Henrik5000/iStock via Getty Images

Q4 2021 was another productive quarter for the All-Weather Portfolio (“AWP”). The diversified AWP returned 13.3% in Q4 beating most major stock market averages by a healthy margin. For reference, the DJIA appreciated by about 7%, the Nasdaq composite by 8.5%, and the S&P 500 by 10.5% last quarter. While the AWP had some problematic areas, other segments shined bright, providing substantial outperformance over many market areas. Moreover, for full-year 2021 the AWP appreciated by 50.5%, nearly doubling the S&P 500’s return of roughly 28%. Let’s look at what worked, did not, and could have performed better. In addition, I want to go over some positions for the new year and discuss some top holdings for 2022.

The Cryptocurrency Basket – 18% of Portfolio Holdings

Let’s begin with our top-performing sector, the cryptocurrency basket. I’ve continuously incorporated Bitcoin and several altcoins into the AWP since 2019 began. While the portfolio allocation percentage has been relatively modest throughout the previous three years, digital assets have enabled total portfolio returns to increase considerably. The integration of the cryptocurrency basket enabled the AWP to nearly quadruple in three years, propelling returns by 281% relative to the S&P 500’s 91% gain for the same period.

Due to the ongoing volatility in the digital asset space, several stops got triggered during the quarter. I also got out of several positions around the highs. For instance, I released a significant part of our Bitcoin (BTC-USD) position, around $66,000, locking in a 53% gain. I also sold a considerable portion of the Ethereum (ETH-USD) holdings for a 42% gain close to the top. Another solid gain was the 46% return in VeChain (VET-USD). The best performer in this sector was ZCash (ZEC-USD), with a return of over 100% in the quarter. A couple of positions saw double-digit losses like Monero (XMR-USD) and Cardano (ADA-USD). Still, ultimately the digital assets segment appreciated by 35% in Q4 and accounted for 17% of holdings at year-end.

As We Advance: While we should continue to see volatility in the digital asset space, I don’t think that we have seen the top here yet. 2022 should bring new ATHs for Bitcoin and many other cryptocurrencies. Provided that price action remains constructive, I will keep a 10-20% portfolio allocation in digital assets in Q1 2022.

Some of my favorite names include Bitcoin, Ethereum, and ChainLink (LINK-USD).

Metals, Metals, Metals

Last quarter, gold, silver, copper, lithium, and other metals played a significant role. While markets were volatile due to the Fed, inflation, and different dynamics, we saw strong performances out of many names.

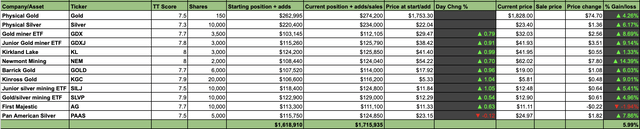

Gold, Silver, Miners (“GSMs”) – 18% of Portfolio Assets

Source: Financial Prophet’s AWP

The GSM segment returned 6% (not including dividends) and accounted for about 18% of portfolio holdings at year-end. The top performer here was Newmont Mining (NEM), delivering roughly a 15% return in the quarter. However, we saw several positions come in with about 10% returns once dividends got calculated.

As We Advance: I like gold, silver, and other metals provided the high inflationary environment. Furthermore, I believe that the market is behind the curve on gold and silver, and the GSM sector could catch a solid bid throughout 2022, making it the surprise outperformer next year.

Some of my favorite names include Kirkland Lake Gold (KL), Newmont Mining, and Kinross (KGC).

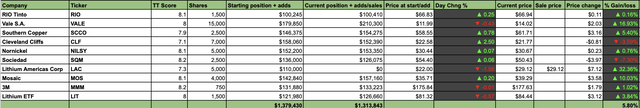

Metals/Industrials – 14% of Portfolio Assets

Source: Financial Prophet’s AWP

Let’s look at our industrials and materials portion of the AWP. With a 32% gain, the top performer was Lithium Americas Corp. (LAC). I sold this position earlier in the quarter, but incidentally, it closed out the year at the exact price I sold it at on November 3rd. We saw a solid 17% gain in Vale S.A. (VALE) which I purchased around the lows in November. Sociedad (SQM) lost about 7% in the quarter. In retrospect, not selling SQM at its blowoff top around $70 was a misstep.

As We Advance: I expect to see more strong performances from copper-related stocks and other metals due to the high inflation environment, relatively robust growth, and other factors. Stocks like Rio Tinto (RIO), Southern Copper (SCCO), and others seem undervalued. Moreover, lithium providers like LAC and SQM should do very well longer-term due to the enormous EV expansion and future demand. Solid material and industrial names should also benefit from the substantial growth and high inflation dynamic.

My favorite names include Lithium Americas Corp, Sociedad, Rio, and Nornickel (OTCPK:NILSY).

Technology Plus – 16% of Portfolio Assets

Technology was a split bag last quarter. While I sold some names like Tesla (TSLA) and Lucid (LCID) near the top, other growth names gave up much of their gains during the correction/rotation period. Without hedging, the return in the technology segment of the AWP was only 4% last quarter. However, due to the implementation of the Covered Call Dividend Plan and the Spread Strategy, returns were boosted considerably to roughly 9% for the quarter. The top performers included Tesla with a 55% return, Lucid 48%, AMD (AMD) 42%, and Qualcomm (QCOM) 24%.

As We Advance: I continue to like technology in the new year. While we will probably continue to see rotation towards more value-oriented equities in the early part of 2022, many growth names have become considerably cheaper. I doubled my Palantir (PLTR) position towards the end of the year. I will continue implementing the covered call dividend plan with specific stocks, as premiums remain incredibly generous for many names.

Some of my top technology picks for the new year include Qualcomm, Intel (INTC), and Palantir.

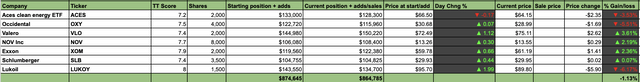

Oil/Energy Segment – 9% of Portfolio Holdings

Source: Financial Prophet’s AWP

The oil and energy segment of the AWP was essentially flat after dividends got factored in. Like most segments, it was a rocky quarter for energy stocks as oil and natural gas prices fluctuated considerably throughout the quarter.

As We Advance: I continue to like the energy space for 2022. Inflation and growth are likely to persist, which should create a constructive backdrop for energy prices moving forward.

My favorite names for 2022 include Lukoil (OTCPK:LUKOY), Valero (VLO), and Occidental (OXY).

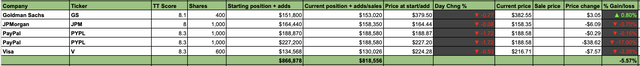

Financials – 8% of Portfolio Assets

Source: Financial Prophet’s AWP

The financials segment was essentially flat if we excluded PayPal (PYPL) last quarter. Due to a slight growth scare and a general risk-off environment in high growth names, PayPal declined notably. However, I doubled my PayPal position near the bottom, and I continue to like the company longer-term.

As We Advance: Many banks and financials are still very cheap relative to the broader market. I believe the market will gravitate towards more value-oriented names in 2022. Therefore, financials will likely do well in a tightening environment. Furthermore, we should see EPS growth and multiple expansion in many financials as we advance in 2022.

Some of my top financial picks for the new year include Goldman Sachs (GS), JPMorgan (JPM), and PayPal.

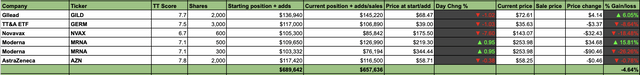

Healthcare – 7% of Portfolio Holdings

Source: Financial Prophet’s AWP

We saw some difficulty with vaccine names in the fourth quarter, and the broader segment declined by roughly 5% (hedging and dividend premiums not included). However, I doubled our Moderna (MRNA) position around the lows. Also, due to the remarkably high covered call premiums in Novavax (NVAX) and Moderna, this segment appreciated by roughly 2% once hedging and dividend premiums got factored in.

As We Advance: I believe healthcare will be another undervalued area that should do well in 2022. Investors should gravitate to the relatively cheap value names in this sector. Moreover, higher growth names in the mRNA and COVID vaccine space could also do well as 2022 progresses.

Some top picks for the new year include Gilead (GILD), Moderna, and Novavax.

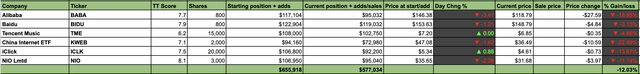

China – 6% of Portfolio Holdings

Source: Financial Prophet’s AWP

Now for the ugly, again, it was China. Another red quarter for the AWP’s China names. While we saw a lot of volatility in the quarter, prices were up sharply early. However, this did not last. Fortunately, most of the China names are continuously on our covered call dividend plan list as they dish out massive premiums. Moreover, I implemented some spread plays throughout Q4, which enabled us to mitigate much of the losses.

As We Advance: The China segment remains an area of much debate. While many names here are relatively undervalued, the risk of delisting and other factors will likely continue to pressure equity prices in early 2022. Therefore, it is good to diversify to other exchanges like Hong Kong if you continue to hold Chinese names. Nevertheless, there should be substantial upside in Chinese equities once the risk premium comes out of the market.

My top picks for 2022 include Alibaba (BABA), Baidu (BIDU), and iClick (ICLK).

Some Crucial Takeaways As We Move On To 2022

Things certainly could have gone smoother last quarter. While the covered call dividend plan provided substantial income and helped mitigate losses in specific sectors, it may have been too much at times. Hedging is essential in investing, but I should have released certain positions sooner instead of holding on for the covered call premium. I should have harvested more profits near the top in China and high-multiple names.

I am keeping the AWP makeup similar to last year. I believe that staying diversified remains critical to achieving optimal investment results. Moreover, I will continue implementing the covered call dividend plan with specific high-yielding names in the AWP. The digital asset basket will remain at around 15-20% of holdings, while the GSM segment will be at a similar mark to start the year. Non-GSM stock holdings account for the lion’s share of portfolio assets, while the cash position remains at about 5%. I wish everyone all my best and a healthy, prosperous, happy new year!

This news is republished from another source. You can check the original article here