It’s been a particularly bearish start to the year for Bitcoin (BTC) and the broader market. As bullish BTC price predictions for 2022 hit the news at the turn of the year, a New Year’s Day rally had provided hope.

The 1st January rally, however, was an outlier in what has been an active 1st week of the year on the news front.

A marked increase in regulatory chatter and activity coupled with FED monetary policy have hit the markets early in the year.

Monetary Policy

On Wednesday, the FED released its FOMC meeting minutes from the December meeting. Catching the markets off-guard, Committee members talked of the need to lift rates sooner to curb inflation. There was also the talk of needing to begin reducing the balance sheet.

Bitcoin (BTC) slumped by 2.7% within the first hour of the FOMC meeting minutes being released. On the day, Bitcoin (BTC) ended the day down by 5.19% and things were not much better elsewhere.

Ripple’s XRP fell by 5.92%, with Litecoin (LTC) and Ethereum (ETH) seeing losses of 7.59% and 6.50% respectively on Wednesday.

Regulator Activity

Ahead of the FOMC meeting minutes that caused a market stir, regulatory chatter and activity had also tested crypto market support.

At the turn of the year, news hit the wires of Indian tax authorities searching 6 exchanges on suspicion of tax evasion. There was also news of a U.S Congress sub-committee preparing to hold a hearing on the impact of crypto mining on the environment.

All of this, coupled with the talk of a global regulatory framework and the SEC lawsuit against Ripple Lab delivered early pressure.

Bitcoin Price Action

On Friday, Bitcoin (BTC) fell by 3.61% to end the day at $41,548. It was a 6th consecutive day in the red and left Bitcoin (BTC) down 10% for the first 7-days of the year. The early pullback has been in stark contrast to the first week of 2021, when Bitcoin (BTC) had surged by 36%.

Key through the Friday session was avoiding a return to sub-$40,000 levels. Finding support at $40,500, Bitcoin (BTC) ended the day at $41,000 levels.

Having seen red for 6 days in a row, avoiding a return to Friday’s low $40,750 will be key. For the bulls, a move back through Friday’s high $43,136 would be needed to avoid further losses.

At the time of writing, Bitcoin (BTC) was down by 0.61% to $41,799.

Elsewhere

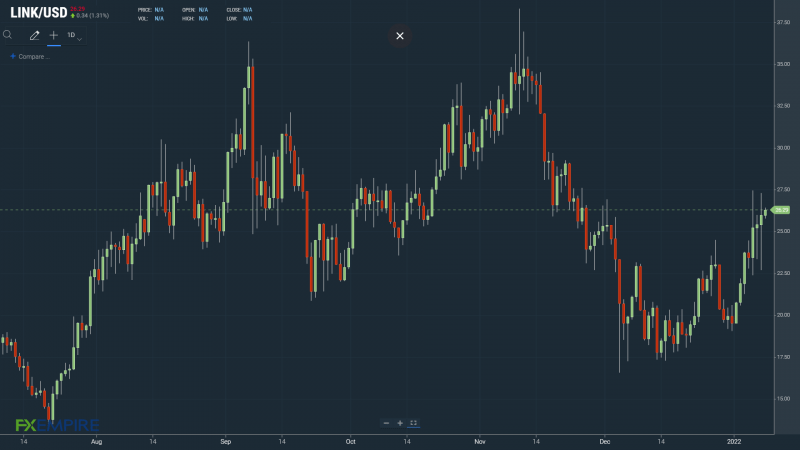

Ethereum (ETH) slid by 6.08%, to lead way down on Friday. Bucking the trend at the start of the year, however, has been Chainlink (LINK). Following a 1.85% gain on Friday, Chainlink (LINK) is up 33% year-to-date. News of an Ethereum (ETH) whale purchasing $4.6m worth of LINK has contributed to the upside. Chainlink’s (LINK) decentralized oracle network continues to draw interest, contributing to this week’s gains.

At the time of writing, Chainlink (LINK) was up by 1.31% to $26.29. A breakout from Wednesday’s high $27.45 would bring $30 levels into play, last struck in mid-November. A pullback to sub-$20 levels, however, would test support at December’s low $15.38.

This article was originally posted on FX Empire

More From FXEMPIRE:

This news is republished from another source. You can check the original article here