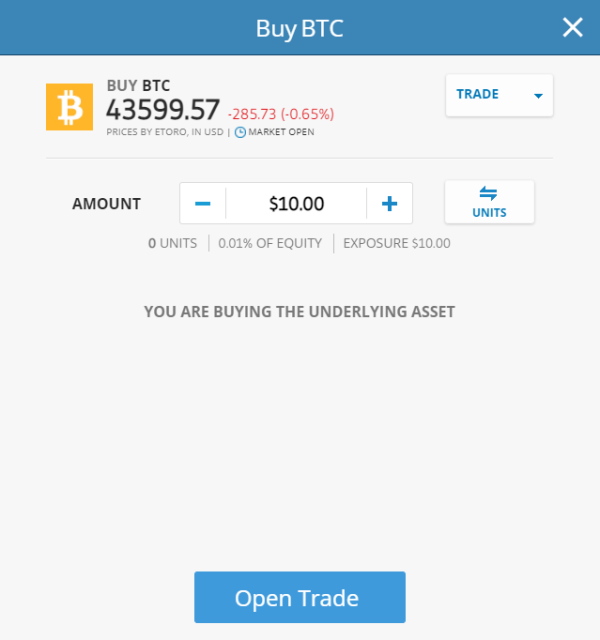

Step 4: Invest in cryptocurrency: The final step is to enter your investment amount and click on ‘Open Trade’.

If the above quickfire walkthrough is a bit too basic for your skillset, we offer a detailed explanation of how to invest in cryptocurrency in the UK further down.

Where to Invest in Cryptocurrency UK

When learning how to invest in cryptocurrency in the UK, you will need to spend a bit of time researching exchanges and brokers.

Important considerations to make include the number of tokens offered by the broker, what fees you will pay, and which payment methods are accepted.

Safety and regulation are, of course, also important. In the sections below, you will find reviews of five top-rated platforms that allow you to invest in cryptocurrency in a low-cost and secure way.

1. eToro – Overall Best Place to Invest in Bitcoin UK

eToro is one of the largest UK brokerage sites with the platform now serving over 23 million global clients. The platform itself is very user-friendly and opening an account takes minutes. You can deposit funds easily too – with eToro supporting e-wallets, debit/credit cards, and UK bank transfers. Once your account is set up – you can then buy and sell more than 45+ cryptos.

This includes everything from Bitcoin, XRP, Binance Coin, and Ethereum to Decentraland, Shiba Inu, Dogecoin, and AAVE. eToro is also great when it comes to fees. GBP deposits cost just 0.5% and cryptocurrency investments will only cost you the spread (from 0.75%). In terms of other assets, eToro also allows you to invest in shares, ETFs, index funds, forex, CFDs and more.

Crucially, this enables you to create a highly diversified portfolio of assets. You might also find the passive investment tools available at eToro of interest. For example, the copy trading feature allows you to ‘copy’ the trades of a seasoned investor. You will also have access to SmartPortfolios, which are professionally managed by the eToro team.

Both of these investment tools are offered at no additional fees. eToro is also the best place to invest in Bitcoin in the UK for its regulated status. Not only does this include regulation from the FCA, but also licensing bodies in the US, Australia, and Cyprus. Moreover, if you decide to invest in non-crypto assets – your funds will be covered by the FSCS up to the first £85,000.

Invest in Bitcoin on eToro Now

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Coinbase – Good Cryptocurrency Exchange for Beginners

If you’re looking at where to invest in cryptocurrency in the UK as a complete novice – Coinbase offers a simple yet powerful trading platform. All you need to do to get started is open an account and upload some ID for verification purposes, and you can get started with one of the best UK crypto exchanges.

If you’re looking at where to invest in cryptocurrency in the UK as a complete novice – Coinbase offers a simple yet powerful trading platform. All you need to do to get started is open an account and upload some ID for verification purposes, and you can get started with one of the best UK crypto exchanges.

Then, you can invest in dozens of cryptocurrencies via a debit or credit card payment. Coinbase will, however, charge you 3.99% in fees – which is much higher than the 0.5% available at eToro. If you are happy to wait a few days for the payment to arrive, you can deposit funds via a UK bank transfer for free. On arrival, you will be charged a commission of 1.49% to invest in cryptocurrency.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

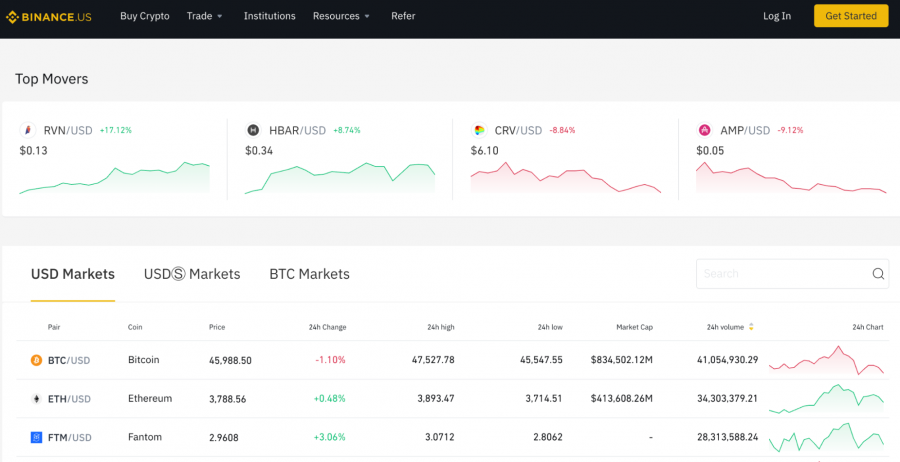

3. Binance – Large Exchange to Trade Cryptocurrency at Low Fees

If you’re seeking a low-cost way to trade digital assets, Binance allows you to enter buy and sell orders at just 0.10% per slide. This low commission rate covers thousands of cryptocurrency markets – so you will never be short of options. Binance also offers cryptocurrency savings accounts and a wide spectrum of advanced trading tools and features.

If you’re seeking a low-cost way to trade digital assets, Binance allows you to enter buy and sell orders at just 0.10% per slide. This low commission rate covers thousands of cryptocurrency markets – so you will never be short of options. Binance also offers cryptocurrency savings accounts and a wide spectrum of advanced trading tools and features.

However, the key issue with Binance is that the exchange is being investigated by the FCA for offering cryptocurrency investment products without the required regulatory remit. As such, the exchange can no longer facilitate UK bank transfers or directly accept debit/credit cards. The only way around this is to deposit funds via Simplex – but this will cost you up to 10% in fees.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

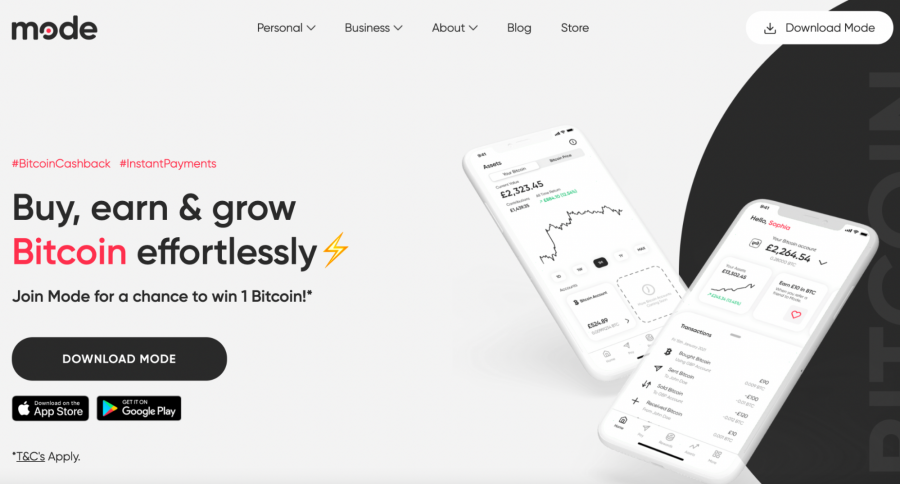

4. Mode – Invest in Bitcoin via an iOS or Android App

If you’re wondering where to invest in cryptocurrency in the UK via a mobile app – you might want to consider Mode. Available to download free of charge on both iOS and Android, the Mode app is relatively user-friendly. You can open a verified account in under 30 minutes by uploading a copy of your passport or driver’s license and depositing funds via a UK bank transfer.

If you’re wondering where to invest in cryptocurrency in the UK via a mobile app – you might want to consider Mode. Available to download free of charge on both iOS and Android, the Mode app is relatively user-friendly. You can open a verified account in under 30 minutes by uploading a copy of your passport or driver’s license and depositing funds via a UK bank transfer.

Although debit/credit cards or e-wallets are not supported, your deposit will be processed via the faster payments network. As such, the funds should arrive quickly. In terms of fees, Mode will charge you a standard commission of 0.99% on all buy and sell orders. However, take note, the only cryptocurrency that you can invest in via Mode is Bitcoin.

5. Huobi – Invest in More Than 300+ Cryptocurrencies

Many traders in the UK are drawn to Huobi for its wide selection of cryptocurrency assets and markets. You will find more than 300+ tokens here, all of which can be traded from just 0.20% per slide. Although Huobi isn’t regulated in the UK, the platform has since attracted more than 10 million users. Moreover, Huobi keeps the vast bulk of client digital funds in cold storage.

Many traders in the UK are drawn to Huobi for its wide selection of cryptocurrency assets and markets. You will find more than 300+ tokens here, all of which can be traded from just 0.20% per slide. Although Huobi isn’t regulated in the UK, the platform has since attracted more than 10 million users. Moreover, Huobi keeps the vast bulk of client digital funds in cold storage.

It also offers a Bitcoin security reserve fund of 20,000 BTC. You can access Huobi online or via the exchange’s mobile app – which is available to download free of charge on both iOS and Android. We also like Huobi for its level of customer service, with the exchange offering support 24 hours per day – 7 days per week. This is easily accessible via a live chat tool via the website or app.

Cryptocurrency Investment Explained

It goes without saying that all investment products carry an element of risk. However, the risks involved when investing in digital currencies are much higher in comparison to traditional assets – such as stocks or index funds.

Therefore, it is wise to do some research on this marketplace when learning how to invest in cryptocurrency UK. The first thing to note is that there are more than 17,000 digital tokens available to buy, sell, and trade.

Once you have decided on a cryptocurrency you like, you will then be required to complete your purchase with an online exchange or broker. You don’t need to buy a full cryptocurrency token – as the likes of Bitcoin and Ethereum can be broken down into smaller units.

For example, instead of outlying tens of thousands of pounds to invest in a full Bitcoin, brokers like eToro allow you to enter the market with just $10 (about £7). The overarching objective of investing in cryptocurrency UK is to make money.

You will be able to do this if you sell your cryptocurrency tokens for more than you paid. For example, if you invest £500 into Bitcoin at a price of $40,000 per token, and sell when BTC hits $50,000 – that’s a profit of 25%. On a £500 investment, this amounts to gains of £125.

Is Cryptocurrency a Good Investment?

Many cryptocurrencies have grown in value by a significant amount in recent years. For example, had you invested in Ethereum five years ago, you would be looking at gains of over 20,000%.

However, you also need to remember that many cryptocurrencies have since lost more than 90% in value – so the risk of loss is high. With this in mind, there are a few simple steps that you can take to ensure you mitigate risk as best as possible when you buy cryptocurrency.

For example:

1. Start Small

As a cryptocurrency newbie, it’s best to start off with modest stakes. As noted earlier, you only need $10 to invest in cryptocurrency at eToro – which for most people is an inconsequential amount.

2. Never Invest More Than You Can Lose

You should never invest an amount of money in cryptocurrency that you cannot afford to lose. Crucially, there is every chance that you will get back less than you originally invested – so make sure you won’t need the funds for primary living costs.

3. Diversify

It is also important to diversify when investing in the cryptocurrency space. As mentioned earlier, you’ve got over 17,000 tokens to choose from – so perhaps consider spreading your investment funds across five or even 10 different cryptocurrencies.

4. Dollar Cost Average

A great way to avoid being exposed to rapid pricing spikes is to dollar-cost average your investments. This means investing smaller but regular sums at fixed intervals.

For example, instead of investing a lump sum of £1,000 – consider spreading this out over 10 monthly purchases at £100 each.

Benefits of Cryptocurrency Investing

If you’re still not sure if digital assets are right for your investment objectives and risk tolerance, below we explore some of the core benefits of this marketplace.

Above-Average Market Returns

Over the course of the past decade, Bitcoin has gone from a digital token worth less than $0.01 to a trillion-dollar asset class. This means that at its peak of $69,000 per token, Bitcoin’s market capitalization was higher than most companies on Wall Street.

Bitcoin isn’t alone in this parabolic increase. The likes of Shiba Inu, Solana, Dogecoin, and many others have seen unprecedented gains over the previous 12 months. In comparison, the FTSE 100 has grown by just 4% in the prior year.

Decentralized and Finite

Many cryptocurrencies are decentralized – meaning that no single person or authority controls the network. Moreover, digital assets like Bitcoin have finite supply – so once BTC hits 21 million tokens, no more will enter circulation.

If your chosen cryptocurrency is decentralized, this also means that its supply cannot be controlled or manipulated. This is in stark contrast to traditional currencies like the British pound or US dollar – which are printed out of thin air and thus – suffer from inflation.

Easy to Enter and Exit the Market

There is often a misconception that buying and selling digital assets in the UK is a complex process. However, this isn’t the case at all – as it takes just minutes to invest in cryptocurrencies in the UK with a debit/credit card or e-wallet.

More importantly, the cryptocurrency market collectively is worth over a trillion dollars, so there is plenty of liquidity on offer. This means that at any time throughout the day, you can cash out your cryptocurrencies back to pounds and pence with ease.

Technology Solves Real Problems

The underlying technology that backs cryptocurrencies like Bitcoin and Ethereum is known as the blockchain. This allows data to be sent, received, and stored in a secure and immutable manner. Moreover, many blockchain projects solve real-world problems.

For example, Ripple allows banks to transfer money internationally in a super-fast and low-cost way – irrespective of which currencies are being used. Similarly, Ethereum allows users to transact in a trustless manner via smart contract technology.

Earn Interest

Many inexperienced traders are surprised to learn that you can earn interest when you invest in cryptocurrency in the UK. This is because your crypto assets will be used to fund loans – with the end borrower paying interest while the agreement is in place.

Moreover, depending on the platform and respective digital token, interest rates on cryptocurrency savings accounts can be highly attractive. For example, at Binance, you can earn an APY of 11% for locking away your Polkadot tokens for 30 days.

The Best Cryptocurrency to Invest in

On the one hand, the process of investing in cryptocurrencies in the UK is simple and safe. However, the challenging part is knowing which specific digital assets to add to your portfolio.

If you’re after a little bit of inspiration in terms of what crypto to invest in, below we discuss 10 of the best digital currencies currently in the market.

1. Bitcoin – Best Cryptocurrency to Invest in 2022 for Long Term Growth

Bitcoin was the first cryptocurrency to enter this marketplace and since its launch in 2009 – it has remained the largest digital token for market capitalization. When hitting its prior all-time high of $68,789.63 – Bitcoin carried a valuation of over $1 trillion.

Bitcoin was the first cryptocurrency to enter this marketplace and since its launch in 2009 – it has remained the largest digital token for market capitalization. When hitting its prior all-time high of $68,789.63 – Bitcoin carried a valuation of over $1 trillion.

Many people that invest in cryptocurrency in the UK for the first time will look to add Bitcoin to their portfolio before moving onto smaller projects. With that said, Bitcoin hasn’t grown as quickly as other digital tokens over the prior 12 months.

For example, over the past year, Bitcoin has grown by just 20%. Binance Coin, on the other hand, has increased in value by over 870% during the same period. This is largely because Bitcoin has a much larger valuation – so the upside potential is more limited than other tokens.

Overall, buying Bitcoin is still the number of cryptocurrency investment.

2. XRP – Fast and Low-Cost Interbank Transactions

The next token from our list of the best cryptocurrency to invest in is XRP. This digital asset project has created technology that enables banks and financial institutions to perform interbank transactions in a low-cost and fast way.

The next token from our list of the best cryptocurrency to invest in is XRP. This digital asset project has created technology that enables banks and financial institutions to perform interbank transactions in a low-cost and fast way.

This translates into a transfer time of just 4-5 seconds at a cost of less than $0.00001 regardless of where the sender and receiver are based. More importantly, XRP bridges the gap between competing currencies – so there are no issues with liquidity.

3. Shiba Inu – Cheap Cryptocurrency to Invest in 2022

Some investors in the UK will look to so-called cheap cryptocurrencies – so that they can purchase a large number of tokens without needing to risk a lot of money. Perhaps the best option in this respect is Shiba Inu.

Some investors in the UK will look to so-called cheap cryptocurrencies – so that they can purchase a large number of tokens without needing to risk a lot of money. Perhaps the best option in this respect is Shiba Inu.

This digital currency – which was launched in 2020, has increased by tens of millions of percent over the prior 18 months. And, as of writing, a single Shiba Inu token will cost you just $0.00002. As such, by meeting the $10 minimum at eToro – you’ll get 500,000 tokens.

4. Ethereum – Smart Contract Project Migrating to PoS

Ethereum is behind Bitcoin in terms of market capitalization – thus this project is the second-largest in the cryptocurrency space. Ethereum allows users to perform transactions above and beyond just financial payments.

Ethereum is behind Bitcoin in terms of market capitalization – thus this project is the second-largest in the cryptocurrency space. Ethereum allows users to perform transactions above and beyond just financial payments.

This is because Ethereum supports smart contract technology – which allows for trustless transactions in a decentralized nature. Moreover, Ethereum will soon be migrating to a Proof-of-Stake (PoS) framework – which will promote more scalable and cost-effective transfers.

The value of Ethereum has skyrocketed since it was launched in 2015. For example, gains of over 20,000% have been achieved in the prior five years of trading. This means that an investment of £500 back in 2017 would now be worth £100,000.

5. Binance Coin – Cryptocurrency Issued by the World’s Largest Exchange

Binance is the world’s largest cryptocurrency exchange. The platform claims to have more than 100 million active users and daily trading volumes often exceed $10 billion. Over the course of 2021, Binance facilitated more than $7 trillion worth of cryptocurrency trades.

Binance is the world’s largest cryptocurrency exchange. The platform claims to have more than 100 million active users and daily trading volumes often exceed $10 billion. Over the course of 2021, Binance facilitated more than $7 trillion worth of cryptocurrency trades.

In 2017 – which is when the exchange was launched, Binance created its own digital token. Known as Binance Coin – or simply BNB, the token allows users of its exchange to reduce their commission rates.

Furthermore, BNB is the digital currency used to fuel the Binance Smart Chain. This is an independent blockchain network that is now home to thousands of tokens and billions of dollars in locked liquidity. Over the course of the prior five years, BNB is up 8,000%.

6. Decentraland – 3D Virtual World With Fast-Growing Cryptocurrency

Launched as recently as 2020, Decentraland is a 3D virtual world that allows its users to build, buy, sell, and trade plots of land. These plots are traded in the form of an NFT (Non-Fungible Token) and subsequently sold in the open marketplace.

Launched as recently as 2020, Decentraland is a 3D virtual world that allows its users to build, buy, sell, and trade plots of land. These plots are traded in the form of an NFT (Non-Fungible Token) and subsequently sold in the open marketplace.

All transactions are fueled by the project’s native digital token – MANA. Over the prior 12 months, the value of MANA has increased by over 1,000%. This makes Decentraland and MANA one of the fastest-growing cryptocurrencies in the market today.

7. Cosmos – Best Crypto to Invest in for Blockchain Interoperability

Before Cosmos came alone, there was no way for competing blockchains to communicate with one another. But, with Cosmos and its underlying interoperability framework, independent blockchain networks can now talk to each other via cross-chain activity.

Before Cosmos came alone, there was no way for competing blockchains to communicate with one another. But, with Cosmos and its underlying interoperability framework, independent blockchain networks can now talk to each other via cross-chain activity.

This means that in theory – Ethereum transactions can communicate with the EOS blockchain, for instance. As Cosmos continues to advance its technology, the value of its respective token – ATOM, performs well. Over the prior year, ATOM has grown by over 300%.

8. Yearn.finance – Decentralized Financial Services for Investors and Borrowers

Yearn.finance is a decentralized platform that connects investors and borrowers. Crucially, all of the lending agreements facilitated on the Yearn.finance platform are executed and settled without a centralized body. This means that users can transact on a peer-to-peer basis.

Yearn.finance is a decentralized platform that connects investors and borrowers. Crucially, all of the lending agreements facilitated on the Yearn.finance platform are executed and settled without a centralized body. This means that users can transact on a peer-to-peer basis.

If you like the sound of decentralized financial services, you can invest in the native digital currency of Yearn.finance – YFI. Interestingly, YFI is one of the most expensive tokens to buy – with a prior all-time high of $93,000. You can, however, invest just $10 into YFI when using eToro.

8. Uniswap – Growing Decentralized Exchange

Many market commentators believe that in the future – the majority of cryptocurrency trades will be carried out at decentralized exchanges. This means that users can buy and sell digital assets without needing to go through a centralized platform.

Many market commentators believe that in the future – the majority of cryptocurrency trades will be carried out at decentralized exchanges. This means that users can buy and sell digital assets without needing to go through a centralized platform.

Moving into 2022, Uniswap is currently one of the most popular decentralized exchanges in the market. To date, the platform has facilitated more than $772 billion worth of volume – which translates into 86 million trades. You can invest in this project by purchasing the UNI token.

9. Chiliz – Bridging the Gap Between Blockchain and Sports Teams

Chiliz is an interesting cryptocurrency project that allows sports fans to connect with their favourite teams via blockchain technology. For instance, those holding Chiliz tokens can vote on important decisions being considered by their respective club.

Chiliz is an interesting cryptocurrency project that allows sports fans to connect with their favourite teams via blockchain technology. For instance, those holding Chiliz tokens can vote on important decisions being considered by their respective club.

In terms of performance, Chiliz is now a multi-billion dollar cryptocurrency. Over the past 12 months alone, the value of Chiliz has increased by more than 770%. Some of the most notable official partners of Chiliz include Manchester City, Paris Saint-Germain and Barcelona.

10. Dogecoin – Most Popular Meme Coin Cryptocurrency to Buy Right Now

Last year, the value of Dogecoin skyrocketed. In the first six months of 2021 alone, the digital token had increased by over 10,000%. This was mainly driven by the tweets and interviews of Tesla CEO Elon Musk – who not only likes Dogecoin but owns tokens himself.

Last year, the value of Dogecoin skyrocketed. In the first six months of 2021 alone, the digital token had increased by over 10,000%. This was mainly driven by the tweets and interviews of Tesla CEO Elon Musk – who not only likes Dogecoin but owns tokens himself.

Musk believes that Dogecoin is far better than Bitcoin as a payments network, not least because transactions are faster and more cost-effective. Although Dogecoin hit highs of $0.73 last year, the token has since dropped below $0.20. This means that you can invest at a cheaper entry price.

Best Penny Cryptocurrency to Invest in

While some digital tokens – namely Bitcoin, Ethereum, and Yearn.finance trade for thousands of pounds, you can also invest in cryptocurrencies that are priced at less than a dollar.

These are known as penny cryptocurrencies and they are appealing to those that want to buy a large number of tokens for a small amount of money.

Some of the best penny cryptocurrencies in the market include:

- IOTA – Blockchain project exploring the internet of things (IoT) via fast and free transactions.

- Stellar – Supports cross-currency transactions around the world in a low-cost, secure, and fast manner. Target markets are small businesses and international remittances.

- Tron – China-based blockchain project that facilitates fast, low-cost, and highly scalable transactions. Its smart contract technology is competing with Ethereum.

The above penny cryptocurrency projects are large-cap assets with a multi-billion dollar market capitalization.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Investing in Cryptocurrency vs Trading Cryptocurrency

The way in which you approach the cryptocurrency industry can come in the form of investing or trading. Although the two terms are often used interchangeably, they actually refer to different strategies.

Investing in Cryptocurrency

When you invest in cryptocurrency in the UK, as opposed to trading, this means that you are buying digital assets as part of a longer-term strategy. Typically, long-term cryptocurrency investors will hold onto their tokens for at least one year.

However, the longer you hold onto your chosen cryptocurrencies, the better chance you have of riding out volatile pricing waves. This is no different from investing in traditional stocks and shares – with the general consensus being that holding for no less than five years is wise.

When you invest in cryptocurrency in the UK on a long-term basis, it’s important that your tokens are kept safe. As we discuss in more detail shortly, this is why using an FCA-regulated broker like eToro is a good option.

Trading Cryptocurrency

On the other hand, if you trade cryptocurrency, as opposed to investing, you are taking part in a shorter-term strategy.

- Day traders, for example, will buy a cryptocurrency and sell their position before the end of the day.

- Swing traders take a slightly longer-term approach, albeit, positions can remain open for anywhere between a few days to several weeks.

By trading cryptocurrency, you can take advantage of pricing swings by attempting to time the market. However, if you’re a complete novice in this industry – it’s best to invest in cryptocurrency over a longer period.

How to Invest in Cryptocurrency Safely

You might be aware of some horror stories from the cryptocurrency industry.

Examples include exchange and wallet hacks, malware, viruses, and even extortion – all of which is associated with the theft of cryptocurrency tokens that can then be laundered in the open marketplace.

As a result, it is absolutely crucial that you learn how to invest in cryptocurrency in the UK safely.

Below we offer some safety-related tips that will ensure your cryptocurrency funds stay secure at all times.

Regulated Brokers

First and foremost, the most effective way of staying safe when investing in cryptocurrency in the UK is to ensure that you only use a regulated broker or exchange. In fact, as a UK resident, it’s wise to only use platforms that are regulated by the FCA.

Although cryptocurrency as an investment product itself is unregulated, using an FCA-licensed platform will ensure that the provider is both legitimate and credible. Moreover, the platform will be required to keep your crypto assets safe at all times.

With that being said, the vast majority of cryptocurrency trading sites are actually unregulated. They bypass conventional regulations by only offering cryptocurrency deposits and withdrawals – or partnering with a third-party processor for GBP payments.

Ultimately, this is why eToro stands out as the best place to invest in cryptocurrency in the UK – as the brokerage is authorized and regulated not only by the FCA, but ASIC, CySEC, and the SEC.

Wallet Security

If you invest in cryptocurrency UK and subsequently decide to withdraw your tokens out of the respective broker or exchange – you need to have a firm understanding of wallet security.

Crucially, if somebody is able to hack your device and gain entry to your wallet, they will be able to withdraw your entire cryptocurrency balance in one fell swoop.

A good option to consider here is the eToro wallet, which comes in the shape of a mobile app for both iOS and Android. The wallet itself is regulated and thus – comes packed with security tools.

How to Invest in Cryptocurrency UK – Tutorial

To conclude this beginner’s guide on how to invest in cryptocurrency in the UK, we are going to walk you through the process step-by-step.

This means showing you how to open an eToro account, depositing funds, searching for your preferred cryptocurrency, and finally – creating a buy order.

From start to finish, you should be able to invest in your first cryptocurrency in less than 10 minutes.

Step 1: Open an Account

To get the process started, head over to the eToro website and look for the ‘Join Now’ button. On clicking it, a registration form will appear on your screen.

Follow the on-screen instructions by entering your personal information and contact details, and choosing a suitable username and password.

eToro will then send a text message to your mobile phone with a unique PIN. Enter this when prompted to complete the first part of the registration process.

Step 2: Know Your Customer (KYC)

Know Your Customer (KYC) process is required at all FCA-regulated brokers. This simply requires eToro to verify your identity and country of residence.

First, upload a government-issued ID – which can be a passport or driver’s license. Second, upload a proof of address that was issued within the prior three months.

Options include an electricity or water bill, or a bank account statement. In most cases, we find that eToro will verify documents in under two minutes.

Step 3: Make a Deposit

Before you can invest in cryptocurrency in the UK, you will need to make a deposit into your eToro account.

You have plenty of payment methods to choose from, albeit, the most convenient option is a debit or credit card.

Alternatively, you can also use PayPal, Skrill, Neteller, or a UK bank transfer. The deposit fee on all of the aforementioned payment methods is just 0.5%.

Moreover, the minimum deposit amount at eToro for new UK customers is $10 – which is about £7.

Step 4: Search for Cryptocurrency

There are two ways in which you can find a cryptocurrency to invest in. First, if you know the name of the digital token that you want to buy – simply search for it. In our example below, we are searching for Bitcoin.

The other option is to click on the ‘Discover’ tab, followed by ‘Crypto’. This will then bring up the full list of digital tokens that the platform supports. When you find the cryptocurrency that you want to invest in, click on the ‘Trade’ button to load an order box.

Step 5: Invest in Cryptocurrency UK

Like in the image below, you will now need to type in your preferred investment size. You do not need to purchase full tokens at eToro. On the contrary, you can invest any dollar-specific amount as long as it meets the minimum of $10.

In our example above, we are looking to invest $10 into Bitcoin – which is about £7. When you are ready to place your market order – you can click on the ‘Open Trade’ button.

Step 6: Sell Cryptocurrency UK

The final part of the investment cycle will occur when you are eventually ready to sell your cryptocurrency back to cash. Assuming that you decided to use eToro to buy your chosen digital token, the selling process will take you no more than 60 seconds.

First, log in to your eToro account and click on the ‘Portfolio’ button. Next, find the cryptocurrency that you wish to cash out and click on the ‘Sell’ button.

After you confirm the order, eToro will sell your cryptocurrency at the next best available price and the cash will show up as a withdrawal balance.

Conclusion

This beginners guide has taught you everything you need to know to safely invest in cryptocurrency UK with low fees.

Not only have we discussed the best cryptocurrency brokers in the market and what steps you need to take to complete your investment – but the benefits and risks of digital assets.

If you have conducted sufficient levels of research and you are ready to invest in cryptocurrency UK, eToro is a great option.

You will need to invest just $10 into your chosen cryptocurrency – and fees are charged on a spread-only basis. And, as eToro is licensed by the FCA, you can invest in a safe and secure way.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

FAQs

Can I invest in cryptocurrency in the UK?

How do I invest in cryptocurrency in the UK?

How can a beginner invest in cryptocurrency?

Which cryptocurrency is best to invest in 2022?

Where is the best place to invest in cryptocurrency UK?

Is it worth investing in cryptocurrency?

This news is republished from another source. You can check the original article here