Bitcoin analysis

Bitcoin’s price closed its daily candle on Sunday – $ 258 and broke off three consecutive days in green figures. Despite last week’s rally, the price of BTC is still below 40 on the RSI which has historically indicated that the price of Bitcoin is in a bear market.

The first chart we look at today is the 1 week BTC / USD chart xtremerider8. The price of BTC was again slammed against the 0.5 fib level [$38.231,4] numerous times over the course of the last week, but has been repelled from eclipsing that figure due to its weekly close of the candle. If BTC bullish traders can eclipse the 0.5 fib level, their secondary target is 0.382 [$41.498,6].

After a strong defense of the 0.5 fib level, bearish traders are now looking to postpone the BTC price towards the bottom of its channel for a retest of the $ 30k level. Their primary goal is to break the 0.618 fib [$34.964,2] with a secondary goal of 0.786 [$30.312,6]. If bearish traders manage to penetrate the $ 30k level to the downside, the technical damage done will indicate that the bears are largely in control of the BTC price action and will be in their zone of control.

Bitcoin Moving Averages: 20-Day [$41.142,12]50-Day [$47.258,12]100-Day [$51.414,63]200-Day [$46.562,25]Year to Date [$41.142,12].

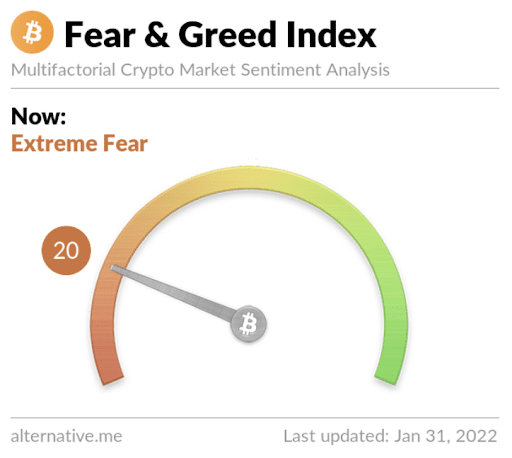

The Fear and Greed Index is 20 (Extreme Fear) and -9 from Sunday’s reading of 29 Fear.

BTC’s 24-hour price range is $ 37.503-38.386 and the 7-day price range is $ 33.505- $ 38.566. Bitcoin’s 52-week price range is $ 29,341- $ 69,044.

Bitcoin’s price on this date last year was $ 33,604.

The average price of BTC over the past 30 days is $ 41,531.

The price of Bitcoin [-0,68%] closed the daily candle with a value of 37.939 dollars.

Ethereum analysis

The price of Ether closed its daily candle in green on Monday and finished a + $ 2.27. However, Ether’s momentum is currently negative and at the lowest levels on a weekly scale in the history of the asset.

The second chart we look at today is the 1 week ETH / USD chart EdgarTigranyan. We can see that the price of Ether has again closed outside its long-term uptrend channel and has failed to break out of the bottom of its range at the $ 2.7k level.

ETH bullish traders were able to recover the 61.80% fib level [$2.408,77] and they controlled much of last week’s price action, but failed to break that channel on the weekly time frame. ETH’s bearish traders are now aiming to pivot where they have pushed back Ether’s bullish traders at the bottom of that range [livello di $2,6k] and postpone the price of ETH down to test the 78.60% fib level [$1,742.8].

Moving Averages of Ether: 20 days [$3.065,72]50 days [$3.699,45]100 days [$3.758,19]200 days [$3.255,13]Year to Date [$3.065,72].

The 24-hour ETH price range is $ 2,557- $ 2,635 and the 7-day price range is $ 2,204- $ 2,638. Ether’s 52-week price range is $ 1,312- $ 4,878.

The price of ETH on this date in 2021 was $ 1,317.

The average price of ETH over the past 30 days is $ 3,103.

The price of Ether [+0,09%] closed the daily candle on Sunday at a value of $ 2,602.6.

Avalanche analysis

Avalanche’s price fell more than 5% on Sunday and closed the daily session at – $ 3.8.

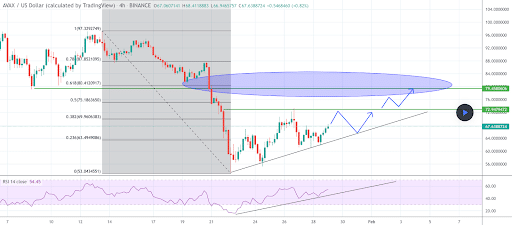

The 4-hour AVAX / USD chart DT65 shows the price of AVAX swinging between a full retracement of 0 [$53,04] and 0.618 [$80,41]. The next critical level for AVAX bullish traders is the 0.38 fib [$69,96] with a secondary goal of 0.5 [$75,18].

Conversely, the AVAX bears are attempting to break the 4-hour trendline and the 0.236 fib [$63,49] and to send the Avalanche price down again to retest a full retracement to 0 [$53,04].

The price range of Avalanche 24-hour is $ 67.17- $ 72.25 and 7-day is $ 55.94- $ 72.75. AVAX’s 52-week price range is $ 9.33- $ 144.96.

Avalanche’s price on this date last year was $ 13.18.

The average price of AVAX over the past 30 days is $ 85.34.

The price of Avalanche [-5,29%] closed the daily candle a $ 68 Sunday.

This news is republished from another source. You can check the original article here