salarko/iStock Editorial via Getty Images

We are value investors, which puts us in scant company in crypto where a lot of strange things go on. While much of crypto is fueled by get-rich-quick fervour, where realities of long-term demand like utility and scalability go often ignored, there are ways to play the crypto phenomenon that are more traditional. Thanks to our data science capabilities, and actual hands-on experience coding smart contracts (albeit simple ones), we do recognise that there is a certain elegance and genius underlying the mechanisms of blockchain and the ideal that the networks that make commerce could be based on it. While we still think there are long-term risks like quantum computing, which interact with political risks connected to China, investors would nonetheless be remiss to deny both the technical achievements within blockchain, as well as the underlying network effects that are fueling parts of the crypto market much like the ‘meme stock’ craze.

While network effects would be a foolish way to justify unmitigated hot-potato speculation on terrible tokens, there are genuine ways in which network effects can create business value and fuel real and enduring demand for certain assets within crypto. We think that cryptogaming is a very legitimate purpose, where blockchain actually lends itself, rather than limits, the design models for many popular games. This is still a very nascent world, and we think it could grow massively, together with NFTs, and that Binance Coin (BNB-USD), correlated to activity on the BSC infrastructure, is the lowest risk way to play a long-term growth in crypto utility.

How Did Cryptocurrency Perform In 2021?

Now that we’re at the beginning of 2022, it’s a good moment to reflect on the performance of crypto in 2021, and discuss what could happen in the coming years. First of all, we have just experienced a meaningful reversal in the performance of coins in general. This reflects the phenomenon that while some in the investment community view crypto as an end-of-the-world hedge, it is a risk asset and when the market becomes spooked, these coins actually decline a lot, as opposed to something like Gold.

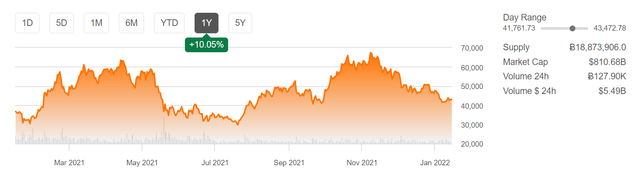

Seeking Alpha

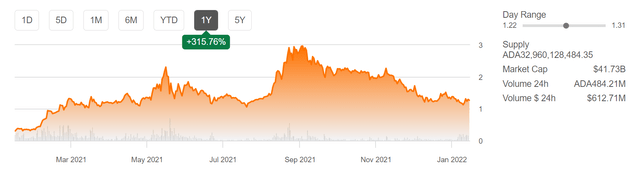

Bitcoin (BTC-USD) came down hard from almost $70k a few months ago to just above $40k now, which has been driving much of the cryptocurrency market movements. Cardano and the connected Ada (ADA-USD) has been trading down meaningfully as well, which tracks the NFT phenomenon quite closely due to the importance of Cardano communities in driving NFT movements.

Seeking Alpha

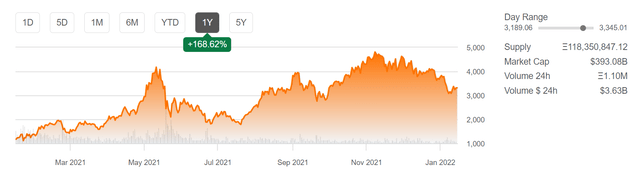

Ethereum (ETH-USD), another major platform for DApps, has been more resilient.

Seeking Alpha

Similarly, Binance has been much more resilient as well, which begins to paint a very relevant picture for our investment thinking within crypto. Coins that act as resources for conducting commercial operations on prolific, higher utility platforms like Binance Smart Chain and Ethereum are the ones that are showing more resilience, due to their more infrastructural positioning. Meanwhile, coins that are connected to more speculative thinking about the markets and fiat currencies, or are simply being traded by whales, are much less resilient in a risk-off environment.

Seeking Alpha

Our Pick: Binance Coin

As far as our crypto thinking goes, we are not interested in any play that involves the thesis that a particular cryptocurrency will become a good store of value just by existing. We think that Bitcoin falls in this category, and the decentralised, unscalable and non-existing governance that surrounds it as a coin makes it untenable in party with the world economy. We think that coins that have utility by being a necessary resource in running smart contracts on a widely used blockchain are the ones that are most likely to become mainstays. In turn, we think that the most widely used blockchain will be the one that doesn’t take the wild west approach to the world of crypto, but is actually governed in a way that allows it to be regulated and also scaled.

As far as governance and scalability goes, Binance with its two blockchains takes the cake in our opinion, and is a very strong contender in becoming a chief platform. The governance and consensus protocol is not particularly decentralised, but it does achieve speed and scalability which is critical to its position as an exchange and center of DApps and blockchain-based commerce. The speed can be attributed to its unique consensus protocol, where BSC uses proof of staked authority (PoSA) which hybridises a proof of authority and delegated proof of stake approach. There are validator candidates who need to be identified by Binance, which then get voted on by delegators every 24 hours to determine the top 21. All these actors are compensated with BNB when they propose blocks, which is non inflationary, and the funds come from fees earned from transactions in the block. Ethereum has tens of thousands of validators, so only having 21 seriously reduces the amount of redundant computation. The ability to identify validators could become a critical element that differentiates Binance, because they can retain the fundamental principles of a consensus protocol while also being able to monitor what interests are able to validate blocks. Moreover, Binance is working to make its platform more regulator friendly all the time by introducing means to identify users who use the exchange, critical since it is still in friction with regulators due to its role as an exchange and its implicit influence on citizens and their investing. Also, data being public on the blockchain allows data analytics and other operations that can help track and deter illicit activity even in concerted efforts across Binance accounts.

Cryptocurrency Catalysts to Watch For

Development skills for Ethereum also happen to be very transferrable to development on Binance, so in addition to factors mentioned above such as better scalability and a more feasible path to becoming government sanctioned, Binance has a shot at becoming its own economy for businesses and people looking to do commerce with unambiguous and tractable blockchain smart contracts. By already being one of the largest hubs in the crypto world, with BNB being one of the largest coins by market cap, they are already benefiting from network effects and preferential attachment that supports winner-take-all dynamics. We think that cryptogaming is a phenomenon that will take place on the platform that is the most prolific. While Ethereum has a certain dominance in the DApp space, Binance with its many useful apps related to trading and farming, is a worthy contender for the throne. It is already a place where you can trade a lot of NFTs and other tokens related to games, even Axie Infinity after integration with Ronin. Moreover, YoHero is a contender game launched on the BSC that is getting a lot of traction. In general, we see a lot of utility in NFTs, even those not given utility by being useful assets in related games. Indeed, in many instances they function much like assets in the art market, which is notoriously pretentious and non-utilitarian in seeming contradiction to its enduring liquidity. But with cryptogaming being such a nascent category, once more actually good games come out that won’t even need to rely on play-to-earn logic, especially those that leverage the inherent trading card model that goes with blockchain tokens like Axie Infinity (but maybe many other types too), there might be massive growth in a whole new category of DApps that could begin and persist on a blockchain like the BSC to drive BNB demand.

Conclusions and Risks

While there are many ways to play the potential cryptogaming boom, and the NFT craze that we are already seeing, we want to take the lower risk approaches. So we look at infrastructure within crypto, where we think Binance, together with its native coin Binance Coin, have the best shot at enduring demand. While Binance as a platform has its regulatory issues, as a blockchain infrastructure for relatively decentralised commerce it is the most likely to both eventually comply with general regulation as well as deliver on its purpose and achieve larger scale thanks to its consensus model. We are already seeing signs that even for cryptogaming DApps, Binance might be the platform of choice, again thanks to its scalability but also because it is a node for so much activity in the community by virtue of being associated with an exchange. With growth in DApps on the platform, and with growth of cryptogaming in general further boosting that, greater activity of running contracts on Binance fueled by the network effects of developers and users joining and growing the app base, Binance Coin is probably the most likely to justify its own >$80 billion market cap. With the infrastructure of Binance finding a middle ground between scalability and decentralisation, while already being a node for a lot of development of smart contracts, we would take the position that they could become an important economy, and Binance coin an important currency, if businesses start embracing the benefits of doing business with programmable, tractable and unambiguous smart contracts.

This news is republished from another source. You can check the original article here